Navigating the world of car insurance can feel like driving through a dense fog. Finding the right coverage at the right price requires careful consideration and research. This comprehensive guide focuses on Progressive car insurance, exploring its offerings, pricing, and unique features to help you make an informed decision. We’ll delve into how to obtain quotes, understand the factors influencing cost, and compare Progressive to its competitors, ultimately empowering you to secure the best car insurance for your needs.

We’ll cover everything from obtaining quotes through Progressive’s various channels—online, phone, or in-person—to understanding the key factors that impact your premium, such as your driving history, vehicle type, and location. We’ll also examine Progressive’s distinctive features, like the Name Your Price® Tool and Snapshot® program, and analyze customer feedback to provide a well-rounded perspective.

Progressive Car Insurance Overview

Progressive is one of the largest auto insurers in the United States, known for its wide range of coverage options, competitive pricing, and innovative tools. They cater to a broad spectrum of drivers, from those seeking basic liability coverage to those needing comprehensive protection for high-value vehicles. This overview will detail their offerings, pricing, and compare them to a competitor.

Progressive offers a comprehensive suite of car insurance products designed to meet diverse needs and budgets. Their coverage options extend beyond the standard liability and collision, encompassing various add-ons for enhanced protection.

Coverage Options Available Through Progressive

Progressive provides various coverage options, including liability coverage (which pays for damages to others involved in an accident you cause), collision coverage (which covers damage to your vehicle regardless of fault), comprehensive coverage (which covers damage from events other than collisions, such as theft or vandalism), uninsured/underinsured motorist coverage (which protects you if you’re hit by an uninsured driver), medical payments coverage (which covers medical bills for you and your passengers regardless of fault), and personal injury protection (PIP) coverage (which covers medical expenses and lost wages for you and your passengers). They also offer roadside assistance, rental car reimbursement, and other add-on options.

Progressive’s Pricing Structures and Discounts

Progressive’s pricing is highly individualized, determined by factors like driving history, age, location, vehicle type, and the coverage selected. They utilize a sophisticated rating system that analyzes various data points to generate a personalized quote. However, they are known for offering numerous discounts to lower premiums. These discounts can include safe driver discounts (for accident-free driving records), multi-policy discounts (for bundling auto and home insurance), good student discounts (for students maintaining high GPAs), and discounts for installing anti-theft devices. For example, a driver with a clean driving record, a good student discount, and who bundles their auto and home insurance with Progressive could see significant savings compared to a driver with multiple accidents and no discounts.

Comparison of Progressive’s Coverage with a Competitor (State Farm)

Progressive’s pricing and coverage options are competitive within the insurance market. The following table provides a comparison with State Farm, another major auto insurer. Note that exact pricing will vary depending on individual circumstances.

| Coverage Type | Progressive | State Farm | Notes |

|---|---|---|---|

| Liability | Offers various liability limits | Offers various liability limits | Limits are customizable based on individual needs and state requirements. |

| Collision | Available as an add-on | Available as an add-on | Covers damage to your vehicle in an accident, regardless of fault. |

| Comprehensive | Available as an add-on | Available as an add-on | Covers damage from events other than collisions (e.g., theft, vandalism). |

| Uninsured/Underinsured Motorist | Available as an add-on | Available as an add-on | Protects you if hit by an uninsured driver. |

Obtaining Quotes from Progressive

Getting a car insurance quote from Progressive is straightforward and can be done through several convenient methods, catering to different preferences and levels of technological comfort. Understanding the process and the necessary information will ensure you receive an accurate and personalized quote.

Progressive offers a variety of ways to obtain a car insurance quote, each with its own advantages. Choosing the right method depends on your personal preference and how much time you have available.

Methods for Obtaining a Progressive Car Insurance Quote

Progressive provides three primary methods for obtaining quotes: online, via phone, and in-person. The online method is generally the fastest and most convenient, offering instant results and allowing for easy comparison of different coverage options. The phone option provides a personalized experience with a live agent who can answer questions and guide you through the process. In-person quotes, while less common, are available through select Progressive agents.

Information Required for an Accurate Quote

To receive an accurate car insurance quote from Progressive, you will need to provide specific information about yourself, your vehicle, and your driving history. This information allows Progressive to assess your risk profile and provide a tailored quote. Missing or inaccurate information can lead to an inaccurate quote.

- Personal Information: This includes your name, address, date of birth, driver’s license number, and contact information.

- Vehicle Information: You’ll need your vehicle’s year, make, model, VIN, and current mileage. Information about any modifications to your vehicle may also be required.

- Driving History: This is crucial and includes your driving record, including any accidents, tickets, or violations in the past few years. You may also be asked about your driving experience.

- Coverage Preferences: You’ll need to specify the type and amount of coverage you desire, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

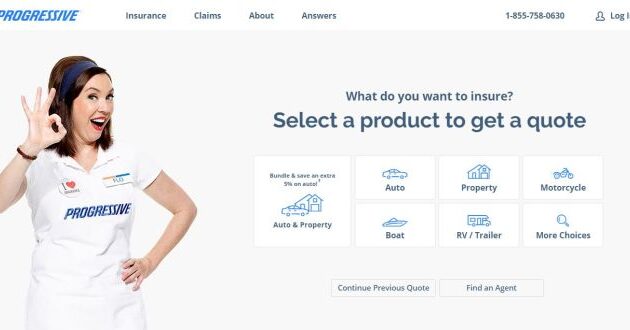

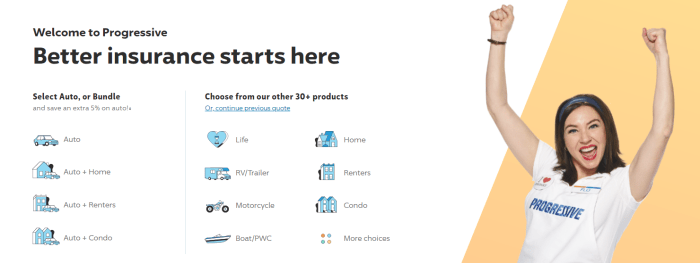

Navigating the Progressive Website to Obtain a Quote

The Progressive website is designed to make obtaining a quote a simple process. The process typically involves several steps.

- Visit the Progressive Website: Navigate to the Progressive website (progressive.com).

- Locate the “Get a Quote” Button: This button is usually prominently displayed on the homepage.

- Enter Your Information: You will be prompted to enter the information Artikeld in the previous section. The website will guide you through each step.

- Review Your Quote: Once you have entered all the necessary information, Progressive will generate a quote based on your risk profile. Carefully review the details of the quote, including the coverage options and the price.

- Compare and Choose: You may be presented with several coverage options. Compare the options and choose the one that best suits your needs and budget.

Obtaining a Quote via the Progressive Mobile App

The Progressive mobile app offers a convenient way to obtain a car insurance quote on the go. The steps are similar to the online process, but the interface is optimized for mobile devices.

- Download and Install the App: Download the Progressive app from your device’s app store.

- Create an Account or Sign In: If you don’t already have an account, you’ll need to create one. Otherwise, sign in to your existing account.

- Start a New Quote: Locate the option to start a new quote within the app.

- Provide Required Information: Enter the necessary information about yourself, your vehicle, and your driving history, following the prompts within the app.

- Review and Compare Quotes: The app will generate a quote. Review the details and compare different coverage options.

Factors Affecting Progressive Car Insurance Quotes

Several key factors influence the cost of your Progressive car insurance quote. Understanding these elements allows you to better anticipate your premium and potentially make choices to lower your costs. These factors are considered individually and often interact to determine your final rate.

Progressive, like other insurers, uses a complex algorithm to assess risk. This algorithm considers numerous data points to calculate a premium that reflects the likelihood of you filing a claim. The more risk you present, the higher your premium will be.

Driving History

Your driving history is a significant factor in determining your Progressive car insurance quote. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, accidents, especially those resulting in injuries or significant property damage, will substantially increase your rates. The severity and frequency of accidents and tickets heavily influence the cost. For example, a single speeding ticket might only slightly raise your premium, whereas a DUI conviction could lead to a much more significant increase, or even policy cancellation in some cases. The age of your driving history also matters; a longer history of safe driving will generally lead to better rates than a shorter one.

Vehicle Type and Age

The type and age of your vehicle significantly impact your insurance costs. Generally, newer cars are more expensive to repair than older cars, leading to higher premiums. The make and model also play a role; some vehicles are more prone to theft or accidents, leading to higher insurance costs. For instance, sports cars often have higher premiums than sedans due to their higher repair costs and higher risk of accidents. Older vehicles, while generally cheaper to insure, may lack advanced safety features, potentially leading to higher premiums if they are deemed less safe. The vehicle’s safety rating, as determined by organizations like the IIHS (Insurance Institute for Highway Safety), directly affects the cost.

Factors Affecting Progressive Car Insurance Quotes: A Prioritized List

The following list prioritizes factors influencing Progressive car insurance quotes, starting with the most impactful:

- Driving History: Accidents, tickets, and DUI convictions significantly impact premiums.

- Vehicle Type and Age: Newer, more expensive-to-repair vehicles, and those with lower safety ratings, generally lead to higher premiums.

- Location: Your address influences rates due to variations in crime rates and accident frequency.

- Coverage Levels: Higher coverage limits (liability, collision, comprehensive) result in higher premiums.

- Age and Gender: Statistically, younger drivers and males often pay higher premiums due to higher accident rates.

- Credit Score: In many states, your credit score is a factor in determining your insurance rates.

- Discounts: Bundling policies, maintaining a good driving record, and installing safety features can significantly reduce your premiums.

Progressive’s Unique Features and Programs

Progressive distinguishes itself from other car insurance providers through several innovative features and programs designed to offer customized coverage and potentially lower premiums. These offerings aim to reward safe driving habits and provide customers with greater control over their insurance costs and experience.

Progressive’s Name Your Price® Tool

The Name Your Price® Tool is a unique feature allowing customers to actively participate in the price-setting process. Instead of simply receiving a quote based on Progressive’s assessment, users input their desired premium amount. The tool then generates coverage options that align with that price point. If a match isn’t found, it suggests adjustments to coverage or driving habits that might help achieve the target price. This empowers consumers with more transparency and control over their insurance costs, though it may result in less comprehensive coverage than a standard quote. The system works by analyzing the user’s provided information (vehicle, driving history, location, etc.) and matching it against their desired price, finding the closest coverage plan available. It’s a helpful tool for budget-conscious individuals, allowing them to find a balance between affordability and protection.

Progressive’s Snapshot® Program

Progressive’s Snapshot® program uses a small device plugged into a vehicle’s diagnostic port (OBD-II) or a smartphone app to monitor driving habits. Data collected includes mileage driven, time of day driving occurs, and braking/acceleration patterns. Based on this information, Progressive adjusts premiums, potentially offering discounts to drivers exhibiting safe driving behaviors.

Benefits include potential premium reductions for safe drivers and the ability to monitor driving habits for self-improvement. Drawbacks include privacy concerns regarding data collection and the potential for inaccurate assessments if the device malfunctions or experiences unusual driving conditions (e.g., emergency braking during a sudden stop). The program’s effectiveness is dependent on accurate data collection and fair algorithm interpretation. For example, a driver who frequently drives in congested city traffic might receive a less favorable rate than a driver who consistently drives on open highways, even if both drive safely.

Other Unique Features and Programs

Progressive offers various other programs designed to enhance customer experience and potentially lower premiums. These include options for bundling home and auto insurance, roadside assistance packages, and accident forgiveness programs. The specific features and availability can vary by state and individual circumstances. For instance, a multi-policy discount could substantially lower the overall cost for customers who bundle their home and auto insurance, while accident forgiveness programs can help drivers avoid premium increases after their first at-fault accident.

Comparison of Progressive’s Claims Process with a Competitor (e.g., Geico)

While both Progressive and Geico are known for relatively streamlined claims processes, they differ in some aspects. Progressive often emphasizes its 24/7 claims service and online claim filing capabilities, focusing on digital convenience. Geico, while also offering online options, might be perceived by some as having a slightly more traditional approach, with a greater emphasis on phone-based claim reporting in certain circumstances. The specific experiences will vary depending on the nature of the claim, location, and individual circumstances. For example, a minor fender bender might be handled entirely online with Progressive, while a more complex claim involving significant damage might require more direct interaction with a claims adjuster, regardless of the insurer.

Customer Reviews and Experiences

Progressive car insurance receives a mixed bag of customer reviews, reflecting the broad range of experiences individuals have with the company. While many praise Progressive for its ease of use and innovative features, others express frustration with claims handling or customer service interactions. Understanding these varied perspectives provides a more complete picture of the company’s performance.

Customer reviews across various platforms, including independent review sites and social media, reveal common themes that shape overall customer satisfaction. These themes allow for a categorized analysis, highlighting both positive and negative aspects of the Progressive experience.

Claims Handling Experiences

Progressive’s claims handling process is a frequent topic in customer reviews. Positive experiences often describe a smooth, efficient process with prompt communication and fair settlements. For example, many customers recount receiving timely assistance after accidents, with claims adjusters readily available to answer questions and guide them through the process. Conversely, negative reviews often cite delays in processing claims, difficulties in reaching claims adjusters, and disputes over settlement amounts. Some customers describe feeling undervalued or ignored during the claims process, leading to significant dissatisfaction.

Customer Service Interactions

Customer service is another key area where opinions diverge. Positive reviews highlight the availability of multiple contact methods (phone, online chat, email) and generally responsive representatives. Customers frequently mention helpful and courteous agents who effectively resolved their inquiries. Negative reviews, however, frequently describe long wait times, unhelpful or dismissive representatives, and difficulty reaching a human agent. Some customers report feeling frustrated by automated systems that failed to adequately address their concerns.

Overall Satisfaction and Pricing

A visual representation of customer reviews would resemble a bell curve. The majority of reviews would cluster around a neutral point, representing average satisfaction. A significant portion would fall on the positive side, reflecting favorable experiences with pricing, convenient online tools, and generally positive interactions. However, a noticeable portion would extend to the negative end, reflecting frustrations with claims processing, customer service difficulties, and perceived unfair pricing in certain instances. The relative sizes of the positive and negative portions of the curve would depend on the specific data source and timeframe considered. For example, a study focused solely on customer complaints might skew the curve more heavily toward the negative. Conversely, a survey focusing on customer retention might yield a more positive distribution.

Comparison with Competitors

Choosing car insurance can feel overwhelming, given the numerous providers and varying coverage options. Direct comparison of Progressive’s offerings with those of its main competitors is crucial for making an informed decision. This section will analyze Progressive’s pricing and features against two other major players in the US car insurance market: State Farm and Geico.

Progressive’s rates are often competitive, particularly for drivers with good driving records and those who utilize their online tools for quotes and management. However, it’s important to note that pricing varies significantly based on individual risk profiles and location. A direct comparison requires considering specific circumstances.

Progressive, State Farm, and Geico Rate Comparison

The following table provides a general comparison of rates and features. It’s crucial to remember that these are illustrative examples and actual quotes will vary based on individual factors such as age, driving history, vehicle type, location, and coverage level. It is always best to obtain personalized quotes from each provider.

| Feature | Progressive | State Farm | Geico |

|---|---|---|---|

| Average Annual Premium (Illustrative Example) | $1200 | $1300 | $1150 |

| Name Your Price® Tool | Yes | No | No |

| 24/7 Customer Service | Yes | Yes | Yes |

| Accident Forgiveness | Offered on some plans | Offered on some plans | Offered on some plans |

| Discounts Available | Multiple (e.g., good driver, bundling, safe driver) | Multiple (e.g., good driver, bundling, defensive driving) | Multiple (e.g., good driver, bundling, multi-car) |

Advantages and Disadvantages of Choosing Progressive

Progressive’s Name Your Price® tool allows customers to specify their desired premium and see coverage options that fit their budget. This level of control is not typically offered by competitors. However, this tool might not always provide the most comprehensive coverage at the lowest possible price. State Farm, known for its extensive agent network, offers personalized service and local support, which can be advantageous for some. Geico, on the other hand, often advertises very competitive rates, but may lack the personalized touch of State Farm’s agent-based model.

Areas of Excellence and Improvement for Progressive

Progressive excels in its technological advancements and user-friendly online tools, such as its Name Your Price® tool and mobile app. These features streamline the quoting and claims processes. However, some customers report difficulties reaching customer service representatives during peak times, suggesting a potential area for improvement in customer support capacity and responsiveness. Further expansion of discounts tailored to specific driver demographics could also enhance its competitiveness.

Final Wrap-Up

Securing affordable and comprehensive car insurance is crucial for responsible drivers. This guide has provided a detailed look at Progressive car insurance, equipping you with the knowledge to navigate the quoting process, understand the factors affecting your premium, and compare Progressive’s offerings against competitors. By leveraging the information presented here, you can confidently choose a policy that aligns with your budget and risk profile, providing peace of mind on the road.

Key Questions Answered

What is Progressive’s Name Your Price® Tool?

It’s a tool that lets you specify your desired premium, and Progressive will find policies that meet your budget.

How does Progressive’s Snapshot® program work?

It uses a device plugged into your car to monitor your driving habits, potentially leading to discounts based on safe driving.

Does Progressive offer roadside assistance?

Yes, roadside assistance is typically available as an add-on to most Progressive policies.

Can I bundle my home and auto insurance with Progressive?

Yes, Progressive offers bundled home and auto insurance packages, often resulting in savings.

What types of coverage does Progressive offer?

Progressive offers a wide range of coverage options including liability, collision, comprehensive, uninsured/underinsured motorist, and more.