New York State’s insurance landscape is complex, encompassing a wide array of policies designed to protect individuals and businesses against various risks. From mandatory auto insurance to specialized coverage for unique New York hazards like flooding, understanding the intricacies of NY state insurance is crucial for residents and businesses alike. This guide provides a clear overview of the different types of insurance available, regulatory bodies, consumer rights, and the process of obtaining and utilizing insurance coverage. We’ll delve into the specifics of personal and commercial insurance lines, exploring the key differences and mandatory coverages required by New York State Read More …

Category: New York Insurance

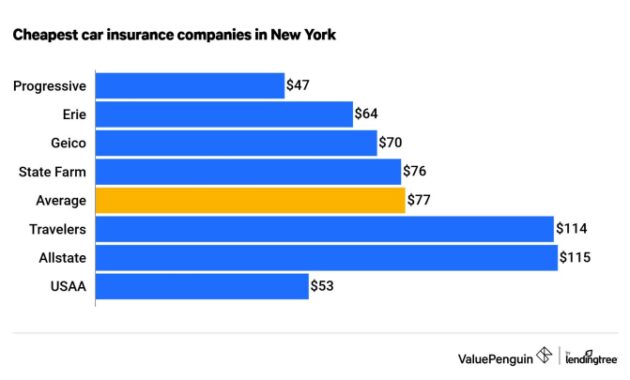

Unlocking the Cheapest Insurance in NY: A Comprehensive Guide

Navigating the world of insurance in New York can feel like traversing a maze. Premiums vary wildly, and understanding the factors that influence cost is crucial to securing affordable coverage. This guide delves into the intricacies of finding the cheapest insurance in NY, across auto, home, and health, empowering you to make informed decisions and save money. We’ll explore the key elements that impact your insurance costs, from your driving record and credit score to the type of coverage you choose. We’ll also debunk common misconceptions and offer practical strategies to negotiate lower premiums and secure the best possible Read More …