Navigating the world of car insurance can feel overwhelming, but understanding your options is key to securing the best coverage at the right price. This guide delves into the specifics of obtaining a USAA car insurance quote, a process that’s often lauded for its efficiency and member-centric approach. We’ll explore the various factors influencing your premium, compare USAA to its competitors, and uncover the hidden benefits that might make it the ideal choice for you.

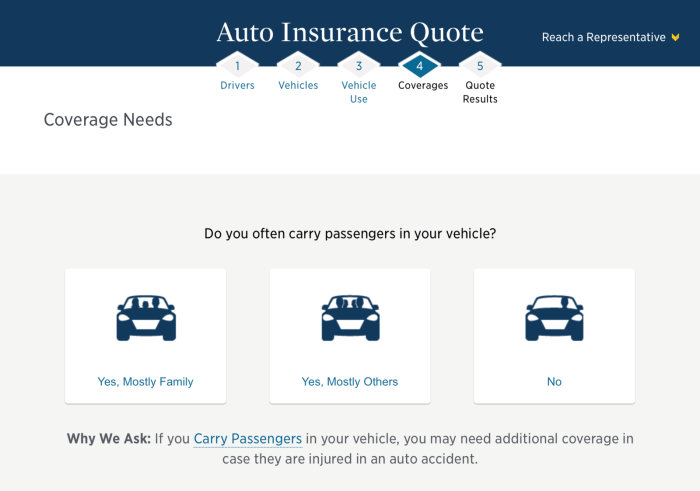

From eligibility requirements and the online quoting process to understanding the impact of driving history and vehicle type on your rates, we aim to provide a clear and comprehensive overview. We’ll also examine USAA’s unique features, such as its renowned customer service and extensive range of discounts, to help you make an informed decision about your car insurance needs.

USAA Car Insurance Overview

USAA offers a comprehensive range of car insurance products designed specifically for military members, veterans, and their families. Known for its strong customer service and competitive rates, USAA provides a variety of coverage options to suit diverse needs and budgets. Its focus on personalized service and member benefits sets it apart in the insurance market.

USAA provides a wide array of car insurance coverages. These options allow members to customize their policy to fit their specific needs and risk tolerance.

Types of Car Insurance Coverage Offered by USAA

USAA offers standard car insurance coverages, including liability, collision, and comprehensive, as well as additional options like uninsured/underinsured motorist coverage, medical payments coverage, and roadside assistance. Liability coverage protects you financially if you cause an accident that injures someone or damages their property. Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, or hail. Uninsured/underinsured motorist coverage helps cover your medical bills and vehicle repairs if you’re involved in an accident with an uninsured or underinsured driver. Medical payments coverage helps pay for medical expenses for you and your passengers, regardless of fault. Roadside assistance provides help with things like flat tires, lockouts, and towing.

USAA Membership Eligibility

Eligibility for USAA car insurance is restricted to members of the USAA family. This includes current and former officers and enlisted personnel of the U.S. military, as well as their eligible family members. Specific eligibility criteria may vary, and it’s advisable to check USAA’s official website for the most up-to-date information on membership requirements. Generally, eligibility extends to spouses, children, and in some cases, parents and other relatives of eligible military members. This exclusive membership base allows USAA to focus its resources on providing exceptional service and competitive rates to a specific demographic.

Factors Affecting USAA Car Insurance Premiums

Several key factors influence the price of USAA car insurance premiums. Understanding these factors can help you anticipate your costs and potentially find ways to lower your premiums. This section will detail the most significant influences on your USAA rate.

Driving History’s Impact on Premiums

Your driving history is a major determinant of your USAA car insurance premium. Accidents and traffic violations significantly increase your risk profile in the eyes of the insurer. A single at-fault accident can lead to a substantial premium increase, often lasting several years. Similarly, multiple speeding tickets or other moving violations will also raise your rates. The severity of the accident or violation directly correlates with the premium increase; a serious accident resulting in injury or significant property damage will result in a far greater increase than a minor fender bender. Maintaining a clean driving record is crucial for keeping your premiums low.

Vehicle Type and Location’s Influence on Insurance Costs

The type of vehicle you insure significantly impacts your premium. Generally, higher-value vehicles, sports cars, and vehicles with a history of theft or accidents command higher premiums due to increased repair costs and higher risk of claims. The location where you park and primarily drive your vehicle also plays a role. Areas with higher rates of theft, accidents, or vandalism will generally result in higher insurance premiums compared to areas with lower crime and accident rates. For example, a vehicle parked in a high-crime urban area will likely be more expensive to insure than one parked in a quiet suburban neighborhood.

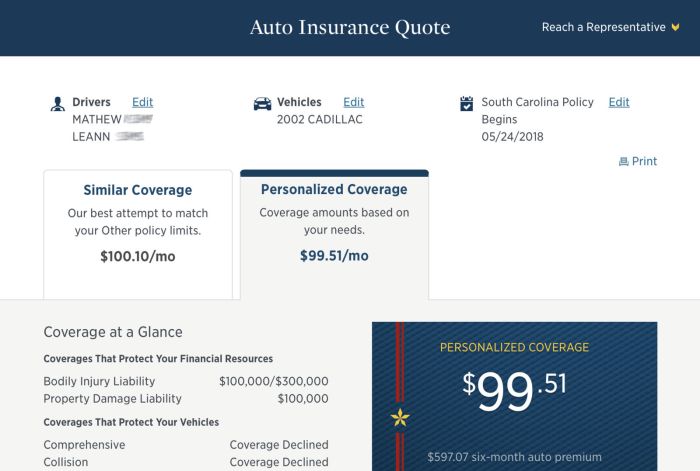

USAA Rate Comparison with Other Major Insurers

Comparing USAA’s rates to other major insurers requires considering several factors, as rates vary significantly based on individual circumstances. However, a general comparison can be made using hypothetical profiles. The table below illustrates a comparison using three major insurers, focusing on the impact of different factors on premiums. Note that these are hypothetical examples and actual rates may vary.

| Factor | USAA (Hypothetical) | Geico (Hypothetical) | State Farm (Hypothetical) |

|---|---|---|---|

| Annual Premium (Clean Driving Record, Average Vehicle, Suburban Location) | $1200 | $1300 | $1400 |

| Premium Increase (At-Fault Accident) | +$300 | +$400 | +$500 |

| Premium Increase (Speeding Ticket) | +$50 | +$75 | +$100 |

| Premium Difference (High-Value Vehicle) | +$200 | +$250 | +$300 |

| Premium Difference (Urban Location) | +$150 | +$200 | +$250 |

USAA Car Insurance Features and Benefits

USAA’s car insurance goes beyond basic coverage, offering a comprehensive suite of features and benefits designed to provide peace of mind and exceptional value to its members. These additions are often cited by policyholders as key reasons for their loyalty. The combination of coverage options, customer service, and additional perks sets USAA apart in the competitive car insurance market.

Beyond standard liability, collision, and comprehensive coverage, USAA offers a range of valuable features that enhance the overall policy experience. These extras are designed to simplify the insurance process and provide additional support during unexpected events. The specific benefits available can vary based on your individual policy and location.

Roadside Assistance

USAA’s roadside assistance program provides valuable support in emergency situations. This service typically includes towing, flat tire changes, lockout assistance, fuel delivery, and battery jump starts. The convenience of having immediate access to this help, especially in unfamiliar locations or during late hours, is a significant benefit. For example, a member locked out of their car late at night could contact USAA’s roadside assistance and receive immediate help, avoiding a potentially stressful situation.

Accident Forgiveness

Accident forgiveness is a valuable feature that protects your premiums from increasing after your first at-fault accident. Many insurance companies will raise your rates after an accident, even if it’s a minor one. USAA’s accident forgiveness program, however, can help mitigate this rate increase, preserving your premium and financial stability. This is particularly beneficial for drivers with clean driving records who may experience an unexpected accident.

Claims Process

USAA’s claims process is generally praised for its efficiency and ease of use. Policyholders can typically file a claim online, by phone, or through the mobile app. The company strives for a straightforward and transparent process, keeping policyholders informed throughout the claim resolution. USAA aims to expedite the process, minimizing the inconvenience and stress associated with filing a claim after an accident or other covered incident. This streamlined approach is often highlighted in positive customer reviews.

Customer Service Reputation

USAA consistently receives high marks for its customer service. Known for its dedication to its members, USAA frequently tops customer satisfaction surveys within the insurance industry. The company’s commitment to personalized service and responsive support is a major factor contributing to its positive reputation. This strong customer service focus often translates to quicker resolution times for claims and easier access to helpful representatives. The overall experience is designed to be supportive and efficient, reducing the frustration often associated with insurance interactions.

USAA vs. Competitors

Choosing car insurance can feel overwhelming, with numerous providers offering various plans. This section compares USAA’s offerings with those of two major competitors, Progressive and Geico, to highlight key differences and help you make an informed decision. The comparison focuses on factors crucial to most consumers: pricing, coverage options, and customer service.

Direct comparison of insurance quotes requires specific driver profiles and locations, making a universal “best” impossible to declare. However, we can analyze general trends and features to illustrate the relative strengths and weaknesses of each provider.

Pricing and Coverage Comparisons

Pricing varies significantly based on individual risk profiles, but general observations can be made. USAA often boasts competitive rates, particularly for military members and their families, leveraging its membership-based model. Progressive and Geico are known for their broad reach and aggressive marketing, often leading to competitive pricing for a wider demographic. However, the specific price will always depend on individual factors.

- USAA: Generally competitive, often lower for members due to risk assessment and loyalty programs. May offer discounts for military affiliation, good driving records, and bundled policies.

- Progressive: Offers a wide range of coverage options and discounts, including usage-based insurance (like Snapshot) that can adjust premiums based on driving habits. Known for aggressive advertising and potentially competitive pricing.

- Geico: Emphasizes ease of use and quick online quoting. Often advertises low rates, but the final price depends on individual risk factors. Provides various discounts, similar to Progressive.

Customer Service and Claims Handling

Exceptional customer service is a key differentiator among insurance companies. Reputation and accessibility influence the overall experience.

- USAA: Consistently receives high marks for customer satisfaction and claims handling. Their member-focused approach often translates to personalized attention and efficient claim resolution. However, accessibility is limited to members.

- Progressive: Offers multiple channels for customer service, including online tools, phone support, and physical locations. Claims handling processes vary depending on the specific claim and location.

- Geico: Similar to Progressive, Geico offers various customer service channels. Their claims process is generally streamlined, but individual experiences may vary.

Advantages and Disadvantages of Choosing USAA

While USAA offers compelling benefits, it’s essential to weigh the advantages against the limitations.

- Advantages: Competitive pricing for members, excellent customer service, strong reputation for claims handling, and specialized discounts for military personnel.

- Disadvantages: Membership restriction limits accessibility, potentially higher premiums for non-members, and fewer coverage options compared to some competitors.

Illustrative Scenarios

Understanding how various factors influence your USAA car insurance premium can be helpful in managing your costs. The following scenarios illustrate the potential impact of age, driving history, and other relevant factors on your premium. Remember that these are illustrative examples and your actual premium may vary based on your specific circumstances and USAA’s current rate structure.

Impact of Driver Profile on USAA Car Insurance Premiums

The cost of car insurance is highly personalized. Several factors, including age and driving record, significantly influence the final premium. The table below provides three distinct scenarios demonstrating this impact. Note that these premiums are estimates and may not reflect the exact pricing from USAA.

| Driver Profile | Age | Driving History | Estimated Premium (Annual) |

|---|---|---|---|

| Young, Inexperienced Driver | 20 | No accidents or tickets, but limited driving experience. | $2,500 – $3,500 |

| Experienced Driver with Accidents | 35 | Clean driving record for 10 years, then two at-fault accidents within the last two years. | $1,800 – $2,800 |

| Senior Driver | 65 | Clean driving record for over 40 years, with no accidents or tickets. | $1,200 – $1,800 |

Understanding USAA’s Discounts and Savings

Saving money on your car insurance is a priority for most drivers, and USAA offers a variety of discounts designed to reward responsible driving habits and membership within their community. These discounts can significantly reduce your premium, making USAA a potentially cost-effective option. Understanding these discounts and how to qualify for them is crucial in maximizing your savings.

USAA’s discount program is multifaceted, offering savings based on a range of factors related to your driving history, vehicle, and membership status. Many discounts can be stacked, meaning you could potentially qualify for multiple savings opportunities, resulting in a substantial reduction in your overall premium. It’s important to contact USAA directly or review their website for the most up-to-date information on discount availability and eligibility criteria, as these can change.

Good Driver Discounts

USAA rewards safe driving with discounts for maintaining a clean driving record. This typically involves a period without accidents or traffic violations. The specific requirements for this discount, such as the length of time without incidents, will vary based on state regulations and USAA’s internal policies. A driver with a history of safe driving can expect a notable reduction in their premium compared to a driver with a less favorable record. For example, a driver with five years of accident-free driving might receive a 10% discount, while a driver with ten years could see a discount of 15% or more. The exact percentage depends on several factors, including your specific location and driving history.

Military Discounts

As a member-owned organization serving the military community, USAA offers significant discounts to active-duty military personnel, veterans, and their eligible family members. These discounts are a core part of USAA’s commitment to its members. The percentage of the discount can vary, but it’s generally substantial, reflecting the organization’s dedication to serving those who have served the country. Eligibility for these discounts is determined by verifying your military affiliation and status.

Bundling Discounts

USAA offers discounts for bundling multiple insurance policies. This means you can save money by insuring your car and other assets, such as your home or motorcycle, through a single policy with USAA. Bundling your insurance policies simplifies your financial management and often results in a considerable reduction in your overall premium compared to purchasing separate policies from different insurers. The savings associated with bundling can vary depending on the types of policies bundled and the coverage levels chosen.

Vehicle Safety Discounts

USAA may offer discounts for vehicles equipped with advanced safety features. These features, such as anti-theft devices, airbags, and anti-lock brakes, demonstrate a commitment to safety and can lead to lower insurance premiums. The specific features that qualify for a discount and the amount of the discount may vary. For instance, a vehicle with advanced driver-assistance systems (ADAS) might receive a larger discount than a vehicle with only basic safety features.

Other Potential Discounts

USAA periodically offers other discounts, such as those for good students, members who complete defensive driving courses, and those who pay their premiums on time. Checking the USAA website or contacting an agent directly is the best way to determine the availability and eligibility requirements for these additional discounts. The availability of these discounts and their specific terms may vary based on location and USAA’s ongoing promotions.

Last Word

Ultimately, choosing the right car insurance provider depends on individual circumstances and priorities. While USAA offers a compelling package of benefits and competitive rates, particularly for military members and their families, careful consideration of your specific needs is paramount. By understanding the factors influencing your premium and comparing USAA’s offerings to those of other major insurers, you can confidently select the policy that best protects you and your vehicle.

FAQ Resource

What types of vehicles does USAA insure?

USAA insures a wide range of vehicles, including cars, motorcycles, RVs, and boats. Specific eligibility may vary depending on the vehicle and your membership status.

Does USAA offer rental car reimbursement?

Yes, USAA offers rental car reimbursement as part of its comprehensive coverage options. The specific details and limits will be Artikeld in your policy.

Can I bundle my home and auto insurance with USAA?

Yes, bundling your home and auto insurance with USAA can often lead to significant discounts. Contact USAA directly to explore bundling options and potential savings.

How do I file a claim with USAA?

You can file a claim with USAA online, via phone, or through their mobile app. The process is typically straightforward and well-supported by their customer service team.