Securing car insurance without a driver’s license presents a unique and often precarious situation. While seemingly counterintuitive, various circumstances might lead individuals to seek such coverage. This exploration delves into the legal ramifications, insurance provider policies, and alternative options available to those navigating this complex area. We’ll examine the motivations behind this pursuit, the potential pitfalls, and the crucial considerations for anyone contemplating this path.

Understanding the legal landscape is paramount. Penalties for possessing car insurance without a license vary significantly across jurisdictions, ranging from fines to more severe consequences. Furthermore, the reasons individuals seek this type of coverage are diverse, from planning for future driving to simply protecting a vehicle’s value. This analysis aims to clarify the intricacies of this situation and provide a comprehensive overview.

Legality of Obtaining Car Insurance Without a License

Obtaining car insurance without a driver’s license is generally illegal, though the specific legal ramifications vary significantly depending on the jurisdiction. The act is often viewed as an attempt to circumvent regulations designed to ensure only qualified and licensed drivers operate vehicles, thereby protecting public safety. This practice can lead to significant legal and financial consequences.

The penalties for possessing car insurance without a license differ considerably across various states and countries. Factors such as the intent behind obtaining the insurance, the specific insurance policy purchased, and the individual’s prior driving record can all influence the severity of the penalties. While some jurisdictions may only issue a warning or a small fine, others may impose more substantial penalties, including suspension of insurance coverage, denial of future insurance applications, or even criminal charges in extreme cases.

Penalties for Obtaining Car Insurance Without a License

The penalties associated with securing car insurance without a driver’s license are multifaceted and heavily dependent on location. In many jurisdictions, simply possessing insurance without a valid license is not in itself a criminal offense, but it becomes problematic if an accident occurs. In such scenarios, insurance companies might refuse to pay claims, and the uninsured individual could face severe legal consequences, including significant fines and potential jail time. Furthermore, obtaining insurance under false pretenses—for example, by misrepresenting your licensing status—is likely to be a far more serious offense than simply possessing insurance without a license.

Scenarios Leading to Insurance Without a License

Several scenarios can lead individuals to attempt obtaining car insurance without a valid driver’s license. These situations often involve a degree of desperation or misunderstanding of the legal implications. For example, someone might be buying a car with the intention of obtaining a license soon but needs insurance coverage in the interim. Another scenario might involve someone who has had their license revoked or suspended and is attempting to maintain insurance coverage on a vehicle they own. Finally, some individuals might attempt to register a vehicle under another person’s name to avoid the need for a license and insurance in their own name. It’s important to note that these actions, while perhaps understandable in their context, are still illegal and carry considerable risk.

Comparison of Legal Consequences Across Regions

The following table illustrates the potential legal consequences in three different regions. Note that these are examples and specific penalties can vary widely based on individual circumstances and local laws. It is crucial to consult local regulations for accurate and up-to-date information.

| Region | Potential Fines | Potential Penalties | Insurance Implications |

|---|---|---|---|

| United States (Example: California) | Varies by state; could range from several hundred to thousands of dollars depending on the circumstances and the state. | Potential suspension of driving privileges, points on driving record, court appearance. | Insurance claims may be denied; future insurance premiums could be significantly higher. |

| United Kingdom | Significant fines, potentially exceeding £1000. | Points on driving license, potential disqualification from driving. | Insurance invalidated; claims denied. |

| Canada (Example: Ontario) | Fines can vary widely depending on the specific offense and the province. | Suspension of driver’s license, potential jail time in serious cases. | Claims likely denied; future insurance availability and rates affected. |

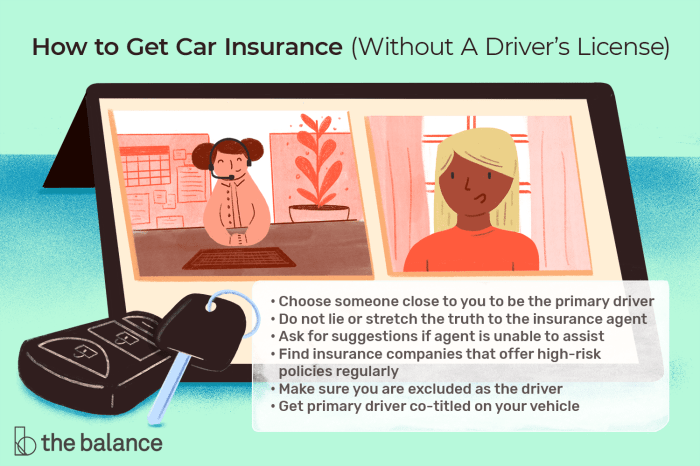

Reasons for Seeking Insurance Without a License

Obtaining car insurance without a driver’s license might seem counterintuitive, but several scenarios explain why individuals pursue this course of action. Understanding these motivations requires examining the interplay between vehicle ownership, future driving plans, and misconceptions about insurance requirements. This often involves a complex interplay of financial considerations, legal interpretations, and personal circumstances.

Several factors contribute to individuals seeking car insurance without a license. These motivations stem from a combination of practical needs, future planning, and, in some cases, a misunderstanding of the legal implications.

Planned Future Driving

Many individuals may purchase car insurance before obtaining a driver’s license, anticipating future driving needs. This proactive approach allows them to secure coverage immediately upon obtaining their license, avoiding any lapse in insurance protection. For example, a young adult nearing driving age might secure insurance on a family vehicle to ensure coverage is in place once they pass their driving test. Another example is someone who has recently moved and intends to obtain a license in their new state or country. Purchasing insurance in advance helps streamline the process and ensure they are insured from day one of driving.

Vehicle Ownership Without Driving

It’s also possible to own a vehicle without actively driving it. This might be the case with classic car collectors, individuals who use their vehicles for occasional trips, or those who have vehicles for specific purposes, such as hauling goods. In these cases, insurance provides liability protection, even if the vehicle isn’t frequently driven. For instance, a person might insure a classic car they own, despite not driving it daily, to safeguard against damage or theft. Similarly, someone owning a trailer might obtain insurance for liability purposes, even if they don’t operate the vehicle towing it regularly.

Misconceptions About Insurance and Licensing Requirements

Some individuals may mistakenly believe that car insurance is solely about protecting the vehicle itself, rather than encompassing liability coverage. This misunderstanding might lead them to believe that insurance is unnecessary without a license. Others might be unaware of the specific legal requirements in their area, particularly concerning minimum liability insurance. A common misconception is that insurance is only needed when actively driving, overlooking the importance of liability coverage even if the car is parked.

Hypothetical Examples

Consider Maria, a recent immigrant who has purchased a car but hasn’t yet taken the driving test in her new country. She wants to be prepared and secure insurance to cover the vehicle until she gets her license. Or take John, who owns a vintage motorcycle he keeps in storage. He doesn’t drive it frequently, but he maintains insurance to protect against potential damage or theft while it’s stored. These scenarios highlight that obtaining car insurance without a driver’s license is not always indicative of illegal activity, but rather a reflection of various circumstances and individual needs.

Insurance Provider Policies Regarding Unlicensed Drivers

Securing car insurance without a driver’s license presents unique challenges. Insurance providers have varying policies regarding this, influenced by factors such as state regulations and their own risk assessment models. Understanding these differences is crucial for individuals seeking coverage in this situation.

Insurance companies assess risk differently, leading to varied approaches to insuring unlicensed drivers. Some may offer limited coverage options, while others may outright refuse coverage. The specific details are highly dependent on the insurer and the applicant’s circumstances.

Variations in Insurance Provider Policies

The policies of different insurance providers regarding unlicensed drivers vary significantly. Some companies may offer limited liability coverage, protecting the insured against third-party claims for injuries or damages caused by an accident. However, this coverage often excludes comprehensive and collision coverage, which protect the insured vehicle itself. Other providers might offer only specialized policies designed for specific situations, such as driving a car for a business purpose without possessing a license. Conversely, some insurers may completely refuse to provide any coverage to individuals without a valid driver’s license, deeming the risk too high. This refusal often stems from the increased likelihood of accidents and higher claim payouts associated with unlicensed drivers.

Hypothetical Scenario Illustrating Insurer Responses

Imagine three individuals – Alex, Ben, and Chloe – all applying for car insurance without a driver’s license. Alex needs coverage for a business vehicle, Ben is learning to drive and needs temporary coverage, and Chloe is using a car temporarily due to an emergency. Company A might offer Alex a specialized commercial policy with limited liability, but refuse Ben and Chloe’s applications. Company B might offer a short-term, limited liability policy to Ben, given his learning-to-drive situation, but deny Chloe’s application due to the emergency nature of her need. Company C might refuse all three applications, maintaining a strict policy against insuring unlicensed drivers.

Methods of Verifying Driving Records and License Status

Insurance companies employ several methods to verify driving records and license status. These include accessing state-maintained driver databases, requesting copies of driving records directly from the applicant, and utilizing third-party verification services specializing in driver information. They might also request proof of insurance for any prior vehicles the applicant has owned. The level of verification varies between companies and the specific circumstances of the application. In some cases, an applicant’s DMV record may be checked automatically as part of the application process. In other instances, the insurer might require the applicant to provide documentation proactively.

Key Differences in Policy Approaches

- Coverage Offered: Some insurers offer limited liability coverage, while others offer no coverage at all or only specialized policies for specific situations.

- Eligibility Requirements: Stricter eligibility criteria exist, such as requiring specific reasons for needing insurance without a license (e.g., business use).

- Verification Methods: Insurers use various methods, including direct access to state databases and third-party verification services, to confirm license status and driving history.

- Premium Costs: Premiums for unlicensed drivers are likely to be significantly higher than for licensed drivers due to the increased risk.

- Policy Duration: Policies for unlicensed drivers might be limited to short durations, reflecting the temporary nature of the situation.

Implications for Vehicle Ownership and Usage

Owning a car while lacking a driver’s license, even with insurance, presents a complex set of challenges and risks. While the insurance policy might cover potential damages caused by the vehicle, the lack of a license introduces significant legal and practical complications. This situation significantly impacts the owner’s ability to utilize their vehicle legally and safely.

The primary risk is legal liability in the event of an accident. Even if the car is insured, operating a vehicle without a license is illegal in most jurisdictions and can lead to substantial fines, license suspension (upon eventual licensing), or even jail time depending on the circumstances and the severity of the accident. Furthermore, insurance companies may deny coverage if they discover the vehicle was being driven illegally at the time of the accident, leaving the owner personally responsible for significant financial liabilities. This responsibility extends to damages to other vehicles, injuries sustained by others, and property damage.

Legal Liabilities in Accidents

Driving without a license dramatically increases the likelihood of an accident due to a lack of experience and training. In the event of an accident, the unlicensed driver faces severe legal consequences. For example, an unlicensed driver involved in a collision resulting in serious injuries to another person could face criminal charges, such as reckless driving or even vehicular manslaughter, in addition to civil lawsuits for damages. The severity of the penalties will depend on the specifics of the accident, the extent of the damage, and the jurisdiction. Insurance coverage might not fully protect the owner from financial ruin in such scenarios, especially if the insurance company discovers the violation of driving without a license. In many cases, the unlicensed driver could be held personally liable for damages exceeding their insurance coverage.

Future Insurance Premiums

Securing a driver’s license after a period of owning a car without one will likely result in higher insurance premiums. Insurance companies assess risk based on driving history, and the lack of a driving record, coupled with the prior ownership of a vehicle without a license, will be viewed as a high-risk factor. The insurer might perceive this as evidence of a lack of responsible vehicle ownership and potential recklessness, leading to a higher premium compared to someone with a clean driving record. For instance, a young driver who obtains their license after owning a car without one for several years might face significantly higher premiums than a peer with a consistent driving history. This elevated cost could persist for several years, potentially impacting their financial planning.

Potential Complications

Several complications can arise from owning a car without a driver’s license. For example, selling the vehicle might prove difficult, as potential buyers might be wary of the vehicle’s history and potential legal issues. Parking the vehicle long-term could incur additional costs, such as storage fees. Furthermore, regular maintenance and repairs could be challenging if the owner cannot legally drive the vehicle to a mechanic or service center. The lack of a licensed driver also prevents the convenient use of the vehicle for essential tasks like commuting to work or transporting family members, necessitating reliance on alternative transportation methods. In short, the car becomes a financial burden rather than a useful asset.

Illustrative Scenarios and Their Implications

Understanding the potential consequences of attempting to obtain car insurance without a driver’s license is crucial. The following scenarios illustrate the diverse situations individuals might face and the resulting legal, financial, and insurance-related repercussions. These examples highlight the significant risks involved.

Scenario 1: The Newly Arrived Immigrant

A recent immigrant, Maria, purchases a used car to commute to her new job. Unsure of the intricacies of the US licensing system and facing immediate transportation needs, she attempts to obtain car insurance without a driver’s license. She believes that having insurance will protect her from potential accidents.

The act of obtaining insurance fraudulently, by misrepresenting her licensing status, is a serious offense.

The insurance company eventually discovers Maria’s lack of a license during a claim or routine audit. Her policy is immediately voided, leaving her financially vulnerable. She faces potential fines and legal repercussions for insurance fraud. Furthermore, obtaining future insurance will be extremely difficult, potentially requiring her to complete a driver’s education course and maintain a spotless driving record for an extended period. This scenario underscores the importance of understanding local regulations before attempting to operate a vehicle.

Scenario 2: The Young Adult with a Suspended License

David, a young adult, has had his driver’s license suspended due to multiple traffic violations. Needing a car for work, he tries to obtain insurance under a friend’s name, hoping to avoid detection. He believes this will allow him to drive legally while keeping his insurance costs down.

Using another person’s name to obtain insurance constitutes insurance fraud, a serious crime with severe penalties.

This deceptive strategy carries substantial risks. If David is involved in an accident, the fraudulent nature of the policy will be revealed. He will be held liable for the accident, and the insurance company will refuse coverage. Beyond the financial implications of accident-related costs, David faces potential jail time and significant fines for insurance fraud and driving with a suspended license. His future insurability is severely jeopardized, possibly requiring him to go through a high-risk driver program and pay exorbitant premiums for years.

Scenario 3: The Undocumented Driver

Carlos, an undocumented immigrant, works long hours and needs a car to get to and from his job. He is ineligible for a driver’s license but attempts to obtain insurance under a false identity. He believes that having insurance will provide some level of protection, even without a valid license.

Driving without a license and obtaining insurance fraudulently under a false identity are serious offenses that could result in deportation.

The consequences for Carlos are particularly severe. Aside from the standard risks associated with insurance fraud, such as policy cancellation and potential legal action, he also faces the possibility of deportation. This highlights the critical link between immigration status, driving regulations, and insurance eligibility. Even if he avoids immediate detection, the long-term implications for his immigration status and ability to obtain insurance in the future are devastating. He may face an almost insurmountable challenge in securing car insurance legitimately in the future.

Final Wrap-Up

Ultimately, obtaining car insurance without a driver’s license treads a fine line between legal compliance and practical needs. While some circumstances might necessitate exploring this avenue, thorough understanding of the legal and financial implications is critical. Individuals should carefully weigh the risks and benefits, considering alternative insurance options and seeking professional advice when necessary. The potential consequences, both legal and financial, can be significant, underscoring the importance of careful consideration and informed decision-making.

Essential Questionnaire

Can I insure a car I own but don’t drive?

Yes, some insurers offer policies for vehicle owners who don’t drive, typically covering liability and comprehensive/collision depending on your needs. This is often less expensive than a full driver’s policy.

What happens if I get into an accident without a license?

The consequences are severe. You’ll likely face penalties for driving without a license, and your insurance claim might be denied or significantly impacted. Liability for damages could fall solely on you.

Is it illegal to list a licensed driver on my policy if I’m not licensed?

This is generally considered insurance fraud. Insurance companies investigate claims thoroughly, and providing false information can result in policy cancellation and legal repercussions.

What are the implications for my future insurance rates?

Even if you obtain insurance without a license, it may affect your rates later. A history of insurance claims or any legal issues related to driving can lead to higher premiums when you finally get your license.