Variable whole life insurance presents a unique blend of life insurance protection and investment potential. Unlike term life insurance, which offers coverage for a specified period, variable whole life insurance provides lifelong coverage while allowing policyholders to invest their cash value in various sub-accounts, mirroring the performance of different market sectors. This dynamic approach offers the possibility of significant cash value growth, but also carries inherent market risks. Understanding the nuances of variable whole life insurance requires careful consideration of its investment components, fee structures, and long-term financial implications. This guide aims to demystify this complex product, providing a Read More …

Category: Financial Planning

Understanding True Stage Life Insurance: A Comprehensive Guide

Life insurance is a cornerstone of financial planning, but navigating the diverse options can be daunting. This guide delves into the intricacies of “true stage” life insurance, a unique approach designed to adapt to the evolving needs of individuals throughout their life journey. We’ll explore its core features, benefits, drawbacks, and suitability, offering a clear understanding of whether this type of policy aligns with your personal circumstances. We’ll examine how true stage life insurance differs from traditional term life and whole life policies, highlighting the advantages and disadvantages at various life stages. Through real-world examples and hypothetical scenarios, we Read More …

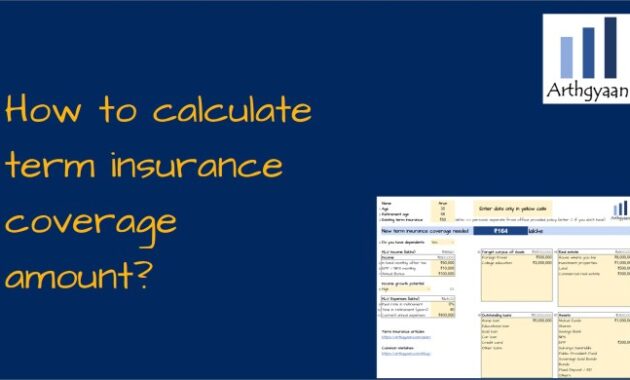

Mastering Your Financial Future: A Comprehensive Guide to the Term Insurance Calculator

Securing your family’s financial well-being is a paramount concern, and understanding life insurance is a crucial step in that process. A term insurance calculator emerges as an invaluable tool, simplifying the often-complex world of life insurance planning. This guide delves into the functionality, benefits, and limitations of these calculators, empowering you to make informed decisions about your future. We will explore how these calculators work, the key factors influencing premium calculations, and the various types of term insurance policies available. Through illustrative examples and visualizations, we aim to demystify the process of selecting the right life insurance coverage, enabling Read More …

Understanding Term Life Insurance: A Comprehensive Guide to Life Insurance Protection

Securing your family’s financial future is a paramount concern, and life insurance plays a crucial role in achieving this. This guide delves into the intricacies of term life insurance, a vital tool for managing risk and providing financial security. We’ll explore its core features, comparing it to whole life insurance, and examining the factors that influence premiums. We’ll also uncover the application process, discuss valuable riders, and illustrate real-world scenarios to highlight its practical applications. From understanding the nuances of policy durations and death benefit payouts to navigating the complexities of choosing the right provider, this guide aims to Read More …

Securing Your Future: A Guide to Reliable Life Insurance

Life insurance is a cornerstone of financial planning, offering peace of mind and security for loved ones. However, navigating the complexities of the life insurance market can be daunting. This guide delves into the crucial aspects of securing reliable life insurance, empowering you to make informed decisions that best protect your family’s future. Understanding what constitutes “reliable” life insurance is paramount. This involves careful consideration of the insurer’s financial strength, policy transparency, and claims processing efficiency. We will explore various policy types, helping you identify the best fit for your individual needs and budget, while also providing practical steps Read More …

Securing Your Future: A Comprehensive Guide to Quotes Life Insurance

Life insurance is a crucial element of financial planning, offering a safety net for loved ones in the event of unexpected loss. Understanding the landscape of life insurance quotes, however, can feel overwhelming. This guide navigates the complexities of obtaining, interpreting, and choosing the right life insurance policy, empowering you to make informed decisions about your future financial security. From exploring the various types of life insurance quotes available—term life, whole life, and more—to understanding the factors influencing their cost (age, health, lifestyle), we’ll demystify the process. We’ll also provide practical tools and advice for comparing quotes, choosing the Read More …

Navigating NFCU Life Insurance: A Comprehensive Guide

Securing your family’s financial future is paramount, and life insurance plays a crucial role in achieving this goal. This guide delves into the world of NFCU life insurance, offering a detailed exploration of its various policies, costs, benefits, and the claims process. We’ll compare NFCU’s offerings to competitors, highlighting key advantages and disadvantages to help you make an informed decision about protecting your loved ones. Understanding life insurance can feel daunting, but with clear information and a structured approach, the process becomes significantly more manageable. This guide aims to demystify NFCU’s life insurance options, empowering you with the knowledge Read More …

Decoding MEC Insurance: A Comprehensive Guide

MEC insurance, or Modified Endowment Contract insurance, presents a unique blend of life insurance and investment features. Unlike traditional life insurance policies, MECs offer the potential for cash value growth alongside a death benefit. However, this flexibility comes with complexities, including specific tax implications and potential penalties for early withdrawals. This guide unravels the intricacies of MEC insurance, offering a clear understanding of its benefits, costs, and risks. We will explore the various types of MEC policies available, their associated fees and investment strategies, and the crucial tax considerations involved. We’ll also examine the potential downsides and when an Read More …

Mastering Your Life Insurance Costs: A Comprehensive Guide to Life Insurance Price Calculators

Navigating the world of life insurance can feel overwhelming, with complex policies and varying costs. A life insurance price calculator offers a powerful tool to demystify this process, providing a personalized estimate of premiums based on your individual circumstances. This guide will equip you with the knowledge to effectively utilize these calculators, understand the factors influencing your costs, and make informed decisions about your financial future. We’ll explore the functionality of different calculators, compare online and offline methods, and delve into the key demographic and lifestyle factors that significantly impact premium calculations. We’ll also examine the limitations of these Read More …

Unlocking Financial Security: A Comprehensive Guide to Whole Life Insurance

Whole life insurance, a cornerstone of long-term financial planning, offers a unique blend of life-long coverage and cash value accumulation. Unlike term life insurance, which provides coverage for a specified period, whole life insurance remains in effect for your entire life, providing a guaranteed death benefit to your beneficiaries. This comprehensive guide delves into the intricacies of whole life insurance, exploring its features, benefits, costs, and suitability for various financial situations. We will examine the mechanics of cash value growth, the various ways to access these funds, and the tax implications of death benefits. We’ll also compare whole life Read More …