Securing the right car insurance in Rochester, NY, requires understanding the unique aspects of the local market. Factors like weather conditions, traffic patterns, and the prevalence of specific types of accidents all influence premiums and coverage needs. This guide delves into the intricacies of Rochester’s car insurance landscape, providing valuable insights for residents seeking affordable and comprehensive protection.

From comparing major providers and exploring different coverage options to understanding the claims process and navigating the impact of Rochester’s unique driving environment, we aim to equip you with the knowledge to make informed decisions about your car insurance. We’ll also address common questions and offer practical tips to help you find the best policy for your individual circumstances.

Understanding Rochester, NY Car Insurance Market

Rochester, NY, presents a diverse car insurance market shaped by its unique demographic profile and driving conditions. Understanding this market is crucial for residents seeking the best coverage at the most competitive rates. This section will explore the key aspects of the Rochester car insurance landscape, from the types of drivers to the factors influencing premium costs.

Rochester, NY Driver Demographics and Insurance Needs

Rochester’s population is a blend of urban and suburban residents, with varying income levels and driving habits. Younger drivers, often with less experience, may face higher premiums due to increased risk. Conversely, older, more experienced drivers might qualify for discounts. The city’s mix of urban and suburban areas also affects insurance rates, with higher density areas potentially leading to more accidents and, consequently, higher premiums. Families with multiple drivers or vehicles will have different insurance needs than single individuals. Commuting patterns and the types of vehicles driven also contribute to the diverse insurance needs within the Rochester community. For example, someone commuting long distances daily in a high-performance vehicle will likely face higher premiums than someone who primarily drives a smaller vehicle for short, local trips.

Major Car Insurance Providers in Rochester, NY

Several major national and regional insurance providers operate extensively in Rochester, NY. These include well-known companies like Geico, State Farm, Progressive, Allstate, and Liberty Mutual, among others. Smaller, regional providers also compete in the market, often offering specialized services or focusing on specific demographics. The availability and competitiveness of these providers create a dynamic market where consumers can compare rates and coverage options. The presence of both large national companies and smaller regional players ensures a diverse range of choices and pricing structures for Rochester residents.

Types of Car Insurance Coverage in Rochester, NY

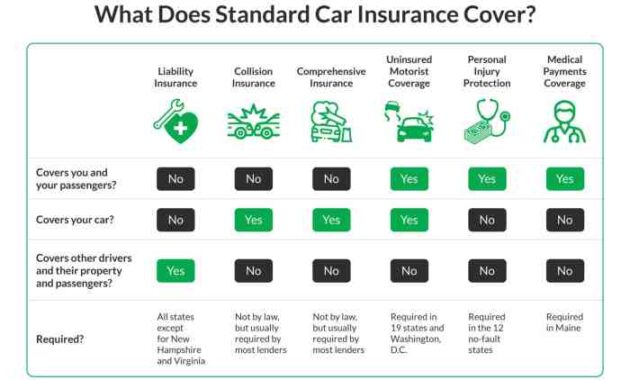

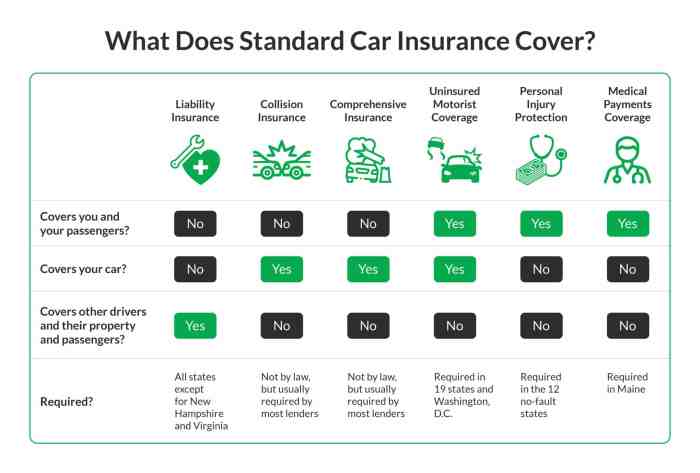

Rochester drivers have access to the standard types of car insurance coverage. Liability insurance is legally mandated and covers damages or injuries caused to others in an accident. Collision coverage protects your vehicle in an accident regardless of fault. Comprehensive coverage protects against non-collision damage, such as theft or vandalism. Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who lacks sufficient insurance. The specific coverage options and their costs will vary based on individual needs and risk assessment. Many drivers opt for a combination of liability, collision, and comprehensive coverage to achieve a balance of protection and affordability.

Factors Influencing Car Insurance Premiums in Rochester, NY

Numerous factors determine the cost of car insurance in Rochester. Driving history is paramount; a clean driving record with no accidents or violations typically results in lower premiums. The type of vehicle plays a significant role; newer, more expensive cars generally cost more to insure. Location within Rochester also influences premiums; higher-risk areas with more accidents may have higher rates. Age and gender can also be factors, with younger drivers and males sometimes facing higher premiums due to statistically higher accident rates. Credit history is another factor considered by many insurers, although the weight given to this factor varies by company. Finally, the amount and type of coverage chosen directly impacts the premium cost; higher coverage limits naturally result in higher premiums.

Finding Affordable Car Insurance in Rochester, NY

Securing affordable car insurance in Rochester, NY, requires a strategic approach. The cost of insurance can vary significantly based on several factors, including your driving record, the type of vehicle you drive, and the coverage you choose. By understanding these factors and employing effective strategies, you can significantly reduce your premiums.

Finding the best car insurance deal involves careful comparison shopping and understanding your insurance needs. This section Artikels practical steps to help Rochester residents find affordable coverage.

Tips for Finding Affordable Car Insurance in Rochester, NY

Several strategies can help Rochester residents lower their car insurance costs. These strategies focus on improving your risk profile and leveraging available resources.

- Maintain a clean driving record: Accidents and traffic violations significantly increase premiums. Defensive driving and adherence to traffic laws are crucial.

- Choose a higher deductible: Opting for a higher deductible reduces your monthly premiums, but you’ll pay more out-of-pocket in case of an accident. Carefully weigh the trade-off between monthly savings and potential out-of-pocket expenses.

- Bundle your insurance policies: Many insurers offer discounts for bundling car insurance with other types of insurance, such as homeowners or renters insurance. This can lead to substantial savings.

- Consider your car’s safety features: Vehicles with advanced safety features, such as anti-theft systems or advanced driver-assistance systems (ADAS), often qualify for discounts.

- Shop around and compare quotes: Don’t settle for the first quote you receive. Compare quotes from multiple insurers to find the best rates. Online comparison tools can simplify this process.

- Explore discounts: Many insurers offer various discounts, such as good student discounts, safe driver discounts, and multi-car discounts. Inquire about all available discounts.

- Review your coverage regularly: Your insurance needs may change over time. Regularly review your coverage to ensure you have the right amount of protection without paying for unnecessary coverage.

Resources for Comparing Car Insurance Quotes

Rochester residents have several resources available to compare car insurance quotes effectively. These resources simplify the process of finding the best rates.

- Online comparison websites: Numerous websites allow you to compare quotes from multiple insurers simultaneously. These sites typically require you to enter your information once, and they present quotes from various providers.

- Independent insurance agents: Independent agents represent multiple insurance companies, allowing you to compare quotes from various providers without visiting each company individually.

- Direct insurers: Many large insurance companies sell policies directly to consumers. You can obtain quotes directly from their websites or by calling their customer service lines.

Obtaining Car Insurance Quotes from Multiple Providers

The process of obtaining quotes is straightforward. Begin by gathering necessary information, such as your driving history, vehicle information, and desired coverage levels. Then, use the resources mentioned above to request quotes.

- Gather your information: Compile your driving history (including accidents and violations), vehicle information (make, model, year), and desired coverage levels (liability, collision, comprehensive).

- Use online comparison tools: Input your information into online comparison websites to receive multiple quotes instantly.

- Contact insurers directly: Contact insurers directly via phone or their websites to obtain quotes.

- Compare quotes: Carefully compare the quotes you receive, paying attention to the coverage offered and the premium cost.

- Choose a policy: Select the policy that best suits your needs and budget.

Average Cost of Car Insurance by Vehicle Type in Rochester, NY

The average cost of car insurance varies significantly depending on the type of vehicle. This table provides estimates based on industry data. These are averages and your actual cost may vary.

| Vehicle Type | Average Annual Cost |

|---|---|

| Sedan | $1200 – $1800 |

| SUV | $1500 – $2200 |

| Truck | $1800 – $2500 |

| Sports Car | $2000 – $3000+ |

Specific Insurance Needs in Rochester, NY

Rochester, NY’s unique climate and urban landscape present specific challenges for drivers, influencing the types of car insurance coverage residents should prioritize. Understanding these needs ensures adequate protection against potential financial losses. This section details crucial insurance considerations for Rochester drivers.

Impact of Weather on Car Insurance Rates

Rochester experiences harsh winters with significant snowfall and icy conditions. These weather events increase the frequency and severity of car accidents. Insurance companies factor this increased risk into their rate calculations. Drivers in Rochester can expect higher premiums compared to areas with milder climates due to the heightened probability of collision claims resulting from winter weather. For example, a driver involved in a multi-vehicle pile-up caused by a blizzard might face higher deductibles or increased premiums in subsequent years. The increased frequency of claims related to snow and ice removal damages also contributes to higher overall rates.

Importance of Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage is particularly vital in Rochester. A significant percentage of drivers may lack adequate insurance or operate vehicles without insurance. In the event of an accident with an uninsured or underinsured driver, UM/UIM coverage protects you and your passengers from substantial out-of-pocket expenses for medical bills, lost wages, and vehicle repairs. This coverage is crucial given the potential for accidents with drivers who may not be able to cover the costs of damages they cause. For instance, a collision with a hit-and-run driver could leave a significant financial burden on the insured without sufficient UM/UIM coverage.

Risks Specific to Driving in Rochester and Insurance Solutions

Rochester’s road network, a mix of urban streets and suburban highways, presents various driving challenges. Heavy traffic congestion, particularly during peak hours, increases the likelihood of fender benders and other minor accidents. Potholes, common during spring thaw, can cause significant tire and suspension damage. Insurance policies typically cover collision damage, regardless of fault, and comprehensive coverage can address damage caused by potholes or other road hazards. Furthermore, the city’s hilly terrain can present challenges in icy or snowy conditions, increasing the risk of accidents. Comprehensive insurance, often included in standard policies, offers protection against such events.

Common Car Accidents and Associated Insurance Claims

Many accidents in Rochester are related to the factors discussed above. A typical list includes:

- Rear-end collisions: Frequently caused by icy roads or sudden stops in congested traffic.

- Side-impact collisions: Often occurring at intersections due to inattentive driving or poor visibility.

- Single-vehicle accidents: Resulting from loss of control due to snow or ice, or striking potholes.

- Multi-vehicle pile-ups: Common during severe winter storms.

These accidents result in a wide range of insurance claims, including property damage claims (vehicle repairs), bodily injury claims (medical expenses, lost wages), and liability claims (covering the other party’s damages if you are at fault). The severity of these claims and the resulting insurance payouts vary widely depending on the circumstances of the accident.

Understanding Insurance Policies & Claims

Navigating the process of filing a car insurance claim can be daunting, but understanding the steps involved can significantly ease the experience. This section details the claim process in Rochester, NY, common claim settlement procedures, potential reasons for claim denials, and provides a visual representation of the entire process.

Filing a car insurance claim in Rochester, NY, generally involves contacting your insurance company as soon as possible after an accident. Prompt reporting is crucial for efficient processing. The specific steps might vary slightly depending on your insurer, but the overall process remains consistent.

Car Insurance Claim Filing Process

After reporting the accident to your insurer, you’ll typically need to provide detailed information about the incident, including the date, time, location, and all parties involved. You will also likely need to provide details of any injuries sustained and property damage. Supporting documentation such as police reports, photographs of the accident scene and damaged vehicles, and medical records will be necessary. Your insurance company will then assign an adjuster who will investigate the claim and determine liability.

Typical Steps in Settling a Car Insurance Claim

The settlement process typically involves several key steps: initial claim reporting, investigation by the insurance adjuster, assessment of damages, negotiation of settlement, and final payment. The adjuster will review all submitted documentation, assess the extent of damages to vehicles and any injuries, and determine the at-fault party. This process can take several weeks or even months depending on the complexity of the claim. Communication with your adjuster throughout the process is key to a smooth settlement.

Examples of Denied Car Insurance Claims

Insurance claims can be denied for several reasons. For example, a claim might be denied if the accident occurred while driving under the influence of alcohol or drugs. Another common reason for denial is if the policyholder failed to report the accident promptly as Artikeld in their policy terms. Claims may also be denied if the damage is deemed to be pre-existing, or if the policyholder intentionally caused the accident. Finally, if the policyholder is found to be at fault and does not have sufficient liability coverage to cover the damages, the claim may be partially or fully denied.

Car Insurance Claim Process Flowchart

Imagine a flowchart. The first box would be “Accident Occurs”. This flows to “Report Accident to Insurer”. Next, “Insurer Assigns Adjuster” follows. This leads to “Adjuster Investigates Claim”, which then branches into two paths: “Liability Determined” and “Liability Undetermined”. “Liability Determined” leads to “Damage Assessment” then to “Settlement Negotiation” and finally to “Claim Settlement”. “Liability Undetermined” might involve further investigation or legal action, ultimately also leading to a “Claim Settlement” (though potentially with different outcomes). If at any point documentation is insufficient, the process loops back to request further information.

Beyond the Basics

Choosing the right car insurance policy in Rochester, NY, involves more than just meeting minimum state requirements. Many supplemental coverages can enhance your protection and peace of mind, offering valuable benefits in unexpected situations. Understanding these options and their potential costs is crucial for making an informed decision.

Roadside Assistance Coverage

Roadside assistance is a valuable add-on that provides help with common roadside emergencies. Benefits include towing, flat tire changes, jump starts, and lockout services. While convenient, the cost can increase your premium, and some services might be available through other means like AAA. Weighing the potential need against the additional cost is key. For example, if you frequently drive long distances or live in an area with unreliable cell service, the added security could be worth the premium increase. Conversely, if you rarely encounter roadside problems and have a reliable support network, it might be a less necessary expense.

Comprehensive and Collision Coverage Levels

Comprehensive and collision coverage protect your vehicle against various incidents. Comprehensive covers damage from non-collision events like fire, theft, or vandalism, while collision covers damage from accidents. Insurance companies offer different coverage levels, typically expressed as percentages of your vehicle’s actual cash value (ACV) or replacement cost. Higher coverage levels offer greater protection but come with higher premiums. Choosing the right level depends on factors such as the age and value of your vehicle, your financial situation, and your risk tolerance. For instance, a newer, expensive car might warrant higher coverage to ensure sufficient compensation in case of damage, while an older car with a lower value might benefit from a lower, more affordable coverage level.

Rental Car Reimbursement Coverage

Rental car reimbursement coverage helps cover the cost of a rental car if your vehicle is damaged and undergoing repairs due to a covered incident (typically collision or comprehensive). This coverage can be a lifesaver, especially if your vehicle is out of commission for an extended period. The amount reimbursed varies by policy and might have daily or total limits. This is particularly beneficial for those who rely on their car for daily commutes or other essential activities. Without this coverage, you would bear the cost of renting a vehicle yourself while waiting for repairs, potentially a significant expense.

Key Features of Optional Coverages

- Roadside Assistance: Towing, flat tire change, jump starts, lockout service, possibly fuel delivery.

- Comprehensive Coverage: Covers damage from events other than collisions, such as fire, theft, vandalism, and weather damage. Coverage levels vary (e.g., 80%, 100% of ACV).

- Collision Coverage: Covers damage to your vehicle from accidents, regardless of fault. Coverage levels vary (e.g., 80%, 100% of ACV).

- Rental Car Reimbursement: Covers the cost of a rental car while your vehicle is being repaired due to a covered incident. Daily and total limits apply.

- Uninsured/Underinsured Motorist Coverage: Protects you in accidents caused by drivers without or with insufficient insurance.

Concluding Remarks

Finding the right car insurance in Rochester, NY, is a crucial step in responsible vehicle ownership. By understanding the local market dynamics, comparing quotes from multiple providers, and carefully selecting coverage options, you can ensure you have the protection you need at a price you can afford. Remember to regularly review your policy and adjust it as your needs change to maintain optimal coverage. Driving safely contributes significantly to lower premiums, so prioritize safe driving practices.

FAQ Corner

What is the average cost of car insurance in Rochester, NY?

The average cost varies significantly based on factors like age, driving history, vehicle type, and coverage level. It’s best to obtain quotes from multiple providers for a personalized estimate.

How does my driving record affect my car insurance rates in Rochester?

Your driving record is a major factor. Accidents and traffic violations significantly increase premiums. Maintaining a clean driving record is key to securing lower rates.

What is uninsured/underinsured motorist coverage, and why is it important in Rochester?

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. Given the potential for accidents, it’s a crucial protection in any area, including Rochester.

Can I bundle my car insurance with other types of insurance?

Yes, many insurers offer discounts for bundling car insurance with home, renters, or other types of insurance. This can lead to significant savings.