Securing affordable auto insurance in Virginia can feel like navigating a maze, but understanding the key factors influencing premiums empowers you to make informed decisions and potentially save significant money. This guide unravels the complexities of Virginia’s auto insurance landscape, providing practical strategies to find the best coverage at the most competitive price.

From understanding mandatory coverage requirements and the penalties for non-compliance to leveraging discounts and negotiating rates, we’ll explore various avenues to lower your insurance costs. We’ll also delve into the factors that insurance companies consider when setting premiums, including driving history, credit score, and vehicle type, equipping you with the knowledge to effectively manage your insurance expenses.

Understanding Virginia’s Auto Insurance Requirements

Driving in Virginia requires adhering to the state’s mandatory auto insurance laws. Understanding these requirements is crucial to avoid penalties and ensure you’re adequately protected in case of an accident. This section will Artikel the minimum coverage, penalties for non-compliance, and various types of insurance coverage available to Virginia drivers.

Minimum Liability Coverage Requirements in Virginia

Virginia law mandates that all drivers carry a minimum amount of liability insurance. This coverage protects others if you cause an accident. The minimum requirements are $25,000 for bodily injury to one person, $50,000 for bodily injury to multiple people in a single accident, and $20,000 for property damage. This means that if you cause an accident resulting in injuries or property damage, your insurance company will pay up to these limits to compensate the injured parties or repair damaged property. It is important to note that these limits are often insufficient to cover significant injuries or extensive property damage, making higher coverage limits a wise investment.

Penalties for Driving Without Insurance in Virginia

Driving without the minimum required auto insurance in Virginia carries significant consequences. These penalties can include fines, license suspension, and even vehicle impoundment. The specific penalties can vary, but they generally increase with each subsequent offense. For example, a first-time offense might result in a fine and a temporary license suspension, while repeat offenses could lead to more severe penalties, including longer license suspensions and higher fines. Furthermore, being uninsured can significantly impact your ability to obtain insurance in the future, as insurers often charge higher premiums or refuse coverage to those with a history of driving without insurance.

Types of Auto Insurance Coverage

Several types of auto insurance coverage are available beyond the minimum liability requirements. Understanding these options is vital for choosing a plan that meets your individual needs and risk tolerance.

- Liability Coverage: As previously discussed, this covers bodily injury and property damage you cause to others. It is mandatory in Virginia.

- Collision Coverage: This covers damage to your vehicle caused by an accident, regardless of fault. If you are involved in a collision, this coverage will help pay for repairs or replacement, even if you were at fault.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or weather-related damage. It provides broader protection than collision coverage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident caused by an uninsured or underinsured driver. It covers your medical bills and vehicle damage in such scenarios.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages, regardless of fault, after an accident. It may also cover medical expenses for passengers in your vehicle.

Cost Comparison of Auto Insurance Plans

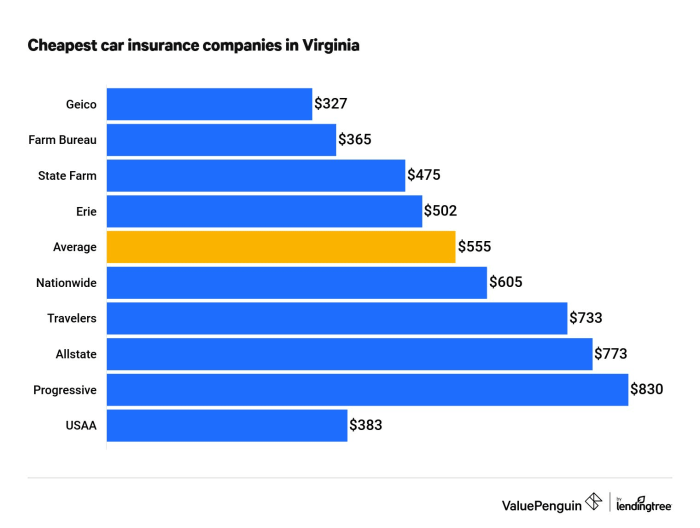

The cost of auto insurance in Virginia varies significantly depending on the coverage level and other factors. The following table illustrates a sample comparison between minimum coverage and a more comprehensive plan. Note that these are average estimates and actual costs can vary based on individual circumstances, such as driving history, age, location, and vehicle type.

| Coverage Type | Minimum Cost (Estimate) | Average Cost (Estimate) | Benefits |

|---|---|---|---|

| Liability Only | $500 – $700 per year | $700 – $1000 per year | Meets minimum state requirements; protects others in case of accident you cause. |

| Liability + Collision + Comprehensive | $1000 – $1500 per year | $1500 – $2500 per year | Covers damages to your vehicle in accidents (collision) and other incidents (comprehensive); protects others in case of accident you cause. |

Factors Affecting Auto Insurance Costs in Virginia

Several key factors influence the cost of auto insurance in Virginia. Insurance companies utilize a complex algorithm considering various aspects of the driver and vehicle to determine premiums, aiming to accurately assess risk. Understanding these factors can help drivers make informed decisions to potentially lower their insurance costs.

Driver’s Age

Younger drivers generally pay higher insurance premiums than older drivers. This is because statistically, younger drivers are involved in more accidents. Insurance companies perceive a higher risk associated with inexperienced drivers. As drivers gain experience and a clean driving record, their premiums typically decrease. For example, a 16-year-old driver will likely pay significantly more than a 35-year-old driver with the same vehicle and similar driving record.

Driving Record

A driver’s driving history significantly impacts insurance rates. Accidents and traffic violations lead to higher premiums. The severity of the accident and the number of violations are key factors. For instance, a driver with multiple speeding tickets and a DUI conviction will face substantially higher premiums than a driver with a clean record. Insurance companies view a history of at-fault accidents as a strong indicator of future risk.

Vehicle Type

The type of vehicle insured also plays a crucial role in determining premiums. Generally, sports cars and high-performance vehicles are more expensive to insure than sedans or smaller vehicles. This is because these vehicles are often more expensive to repair and are statistically involved in more severe accidents. For example, insuring a luxury SUV will typically cost more than insuring a compact sedan, even if both drivers have similar driving records. Trucks, depending on size and intended use, may fall somewhere in between.

Location

Where a driver lives significantly impacts their insurance rates. Areas with higher rates of accidents and theft tend to have higher insurance premiums. This reflects the increased risk for insurance companies in those locations. A driver living in a densely populated urban area with a high crime rate will likely pay more than a driver in a rural area with lower crime statistics.

Credit Score

In Virginia, as in many states, a driver’s credit score can influence their auto insurance rates. While the exact correlation isn’t always transparent, insurers often consider credit scores as an indicator of overall risk. A good credit score can often result in lower premiums, while a poor credit score may lead to higher premiums. This is because individuals with poor credit may be considered higher risk by insurers. It’s important to note that this is a controversial practice and its legality is subject to state regulations.

Discounts and Savings Opportunities

Saving money on your Virginia auto insurance is achievable through various discounts and smart policy choices. Understanding these opportunities can significantly reduce your annual premiums. This section details common discounts, the process of obtaining them, and the benefits of bundling insurance policies.

Many insurance companies offer a range of discounts to incentivize safe driving and responsible financial habits. These discounts can substantially lower your premiums, making car insurance more affordable. Securing these discounts often involves providing the necessary documentation and demonstrating eligibility.

Common Auto Insurance Discounts

Several common discounts are available to Virginia drivers. These include good student discounts, which reward academic achievement; safe driver discounts, recognizing a history of accident-free driving; and multiple-car discounts, offering savings for insuring multiple vehicles under one policy. Other discounts may be available based on specific features of your vehicle or your driving habits, such as anti-theft devices or telematics programs. Companies may also offer discounts for affiliations, such as memberships in specific organizations or employment with certain companies.

Obtaining Discounts from Insurance Companies

The process of obtaining discounts varies slightly between insurance companies, but generally involves providing supporting documentation. For a good student discount, you’ll typically need to provide proof of enrollment and academic standing, such as a transcript or report card showing a certain GPA. For safe driver discounts, your driving record, obtained from the DMV, will be reviewed. Multiple-car discounts are usually automatically applied once you add a second vehicle to your policy. Always confirm the specific requirements and documentation needed with your chosen insurer. Proactively inquire about all available discounts; insurers don’t always automatically apply every discount you qualify for.

Bundling Home and Auto Insurance

Bundling your home and auto insurance policies with the same company is a highly effective way to save money. Insurers often offer significant discounts for bundling, as it simplifies their administration and reduces risk. This discount can range from a few percentage points to a substantial reduction in your overall premiums. For example, a driver paying $1200 annually for auto insurance and $600 for homeowners insurance might see a combined discount of 15%, resulting in a total annual savings of $270. This is a considerable benefit, highlighting the financial advantage of bundling.

Potential Discounts Available in Virginia

Below is a list of potential discounts offered by various Virginia auto insurance providers. Remember to verify availability and specific requirements with your insurer.

- Good Student Discount

- Safe Driver Discount

- Multiple Car Discount

- Anti-theft Device Discount

- Defensive Driving Course Discount

- Telematics Program Discount (usage-based insurance)

- Bundling Home and Auto Insurance Discount

- Senior Citizen Discount (in some cases)

- Military Discount

- Affiliation Discounts (e.g., professional organizations)

Ultimate Conclusion

Ultimately, finding cheap auto insurance in Virginia requires a proactive approach. By carefully comparing quotes, understanding the various coverage options, and adopting safe driving habits, you can significantly reduce your premiums while ensuring adequate protection. Remember, the cheapest policy isn’t always the best; prioritize coverage that meets your individual needs and financial situation. Take control of your insurance costs and drive with confidence knowing you’ve secured the best possible deal.

Essential FAQs

What happens if I’m involved in an accident without insurance in Virginia?

Driving without insurance in Virginia is illegal and carries significant penalties, including fines, license suspension, and potential legal liabilities if you cause an accident.

Can I get insurance if I have a poor driving record?

Yes, but it will likely be more expensive. Companies consider your driving history, so a clean record leads to lower premiums. You may need to explore high-risk insurance providers.

How often should I review my auto insurance policy?

It’s recommended to review your policy annually, or even more frequently if there are significant life changes (new car, address change, etc.), to ensure you have the right coverage at the best price.

What is the difference between liability and collision coverage?

Liability insurance covers damages you cause to others, while collision insurance covers damages to your vehicle, regardless of fault.

Do all insurance companies offer the same discounts?

No, discounts vary by company. It’s essential to compare quotes from multiple providers to find the best deals available to you.