Navigating the world of car insurance can feel like deciphering a complex code. Understanding your policy, comparing rates, and filing claims all require a clear grasp of the process. This guide demystifies the often-confusing realm of “car vehicle insurance check,” providing a straightforward approach to managing your automotive insurance needs, whether it’s a routine review or a critical claim.

From understanding the various ways you might check your car insurance—be it for renewal, comparison shopping, or verifying coverage—to mastering the online tools available, this guide equips you with the knowledge and resources to confidently handle all your car insurance-related tasks. We’ll cover the different types of checks, the information you’ll need, potential pitfalls to avoid, and provide practical solutions to common problems. Let’s ensure you’re in control of your car insurance.

Understanding “Car Vehicle Insurance Check”

The phrase “car vehicle insurance check” encompasses a range of activities related to verifying, comparing, or updating car insurance coverage. It’s a broad term that can refer to various processes depending on the user’s needs and context. Understanding the nuances of this phrase is crucial for effectively designing user-friendly insurance services and resources.

The term “car vehicle insurance check” can be used in several distinct ways, reflecting different stages in the insurance lifecycle. It’s not simply about confirming the existence of a policy; it can involve comparisons, renewals, and claims processes. The specific meaning depends heavily on the situation and the user’s intent.

Different Uses of “Car Vehicle Insurance Check”

The phrase “car vehicle insurance check” can refer to several distinct actions. For instance, a driver might use it to check their current policy details, compare quotes from different providers, verify coverage before a trip, or confirm coverage after an accident. The context significantly impacts the interpretation of the phrase.

Contexts for Using “Car Vehicle Insurance Check”

This phrase appears in several key contexts:

- Policy Renewal: Drivers use this phrase to check their renewal options, compare prices with competitors, and ensure continued coverage. They might search for “car insurance renewal check” or “check car insurance renewal price.”

- Comparison Shopping: Individuals utilize this phrase when comparing insurance quotes from multiple providers. Searches like “check car insurance quotes” or “compare car insurance check” are common.

- Claims Process: After an accident, drivers might use the phrase to check the status of their claim, verify coverage, or understand the claims process. They might search for “check car insurance claim status” or “car insurance check coverage after accident.”

- Policy Verification: This could involve verifying the validity of a policy for various reasons, such as a rental car agreement or loan application. The search might be “check car insurance policy validity” or “verify car insurance details.”

Examples of User Searches

Users employ various search terms related to “car vehicle insurance check,” reflecting their specific needs:

- “Check my car insurance policy details”

- “Compare car insurance quotes online”

- “Car insurance check coverage for accidents”

- “How to check my car insurance claim status”

- “Car insurance renewal check and comparison”

User Journey Map for Checking Car Insurance

The user journey for checking car insurance can be visualized as a series of steps. This map illustrates a typical scenario where a user wants to check their policy details.

Imagine a user, let’s call her Sarah, who needs to check her policy details. The journey would likely unfold as follows:

- Initiation: Sarah realizes she needs to access her policy information, perhaps to confirm coverage details before a road trip.

- Search: She performs a web search, typing in a phrase like “check car insurance policy details.” This leads her to her insurance provider’s website or a comparison website.

- Login/Access: Sarah navigates to the login page and enters her credentials. This might involve multi-factor authentication for enhanced security.

- Policy Information: Once logged in, Sarah accesses her policy details page. This page clearly displays her policy number, coverage levels, expiry date, and other relevant information.

- Verification: Sarah reviews the information to confirm the details are accurate and meet her needs.

- Action (optional): Based on her review, Sarah might choose to update her information, request changes, or simply close the page, satisfied with the information obtained.

Types of Car Insurance Checks

Understanding the different types of car insurance checks available is crucial for effectively managing your policy and ensuring you have the right coverage. These checks allow you to verify information, track claims, and generally maintain a clear understanding of your insurance status. This section will Artikel the key types of checks and their respective features.

Policy Review Checks

A policy review check provides a comprehensive overview of your current car insurance policy. This includes details like your coverage limits (liability, collision, comprehensive), deductibles, premiums, and any applicable endorsements or riders. It’s a valuable tool for confirming that your policy accurately reflects your needs and risk tolerance. Regular policy reviews can help identify areas where adjustments might be beneficial, such as increasing coverage limits or lowering premiums through safe driving discounts. For example, a policy review might reveal that your liability coverage is too low for your comfort level, prompting you to increase it.

Coverage Verification Checks

Coverage verification checks confirm whether you have the necessary insurance coverage for a specific purpose. This is often required when renting a car, financing a vehicle, or registering a car in a new state. The check verifies that your policy is active, that it meets the minimum requirements, and that the coverage extends to the specific vehicle and circumstances. A failed coverage verification check could result in penalties, such as rental car refusal or registration delays. For instance, if you are financing a car, the lender will likely require a coverage verification check to ensure the vehicle is adequately insured.

Claims Status Checks

Claims status checks provide updates on the progress of a filed insurance claim. This type of check offers information regarding the claim’s current stage, any required documentation, and estimated processing time. Regular claims status checks help ensure a smooth claims process and allow you to proactively address any issues or delays. For example, a claims status check might indicate that your claim is pending further investigation or that additional documentation is required to expedite the process.

| Check Type | Purpose | Information Provided | Benefits |

|---|---|---|---|

| Policy Review | Review current policy details | Coverage limits, deductibles, premiums, endorsements | Identifies areas for improvement, ensures adequate coverage |

| Coverage Verification | Confirms active insurance coverage | Policy status, coverage limits, vehicle details | Meets legal and contractual requirements, avoids penalties |

| Claims Status | Tracks progress of a filed claim | Claim status, required documents, processing time | Ensures smooth claims process, allows proactive issue resolution |

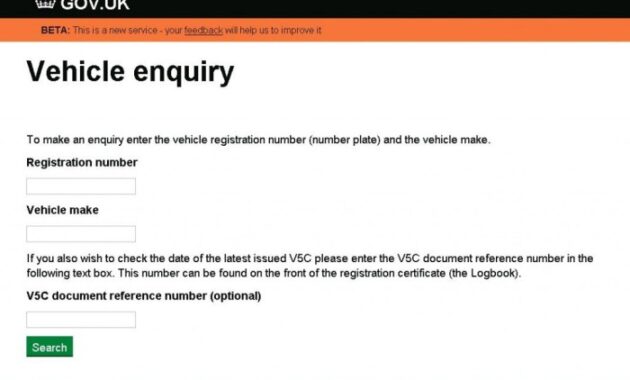

Online Resources for Checking Car Insurance

Finding the right car insurance can feel overwhelming, but thankfully, several online resources simplify the process. These platforms offer various ways to compare policies, understand coverage options, and ultimately find the best fit for your needs and budget. Choosing the right platform depends on your preferences and the level of detail you require.

Different online platforms offer distinct advantages and disadvantages when checking car insurance. Understanding these differences allows for a more efficient and informed search. Broadly, these platforms can be categorized into insurer websites and comparison websites.

Insurer Websites

Insurer websites provide direct access to the specific policies offered by a particular company. This allows for a detailed examination of coverage options, pricing structures, and policy features. However, comparing multiple insurers requires visiting each website individually, making the process potentially time-consuming.

Comparison Websites

Comparison websites aggregate information from multiple insurance providers, allowing for side-by-side comparisons of policies and prices. This streamlines the process, saving time and effort. However, the information presented may be simplified, potentially overlooking nuanced details of specific policies. Additionally, the ranking or prominence given to certain insurers might be influenced by advertising relationships.

Reputable Websites for Checking Car Insurance

Choosing a reliable website is crucial for accurate and unbiased information. The following is a list of reputable websites commonly used for checking car insurance. Note that the availability and specific features of these sites may vary depending on your location.

- Insurer Websites: Directly accessing the websites of major insurance providers (e.g., Geico, State Farm, Progressive, Allstate) provides detailed policy information, but requires individual searches for each company.

- Comparison Websites: Sites like The Zebra, NerdWallet, and Insurance.com aggregate quotes from various insurers, offering a convenient comparison tool. However, remember that these sites may not include every insurer in your area.

Information Needed to Check Car Insurance

Verifying your car insurance details requires specific information. Having this information readily available streamlines the process and ensures a quick and accurate check. The following details are typically necessary, depending on the method you use to check your coverage.

Gathering the necessary information beforehand is crucial for a smooth and efficient insurance check. Missing information can lead to delays and potential frustration. This section Artikels the key details needed and suggests ways to retrieve them if they are unavailable.

Required Information for Car Insurance Verification

The specific information needed will vary depending on whether you are checking your insurance online through your provider’s website, contacting your insurer directly, or using a third-party verification service. However, these items are frequently required.

- Policy Number: This unique identifier is crucial. It’s a series of numbers and/or letters found on your insurance policy documents.

- Driver’s License Number: Your driver’s license number is needed to verify your identity and link it to the insurance policy.

- Vehicle Identification Number (VIN): The VIN is a unique 17-character code identifying your vehicle. It’s usually found on the dashboard, driver’s side doorjamb, or in your vehicle’s registration documents.

- Insurer’s Name and Contact Information: Knowing your insurance company’s name and contact details is essential for contacting them directly. This information is usually printed on your insurance card or policy documents.

- Date of Birth: Your date of birth is used for identification purposes to confirm your identity and access your insurance information.

Obtaining Missing Information

If you’re missing any of the above information, here’s how to obtain it:

- Policy Number: Check your insurance policy documents, your insurance card, or contact your insurance provider directly. They will be able to provide this information.

- Driver’s License Number: Your driver’s license itself will have this number clearly displayed. If you’ve lost your license, you can usually obtain a replacement from your local Department of Motor Vehicles (DMV).

- Vehicle Identification Number (VIN): Locate your vehicle’s VIN using the methods described above. If you can’t find it, consult your vehicle’s registration documents or contact your vehicle’s manufacturer.

- Insurer’s Name and Contact Information: This information should be readily available on your insurance card or policy documents. If not, look for any paperwork related to your insurance payments.

- Date of Birth: This is usually found on your driver’s license or other official identification documents.

Potential Issues When Checking Car Insurance

Checking your car insurance information, whether online or through other means, isn’t always straightforward. Several factors can lead to difficulties in accessing or verifying your policy details, causing frustration and potentially impacting your ability to manage your coverage effectively. Understanding these potential problems and how to resolve them is crucial for maintaining adequate insurance protection.

Problems can range from simple data entry errors to more complex technical glitches or account access issues. Being prepared for these potential roadblocks will help you navigate the process smoothly and ensure you have the accurate information you need.

Incorrect Information Displayed

Incorrect information displayed on your insurance provider’s website or documents can stem from several sources, including data entry errors during policy creation or updates, system glitches, or even human error in processing your information. For instance, your address might be listed incorrectly, leading to inaccurate premium calculations or difficulties in filing a claim. Your vehicle details, such as the make, model, or year, might also be misrepresented.

Resolving these issues usually involves contacting your insurance provider directly. They will need to verify your information and correct any discrepancies. Be prepared to provide supporting documentation, such as your driver’s license, vehicle registration, and policy documents, to facilitate the correction process.

- Solution: Contact your insurance provider’s customer service department immediately. Provide them with the correct information and any supporting documentation.

- Solution: If the error persists after contacting customer service, consider submitting a formal written complaint detailing the issue and the steps you’ve taken to resolve it.

To avoid this, always double-check your policy documents thoroughly upon receipt and report any inaccuracies promptly.

Website Errors and Technical Glitches

Insurance company websites, like any other website, are susceptible to technical errors and glitches. These can range from temporary outages to more persistent problems affecting the accuracy or accessibility of your policy information. For example, a website error might prevent you from logging in, viewing your policy details, or making payments. This can be particularly frustrating when you need access to urgent information.

Addressing these issues often involves troubleshooting common technical problems. If the problem persists, contacting customer service is necessary.

- Solution: Try clearing your browser’s cache and cookies. Sometimes, outdated cached data can interfere with website functionality.

- Solution: Try accessing the website from a different browser or device.

- Solution: Contact your insurance provider’s technical support or customer service if the problem persists.

Best practices include using a reliable internet connection and regularly updating your browser software to minimize the risk of encountering technical difficulties.

Account Access Issues

Difficulty accessing your online account can stem from forgotten passwords, incorrect login credentials, or account lockouts due to multiple failed login attempts. This can prevent you from accessing crucial policy information, making timely payments, or managing your coverage. For example, a forgotten password can delay your ability to review your policy before a renewal date.

Account access issues usually have straightforward solutions, often involving password reset procedures or contacting customer support for assistance.

- Solution: Utilize the password reset feature provided on your insurance provider’s website.

- Solution: Contact your insurance provider’s customer service department for assistance if you are locked out of your account or experiencing persistent login issues.

To avoid these problems, create strong, unique passwords and store them securely. Consider using a password manager to help manage your online credentials.

Ending Remarks

Successfully navigating the car vehicle insurance check process empowers you to manage your policy effectively, ensuring you have the right coverage at the best price. By understanding the different types of checks available, utilizing online resources efficiently, and anticipating potential issues, you can confidently handle all aspects of your car insurance. Remember to keep your policy documents readily accessible and don’t hesitate to contact your insurer with any questions or concerns. Proactive management ensures peace of mind on the road.

FAQ

What happens if I can’t find my policy number?

Contact your insurance company directly. They can help you locate your policy number using your personal information.

Can I check my car insurance coverage online?

Yes, most insurance companies offer online portals where you can access your policy details and check your coverage.

How often should I review my car insurance policy?

It’s recommended to review your policy at least annually, or whenever there’s a significant life change (e.g., new car, change of address).

What if I suspect fraudulent activity on my insurance account?

Contact your insurance company immediately to report any suspicious activity. They will guide you through the necessary steps to secure your account.