Navigating the world of car insurance can feel like deciphering a complex code. Premiums vary wildly, and understanding the factors that influence cost is crucial to securing the best—and most affordable—coverage. This guide unravels the mysteries behind finding the cheapest car insurance, empowering you to make informed decisions and save money without sacrificing essential protection.

From understanding the different types of coverage and their implications to mastering the art of comparing quotes and negotiating rates, we’ll equip you with the knowledge and strategies needed to secure the most cost-effective car insurance policy tailored to your specific needs. We’ll explore the key factors influencing premiums, offering practical tips and insights to help you minimize your expenses while maintaining adequate coverage.

Understanding “Cheapest Car Insurance”

Finding the cheapest car insurance involves understanding the various factors that influence premiums. It’s not simply about finding the lowest advertised price; it’s about finding the best value for your specific needs and risk profile. Several interconnected elements determine your insurance cost, and a comprehensive understanding of these factors is crucial for making an informed decision.

Factors Influencing Car Insurance Costs

Numerous factors contribute to the final cost of your car insurance. These can be broadly categorized into driver-related factors, vehicle-related factors, and location-based factors. Driver-related factors include your age, driving history (accidents and violations), credit score, and driving experience. Vehicle-related factors consider the make, model, year, and safety features of your car. Location-based factors encompass the geographic area where you reside and park your vehicle, as rates vary significantly based on accident frequency and theft rates in different regions. For example, a young driver with a poor driving record living in a high-crime area will generally pay significantly more than an older driver with a clean record living in a rural area, even if they drive the same car.

Types of Car Insurance Coverage

Car insurance policies typically offer various coverage options. Liability coverage pays for damages or injuries you cause to others in an accident. Collision coverage reimburses you for damage to your car resulting from a collision, regardless of fault. Comprehensive coverage protects against damage or loss not related to collisions, such as theft, vandalism, or weather damage. Uninsured/Underinsured motorist coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. Medical payments coverage helps pay for medical expenses for you and your passengers, regardless of fault. The combination of coverages you choose significantly impacts your premium. Opting for only the minimum required liability coverage will be cheaper, but leaves you with greater financial risk in case of an accident.

Driver Demographics and Insurance Premiums

Driver demographics play a substantial role in determining insurance premiums. Younger drivers generally pay more due to statistically higher accident rates. Drivers with poor credit scores often face higher premiums as insurers view them as higher risks. Your driving history is crucial; multiple accidents or traffic violations will significantly increase your premiums. Gender can also be a factor, though this is becoming less significant in many jurisdictions. For instance, a 20-year-old driver with a speeding ticket will likely pay considerably more than a 50-year-old driver with a clean driving record.

Average Insurance Costs for Different Car Makes and Models

The make and model of your car also influence insurance premiums. Generally, more expensive and high-performance vehicles command higher insurance rates due to their higher repair costs and potential for greater damage. Cars with advanced safety features may qualify for discounts. The table below provides estimated average annual insurance costs for selected vehicles. Note that these are averages and can vary significantly based on the factors discussed above.

| Make & Model | Average Annual Cost (USD) | Make & Model | Average Annual Cost (USD) |

|---|---|---|---|

| Honda Civic | $1200 | Toyota Camry | $1300 |

| Ford F-150 | $1500 | BMW 3 Series | $1800 |

| Chevrolet Silverado | $1600 | Porsche 911 | $3000 |

Finding Affordable Car Insurance Options

Securing affordable car insurance requires a proactive approach involving careful comparison shopping and a thorough understanding of your policy. This involves utilizing various resources and techniques to identify the best coverage at the most competitive price. Remember, the cheapest option isn’t always the best, so a balance between cost and adequate protection is key.

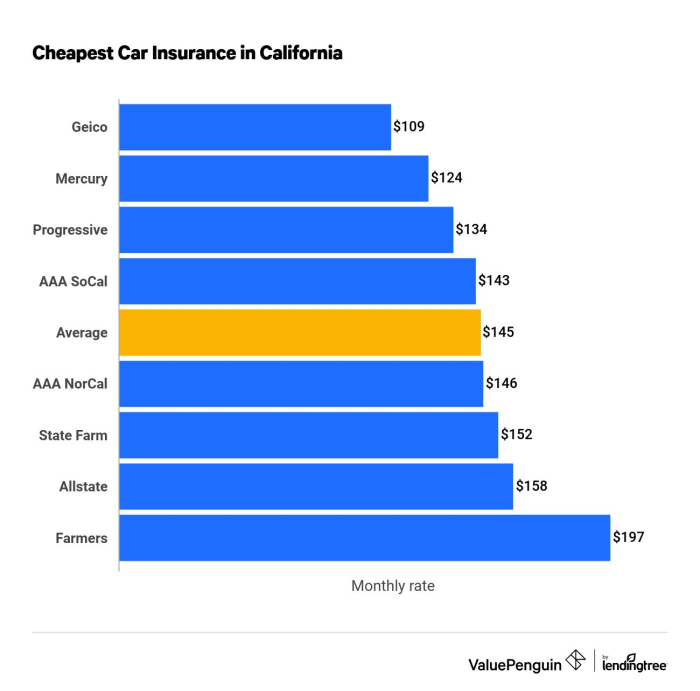

Finding the best car insurance rates often involves comparing quotes from multiple providers. This allows you to see the range of prices and coverage options available, enabling you to make an informed decision. Don’t rely on just one quote; broaden your search to ensure you’re getting the most competitive offer.

Comparing Car Insurance Quotes

Several methods exist for efficiently comparing car insurance quotes. You can contact insurance companies directly, either by phone or in person, to request quotes. This allows for personalized service and the opportunity to ask specific questions about policy details. Alternatively, many insurance providers offer online quote tools, enabling quick and easy comparison across various plans. Using a combination of these methods often yields the best results. Finally, independent comparison websites aggregate quotes from numerous providers, streamlining the comparison process.

Benefits and Drawbacks of Online Comparison Tools

Online comparison tools offer several advantages. They are convenient, saving you time and effort by providing multiple quotes simultaneously. They also promote transparency, allowing you to compare coverage options and prices side-by-side. However, they have limitations. The results may not encompass every provider, and the information presented might be simplified, potentially omitting crucial details. It’s essential to verify the information presented on these sites with the insurance company directly.

The Importance of Careful Policy Review

Before committing to a car insurance policy, meticulously review the policy document. Pay close attention to the coverage details, deductibles, premiums, and any exclusions. Understanding these aspects will ensure that the policy aligns with your needs and budget. Don’t hesitate to contact the insurance company for clarification on any unclear terms or conditions. A thorough understanding of your policy protects you from unexpected costs or inadequate coverage.

A Step-by-Step Guide to Obtaining Car Insurance

Obtaining car insurance involves a series of straightforward steps. First, gather necessary information, including your driver’s license, vehicle information (make, model, year), and driving history. Second, use online comparison tools or contact insurance providers directly to obtain quotes. Third, compare quotes, focusing on coverage, premiums, and deductibles. Fourth, carefully review the policy documents of your preferred option. Finally, finalize the purchase and ensure you receive confirmation of your coverage. Remember to keep your policy information readily available.

Factors Affecting Insurance Premiums

Understanding how car insurance companies determine your premiums is crucial for securing the best possible rate. Numerous factors contribute to the final cost, and recognizing these elements empowers you to make informed decisions that can save you money. This section will break down the key influences on your car insurance premium.

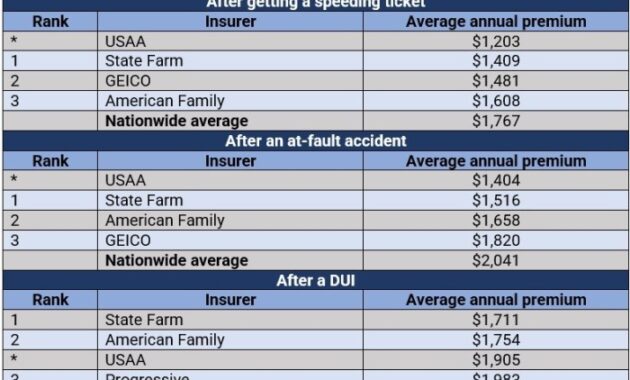

Driving Record

Your driving history significantly impacts your insurance premium. Insurance companies view a clean driving record as a sign of responsible behavior and low risk. Conversely, a history of accidents, traffic violations, or DUI convictions indicates a higher likelihood of future claims, leading to increased premiums. For example, a single speeding ticket might result in a modest premium increase, while multiple accidents or a DUI could lead to substantially higher rates, or even policy cancellation in some cases. A driver with a spotless record for several years will generally receive lower premiums than a driver with a history of incidents.

Age and Gender

Statistically, younger drivers are involved in more accidents than older drivers. Insurance companies reflect this in their pricing models, with younger drivers often facing higher premiums. This is largely due to inexperience and a higher propensity for risk-taking behaviors. Gender also plays a role, although the impact varies by region and insurance provider. Historically, male drivers have been statistically associated with a higher risk profile than female drivers, though this gap is narrowing in many areas.

Location

Where you live heavily influences your insurance rates. Areas with high crime rates, frequent accidents, or a higher prevalence of vehicle theft will typically command higher premiums due to the increased risk of claims. For instance, living in a densely populated urban area with a high volume of traffic may result in higher premiums compared to living in a rural area with lower traffic density and fewer reported incidents. The cost of repairs and medical care also plays a role; areas with higher costs of living generally have higher insurance premiums.

Vehicle Type

The type of car you drive is another key factor. Sports cars and luxury vehicles are often more expensive to insure due to their higher repair costs and greater potential for theft. Conversely, smaller, less expensive vehicles typically have lower insurance premiums. Features like anti-theft systems and safety technology can also influence premiums; vehicles equipped with advanced safety features may qualify for discounts.

Discounts

Many insurance companies offer various discounts to reduce premiums. These incentives reward safe driving habits and responsible behavior. Examples include good student discounts for high-achieving students, safe driver discounts for those with clean driving records, and multi-policy discounts for bundling car insurance with other types of insurance, such as homeowners or renters insurance. Other potential discounts include discounts for anti-theft devices, driver training courses, and continuous insurance coverage.

Saving Money on Car Insurance

Securing the cheapest car insurance is a priority for many drivers, but finding the lowest rate isn’t always about simply comparing quotes. Active strategies can significantly reduce your premiums. This section explores effective methods for negotiating lower rates, improving your driving habits, and leveraging policy features to minimize your annual cost.

Negotiating lower insurance rates often involves more than just switching companies. Many insurers are willing to work with loyal customers or those who bundle multiple policies.

Negotiating Lower Insurance Rates

Insurance companies sometimes have some wiggle room in their pricing. Directly contacting your insurer and politely explaining your financial situation or presenting quotes from competitors can be surprisingly effective. Highlight your clean driving record and any safety features on your vehicle to strengthen your negotiating position. Consider bundling your car insurance with home or renters insurance; many companies offer discounts for multiple policies. Finally, explore loyalty programs or discounts offered by your insurer. A small discount can add up over time.

Improving Driving Habits to Reduce Risk and Premiums

Safe driving habits are directly linked to lower insurance premiums. Insurance companies assess risk based on your driving history. By adopting safer driving practices, you can significantly reduce your likelihood of accidents and, consequently, your insurance costs.

Increasing Your Deductible

Raising your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can result in lower premiums. This is because you’re accepting more financial responsibility in the event of an accident. However, carefully weigh the potential cost savings against your ability to afford a higher deductible in case of a claim. For example, increasing your deductible from $500 to $1000 might save you 15-20% on your premium. This is a significant saving for those who haven’t made a claim in years and are comfortable with the increased financial risk.

Maintaining a Good Driving Record

Maintaining a clean driving record is paramount to securing lower insurance rates. A history of accidents or traffic violations significantly increases your premiums. Insurance companies view this as a higher risk profile.

- Avoid speeding tickets: Speeding significantly increases your risk of accidents.

- Obey traffic laws: Following all traffic regulations demonstrates responsible driving.

- Practice defensive driving: Anticipating potential hazards and reacting safely minimizes accident risk.

- Complete a defensive driving course: Many insurers offer discounts for completing approved courses.

- Avoid driving under the influence of alcohol or drugs: DUI convictions drastically increase premiums.

Understanding Policy Coverage

Choosing the right car insurance policy involves understanding the different types of coverage available and their respective limits. This knowledge empowers you to make informed decisions based on your individual needs and risk tolerance. Failing to understand your policy could leave you financially vulnerable in the event of an accident.

Types of Car Insurance Coverage

Car insurance policies typically offer several types of coverage. Liability coverage protects you financially if you cause an accident that injures someone or damages their property. Collision coverage pays for repairs to your vehicle regardless of who is at fault. Comprehensive coverage protects against damage caused by events other than collisions, such as theft, vandalism, or weather-related incidents. Uninsured/Underinsured Motorist coverage protects you if you are involved in an accident with a driver who lacks sufficient insurance. Personal Injury Protection (PIP) covers medical expenses and lost wages for you and your passengers, regardless of fault. Medical Payments coverage is similar to PIP but often has lower limits.

Coverage Limits and Policy Variations

Coverage limits represent the maximum amount your insurance company will pay for a specific type of claim. For example, a liability policy might have limits of $100,000 per person and $300,000 per accident for bodily injury. Collision and comprehensive coverage often have separate limits, typically the actual cash value (ACV) or replacement cost of your vehicle, subject to your deductible. The specific limits and types of coverage offered vary widely between insurance companies and policy types. A basic policy might only include liability coverage, while a more comprehensive policy could include all the coverage types mentioned above, with higher limits. Understanding these variations is crucial for selecting a policy that adequately protects your financial interests.

Filing a Claim After an Accident

The claims process typically begins by contacting your insurance company as soon as possible after an accident. You will need to provide details about the accident, including the date, time, location, and involved parties. You should also gather information such as police reports, witness statements, and photos of the damage. Your insurer will then investigate the claim and determine liability. If your claim is approved, you’ll receive payment for covered repairs or medical expenses, less any applicable deductible. Failure to follow the proper claims procedures could delay or jeopardize your claim.

Visual Representation of Car Insurance Coverage

Imagine a layered circle. The outermost layer represents Liability coverage, the broadest protection, shielding you from financial responsibility for injuries or damages you cause to others. The next layer inward is Collision coverage, protecting your own vehicle from damage in an accident. Inside that is Comprehensive coverage, which acts as a shield against non-collision damage. A smaller, central circle represents Uninsured/Underinsured Motorist and PIP/Med-Pay coverages, offering protection against accidents involving drivers without sufficient insurance or covering medical expenses regardless of fault. Each layer’s size visually represents the coverage limits; a larger layer indicates higher coverage limits, providing greater financial protection. The deductible is represented as a small gap between each layer and the next, symbolizing the amount you’re responsible for before insurance coverage kicks in. The entire circle illustrates the comprehensive nature of a well-rounded car insurance policy, protecting you from various risks.

Ultimate Conclusion

Securing the cheapest car insurance doesn’t mean compromising on vital protection. By understanding the factors influencing premiums, employing effective comparison strategies, and practicing safe driving habits, you can significantly reduce your costs without sacrificing the peace of mind that comprehensive coverage provides. Remember, a little research and proactive planning can go a long way in saving you money on your car insurance premiums, allowing you to keep more of your hard-earned money in your pocket.

Question Bank

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others. Collision coverage pays for damage to your own vehicle, regardless of fault.

How does my credit score affect my car insurance rates?

In many states, insurers use credit-based insurance scores to assess risk. A higher credit score generally leads to lower premiums.

Can I get car insurance without a driving history?

Yes, but you’ll likely pay higher premiums. Insurers may use other factors to assess risk, such as your age and location.

What is a usage-based insurance program?

These programs use telematics devices or smartphone apps to track your driving habits. Safe driving can result in lower premiums.