Navigating the world of car insurance can feel like driving through a dense fog, especially in a state like Virginia with its diverse insurance landscape. Finding affordable coverage shouldn’t be a race against time or a gamble with your financial security. This guide provides a clear path to understanding the factors that influence car insurance costs in Virginia, empowering you to make informed decisions and secure the best possible rates.

We’ll explore the intricacies of Virginia’s car insurance market, examining minimum requirements, common coverage types, and the impact of personal factors like driving history and credit score. We’ll also equip you with practical strategies to lower your premiums, compare insurers effectively, and navigate the application process with confidence. By the end, you’ll be well-prepared to find cheap car insurance in VA that meets your needs and budget.

Understanding Virginia’s Car Insurance Market

Navigating the car insurance landscape in Virginia can feel complex, with numerous factors influencing the final cost. Understanding these factors allows drivers to make informed decisions and potentially save money. This section provides an overview of the Virginia car insurance market, covering key aspects that affect premiums and outlining the state’s minimum insurance requirements.

Several key factors contribute to the variability of car insurance costs in Virginia. These include your driving history (accidents, tickets, and claims), age and gender, the type of vehicle you drive (make, model, and year), your location within the state (urban areas generally have higher rates), and the coverage levels you choose. Credit history can also play a role, with insurers often using credit-based insurance scores to assess risk. Your driving habits, such as mileage driven annually, also influence premiums. Insurers consider the risk they are taking on when insuring you, and these factors all contribute to their assessment.

Common Car Insurance Types in Virginia

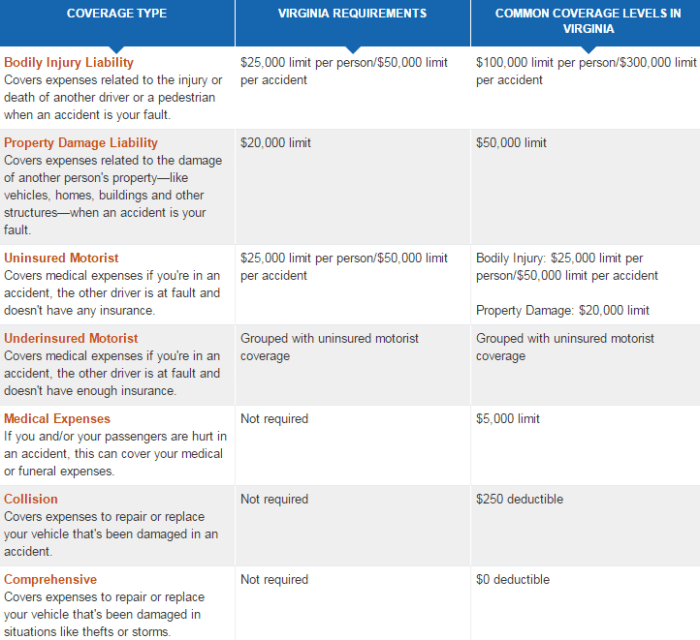

Virginia offers a range of car insurance options to meet diverse needs and budgets. Understanding the differences between these types of coverage is crucial for choosing the right policy. Common types include liability coverage (bodily injury and property damage), collision coverage (damage to your own vehicle), comprehensive coverage (damage from non-collision events like theft or vandalism), uninsured/underinsured motorist coverage (protection against drivers without adequate insurance), and medical payments coverage (medical expenses for you and your passengers). Many drivers opt for a combination of these coverages to create a policy that best suits their circumstances and risk tolerance.

Minimum Insurance Requirements in Virginia

Virginia law mandates minimum liability coverage for all drivers. This means that drivers must carry a minimum of $25,000 in bodily injury liability coverage per person, $50,000 in bodily injury liability coverage per accident, and $20,000 in property damage liability coverage. Failing to maintain this minimum insurance can result in significant penalties, including fines and suspension of driving privileges. While meeting the minimum requirements is legally sufficient, many drivers opt for higher coverage limits to provide greater financial protection in the event of an accident. It is advisable to carefully consider your individual needs and financial circumstances when choosing your coverage levels.

Average Car Insurance Costs in Virginia Cities

The following table presents estimated average annual costs for different car insurance types across several Virginia cities. Note that these are averages and individual costs can vary significantly based on the factors mentioned previously. These figures are illustrative and should not be taken as precise predictions for individual drivers. Always obtain quotes from multiple insurers for a personalized assessment.

| City | Liability Only (Annual) | Liability + Collision (Annual) | Full Coverage (Annual) | Uninsured/Underinsured Motorist (Annual Add-on) |

|---|---|---|---|---|

| Richmond | $500 | $1000 | $1500 | $100 |

| Norfolk | $550 | $1100 | $1600 | $110 |

| Virginia Beach | $600 | $1200 | $1700 | $120 |

| Charlottesville | $450 | $900 | $1350 | $90 |

Finding Affordable Car Insurance Options

Securing affordable car insurance in Virginia requires a proactive approach and a thorough understanding of the factors influencing premiums. By strategically comparing providers, leveraging discounts, and maintaining a responsible driving record, Virginia drivers can significantly reduce their insurance costs. This section Artikels effective strategies to achieve lower premiums.

Impact of Driving History on Insurance Rates

Your driving history is a primary determinant of your car insurance rates in Virginia. A clean driving record, free of accidents and traffic violations, translates to lower premiums. Conversely, accidents, especially those resulting in injuries or significant property damage, will substantially increase your rates. Similarly, multiple speeding tickets or other moving violations can lead to higher premiums. Insurance companies assess risk based on past driving behavior, assuming that a history of incidents indicates a higher likelihood of future claims. For example, a driver with a DUI conviction will likely face significantly higher premiums than a driver with a spotless record for many years. The impact of a single incident can vary based on the severity of the infraction and the specific insurance company’s rating system.

Influence of Credit Score on Insurance Premiums

In Virginia, as in many other states, your credit score can influence your car insurance rates. Insurers often use credit-based insurance scores to assess risk. The rationale is that individuals with poor credit may be considered higher-risk policyholders. A higher credit score generally correlates with lower insurance premiums. While the exact impact varies by insurer, a significant difference in premiums can exist between drivers with excellent credit and those with poor credit. For instance, a driver with a credit score above 750 might qualify for significant discounts, whereas a driver with a score below 600 might face substantially higher rates. It’s important to note that this practice is legal in Virginia, but some companies offer credit-based insurance score discounts.

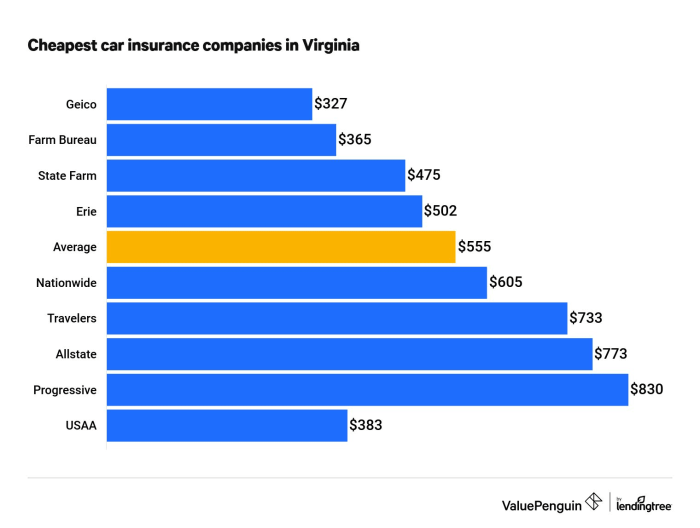

Comparison of Insurance Provider Services

Several insurance providers operate in Virginia, each offering varying levels of coverage, services, and pricing. Direct comparison is crucial for finding the best value. For example, some companies might specialize in offering lower premiums for young drivers, while others might focus on comprehensive coverage options with additional benefits like roadside assistance. Some providers may offer online tools and customer service channels that are more user-friendly than others. Factors like policy customization options, claims processing speed, and customer reviews should also be considered when comparing providers. Large national insurers often have a wider range of coverage options and discounts, while smaller, regional companies might offer more personalized service and potentially more competitive rates for specific demographics.

Commonly Offered Discounts

Many car insurance companies in Virginia offer various discounts to reduce premiums. These discounts can significantly lower your overall cost.

- Good Student Discount: Offered to students maintaining a certain GPA.

- Safe Driver Discount: Awarded for maintaining a clean driving record for a specified period.

- Multi-Car Discount: Applies when insuring multiple vehicles under the same policy.

- Multi-Policy Discount: Offered for bundling car insurance with other types of insurance, such as homeowners or renters insurance.

- Defensive Driving Course Discount: Awarded upon completion of an approved defensive driving course.

- Vehicle Safety Features Discount: Applies to vehicles equipped with anti-theft devices or other safety features.

- Payment Plan Discount: Sometimes offered for paying premiums annually or semi-annually rather than monthly.

It’s essential to contact individual insurance companies to inquire about specific discount eligibility and details. The availability and amount of discounts can vary considerably between providers.

Navigating the Insurance Application Process

Applying for car insurance in Virginia can seem daunting, but with a structured approach, the process becomes manageable. This section provides a step-by-step guide to help you navigate the application process efficiently and ensure you secure the best possible coverage at an affordable price. Accurate completion is key to avoiding delays and ensuring your application is processed smoothly.

The Application Process: A Step-by-Step Guide

The application process generally involves these key steps: First, you’ll need to gather necessary information, then compare quotes from multiple insurers, complete the application form, provide supporting documentation, and finally, review and accept the policy.

- Gather Necessary Information: Before you begin, collect all relevant information, including your driver’s license number, vehicle identification number (VIN), vehicle details (make, model, year), and driving history. Having this information readily available will streamline the application process.

- Compare Quotes from Multiple Insurers: Shopping around is crucial. Use online comparison tools or contact insurers directly to obtain quotes. This allows you to compare prices and coverage options before making a decision. Consider factors like deductibles and coverage limits when comparing.

- Complete the Application Form: Most insurers offer online applications, which are often faster and more convenient. Ensure all information is accurate and complete. Inaccuracies can lead to delays or even rejection of your application.

- Provide Supporting Documentation: You may be required to provide supporting documentation, such as proof of address, driver’s license, and vehicle registration. Having these documents ready will expedite the process.

- Review and Accept the Policy: Carefully review the policy details, including coverage limits, deductibles, and exclusions, before accepting. Understanding your policy is vital to ensure you have the appropriate protection.

Tips for Accurate Application Completion

Providing accurate information on your application is paramount. Errors can lead to delays, higher premiums, or even policy cancellation. Double-check all information, including your address, driving history, and vehicle details. If you are unsure about any information, contact the insurer directly for clarification. Consider keeping a copy of your completed application for your records.

Understanding Policy Details Before Signing

Before signing any insurance policy, thoroughly review all terms and conditions. Pay close attention to the coverage limits, deductibles, exclusions, and any additional riders or endorsements. If anything is unclear, contact the insurer to seek clarification. Understanding your policy ensures you are adequately protected and avoid unexpected costs in the event of an accident. A clear understanding prevents future disputes and ensures you receive the coverage you expect.

Filing a Claim with a Virginia Car Insurance Provider

Filing a claim involves reporting the incident to your insurer as soon as possible, usually by phone or online. You’ll need to provide details about the accident, including the date, time, location, and involved parties. You’ll also need to provide information about any injuries or damages. The insurer will then investigate the claim and determine liability. Cooperate fully with the insurer’s investigation and provide any requested documentation promptly. Keep records of all communication and documentation related to your claim. Following these steps will help ensure a smooth and efficient claims process.

Understanding Policy Coverage and Exclusions

Choosing the right car insurance policy in Virginia requires a clear understanding of what’s covered and what’s not. This knowledge empowers you to make informed decisions and avoid unexpected costs in the event of an accident or other covered incident. Let’s delve into the specifics of policy coverage and exclusions.

Types of Car Insurance Coverage in Virginia

Virginia, like other states, mandates certain minimum levels of car insurance coverage. However, drivers can opt for higher coverage limits and additional types of protection. Understanding these options is crucial for securing adequate financial protection.

- Bodily Injury Liability: This covers medical bills and other expenses for injuries you cause to others in an accident. Virginia’s minimum requirement is 25/50/20, meaning $25,000 per person injured, $50,000 per accident for multiple injuries, and $20,000 for property damage.

- Property Damage Liability: This covers the cost of repairing or replacing the other person’s vehicle or property damaged in an accident you caused. The minimum in Virginia is $20,000.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle damage.

- Collision Coverage: This pays for repairs or replacement of your vehicle regardless of fault, even if you caused the accident.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or hail.

- Personal Injury Protection (PIP): This covers your medical expenses and lost wages, regardless of fault. It may also cover passengers in your vehicle.

- Medical Payments Coverage (Med-Pay): This covers medical expenses for you and your passengers, regardless of fault, but it typically has lower limits than PIP.

Common Exclusions in Car Insurance Policies

While car insurance provides crucial protection, it’s essential to understand what isn’t covered. Knowing these exclusions can prevent misunderstandings and disappointment in the event of a claim.

- Driving Under the Influence (DUI): Most policies exclude coverage if you were driving under the influence of alcohol or drugs.

- Intentional Acts: Damage caused intentionally is generally not covered.

- Racing or Other Illegal Activities: Coverage is typically excluded for accidents occurring during illegal activities such as street racing.

- Wear and Tear: Normal wear and tear on your vehicle is not covered.

- Damage from Certain Events (Depending on Policy): Some policies may exclude coverage for specific events, such as flood damage, unless you have purchased additional coverage.

Visual Representation of Car Insurance Coverage

Imagine a circle divided into several sections. The largest section represents Liability Coverage (Bodily Injury and Property Damage), encompassing the potential costs associated with injuring others or damaging their property. Adjacent to this is a smaller section for Collision Coverage, representing repairs to your vehicle resulting from accidents. Another section, of similar size to Collision, represents Comprehensive Coverage, covering non-collision damages like theft or weather events. Smaller sections represent Uninsured/Underinsured Motorist coverage, PIP, and Med-Pay. The size of each section reflects the relative proportion of coverage provided by a typical policy; however, the actual size and presence of certain sections will vary depending on the chosen policy and coverage limits.

Liability Coverage vs. Collision Coverage

Liability coverage protects others from your driving mistakes, while collision coverage protects your vehicle from damage, regardless of fault. Liability is legally mandated in Virginia, while collision is optional. Liability only pays for damages to other people and their property, not your own vehicle. Collision coverage, on the other hand, pays for repairs or replacement of your vehicle even if the accident was your fault. For example, if you cause an accident and injure someone, your liability coverage would pay for their medical bills. If your car is damaged in the same accident, your collision coverage would pay for the repairs. Choosing the right balance between these two coverages depends on your individual risk tolerance and financial situation.

Resources for Finding Cheap Car Insurance

Finding the best car insurance rates in Virginia requires diligent research and comparison shopping. Several resources are available to help you navigate this process effectively and secure the most affordable coverage for your needs. Understanding how to utilize these resources is key to saving money on your premiums.

Reputable Online Resources for Comparing Car Insurance Quotes

Numerous websites facilitate the comparison of car insurance quotes from multiple providers. These tools streamline the process, allowing you to input your information once and receive quotes from various companies simultaneously. This saves significant time and effort compared to contacting each insurer individually. It’s crucial to use multiple comparison websites to ensure a comprehensive view of available options. Some well-regarded examples include The Zebra, NerdWallet, and Policygenius. These platforms often include features such as customer reviews and ratings to help you make informed decisions.

Tips for Effectively Using Online Comparison Tools

To maximize the effectiveness of online comparison tools, it’s important to provide accurate and complete information. Inaccuracies can lead to inaccurate quotes. Ensure you input your driving history, vehicle details, and desired coverage accurately. It’s also beneficial to compare quotes across different coverage levels to understand the cost-benefit trade-offs. Remember to consider factors beyond price, such as the insurer’s reputation and customer service ratings. Finally, don’t hesitate to contact insurers directly if you have questions about specific policy details or require clarification on a quote.

Benefits and Drawbacks of Using an Insurance Broker

Insurance brokers act as intermediaries between you and multiple insurance companies. A key benefit is their expertise in navigating the complexities of insurance policies and identifying the best options for your specific circumstances. Brokers can often access a wider range of insurers than you could independently, potentially leading to better rates and coverage options. However, brokers typically charge fees or commissions, which can impact the overall cost. Therefore, it’s important to weigh the potential savings from a broker’s expertise against their fees. Carefully consider the broker’s reputation and experience before engaging their services.

Flowchart Illustrating the Process of Finding and Selecting Affordable Car Insurance

The process of finding and selecting affordable car insurance can be visualized as a flowchart. The flowchart would begin with gathering personal information (driving history, vehicle details, etc.). This would then lead to using online comparison tools to generate quotes from multiple insurers. Next, you would compare quotes, considering price, coverage, and insurer reputation. Following this, you would select a preferred insurer and coverage level. The final step involves completing the application process and paying the premium. This structured approach helps ensure a thorough and efficient search for affordable insurance.

Outcome Summary

Securing cheap car insurance in Virginia requires a strategic approach, combining knowledge of the market with proactive steps to manage your risk profile. By understanding the key factors influencing premiums, leveraging available discounts, and comparing quotes from multiple providers, you can significantly reduce your insurance costs without compromising essential coverage. Remember, informed decisions lead to better outcomes, so take advantage of the resources and strategies Artikeld in this guide to find the perfect balance between affordability and comprehensive protection.

FAQ Summary

What is the minimum car insurance coverage required in Virginia?

Virginia mandates minimum liability coverage of $25,000 for injury or death of one person, $50,000 for injury or death of two or more people, and $20,000 for property damage in a single accident.

How does my credit score affect my car insurance rates?

In Virginia, insurers can consider your credit score when determining your rates. A higher credit score generally leads to lower premiums, while a lower score may result in higher premiums.

Can I get car insurance without a driving history?

Yes, but you’ll likely pay higher premiums. Insurers assess risk based on driving history; lacking one means they have less data to assess your risk. Providing proof of a driver’s education course may help.

What are some common discounts offered by Virginia car insurance companies?

Common discounts include good driver discounts, multi-car discounts, bundling discounts (home and auto), safe driver discounts (telematics programs), and discounts for anti-theft devices.