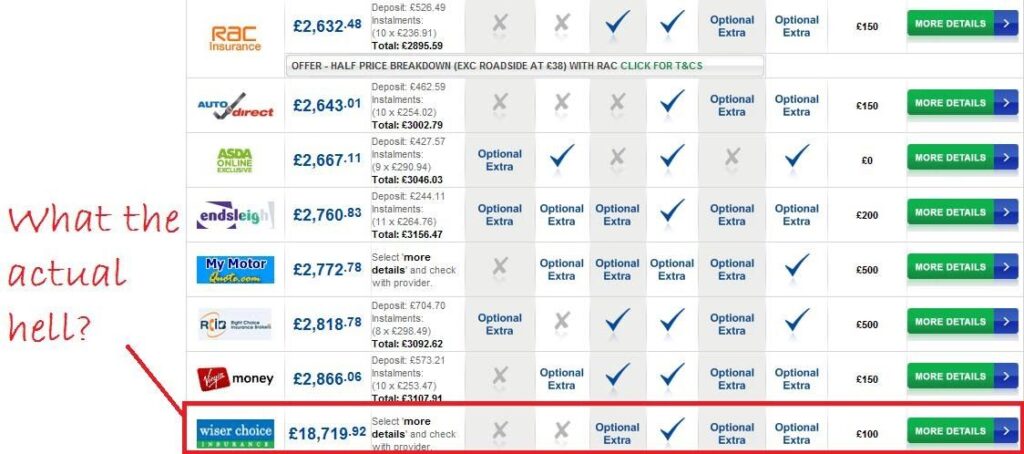

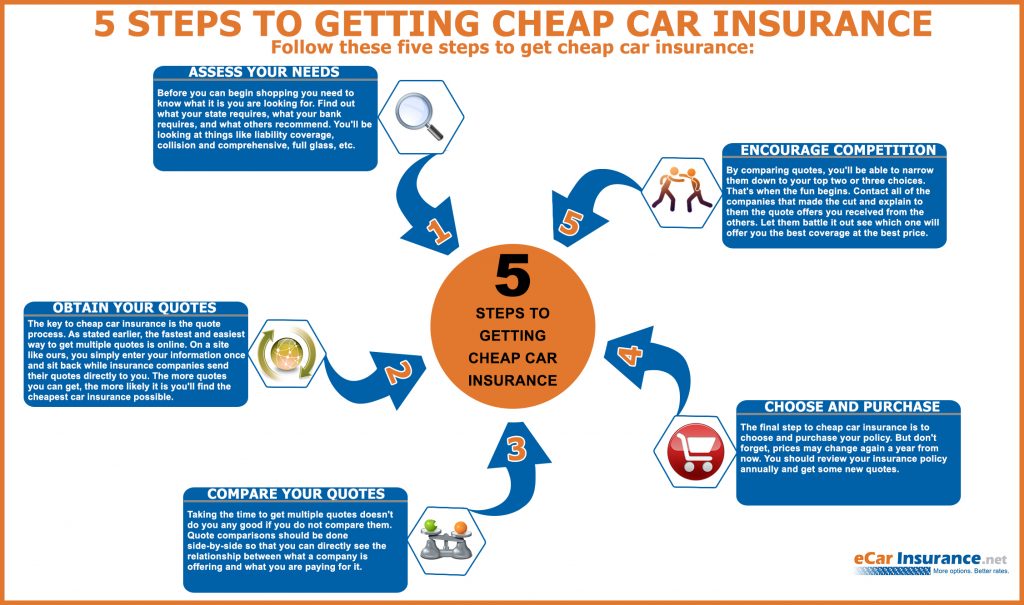

How to get car insurance takes center stage as we embark on a journey to navigate the complexities of securing this essential protection. Understanding the intricacies of car insurance, from coverage types to premium factors, is crucial for making informed decisions that safeguard your financial well-being and provide peace of mind on the road. This guide aims to demystify the world of car insurance, providing insights into the various types of coverage available, the factors influencing premium costs, and the essential steps involved in obtaining a policy that aligns with your individual needs. By equipping you with knowledge and Read More …