Cheap car insurance NJ is a common search term for drivers in the Garden State, as they seek to find affordable coverage while still meeting the state’s mandatory insurance requirements. New Jersey drivers are required to have specific types of insurance, including liability, personal injury protection (PIP), and uninsured/underinsured motorist coverage. These requirements can vary depending on the type of vehicle, driving history, and other factors. Finding the best deals on car insurance in New Jersey can be a challenge, but with a little research and comparison shopping, it’s possible to find a policy that meets your needs and fits your budget.

When searching for cheap car insurance in New Jersey, it’s important to consider the factors that influence premiums. These factors include your driving history, age, gender, location, and the type of vehicle you drive. You can also find ways to save money on your car insurance by taking advantage of discounts, such as safe driver discounts, good student discounts, and bundling discounts.

Understanding Car Insurance in New Jersey

Navigating the world of car insurance can feel overwhelming, especially in a state like New Jersey with its unique requirements and regulations. This guide will help you understand the basics of car insurance in New Jersey, including the mandatory coverage, different types of insurance available, and the factors that influence your premiums.

Mandatory Car Insurance Requirements in New Jersey

New Jersey law mandates that all drivers must carry a minimum level of car insurance to cover potential financial losses arising from accidents. This requirement ensures that victims of accidents have access to compensation for their injuries and property damage. Failure to comply with these requirements can lead to serious consequences, including fines, license suspension, and even imprisonment.

- Liability Coverage: This is the most essential type of car insurance in New Jersey. It covers damages to other people’s property or injuries caused by you in an accident. Liability coverage is split into two parts:

- Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for the other driver and passengers in the other vehicle involved in the accident.

- Property Damage Liability: This covers the cost of repairs or replacement for the other vehicle and any other damaged property involved in the accident.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault in an accident. PIP coverage is mandatory in New Jersey.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It covers your medical expenses, lost wages, and other related costs. This coverage is mandatory in New Jersey.

Types of Car Insurance Coverage Available in New Jersey

Beyond the mandatory requirements, several other types of car insurance coverage can provide additional protection and peace of mind. These optional coverages can help you avoid significant financial burdens in the event of an accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional but can be crucial if you have a loan or lease on your vehicle.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged due to events other than a collision, such as theft, vandalism, or natural disasters. This coverage is optional but can be valuable if your vehicle is relatively new or has a high value.

- Rental Reimbursement: This coverage helps cover the cost of renting a vehicle while yours is being repaired after an accident.

- Roadside Assistance: This coverage provides assistance with situations like flat tires, dead batteries, and lockouts.

- Medical Payments Coverage (MedPay): This coverage provides supplemental medical payments for you and your passengers, regardless of who is at fault.

Factors Influencing Car Insurance Premiums in New Jersey

Your car insurance premiums are determined by various factors, and understanding these factors can help you find the best rates.

- Driving Record: Your driving history, including accidents, traffic violations, and DUI convictions, significantly influences your premiums. A clean driving record generally translates into lower premiums.

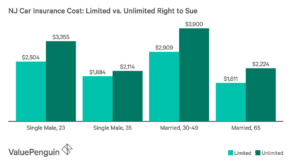

- Age and Gender: Younger and less experienced drivers typically pay higher premiums due to their increased risk of accidents. Gender can also play a role, as statistics show that men tend to have higher accident rates than women.

- Vehicle Type: The make, model, and year of your vehicle can affect your premiums. Vehicles with high performance, safety features, or a history of high repair costs often carry higher premiums.

- Location: Your zip code can impact your premiums, as insurance companies consider the risk of accidents in different areas. Areas with higher crime rates or more traffic congestion may have higher premiums.

- Credit History: In New Jersey, insurance companies can use your credit history to determine your premiums. Individuals with good credit history typically qualify for lower rates.

- Coverage Levels: The amount of coverage you choose, such as the liability limits, can impact your premiums. Higher coverage levels generally result in higher premiums.

- Deductibles: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles usually result in lower premiums.

- Discounts: Insurance companies offer various discounts to reduce your premiums. These discounts may be available for factors like good driving records, safety features, multi-car policies, and bundling insurance with other products.

Finding Affordable Car Insurance in New Jersey: Cheap Car Insurance Nj

Finding the right car insurance in New Jersey can be a daunting task, especially when you’re trying to keep costs down. However, with some research and strategic planning, you can find affordable coverage that meets your needs.

Tips for Finding Cheap Car Insurance in New Jersey

Finding cheap car insurance in New Jersey involves several strategies. Here are some key tips to consider:

- Shop Around: Comparing quotes from multiple insurance providers is crucial. Use online comparison tools or contact insurance agents directly to get personalized quotes.

- Increase Your Deductible: A higher deductible means you’ll pay more out of pocket if you have an accident, but your premiums will be lower. Consider your financial situation and risk tolerance when choosing a deductible.

- Bundle Your Policies: Combining your car insurance with other policies like homeowners or renters insurance can often lead to significant discounts.

- Maintain a Good Driving Record: Avoiding accidents and traffic violations will keep your premiums lower.

- Take Defensive Driving Courses: Completing a defensive driving course can earn you discounts and demonstrate your commitment to safe driving.

- Consider a Telematics Program: Some insurance companies offer telematics programs that track your driving habits and reward safe driving with lower premiums.

- Explore Discounts: Ask about available discounts, such as good student discounts, multi-car discounts, and safe driver discounts.

Comparing Car Insurance Providers in New Jersey

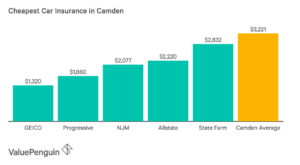

Several reputable car insurance providers operate in New Jersey, each offering unique coverage options and pricing structures.

- State Farm: State Farm is known for its extensive coverage options and customer service. It offers a range of discounts, including good student discounts, multi-car discounts, and safe driver discounts.

- Geico: Geico is known for its competitive rates and convenient online services. It offers various discounts, including good driver discounts, multi-car discounts, and military discounts.

- Progressive: Progressive is known for its personalized insurance plans and innovative features, such as its Snapshot program that tracks driving habits. It offers discounts for safe drivers, good students, and multiple vehicles.

- Allstate: Allstate is known for its comprehensive coverage options and personalized customer service. It offers discounts for good students, safe drivers, and multiple vehicles.

- Liberty Mutual: Liberty Mutual is known for its financial strength and commitment to customer satisfaction. It offers discounts for good students, safe drivers, and multiple vehicles.

Average Car Insurance Costs in New Jersey

Car insurance costs in New Jersey can vary significantly based on several factors, including age, driving history, vehicle type, and location.

| Demographic | Average Annual Car Insurance Cost |

|---|---|

| Young Drivers (Under 25) | $2,500 – $3,500 |

| Mature Drivers (Over 65) | $1,500 – $2,500 |

| Drivers with Clean Records | $1,000 – $2,000 |

| Drivers with Accidents or Violations | $2,000 – $3,000 |

| Drivers in Urban Areas | $1,500 – $2,500 |

| Drivers in Rural Areas | $1,000 – $1,500 |

Discounts and Savings on Car Insurance in New Jersey

Finding the right car insurance policy in New Jersey can be challenging, but there are numerous ways to save money and find the best coverage for your needs. Many car insurance companies offer discounts to help you lower your premiums. Taking advantage of these discounts can significantly reduce your overall insurance costs.

Discounts Available in New Jersey

Car insurance discounts in New Jersey are designed to reward safe driving habits and responsible behavior. These discounts can be applied to various aspects of your insurance policy, including your premium, coverage, and deductible.

- Good Driver Discount: This discount is offered to drivers with a clean driving record, meaning no accidents or traffic violations for a specified period. It is a significant discount, often reducing your premium by 10% or more.

- Safe Driver Discount: Similar to the good driver discount, the safe driver discount rewards drivers who have demonstrated safe driving habits. This might involve completing a defensive driving course or having a telematics device installed in your car that monitors your driving behavior.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you can often qualify for a multi-car discount. This discount is usually a percentage off your total premium for each additional vehicle insured.

- Multi-Policy Discount: Bundling different types of insurance, such as home, renters, or life insurance, with the same company can result in a multi-policy discount. This can be a substantial savings, as companies often offer significant discounts for bundling multiple policies.

- Good Student Discount: High school and college students with good grades may be eligible for a good student discount. This discount recognizes the responsibility and maturity associated with academic achievement.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or GPS trackers, can reduce your insurance premium. These devices deter theft and can help recover your vehicle if stolen.

- Low Mileage Discount: Drivers who drive fewer miles annually may qualify for a low mileage discount. This discount reflects the reduced risk of accidents associated with lower mileage.

Maximizing Savings on Car Insurance

To maximize savings on your car insurance, consider the following strategies:

- Compare Quotes: Don’t settle for the first quote you receive. Compare quotes from multiple insurance companies to find the best rates and coverage options.

- Shop Around Regularly: Car insurance rates can fluctuate over time, so it’s essential to shop around for new quotes periodically, even if you’re happy with your current policy. This can help ensure you’re getting the best possible rate.

- Consider Your Coverage Needs: Carefully assess your coverage needs and choose the right policy for your situation. Avoid unnecessary coverage that adds to your premium without providing significant value.

- Increase Your Deductible: A higher deductible means you’ll pay more out of pocket in case of an accident, but it can also lower your premium. This strategy can be beneficial if you’re confident in your driving abilities and have some financial flexibility.

- Maintain a Good Driving Record: Safe driving habits are crucial for keeping your insurance rates low. Avoid accidents and traffic violations to qualify for discounts and avoid premium increases.

- Take Advantage of Discounts: Actively seek out and utilize all available discounts, such as those for good driving, multiple vehicles, bundling policies, and other eligibility criteria.

Benefits of Bundling Insurance Policies

Bundling your car insurance with other types of insurance, such as home, renters, or life insurance, offers several advantages:

- Significant Discounts: Insurance companies often offer substantial discounts for bundling multiple policies. These discounts can significantly reduce your overall insurance costs.

- Convenience and Simplicity: Managing all your insurance policies with a single provider simplifies your insurance needs. You’ll have one point of contact for billing, claims, and policy adjustments.

- Streamlined Customer Service: Having a single insurance provider for multiple policies can streamline your customer service experience. You’ll have a dedicated representative who understands your entire insurance portfolio.

- Potential for Additional Perks: Some insurance companies offer additional perks or benefits for bundling policies, such as loyalty programs, exclusive discounts, or enhanced customer service.

Navigating Car Insurance in New Jersey

Navigating the world of car insurance can feel overwhelming, especially in a state like New Jersey with its unique regulations and requirements. Understanding the basics of your policy and the claims process can make a significant difference in your experience.

Understanding Car Insurance Policies

A car insurance policy is a contract between you and your insurance company, outlining the coverage you’ll receive in case of an accident or other covered event. It’s crucial to understand the terms and conditions of your policy to ensure you’re adequately protected.

- Liability Coverage: This is the most basic type of car insurance, covering damages to other people’s property or injuries you cause in an accident. New Jersey requires a minimum liability coverage of $15,000 per person, $30,000 per accident, and $5,000 for property damage.

- Collision Coverage: This covers damages to your own vehicle in an accident, regardless of who is at fault. You’ll need to pay a deductible, which is a fixed amount you’re responsible for before the insurance kicks in.

- Comprehensive Coverage: This protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. Like collision coverage, it has a deductible.

- Uninsured/Underinsured Motorist Coverage: This protects you in case you’re involved in an accident with a driver who doesn’t have enough insurance or no insurance at all. It covers your medical expenses and property damage.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related costs if you’re injured in an accident, regardless of fault. It’s mandatory in New Jersey.

Filing a Car Insurance Claim

In case of an accident, it’s important to know how to file a claim with your car insurance provider.

- Report the Accident: Immediately contact your insurance company to report the accident, providing all the necessary details, including the date, time, location, and involved parties.

- Gather Information: Collect as much information as possible about the accident, including the other driver’s name, address, insurance information, and any witness details.

- Document the Damage: Take pictures or videos of the damage to your vehicle and the accident scene. This will help support your claim.

- Follow Up: Keep track of your claim’s progress and contact your insurance company if you have any questions or concerns.

Avoiding Car Insurance Scams, Cheap car insurance nj

Unfortunately, car insurance scams are prevalent. It’s essential to be aware of common scams and how to protect yourself.

- Staged Accidents: Be cautious of accidents that seem too convenient or orchestrated. If you suspect a staged accident, don’t agree to anything or sign any documents without consulting your insurance company.

- Fake Claims: Be wary of claims involving fabricated injuries or exaggerated damage. If you suspect a fake claim, report it to your insurance company.

- Identity Theft: Protect your personal information, such as your driver’s license and Social Security number, to prevent identity theft and fraudulent claims.

Resources and Information for New Jersey Drivers

Navigating the world of car insurance in New Jersey can feel overwhelming, but there are valuable resources available to help you make informed decisions and find the best coverage at the most affordable price. Understanding where to turn for information and guidance is crucial for securing the right car insurance policy.

Reputable Resources for Obtaining Car Insurance Quotes and Comparing Prices in New Jersey

Several reputable online platforms and resources offer car insurance quotes and comparison tools. These platforms allow you to enter your information once and receive quotes from multiple insurance companies, simplifying the comparison process.

- Insurance Comparison Websites: Websites like NerdWallet, PolicyGenius, and The Zebra allow you to compare quotes from various insurance providers in New Jersey. They gather your information and present you with a range of options, making it easier to find the best deal.

- Insurance Company Websites: Many insurance companies, such as GEICO, State Farm, and Progressive, have websites where you can obtain quotes directly. This allows you to explore their specific offerings and coverage options.

Information on the New Jersey Department of Banking and Insurance Website

The New Jersey Department of Banking and Insurance (DOBI) plays a crucial role in regulating the insurance industry in the state. Their website is a valuable resource for New Jersey drivers seeking information about car insurance.

- Consumer Resources: The DOBI website provides a wealth of consumer resources, including information on insurance requirements, coverage options, and consumer rights. They also offer guidance on filing complaints against insurance companies.

- Insurance Company Information: The DOBI website provides information about licensed insurance companies operating in New Jersey, including their financial stability and customer satisfaction ratings. This information can be helpful when choosing an insurance provider.

- Insurance Laws and Regulations: The DOBI website contains information about New Jersey’s car insurance laws and regulations, including requirements for minimum coverage, penalties for driving without insurance, and procedures for resolving disputes with insurance companies.

Steps Involved in Obtaining Car Insurance in New Jersey

The process of obtaining car insurance in New Jersey involves several steps, each crucial for securing the right coverage.

- Gather Information: Begin by gathering essential information, such as your driver’s license number, vehicle identification number (VIN), and driving history. This information is needed for obtaining quotes.

- Compare Quotes: Use online comparison tools or contact insurance companies directly to obtain quotes. Be sure to compare quotes from multiple providers to find the best deal.

- Choose a Policy: Once you have compared quotes, select the policy that best suits your needs and budget. Consider factors such as coverage options, deductibles, and premiums.

- Pay Your Premium: After choosing a policy, you will need to pay your premium. You can typically pay online, by phone, or by mail.

- Receive Your Insurance Card: Once your premium is paid, you will receive an insurance card that proves you have car insurance. Keep this card in your vehicle at all times.

Final Wrap-Up

Navigating the world of car insurance in New Jersey can be overwhelming, but with the right information and strategies, finding cheap car insurance NJ is possible. By understanding the state’s requirements, exploring different coverage options, and utilizing available discounts, drivers can find a policy that provides adequate protection without breaking the bank. Remember, comparing quotes from multiple insurers and taking advantage of discounts can help you secure the most affordable car insurance in New Jersey.

FAQ

What are the minimum car insurance requirements in New Jersey?

New Jersey requires drivers to have liability insurance, personal injury protection (PIP), and uninsured/underinsured motorist coverage. The specific amounts of coverage required vary depending on the type of vehicle and other factors.

What are some tips for getting cheap car insurance in New Jersey?

To find cheap car insurance in New Jersey, consider comparing quotes from multiple insurers, taking advantage of available discounts, and increasing your deductible. You can also look for discounts for good driving records, safe driver courses, and bundling multiple insurance policies.

How can I find a reputable car insurance provider in New Jersey?

You can find reputable car insurance providers in New Jersey by checking with the New Jersey Department of Banking and Insurance, reading online reviews, and getting recommendations from friends and family.