Securing the right car insurance in the USA can feel like navigating a complex maze. With a vast landscape of providers, coverage options, and state-specific regulations, understanding your needs and finding the best policy can be overwhelming. This comprehensive guide unravels the intricacies of car insurance in the US, empowering you to make informed decisions and protect yourself on the road.

From understanding the different types of coverage – liability, collision, comprehensive, and more – to identifying factors that influence premiums (like age, driving history, and location), we’ll equip you with the knowledge to compare quotes effectively, decipher policy details, and ultimately, secure the most suitable and affordable car insurance for your circumstances. We’ll also explore how technology is reshaping the industry and how you can leverage discounts to save money.

Types of Car Insurance in the USA

Choosing the right car insurance can feel overwhelming, given the variety of options available. Understanding the different types of coverage is crucial to securing adequate protection while managing your budget effectively. This section details the major types of car insurance coverage offered in the United States, outlining their benefits, drawbacks, and cost factors.

Liability Coverage

Liability insurance covers damages and injuries you cause to others in an accident. It’s typically broken down into bodily injury liability and property damage liability. Bodily injury liability covers medical bills, lost wages, and pain and suffering for injured individuals. Property damage liability covers repairs or replacement of the other person’s vehicle or property. State minimums for liability coverage vary, but carrying higher limits is recommended to protect yourself from potentially devastating financial consequences.

| Coverage Type | Description | Typical Costs | Common Exclusions |

|---|---|---|---|

| Bodily Injury Liability | Covers medical expenses, lost wages, and pain and suffering for injuries you cause to others. | Varies widely based on location, driving record, and coverage limits; can range from $200 to $1000+ annually. | Injuries to you or your passengers; damages to your own vehicle. |

| Property Damage Liability | Covers damage to another person’s vehicle or property caused by you. | Varies widely based on location, driving record, and coverage limits; often included with bodily injury liability. | Damage to your own vehicle; injuries to you or your passengers. |

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. This means that even if you caused the accident, your insurance will help cover the cost of repairing your car. Collision coverage is optional, but highly recommended, especially for newer vehicles.

| Coverage Type | Description | Typical Costs | Common Exclusions |

|---|---|---|---|

| Collision | Pays for repairs or replacement of your vehicle following an accident, regardless of fault. | Varies significantly based on vehicle value, location, and driving record; can range from $200 to $1000+ annually. | Damage caused by wear and tear, vandalism (unless comprehensive coverage is also included), or events not involving a collision. |

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. Like collision coverage, it’s optional but offers valuable protection against unforeseen circumstances.

| Coverage Type | Description | Typical Costs | Common Exclusions |

|---|---|---|---|

| Comprehensive | Covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters. | Varies based on vehicle value, location, and driving record; often comparable to collision coverage costs. | Damage from wear and tear; damage caused by a collision (covered by collision coverage). |

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle repairs, even if the other driver is at fault and lacks sufficient insurance. Given the prevalence of uninsured drivers in some areas, this coverage is highly advisable.

| Coverage Type | Description | Typical Costs | Common Exclusions |

|---|---|---|---|

| Uninsured/Underinsured Motorist | Covers your medical bills and vehicle repairs if involved in an accident with an uninsured or underinsured driver. | Varies by location and coverage limits; a relatively inexpensive addition to a policy. | Injuries or damages you cause to others; damages resulting from intentional acts. |

Factors Influencing Insurance Costs

Several factors influence the cost of each type of coverage. These include your driving record (accidents and violations), age, location (rates vary by state and even zip code), vehicle type and value, credit score, and the amount of coverage you choose. For example, a driver with multiple accidents and traffic tickets will typically pay significantly more than a driver with a clean record. Similarly, insuring a high-performance sports car will generally be more expensive than insuring a smaller, less expensive vehicle.

Factors Affecting Car Insurance Premiums

Your car insurance premium isn’t plucked from thin air; it’s carefully calculated based on a variety of factors that assess your risk profile. Insurance companies use sophisticated algorithms to weigh these factors, ultimately determining how much you’ll pay each year. Understanding these factors can help you make informed decisions about your driving habits and vehicle choices.

Several key elements influence the final cost of your car insurance. These factors are analyzed individually and then combined to produce a comprehensive risk assessment. A higher risk profile generally translates to a higher premium.

Driver Age and Experience

Younger drivers, particularly those under 25, statistically have a higher incidence of accidents. This increased risk leads to higher premiums. Conversely, as drivers age and accumulate years of safe driving experience, their premiums tend to decrease. This reflects the reduced risk associated with more mature and experienced drivers. Insurance companies often reward years of accident-free driving with discounts.

Driving History

Your driving record is a crucial factor. Accidents, speeding tickets, and other moving violations significantly impact your premium. Multiple incidents within a short period will substantially increase your cost. Conversely, a clean driving record with no accidents or tickets can result in lower premiums and potential discounts.

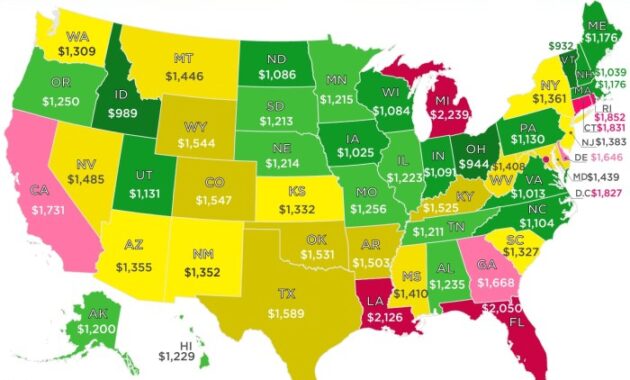

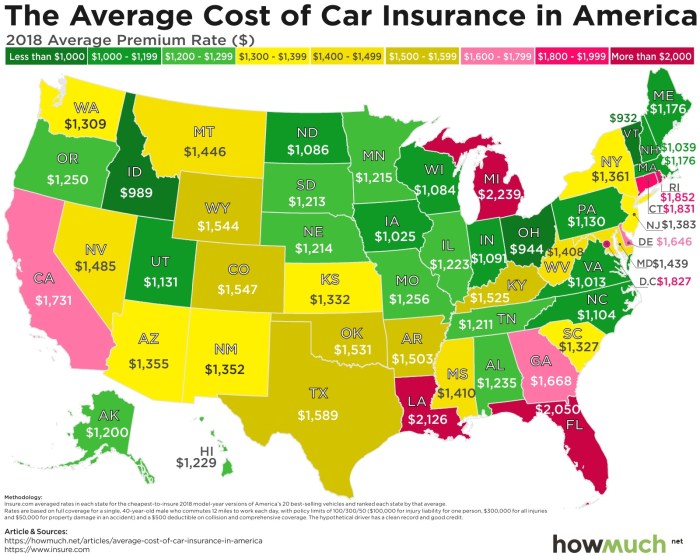

Location

Where you live plays a significant role. Areas with high crime rates, congested traffic, and a higher frequency of accidents typically have higher insurance premiums. This is because the likelihood of an insured vehicle being involved in an accident or theft is statistically higher in these locations. Rural areas, conversely, may offer lower rates due to lower accident risks.

Vehicle Type

The type of vehicle you drive influences your premium. Sports cars and luxury vehicles are often more expensive to insure due to their higher repair costs and greater potential for theft. Smaller, less expensive cars generally have lower premiums. The vehicle’s safety features, such as airbags and anti-lock brakes, also factor into the calculation. Vehicles with advanced safety technologies often receive discounts.

Coverage Choices

The level of coverage you select directly affects your premium. Comprehensive and collision coverage, which protects against damage to your vehicle, is more expensive than liability-only coverage, which covers damage you cause to others. Higher coverage limits naturally translate to higher premiums. Choosing higher deductibles, the amount you pay out-of-pocket before insurance kicks in, can lower your premiums.

Hypothetical Scenario: High vs. Low Premium

Let’s consider two drivers:

* Driver A: A 20-year-old with a speeding ticket, driving a new sports car in a large city, opting for full coverage with a low deductible. This driver profile presents a high-risk profile, resulting in a significantly higher premium.

* Driver B: A 45-year-old with a clean driving record, driving a used compact car in a rural area, opting for liability-only coverage with a high deductible. This driver profile presents a low-risk profile, resulting in a significantly lower premium.

The contrast between these two scenarios illustrates how various factors combine to determine the final cost of car insurance. Understanding these factors can empower you to make choices that may reduce your premium.

Finding and Comparing Car Insurance Quotes

Securing the best car insurance involves more than just picking the first policy you see. A thorough comparison of quotes from multiple providers is crucial to finding the right coverage at the most competitive price. This process requires careful consideration of your needs and a systematic approach to evaluating different options.

Finding the right car insurance involves actively seeking quotes from various companies and comparing their offerings. This ensures you get the best coverage at a price that fits your budget. Failing to compare quotes can lead to overpaying for insurance or settling for inadequate coverage.

Online Comparison Tools

Many websites specialize in comparing car insurance quotes from a wide range of providers. These tools streamline the process by allowing you to input your information once and receive multiple quotes simultaneously. Using these tools saves significant time and effort compared to contacting each insurer individually. Some popular comparison websites often include detailed policy summaries, customer reviews, and financial ratings of the insurers, assisting in making informed decisions. Remember to check the reputation and objectivity of the comparison website before relying on its results. Some websites may prioritize certain insurers based on commission structures.

Directly Contacting Insurers

While online comparison tools are convenient, it’s beneficial to also contact insurers directly. This allows you to ask specific questions about policy details and potentially negotiate better rates. This direct approach can uncover options or discounts not readily available through comparison websites. For instance, some insurers may offer discounts for bundling home and auto insurance or for completing a defensive driving course, which might not be highlighted on a comparison site.

Reading the Fine Print and Understanding Policy Details

Before committing to any policy, meticulously review the fine print. Pay close attention to coverage limits, deductibles, exclusions, and any additional fees or surcharges. Understanding these details ensures you’re aware of your responsibilities and the extent of coverage provided. For example, a policy might offer liability coverage but have a low limit, leaving you financially vulnerable in a serious accident. Similarly, understanding your deductible – the amount you pay out-of-pocket before insurance coverage kicks in – is vital in choosing a plan that fits your financial capabilities. Comparing policies with similar coverage levels but different deductibles can significantly impact your overall cost.

Understanding Insurance Policies and Claims

Understanding your car insurance policy and the claims process is crucial for protecting yourself financially in the event of an accident or damage to your vehicle. This section details the essential components of a typical policy and Artikels the steps involved in filing and resolving a claim.

Standard Car Insurance Policy Components

A standard car insurance policy comprises several key sections, each defining specific coverages and responsibilities. Understanding these components is essential for making informed decisions and navigating the claims process effectively.

| Policy Section | Description | Key Terms | Example Scenarios |

|---|---|---|---|

| Liability Coverage | Covers bodily injury or property damage you cause to others in an accident. | Bodily Injury Liability, Property Damage Liability, Limits of Liability | You rear-end another car, causing $5,000 in damages to their vehicle and $10,000 in medical bills for the driver. Your liability coverage would pay for these expenses up to your policy limits. |

| Collision Coverage | Covers damage to your vehicle caused by an accident, regardless of fault. | Deductible, Collision Damage Waiver | You hit a deer, causing significant damage to your car’s front end. Your collision coverage would pay for repairs, minus your deductible. |

| Comprehensive Coverage | Covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, or weather damage. | Deductible, Acts of God | Your car is stolen and later recovered with significant damage. Your comprehensive coverage would help cover the repair costs, less your deductible. A tree falls on your car during a storm; comprehensive coverage would apply. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re injured by an uninsured or underinsured driver. | Uninsured Motorist Bodily Injury, Uninsured Motorist Property Damage | You are hit by a driver without insurance. Your uninsured/underinsured motorist coverage would help pay for your medical bills and vehicle repairs. |

| Medical Payments Coverage (Med-Pay) | Covers medical expenses for you and your passengers, regardless of fault. | Medical Bills, Treatment Costs | You and your passenger are injured in an accident. Med-Pay coverage would help cover your medical expenses, even if you are at fault. |

The Claims Process

Filing a car insurance claim involves several steps, beginning with promptly reporting the accident to your insurer and the authorities. Accurate and thorough documentation is vital throughout the process.

The process typically begins with reporting the accident to your insurance company, often within a specified timeframe (usually 24-48 hours). You’ll need to provide details of the accident, including the date, time, location, and involved parties. Next, you’ll likely need to provide a police report number (if applicable) and details about the damages. The insurer will then investigate the claim, potentially requesting additional information or arranging for an inspection of the damaged vehicle. Once the investigation is complete, your insurer will determine liability and the amount of coverage available. After agreeing on the settlement, you will receive compensation, which might involve direct payment for repairs, reimbursement for medical expenses, or a settlement check.

Common Claim Scenarios and Resolution

Various scenarios can lead to car insurance claims. Understanding how to navigate these scenarios can ensure a smoother claims process.

Scenario 1: Minor Collision with Known Driver: If you’re involved in a minor fender bender with a driver who has insurance, exchange information (names, addresses, insurance details, driver’s license numbers, vehicle information) and immediately report the accident to your insurer. Both parties’ insurance companies will likely handle the claim. If fault is clear, the at-fault driver’s insurance will likely cover the damages. If fault is disputed, the insurance companies will investigate.

Scenario 2: Hit and Run: If you are involved in a hit and run, immediately contact the police to file a report. Then, contact your insurance company to report the incident and file a claim under your comprehensive or uninsured/underinsured motorist coverage (depending on your policy).

Scenario 3: Vehicle Theft: Report the theft to the police immediately and obtain a police report number. Contact your insurance company and file a claim under your comprehensive coverage. You will likely need to provide proof of ownership and any other relevant documentation.

Discounts and Savings on Car Insurance

Lowering your car insurance premiums doesn’t have to be a mystery. Many insurance companies offer a variety of discounts, allowing you to significantly reduce your annual cost. By understanding these discounts and meeting the eligibility requirements, you can save hundreds of dollars. This section details common discounts and how to access them.

Types of Car Insurance Discounts

Numerous discounts are available, and the specific offerings vary by insurance company. It’s essential to check with your insurer to see which discounts you qualify for. Many discounts can be combined, leading to even greater savings.

- Safe Driving Discounts: These are among the most common. Insurance companies reward drivers with clean driving records, often offering discounts for accident-free years or for maintaining a certain number of years without a speeding ticket or other moving violation. Eligibility typically requires providing proof of your driving history through your driving record. The discount amount increases with the length of time you maintain a clean record. For example, five years without an accident might earn a 15% discount, while ten years could yield a 25% discount. The specific percentage varies greatly depending on the insurer and your location.

- Bundling Discounts: Many insurers offer discounts if you bundle your car insurance with other types of insurance, such as homeowners or renters insurance. This incentivizes customers to consolidate their insurance needs with a single provider. Eligibility is straightforward; simply provide proof of other policies with the same insurer. Discounts typically range from 5% to 25%, depending on the policies bundled.

- Good Student Discounts: Students maintaining a high grade point average (GPA) are often eligible for discounts. This encourages academic achievement and responsible behavior. Eligibility usually requires providing proof of enrollment and GPA from your educational institution. The discount percentage varies by insurer and GPA requirement; a 3.0 GPA or higher is common.

- Vehicle Safety Features Discount: Cars equipped with advanced safety features like anti-lock brakes (ABS), airbags, electronic stability control (ESC), and anti-theft systems often qualify for discounts. These features reduce the likelihood of accidents and injuries, leading to lower insurance claims. Eligibility is based on the vehicle’s features; providing proof of purchase or vehicle specifications might be necessary. The discount percentage varies depending on the specific features and the insurer.

- Telematics Programs: Some insurers offer discounts based on your driving behavior. These programs utilize telematics devices or smartphone apps to monitor your driving habits (speed, acceleration, braking, mileage). Safe driving habits, as measured by the program, earn you a discount. Eligibility requires enrollment in the program and allowing the insurer to monitor your driving data. Discounts are typically tiered, with larger discounts for consistently safe driving.

- Payment Plan Discounts: Paying your premium in full upfront, instead of making monthly payments, may qualify you for a discount. This simplifies the insurer’s payment processing. Eligibility is straightforward; simply pay your premium in full. The discount percentage varies by insurer.

Leveraging Discounts to Reduce Premiums

To maximize your savings, proactively research the discounts offered by different insurance companies. Carefully review your eligibility for each discount and provide the necessary documentation to your insurer. Compare quotes from multiple insurers to find the best combination of coverage and discounts. Consider switching insurers if you find a better deal that includes discounts you qualify for. Remember, the total savings from combining multiple discounts can be substantial.

The Role of Technology in Car Insurance

Technology is rapidly transforming the car insurance industry, moving away from traditional risk assessment models towards more personalized and data-driven approaches. This shift is largely driven by advancements in telematics and other technologies that allow insurers to gather and analyze vast amounts of driving data, leading to more accurate risk profiling and fairer premiums.

The integration of technology is reshaping various aspects of the insurance process, from initial quote generation to claims handling. This increased efficiency and data-driven precision benefits both insurers and policyholders, fostering a more transparent and equitable system.

Telematics and Usage-Based Insurance (UBI)

Telematics, the use of technology to monitor and analyze driving behavior, is at the heart of this transformation. Usage-based insurance (UBI) programs leverage telematics data—collected through devices plugged into the car’s diagnostic port or smartphone apps—to assess individual driving habits. This data includes speed, acceleration, braking, mileage, and even time of day driving occurs. Insurers use this information to create personalized premiums, rewarding safer drivers with lower rates and potentially penalizing those exhibiting riskier driving behaviors.

Benefits and Drawbacks of Usage-Based Insurance Programs

UBI programs offer several advantages. For safe drivers, premiums can be significantly reduced, reflecting their responsible driving habits. For insurers, UBI provides a more accurate assessment of risk, leading to better pricing and reduced payouts from accidents. However, UBI also presents challenges. Privacy concerns surrounding the collection and use of driving data are paramount. Furthermore, factors beyond a driver’s control, such as traffic congestion, can influence UBI scores unfairly. The potential for bias in algorithms used to analyze driving data also needs careful consideration. For example, a driver frequently navigating congested city streets might receive a higher risk score than a driver on open highways, despite exhibiting safe driving practices in both situations.

Innovative Technologies in Risk Assessment and Claims Management

Insurance companies are employing various innovative technologies to improve risk assessment and claims handling. For instance, advanced analytics are used to identify patterns and predict future claims more accurately. Computer vision, using image recognition technology, is being used to assess damage in accident claims, speeding up the process and potentially reducing costs. Furthermore, the use of drones for damage assessment in remote areas or following natural disasters offers a quicker and more efficient approach than traditional methods. Predictive modeling, based on vast datasets, is increasingly used to anticipate high-risk drivers and locations, allowing for proactive interventions and targeted safety campaigns. This data-driven approach to risk management helps insurers allocate resources more effectively and proactively address potential safety concerns.

Closure

Choosing the right car insurance in the USA is a crucial step in responsible vehicle ownership. By understanding the various coverage options, factors influencing premiums, and available discounts, you can confidently navigate the insurance market and secure a policy that provides adequate protection without breaking the bank. Remember to regularly review your policy and compare rates to ensure you’re getting the best value for your needs. Driving safely and maintaining a clean driving record are also key to keeping your premiums low.

FAQ Insights

What is uninsured/underinsured motorist coverage?

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle repairs even if the at-fault driver lacks sufficient insurance.

How often should I review my car insurance policy?

It’s recommended to review your policy at least annually, or whenever there’s a significant life change (new car, address change, marriage, etc.). This ensures your coverage remains adequate and reflects your current needs.

What is a SR-22 form?

An SR-22 is a certificate of insurance filed with your state’s Department of Motor Vehicles. It proves you have the minimum required car insurance, often mandated after a serious driving violation.

Can I get car insurance if I have a DUI on my record?

Yes, but it will likely be more expensive. High-risk drivers often need to seek specialized insurance providers who cater to their circumstances.

What is the difference between liability and collision coverage?

Liability coverage pays for damages to others’ property or injuries to others in an accident you cause. Collision coverage pays for repairs to your vehicle, regardless of fault.