Finding the right car insurance in San Antonio can feel like navigating a complex maze. With a diverse population and a dynamic insurance market, understanding your options and securing the best coverage requires careful consideration. This guide delves into the intricacies of San Antonio’s car insurance landscape, providing insights into premiums, coverage types, and strategies for finding the most suitable and affordable policy for your needs.

From understanding the factors influencing your rates – like your driving history, the type of vehicle you drive, and even your credit score – to navigating the complexities of different coverage options, we aim to empower you with the knowledge to make informed decisions. We’ll explore the unique characteristics of San Antonio’s insurance market, comparing leading providers and offering practical tips to help you secure a policy that provides both comprehensive protection and peace of mind.

Understanding San Antonio’s Car Insurance Market

San Antonio, Texas, boasts a dynamic and sizable car insurance market, shaped by its unique demographic profile and local conditions. Understanding this market requires examining its key players, competitive dynamics, and the factors driving premium costs. This analysis will provide insights into the complexities of securing affordable and adequate car insurance within the city.

San Antonio Car Insurance Market Overview

The San Antonio car insurance market is substantial, reflecting the city’s large population and high vehicle ownership rates. Major national insurers like State Farm, Geico, and Progressive maintain a strong presence, competing with numerous regional and independent agencies. This competitive landscape generally benefits consumers, although the specific premiums vary significantly based on individual factors. The market is characterized by a mix of online and brick-and-mortar providers, offering various policy options and levels of customer service.

Demographics of San Antonio Drivers and Insurance Needs

San Antonio’s diverse population influences its insurance needs. A significant portion of the population falls within younger age brackets, often associated with higher risk and consequently, higher premiums. The city also has a considerable Hispanic population, and understanding cultural nuances related to insurance purchasing is crucial for providers. Furthermore, income levels vary across neighborhoods, affecting the types of vehicles owned and the affordability of different insurance coverage options. These demographic factors contribute to the diverse range of insurance products and pricing strategies observed in the market.

Factors Influencing Car Insurance Premiums in San Antonio

Several factors influence car insurance premiums in San Antonio. Crime rates, particularly theft and auto accidents, directly impact insurance costs. Higher crime rates lead to increased claims, forcing insurers to adjust premiums accordingly. Traffic patterns and congestion levels also play a role; higher traffic density often correlates with a greater likelihood of accidents. Furthermore, the cost of auto repairs and medical care in the San Antonio area influences the overall cost of claims, indirectly affecting premiums. Finally, individual driver characteristics like age, driving history, and credit score significantly impact the premium calculation.

Average Car Insurance Premiums Across San Antonio Zip Codes

The following table provides a hypothetical comparison of average car insurance premiums across four different San Antonio zip codes. Note that these are illustrative examples and actual premiums will vary based on individual circumstances. Real-world data would be needed for accurate figures, obtainable from insurance comparison websites or industry reports.

| Zip Code | Average Annual Premium (Example) | Factors Influencing Premium | Notes |

|---|---|---|---|

| 78201 | $1200 | High crime rate, dense traffic | Data based on hypothetical model |

| 78209 | $1000 | Moderate crime rate, moderate traffic | Data based on hypothetical model |

| 78212 | $1100 | High traffic, average crime rate | Data based on hypothetical model |

| 78247 | $900 | Lower crime rate, less dense traffic | Data based on hypothetical model |

Types of Car Insurance Coverage Available in San Antonio

Choosing the right car insurance in San Antonio involves understanding the various coverage options available. The specific needs of each driver will determine the optimal combination of coverages, balancing cost and protection. This section details the common types of coverage, their benefits and drawbacks, and a general overview of costs. Remember that actual costs vary widely depending on factors like your driving record, age, vehicle type, and the insurance company.

Liability Coverage

Liability insurance protects you financially if you cause an accident that injures someone or damages their property. It covers the medical bills, lost wages, and property repair costs of the other party. In Texas, liability coverage is mandatory, typically expressed as a three-number combination, such as 30/60/25. This means $30,000 per person for bodily injury, $60,000 total for bodily injury in an accident, and $25,000 for property damage. The benefit is crucial protection from potentially devastating financial consequences. However, liability coverage only protects others; it doesn’t cover your own medical bills or vehicle repairs if you are at fault. The cost of liability coverage is generally the lowest compared to other types of coverage and is a foundational element of any car insurance policy.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This includes collisions with other vehicles, objects, or even rollovers. The benefit is peace of mind knowing your vehicle is protected in the event of an accident. A significant drawback is the cost; collision coverage is typically more expensive than liability coverage. The cost will depend on the value of your vehicle and your deductible (the amount you pay out-of-pocket before the insurance kicks in). A higher deductible generally results in lower premiums.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions. This includes things like theft, vandalism, fire, hail, flood, and even damage from animals. The benefit is broad protection against a wide range of risks. Similar to collision coverage, the cost can be substantial, and the deductible will affect your premium. The cost will also vary depending on the value of your vehicle and the risk factors associated with your location (e.g., higher risk of theft or hail damage).

Cost Comparison of Coverage Options in San Antonio

Providing exact cost figures is impossible without specific driver information. However, a general comparison can be made. Liability coverage is typically the cheapest, followed by collision, and then comprehensive. The combination of liability, collision, and comprehensive is often referred to as “full coverage.” The total cost of full coverage will be significantly higher than liability-only coverage, but it provides significantly more protection. Factors such as your driving history, credit score, and the age and make of your vehicle significantly impact the final cost. It is best to obtain quotes from multiple insurance providers to compare prices and coverage options.

Common Add-ons or Endorsements

Several add-ons can enhance your car insurance policy. These additions provide extra protection beyond the standard coverages.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver.

- Medical Payments Coverage: This covers medical expenses for you and your passengers, regardless of fault.

- Rental Reimbursement: This covers the cost of a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This provides services like towing, flat tire changes, and lockout assistance.

- Gap Insurance: This covers the difference between the amount you owe on your car loan and the actual cash value of your vehicle if it’s totaled.

Finding the Best Car Insurance Deal in San Antonio

Securing the most affordable car insurance in San Antonio requires a strategic approach. By understanding the market, comparing quotes effectively, and considering various factors influencing premiums, drivers can significantly reduce their annual costs. This section Artikels key strategies and information to help you navigate the process and find the best deal.

Strategies for Comparing Car Insurance Quotes

Comparing quotes from multiple providers is crucial for finding the best car insurance deal. Don’t rely on just one quote; obtaining at least three to five quotes from different companies allows for a thorough comparison of coverage options and prices. Use online comparison tools to streamline the process, but always verify the details directly with the insurance companies. Pay close attention to the specific coverage details offered at each price point, ensuring you’re comparing apples to apples. Consider factors like deductibles and coverage limits when evaluating different quotes. A slightly higher premium with a lower deductible might be a more cost-effective option in the long run.

Factors Impacting Car Insurance Rates

Several factors influence your car insurance premiums in San Antonio. Your driving history is paramount; accidents and traffic violations significantly increase your rates. Age is another key factor; younger drivers generally pay more due to higher risk profiles. Your credit score surprisingly plays a role; insurers often use credit scores to assess risk. The type of vehicle you drive also matters; expensive cars or those with a history of theft attract higher premiums. Your location within San Antonio can also impact your rates due to varying accident rates and crime statistics in different neighborhoods. Finally, the amount and type of coverage you choose directly affect your premium; comprehensive and collision coverage, while more expensive, offer greater protection.

Tips for Negotiating Lower Car Insurance Premiums

Negotiating lower premiums is possible. Bundle your car insurance with other policies, such as homeowners or renters insurance, from the same company to often secure discounts. Maintain a clean driving record by avoiding accidents and traffic violations. Consider increasing your deductible; a higher deductible reduces your premium but increases your out-of-pocket expenses in case of an accident. Explore discounts offered by insurers; many offer discounts for good students, safe drivers, and those who install anti-theft devices. Shop around regularly and don’t be afraid to switch insurers if you find a better deal. Be prepared to discuss your driving history and other relevant factors when negotiating. Loyalty discounts might be offered for long-term customers, but don’t hesitate to switch if a better offer is available elsewhere.

Comparison of Leading Car Insurance Companies in San Antonio

Below is a comparison table of some leading car insurance companies in San Antonio. Note that prices are estimates and can vary based on individual factors. This table should be used as a starting point for your own research.

| Company | Average Annual Premium (Estimate) | Key Features | Customer Service Rating (Example) |

|---|---|---|---|

| State Farm | $1200 | Wide coverage options, strong customer service | 4.5 stars |

| Geico | $1100 | Competitive pricing, online convenience | 4 stars |

| Progressive | $1300 | Name-your-price tool, various discounts | 4.2 stars |

| USAA | $1000 | Excellent for military members and families | 4.8 stars |

Illustrating Common Car Insurance Scenarios in San Antonio

Understanding real-life scenarios helps clarify the importance of adequate car insurance coverage in San Antonio. This section details two common accident types and illustrates how different coverage options would respond.

Minor Car Accident in San Antonio: Insurance Claim Process

Imagine a minor fender bender at a busy San Antonio intersection. Your vehicle sustains $2,000 in damage, and the other driver’s car has $1,500 worth of damage. Both drivers admit fault. The claim process begins with contacting your insurance company immediately. You’ll provide details of the accident, including the date, time, location, and the other driver’s information. Your insurer will then initiate an investigation, potentially involving a claims adjuster visiting the scene or reviewing police reports (if filed). If you have collision coverage, your insurer will typically cover the repairs to your vehicle, minus your deductible. Liability coverage will cover the other driver’s damages. If both drivers have collision coverage, each party deals with their respective insurers. If one driver is uninsured, the process becomes more complex, and uninsured/underinsured motorist coverage would become crucial.

Significant Car Accident in San Antonio: Insurance Claim Process

Consider a more serious scenario: a multi-vehicle accident on Highway 281 resulting in significant property damage and injuries. Your vehicle is totaled, and another driver suffers severe injuries requiring extensive medical care. The claim process is far more involved. Police will likely be involved, creating an official accident report. Your insurance company will investigate, requiring you to provide detailed information about the accident, your injuries (if any), and the extent of the damage. Your collision coverage will cover the repair or replacement of your vehicle (minus your deductible). Your liability coverage will cover the other driver’s medical expenses and property damage up to your policy limits. However, if the other driver’s medical bills and damages exceed your liability coverage, you could face significant personal financial responsibility. Uninsured/underinsured motorist bodily injury coverage would be essential if the at-fault driver lacked sufficient insurance. Your personal injury protection (PIP) coverage, if you have it, will help cover your medical bills and lost wages, regardless of fault.

Illustrative Visual Depiction of the Car Insurance Claim Process

The visual would be a flowchart. It would begin with the “Accident Occurs” box, leading to “Contact Your Insurance Company” box. This then branches into two paths: one for “Minor Accident” and one for “Significant Accident”. The “Minor Accident” path shows a simplified process involving reporting, investigation, and repair/settlement. The “Significant Accident” path illustrates a more complex process, including police involvement, detailed investigation, potential legal proceedings, and multiple claims settlements for various parties. Both paths converge at a final box, “Claim Resolution”. The flowchart uses arrows to show the sequence of steps and boxes to represent each stage of the process. Different colors could be used to highlight different coverage types involved at each stage (e.g., green for collision, blue for liability, red for uninsured/underinsured motorist).

Factors Affecting Car Insurance Costs in San Antonio

Several factors influence the cost of car insurance in San Antonio, a city with a diverse population and varying driving conditions. Understanding these factors can help drivers in San Antonio make informed decisions to secure the best possible rates. These factors interact in complex ways, so it’s crucial to consider them holistically.

Vehicle Type’s Influence on Insurance Premiums

The type of vehicle significantly impacts insurance premiums. Generally, high-performance cars, luxury vehicles, and those with a history of theft or accidents command higher premiums due to increased repair costs and higher risk profiles. Conversely, smaller, less expensive vehicles often attract lower premiums. For instance, a sports car like a Porsche 911 will typically cost considerably more to insure than a fuel-efficient Honda Civic due to higher repair costs and a greater likelihood of accidents or theft. The vehicle’s safety features, such as anti-theft systems and advanced driver-assistance systems (ADAS), also play a role; vehicles equipped with these features may receive discounts.

Driving History’s Impact on Car Insurance Rates

A driver’s history is a major determinant of insurance costs. A clean driving record with no accidents or traffic violations results in lower premiums. Conversely, accidents, speeding tickets, and DUI convictions significantly increase rates. Insurance companies view these incidents as indicators of higher risk. For example, a driver with multiple speeding tickets within a year might see their premiums increase by 20% or more compared to a driver with a spotless record. The severity of the accident also plays a role; a major accident causing significant damage will result in a more substantial premium increase than a minor fender bender.

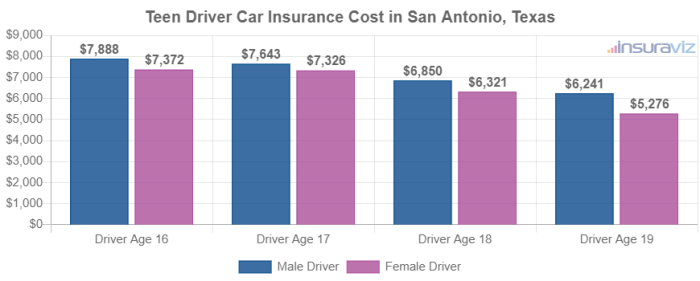

Insurance Costs Across Different Age Groups

Insurance costs vary considerably across age groups. Younger drivers (typically under 25) generally pay higher premiums due to statistically higher accident rates among this demographic. Insurance companies perceive them as higher risk. Conversely, older drivers (typically over 65) may also see higher premiums, although this is often less dramatic than for younger drivers. This can be attributed to factors such as age-related health concerns affecting driving ability. Mid-range age groups (approximately 25-65) typically enjoy the lowest premiums, reflecting a lower statistical risk profile. It’s important to note that these are general trends; individual driving records and other factors still play a significant role.

Summary of Factors Influencing Car Insurance Premiums

| Factor | Relative Impact | Example | Mitigation Strategies |

|---|---|---|---|

| Vehicle Type | High | Sports car vs. compact car | Choose a safer, less expensive vehicle |

| Driving History | Very High | Multiple accidents vs. clean record | Maintain a clean driving record, take defensive driving courses |

| Age | Moderate to High | Young driver vs. middle-aged driver | Maintain a clean driving record, consider bundling policies |

| Location | Moderate | High-crime area vs. low-crime area | Consider living in a lower-risk area (if possible) |

Ending Remarks

Securing the right car insurance in San Antonio is a crucial step in responsible driving. By understanding the market dynamics, comparing quotes effectively, and choosing coverage that aligns with your individual needs and risk profile, you can navigate the complexities of the insurance process with confidence. Remember to regularly review your policy and adjust it as your circumstances change to ensure you maintain optimal protection on the road. Driving safely and proactively managing your insurance needs are key to a smooth and worry-free driving experience in the vibrant city of San Antonio.

FAQ

What is the average cost of car insurance in San Antonio?

The average cost varies greatly depending on factors like age, driving history, vehicle type, and coverage level. It’s best to obtain personalized quotes from multiple insurers.

How does my credit score affect my car insurance rates?

In many states, including Texas, insurance companies consider credit scores when determining rates. A higher credit score generally translates to lower premiums.

What should I do if I’m involved in a minor accident in San Antonio?

Exchange information with the other driver(s), call the police to file a report (if needed), and contact your insurance company to report the accident as soon as possible.

Can I get car insurance without a driver’s license?

No, you generally need a valid driver’s license to obtain car insurance.