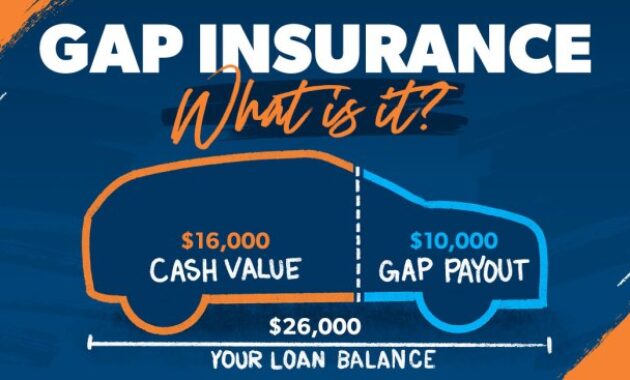

Can you use gap insurance when trading in a car? This question often arises for car owners who are considering trading in their vehicle. Gap insurance, designed to cover the difference between what you owe on your car loan and its actual market value, is a valuable tool for some, but its applicability in a trade-in scenario can be unclear. This article explores the intricacies of gap insurance and its potential benefits during a trade-in, shedding light on its workings and the key factors to consider. Gap insurance essentially acts as a safety net for those who face the Read More …