Navigating the world of car insurance can feel overwhelming, especially in a state like Louisiana with its unique market dynamics. Securing affordable coverage without sacrificing essential protection is a top priority for many drivers. This guide delves into the intricacies of finding cheap car insurance in Louisiana, providing practical strategies and valuable insights to help you make informed decisions and secure the best possible rates.

We’ll explore the factors influencing insurance costs, compare different coverage options, and offer actionable tips for negotiating lower premiums. From understanding minimum legal requirements to leveraging discounts and improving your driving habits, this guide equips you with the knowledge to effectively manage your car insurance expenses in Louisiana.

Understanding Louisiana’s Car Insurance Market

Navigating the Louisiana car insurance market requires understanding several key factors that influence costs and coverage options. This includes a detailed look at the state’s minimum requirements, the various types of coverage available, and the significant role your driving history plays in determining your premium.

Louisiana’s car insurance market is shaped by a number of interconnected factors. High accident rates, a large number of uninsured drivers, and the state’s geographical location (particularly its susceptibility to hurricanes and other natural disasters) all contribute to higher premiums compared to some other states. The density of population in certain areas, particularly urban centers, also plays a role, as does the cost of vehicle repairs and medical care within the state. Furthermore, the regulatory environment and the competitive landscape among insurance providers influence the overall pricing structure.

Factors Influencing Car Insurance Costs in Louisiana

Several factors contribute to the variability in car insurance costs across Louisiana. These include the driver’s age and driving history, the type and value of the vehicle, the coverage level selected, and the driver’s location. For example, a young, inexperienced driver living in a high-crime, densely populated area will generally pay significantly more than an older, experienced driver with a clean record residing in a rural area. The make and model of the vehicle also impact premiums, as some cars are more expensive to repair than others. Comprehensive and collision coverage, which protect against damage from non-accident events and accidents respectively, will also increase the cost of insurance.

Types of Car Insurance Coverage Available in Louisiana

Louisiana, like other states, offers a range of car insurance coverage options. The most common types include liability coverage (bodily injury and property damage), uninsured/underinsured motorist coverage, collision coverage, comprehensive coverage, medical payments coverage, and personal injury protection (PIP). Liability coverage is mandatory and protects against financial losses resulting from accidents you cause. Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who lacks adequate insurance. Collision and comprehensive coverages are optional but highly recommended; collision covers damage from accidents, while comprehensive covers damage from non-accident events such as theft or hail damage. Medical payments coverage and PIP help cover medical expenses for you and your passengers regardless of fault.

Louisiana’s Minimum Insurance Requirements

Louisiana law mandates minimum liability coverage for all drivers. This typically includes a minimum of $15,000 in bodily injury liability coverage per person, $30,000 per accident, and $10,000 in property damage liability coverage. It’s crucial to understand that these minimums might not be sufficient to cover significant damages in a serious accident. Many drivers opt for higher coverage limits to provide greater protection. Failure to carry the state-mandated minimum insurance can result in significant fines and license suspension.

The Role of Driving History in Determining Insurance Premiums

Your driving record significantly impacts your car insurance premiums in Louisiana. Insurance companies use a points system to assess risk. Accidents, speeding tickets, and other moving violations lead to an accumulation of points, resulting in higher premiums. A clean driving record, on the other hand, often qualifies you for discounts. Factors like the severity of accidents and the time elapsed since the incident also influence the impact on your rates. For instance, a major accident with injuries will likely have a more substantial impact on your premium than a minor fender bender. Maintaining a good driving record is therefore essential for keeping your insurance costs manageable.

Finding Affordable Car Insurance Options

Securing affordable car insurance in Louisiana requires careful planning and research. Understanding your options and leveraging available discounts can significantly reduce your premiums. This section will Artikel strategies for finding the best deals and navigating the Louisiana insurance market effectively.

Finding the right car insurance policy involves comparing quotes from multiple insurers and understanding the various coverage options available. Several reputable companies operate within Louisiana, each offering different packages and pricing structures.

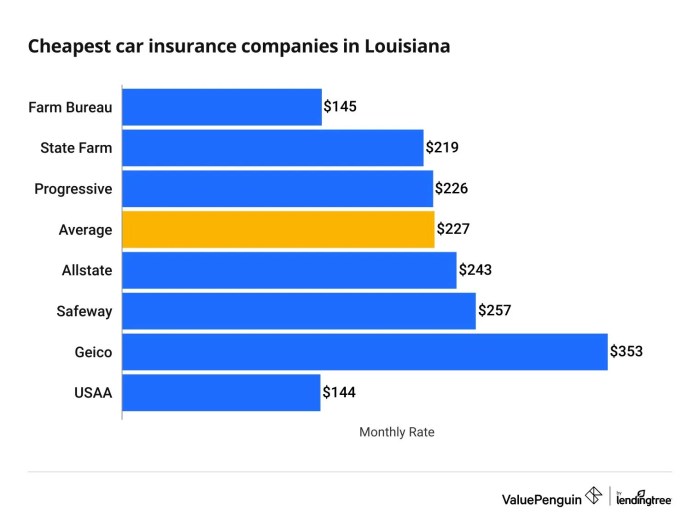

Reputable Car Insurance Companies in Louisiana

Several well-established and reliable insurance companies offer services in Louisiana. These companies are known for their customer service and range of coverage options. It’s important to compare quotes from several providers to find the best fit for your needs and budget. Remember that rates can vary based on individual factors such as driving history and the type of vehicle insured.

Negotiating Lower Insurance Premiums

Negotiating your insurance premium can be a successful strategy for lowering your overall cost. Several tactics can be employed to achieve lower premiums. Open communication with your insurance provider is key to exploring potential savings.

Tips for negotiating lower premiums include:

- Shop around and compare quotes from multiple insurers. This allows you to identify the most competitive rates.

- Bundle your insurance policies (home, auto, etc.) with the same provider to qualify for discounts.

- Maintain a clean driving record. Accidents and traffic violations significantly impact premiums.

- Consider increasing your deductible. A higher deductible typically results in lower premiums.

- Explore available discounts (see below). Many insurers offer discounts for various factors, such as good student status, safety features in your car, or completing a defensive driving course.

- Ask about payment options. Paying your premium in full annually may result in a discount compared to monthly payments.

- Negotiate directly with your insurer. Explain your situation and explore options for reducing your premium.

Impact of Discounts on Overall Cost

Discounts play a significant role in reducing your car insurance costs. Several factors can qualify you for discounts, substantially lowering your overall premium. These discounts can range from a few percentage points to a more significant reduction depending on the specific discount and the insurer.

Common discounts include:

- Good Driver Discount: Awarded for maintaining a clean driving record for a specified period (typically 3-5 years without accidents or violations).

- Bundling Discount: Offered for combining multiple insurance policies (auto, home, renters) with the same insurer.

- Safe Driver Discount: May be offered for completing a defensive driving course or installing telematics devices in your vehicle that monitor your driving habits.

- Good Student Discount: Available to students maintaining a certain GPA.

- Vehicle Safety Features Discount: Awarded for vehicles equipped with anti-theft devices or advanced safety features.

Hypothetical Insurance Options Comparison

The following table provides a hypothetical comparison of car insurance options. Remember that actual prices will vary depending on individual factors and the specific insurer.

| Company | Coverage | Price (Annual) | Features |

|---|---|---|---|

| Company A | Liability, Uninsured Motorist | $800 | 24/7 customer service, online portal |

| Company B | Liability, Collision, Comprehensive | $1200 | Accident forgiveness, roadside assistance |

| Company C | Liability, Collision, Comprehensive, Uninsured Motorist | $1500 | Rental car reimbursement, accident forgiveness, discounts for bundling |

| Company D | Liability, Uninsured Motorist, Medical Payments | $950 | Telematics program for potential discounts |

Factors Affecting Insurance Premiums

Several interconnected factors influence the cost of car insurance in Louisiana, impacting the final premium you pay. Understanding these factors can help you make informed decisions about your coverage and potentially save money. These factors range from personal characteristics to the type of vehicle you drive and your driving history.

Demographic Factors and Insurance Rates

Age, gender, and location significantly affect car insurance premiums. Statistically, younger drivers (typically under 25) are considered higher risk due to inexperience and a higher likelihood of accidents. This translates to higher premiums. Conversely, older drivers, often with more experience and a better driving record, may qualify for lower rates. Gender can also play a role, though the impact varies by state and insurer. Location is a crucial factor because insurance companies assess risk based on accident rates, crime statistics, and the prevalence of theft in specific areas. Living in a high-risk area will generally lead to higher premiums than residing in a safer neighborhood.

Vehicle Type and Insurance Costs

The type of vehicle you drive directly impacts your insurance costs. Luxury cars, sports cars, and high-performance vehicles are typically more expensive to insure due to higher repair costs and a greater potential for theft. Conversely, smaller, less expensive vehicles generally come with lower insurance premiums. The vehicle’s safety features, such as anti-lock brakes and airbags, also play a role; vehicles with advanced safety features might receive discounts. The vehicle’s age and condition also influence premiums; older cars may be cheaper to insure but could lack modern safety features.

Claims History and Future Premiums

Your driving record significantly impacts future insurance premiums. Filing a claim, especially for an at-fault accident, will likely result in a premium increase. The severity of the accident and the amount of damage also affect the premium adjustment. Multiple claims within a short period will result in even larger increases. Maintaining a clean driving record, free of accidents and traffic violations, is crucial for keeping your insurance costs low. Many insurance companies offer discounts for drivers with no claims for a specific period.

Liability-Only vs. Comprehensive Coverage

Liability-only insurance covers damages you cause to others in an accident, including property damage and bodily injury. Comprehensive coverage, on the other hand, extends this to cover damage to your own vehicle, regardless of fault, and often includes other benefits like theft and vandalism protection. Liability-only policies are generally cheaper than comprehensive policies, as they cover a smaller range of risks. However, the financial risk to the policyholder is higher in case of an accident causing damage to their own vehicle. Choosing between liability-only and comprehensive coverage involves balancing cost with the level of protection desired. A driver with an older vehicle might opt for liability-only to save money, while someone with a new car might prioritize comprehensive coverage for maximum protection.

Saving Money on Car Insurance

Securing affordable car insurance in Louisiana requires a proactive approach. By understanding the factors influencing your premiums and implementing strategic cost-saving measures, you can significantly reduce your annual expenses. This section Artikels key strategies to help you achieve lower insurance costs.

Improving Driving Habits to Lower Insurance Costs

Safe driving habits are a cornerstone of lower insurance premiums. Insurance companies heavily weigh your driving record when calculating your rates. A clean driving record, free of accidents and traffic violations, demonstrates lower risk and translates to lower premiums. Maintaining a consistent and safe driving style, such as avoiding speeding, aggressive driving, and distracted driving, will significantly reduce your likelihood of accidents and subsequent insurance increases. Furthermore, completing a defensive driving course can often earn you a discount, further reducing your costs. Consider keeping a detailed driving log to track your mileage and driving patterns. This can be beneficial when comparing quotes from different insurers, particularly if you have a low annual mileage.

The Benefits of Maintaining a Good Credit Score

In many states, including Louisiana, insurance companies consider your credit score when determining your premiums. A good credit score indicates financial responsibility, which is often correlated with responsible driving behavior. Individuals with higher credit scores are generally perceived as lower-risk drivers, leading to lower insurance rates. Improving your credit score involves consistently paying bills on time, managing your debt-to-income ratio, and avoiding new credit applications unless absolutely necessary. Regularly checking your credit report for errors and addressing any inaccuracies can also positively impact your score and, consequently, your insurance premiums. A significant improvement in your credit score could result in a noticeable reduction in your insurance costs over time. For example, a driver with a credit score moving from the “poor” to “good” range might see a reduction of 15-20% in their premiums.

Accurately Assessing Your Insurance Needs

Determining the appropriate level of car insurance coverage is crucial for both protection and cost-effectiveness. Carefully evaluate your individual needs and risk tolerance. Consider factors such as the age and value of your vehicle, your driving history, and your financial situation. Opting for the minimum required coverage might save money upfront, but it leaves you vulnerable in the event of a significant accident. Conversely, purchasing excessive coverage might be unnecessarily expensive. A thorough comparison of different coverage options from multiple insurers is recommended to find the optimal balance between protection and affordability. For example, consider if you need comprehensive coverage, which covers damages from events like theft or hail, or if liability coverage, which protects you against damages you cause to others, is sufficient for your needs. Comparing quotes from various insurers with different coverage levels allows you to identify the most cost-effective plan that still adequately meets your insurance needs.

Resources for Finding Affordable Insurance

Finding affordable car insurance requires diligent research and comparison shopping. Several resources can assist in this process.

- Online comparison websites: These websites allow you to compare quotes from multiple insurers simultaneously, simplifying the process of finding the best rates. Examples include The Zebra, NerdWallet, and Policygenius.

- Independent insurance agents: These agents represent multiple insurance companies, allowing them to compare rates and coverage options from various providers.

- Direct insurers: Companies like Geico, Progressive, and State Farm offer insurance directly to consumers, often with competitive rates.

- Your state’s insurance department: Your state’s insurance department website can provide information on consumer protection, licensing, and complaint resolution processes. It might also offer resources for finding affordable insurance options.

Understanding Policy Details

Navigating the complexities of your car insurance policy is crucial for ensuring you’re adequately protected and understand your rights in the event of an accident. Failing to understand your policy can lead to unexpected costs and delays in receiving compensation. This section will clarify key aspects of your policy, empowering you to be a more informed consumer.

Filing a Claim with Your Insurer

The claims process generally begins by contacting your insurance company’s claims department as soon as possible after an accident. You’ll typically provide details about the accident, including the date, time, location, and individuals involved. You might be asked to provide information about your vehicle, the other vehicles involved, and any witnesses. Your insurer will then guide you through the necessary steps, which may include providing a police report, attending a claim adjuster’s assessment, and submitting supporting documentation. The specific steps may vary depending on the nature of the accident and your policy coverage. Remember to keep accurate records of all communication and documentation related to your claim.

Importance of Reading and Understanding Policy Documents

Your insurance policy is a legally binding contract outlining your coverage, exclusions, and responsibilities. Thoroughly reviewing your policy document allows you to understand your rights and obligations. This includes knowing the extent of your coverage (liability, collision, comprehensive, etc.), the deductibles you’ll be responsible for, and the specific procedures for filing a claim. Understanding your policy prevents misunderstandings and ensures you can make informed decisions about your coverage. Ignoring your policy can lead to disputes and potential financial losses.

Common Exclusions and Limitations in Car Insurance Policies

Most car insurance policies contain exclusions, which are specific events or circumstances not covered by the policy. Common exclusions include damage caused by wear and tear, intentional acts, and driving under the influence of alcohol or drugs. Policies also have limitations, such as limits on the amount of coverage provided for certain types of losses (e.g., liability limits). Understanding these exclusions and limitations is crucial for managing expectations and avoiding costly surprises. For instance, a standard policy may not cover damage to your car caused by flooding unless you’ve purchased specific flood coverage as an add-on.

Hypothetical Claim Scenario

Imagine you’re involved in a minor car accident. You safely pull over to the side of the road and exchange information with the other driver. You immediately call your insurance company’s claims hotline to report the accident. A claims adjuster is assigned to your case and schedules an inspection of both vehicles. After reviewing the police report, photos of the damage, and statements from both drivers, the adjuster determines the liability and approves your claim. You’ll be responsible for paying your deductible before receiving compensation for the repairs to your vehicle. The entire process, from initial reporting to receiving payment, may take several weeks, depending on the complexity of the claim and the availability of repair facilities.

Online Resources and Tools

Navigating the world of car insurance in Louisiana can feel overwhelming, but the internet offers powerful tools to simplify the process and help you find the best coverage at the most affordable price. Online resources provide a convenient and efficient way to compare quotes from multiple insurers, saving you valuable time and effort.

The benefits of using online comparison tools are numerous. They allow you to quickly input your information and receive multiple quotes simultaneously, enabling direct price comparisons between different insurance companies. This side-by-side comparison reveals price differences and coverage variations, empowering you to make informed decisions based on your specific needs and budget. Furthermore, online tools often offer educational resources and explanations of policy details, enhancing your understanding of car insurance.

Information Needed for Accurate Quotes

To obtain accurate and reliable car insurance quotes online, you will need to provide specific information about yourself, your vehicle, and your driving history. This typically includes your driver’s license number, date of birth, address, vehicle identification number (VIN), vehicle year, make, and model, and your driving history, including any accidents or traffic violations within a specified period. Providing accurate information is crucial; inaccuracies can lead to inaccurate quotes or even policy denial. Failure to disclose pertinent information could result in higher premiums or coverage issues down the line.

Verifying the Legitimacy of Online Insurance Providers

Not all online insurance providers are created equal. It’s essential to verify the legitimacy of any provider before sharing personal information. Check for the provider’s license with the Louisiana Department of Insurance. Look for clear contact information, including a physical address and phone number. Be wary of providers with overly aggressive sales tactics or those that request payment via unusual methods. Reading online reviews and checking the Better Business Bureau’s website for complaints can also help you assess a provider’s reputation and trustworthiness. A legitimate provider will be transparent about their fees and coverage details.

Comparing Car Insurance Quotes

A sample webpage layout for comparing car insurance quotes could be structured as follows: At the top, a clear heading stating “Compare Car Insurance Quotes.” Below this, a table would be presented. The table’s columns would list different insurance providers, while rows would display key details such as monthly premiums, deductibles, coverage limits (liability, collision, comprehensive), and any additional features or discounts offered. A prominent section at the top would allow users to input their information for quote generation. A clear and concise explanation of the table’s contents would be visible just below the heading. Finally, a section detailing the methodology of comparison and the disclaimer regarding the information’s accuracy would be placed at the bottom. This would provide a clear and organized view of the different options available, allowing for easy comparison and selection.

Conclusive Thoughts

Finding cheap car insurance in Louisiana requires a proactive approach and a thorough understanding of the market. By carefully considering the factors influencing premiums, comparing quotes from multiple insurers, and implementing the strategies Artikeld in this guide, you can significantly reduce your insurance costs while maintaining adequate coverage. Remember, proactive comparison shopping and a commitment to safe driving habits are key to securing affordable and reliable car insurance protection.

Expert Answers

What is the minimum car insurance coverage required in Louisiana?

Louisiana mandates a minimum of $15,000 bodily injury liability coverage per person, $30,000 per accident, and $25,000 in property damage liability coverage.

How does my credit score affect my car insurance rates?

In many states, including Louisiana, insurers consider your credit score as a factor in determining your premiums. A good credit score generally translates to lower rates.

Can I bundle my car and home insurance for a discount?

Yes, many insurance companies offer discounts for bundling your car and home insurance policies. This can lead to significant savings.

What types of discounts are commonly available?

Common discounts include good driver discounts, multi-car discounts, safe driver discounts, and discounts for completing defensive driving courses.

What should I do if I need to file a claim?

Contact your insurance company immediately after an accident to report the incident and follow their instructions for filing a claim. Gather all necessary information, such as police reports and witness statements.