Navigating the world of auto insurance in North Carolina can feel like driving through a maze. Finding affordable coverage shouldn’t be a stressful experience. This guide demystifies the process of securing cheap auto insurance in NC, offering insights into factors influencing costs, strategies for securing the best rates, and a comparison of leading providers. We’ll equip you with the knowledge to make informed decisions and find the policy that best suits your needs and budget.

From understanding the various coverage options and discounts available to learning how your driving history and credit score impact premiums, we’ll cover it all. We’ll also explore the legal requirements and resources available to North Carolina drivers, empowering you to confidently navigate the complexities of auto insurance.

Understanding “Cheap Auto Insurance NC”

Finding affordable auto insurance in North Carolina can seem daunting, but understanding the factors that influence costs allows for informed decision-making. Several key elements determine your premium, and by understanding them, you can actively work towards securing a more competitive rate.

Factors Influencing Auto Insurance Costs in North Carolina

Several factors contribute to the cost of auto insurance in North Carolina. These factors are considered by insurance companies when calculating your premium. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Factors Affecting Insurance Premiums

Insurance companies use a complex algorithm to determine your premium, considering your driving record, the type of vehicle you drive, your location, and your coverage choices. A clean driving record with no accidents or violations significantly reduces premiums. The type of car you drive—its make, model, year, and safety features—also plays a crucial role, as some vehicles are statistically more prone to accidents or more expensive to repair. Your location within North Carolina also matters, as rates vary based on the accident frequency and crime rates in your area. Finally, the type and amount of coverage you choose directly impact your premium; higher coverage levels naturally mean higher costs.

Types of Auto Insurance Coverage in NC

North Carolina requires minimum liability coverage, but you can opt for additional protection. Understanding the different types of coverage is crucial for making an informed decision about your insurance needs.

Available Auto Insurance Coverages

- Liability Coverage: This covers injuries or damages you cause to others in an accident. North Carolina’s minimum requirements are $30,000 for injuries per person, $60,000 for injuries per accident, and $25,000 for property damage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver.

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, or weather damage.

- Medical Payments Coverage (Med-Pay): This covers medical expenses for you and your passengers, regardless of fault.

- Personal Injury Protection (PIP): This covers medical expenses and lost wages for you and your passengers, regardless of fault. It may also cover other expenses such as funeral costs.

Common Discounts Offered by NC Insurance Providers

Many insurance companies offer discounts to help lower your premiums. Taking advantage of these discounts can lead to significant savings.

Available Insurance Discounts

- Good Driver Discount: Awarded for maintaining a clean driving record for a specified period.

- Safe Driver Discount: Often based on telematics data showing safe driving habits.

- Multi-Car Discount: Offered for insuring multiple vehicles under the same policy.

- Multi-Policy Discount: Awarded for bundling auto insurance with other types of insurance, such as homeowners or renters insurance.

- Good Student Discount: Available to students with good grades.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can result in a discount.

Average Insurance Costs for Different Vehicle Types in NC

The type of vehicle you drive significantly impacts your insurance premium. Generally, higher-performance vehicles, luxury cars, and vehicles with a history of higher repair costs will have higher insurance premiums.

Vehicle Type and Insurance Cost

Providing exact average costs is difficult as rates vary greatly based on numerous factors. However, we can illustrate the general trend: A small, fuel-efficient sedan will typically have lower insurance premiums compared to a large SUV or a sports car. For example, insuring a Honda Civic might cost considerably less than insuring a Porsche 911 or a Ford F-150 pickup truck. This difference stems from factors like repair costs, the likelihood of theft, and the vehicle’s inherent safety features.

Finding Affordable Auto Insurance in NC

Securing affordable auto insurance in North Carolina requires a strategic approach. Understanding the various resources available and employing effective strategies can significantly reduce your premiums. This section Artikels key steps and resources to help you find the best rates.

Finding the most competitive auto insurance rates in North Carolina involves leveraging online comparison tools and understanding the factors that influence your premiums. Several websites allow you to input your information and receive multiple quotes simultaneously, saving you considerable time and effort.

Resources for Comparing Auto Insurance Quotes

Several websites offer free online quote comparison services. These tools allow you to input your information once and receive quotes from multiple insurers, enabling a direct comparison of prices and coverage options. Examples include but are not limited to: The Zebra, NerdWallet, and Policygenius. These sites typically aggregate quotes from a range of insurers, providing a comprehensive overview of the market. Remember to verify the accuracy of the information provided by comparing it against the insurer’s official website.

A Step-by-Step Guide to Obtaining the Best Rates

Obtaining the best auto insurance rates involves a systematic approach. This process minimizes the effort involved and maximizes your chances of finding the most suitable and affordable coverage.

- Gather Necessary Information: Before starting, collect essential data such as your driver’s license number, vehicle information (year, make, model), and driving history. Accurate information is crucial for obtaining accurate quotes.

- Use Online Comparison Tools: Utilize online comparison websites to receive multiple quotes from different insurers. Compare not only price but also coverage options and customer reviews.

- Contact Insurers Directly: After identifying a few promising quotes online, contact the insurers directly to discuss specific details and potentially negotiate better rates. Sometimes, speaking directly to an agent can uncover additional discounts or tailored options.

- Review Policy Details Carefully: Before committing to a policy, thoroughly review all the terms, conditions, and coverage details to ensure they meet your needs and budget.

- Consider Bundling Policies: Explore bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, as this often leads to significant discounts.

The Importance of Credit Scores in Determining Insurance Premiums

In North Carolina, as in many other states, insurance companies often use credit-based insurance scores to assess risk and determine premiums. A higher credit score generally indicates a lower risk profile, resulting in lower insurance premiums. Conversely, a lower credit score can lead to higher premiums. This is because insurers believe that individuals with good credit are more likely to pay their bills on time, including insurance premiums. It’s important to note that while credit scores are a factor, they are not the sole determinant of your insurance rate.

Tips for Lowering Insurance Premiums in NC

Several strategies can help lower your auto insurance premiums in North Carolina. Implementing these can lead to significant savings over time.

- Maintain a Good Driving Record: Avoid accidents and traffic violations, as these significantly impact your insurance premiums. A clean driving record is one of the most effective ways to keep your rates low.

- Increase Your Deductible: Choosing a higher deductible can lower your premiums. This requires careful consideration of your financial situation and risk tolerance, as a higher deductible means you’ll pay more out-of-pocket in the event of a claim.

- Consider Safety Features: Vehicles equipped with anti-theft devices or advanced safety features like anti-lock brakes or airbags often qualify for discounts.

- Take a Defensive Driving Course: Completing a state-approved defensive driving course can lead to premium reductions. These courses demonstrate a commitment to safe driving practices.

- Shop Around Regularly: Insurance rates fluctuate, so it’s advisable to compare quotes from different insurers annually or even more frequently to ensure you are getting the best possible rate.

- Maintain a Good Credit Score: As mentioned previously, a good credit score can significantly influence your insurance premiums. Work on improving your credit score if necessary.

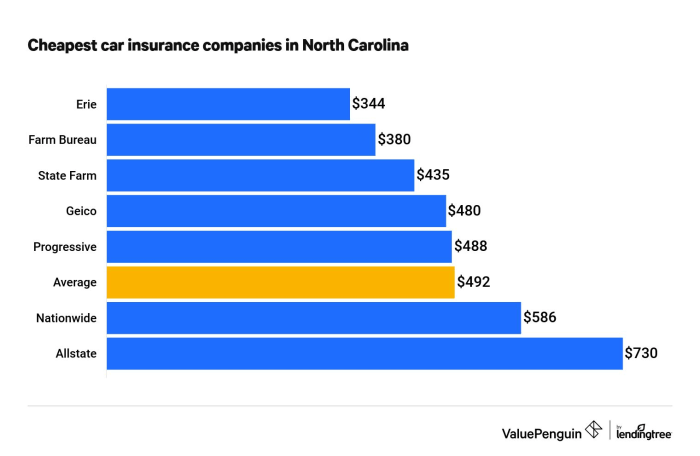

Insurance Provider Comparison in NC

Choosing the right auto insurance provider in North Carolina can significantly impact your budget and peace of mind. Several factors beyond price should be considered, including the level of customer service, the breadth of coverage options, and the provider’s financial stability. This comparison aims to highlight key differences between some major providers to aid in your decision-making process. Remember that rates vary greatly based on individual factors like driving history, vehicle type, and location.

North Carolina Auto Insurance Provider Comparison

The following table compares four major auto insurance providers in North Carolina. Note that these are average figures and actual rates can vary considerably.

| Provider Name | Average Annual Rate (Estimate) | Customer Satisfaction Score (J.D. Power & Associates, Example Data) | Coverage Options |

|---|---|---|---|

| GEICO | $1200 | 850 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP), Medical Payments |

| State Farm | $1350 | 880 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP), Medical Payments, Roadside Assistance |

| Progressive | $1150 | 820 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP), Medical Payments, Customized Coverage Options |

| Allstate | $1400 | 860 | Liability, Collision, Comprehensive, Uninsured/Underinsured Motorist, Personal Injury Protection (PIP), Medical Payments, Accident Forgiveness |

Note: The average annual rates and customer satisfaction scores presented are illustrative examples based on industry averages and publicly available data from sources like J.D. Power. Actual rates and scores may vary depending on numerous factors. Always obtain personalized quotes from multiple providers for accurate comparison.

Strengths and Weaknesses of Providers

Each provider offers unique strengths and weaknesses. Understanding these can help you choose a provider that best fits your needs.

GEICO: Strengths include generally competitive pricing and a user-friendly online experience. A potential weakness could be a less personalized customer service experience compared to some competitors due to their high volume of customers.

State Farm: Known for its extensive agent network and strong customer service reputation, State Farm might have slightly higher premiums compared to some competitors. The extensive agent network provides convenient access to in-person assistance.

Progressive: Progressive often offers customizable coverage options and competitive pricing, but customer service experiences can be inconsistent depending on the method of contact (phone vs. online).

Allstate: Allstate provides a comprehensive range of coverage options, including unique features like accident forgiveness. However, their premiums might be higher than some competitors.

Downsides of Choosing the Cheapest Option

While saving money is important, selecting the absolute cheapest auto insurance policy without considering other factors can have significant downsides. The cheapest option may offer minimal coverage, leaving you financially vulnerable in the event of an accident. It might also have poor customer service, making filing a claim a difficult and frustrating experience. A lower premium may reflect a higher deductible, meaning you’ll pay more out-of-pocket in the event of a claim. Adequate coverage that protects your assets and provides peace of mind is crucial, even if it means paying slightly more.

Illustrative Examples

Understanding the cost of auto insurance in North Carolina can be complex. These examples illustrate how various factors influence your premium, providing a clearer picture of how to potentially save money.

Bundling Home and Auto Insurance

Bundling your home and auto insurance with the same provider often results in significant savings. Let’s consider Sarah, a homeowner in Charlotte with a $250,000 home and a mid-range sedan. If she purchased home and auto insurance separately, she might pay $1,200 annually for home insurance and $800 annually for auto insurance, totaling $2,000. However, by bundling these policies with a single provider, she could receive a discount of 15%, reducing her total annual premium to $1,700, saving her $300 per year. This discount varies by provider and policy details, but it highlights the potential cost savings.

High-Risk vs. Low-Risk Driver Premiums

Insurance premiums significantly differ based on driving history. Consider two drivers in Raleigh with similar vehicles: Mark, a 25-year-old with a clean driving record, and David, a 25-year-old with two speeding tickets and an at-fault accident in the past three years. Mark, the low-risk driver, might pay around $700 annually for liability-only coverage. David, due to his high-risk profile, could expect to pay significantly more, perhaps $1,400 or even higher, reflecting the increased risk to the insurance company. This illustrates the importance of maintaining a clean driving record.

Impact of a Single Traffic Violation

A single traffic violation can substantially increase your insurance premium. Imagine Lisa, a driver in Greensboro with a spotless record paying $900 annually for her car insurance. After receiving a reckless driving citation, her insurer might increase her premium by 20%, raising her annual cost to $1,080. This increase reflects the heightened risk associated with reckless driving. The impact can be even greater with more serious violations like DUI.

Impact of Different Coverage Options

Choosing different coverage options directly impacts your premium. Let’s compare two drivers in Asheville with identical vehicles and driving records. Anna chooses liability-only coverage, which is the minimum required in North Carolina, while Beth opts for full coverage, including collision and comprehensive. Anna’s annual premium might be $650, while Beth’s, including the additional coverage, might be $1,100. The higher cost for Beth reflects the broader protection offered by full coverage, which covers damages to her own vehicle in accidents or from other events like theft or vandalism. This illustrates the trade-off between cost and coverage level.

Closure

Securing cheap auto insurance in North Carolina is achievable with careful planning and informed decision-making. By understanding the factors that influence premiums, utilizing available resources for comparison shopping, and adopting cost-saving strategies, you can significantly reduce your insurance expenses without compromising essential coverage. Remember to regularly review your policy and shop around to ensure you’re always getting the best value for your money. Safe driving habits are not only beneficial for your personal safety but also contribute to lower insurance premiums in the long run.

Q&A

What is the minimum auto insurance coverage required in NC?

North Carolina requires a minimum of 30/60/25 liability coverage. This means $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage.

How does my credit score affect my insurance premiums?

In North Carolina, insurers consider your credit score as a factor in determining your risk profile. A higher credit score generally translates to lower premiums.

Can I bundle my home and auto insurance for a discount?

Yes, many insurance providers offer discounts for bundling home and auto insurance policies. This is often a significant way to save money.

What happens if I drive without insurance in NC?

Driving without insurance in North Carolina is illegal and can result in significant fines, license suspension, and even jail time.