Navigating the world of auto insurance in Florida can feel like traversing a minefield. The sheer number of providers, coverage options, and factors influencing premiums can be overwhelming, especially when the goal is finding cheap FL auto insurance. This guide aims to demystify the process, providing you with the knowledge and tools to make informed decisions and secure affordable yet adequate protection for your vehicle.

We’ll explore the key elements affecting your insurance costs, from your driving history and vehicle type to your location and credit score. We’ll also equip you with strategies for lowering your premiums, including comparing quotes, leveraging discounts, and understanding policy details. Ultimately, our goal is to empower you to find the best balance between cost and comprehensive coverage.

Understanding “Cheap FL Auto Insurance”

Finding affordable auto insurance in Florida is a common goal for many drivers. However, the pursuit of “cheap” insurance shouldn’t overshadow the importance of adequate coverage. Understanding the factors that influence the cost and the various types of coverage available is crucial for making an informed decision that balances affordability with protection.

Factors Influencing the Cost of Auto Insurance in Florida

Several factors significantly impact the price of auto insurance in Florida. These include your driving record (accidents, tickets, and DUI convictions), age and driving experience (younger drivers generally pay more), the type of vehicle you drive (sports cars and luxury vehicles are often more expensive to insure), your credit score (in many states, including Florida, insurers consider credit history), your location (insurance rates vary by zip code due to factors like crime rates and accident frequency), and the coverage you choose (more comprehensive coverage costs more). Additionally, your insurance history and the number of drivers on your policy play a role. For example, a driver with multiple at-fault accidents will likely pay significantly more than a driver with a clean record. Similarly, insuring a high-performance vehicle in a high-risk area will result in a higher premium compared to insuring a standard vehicle in a safer area.

Types of Auto Insurance Coverage in Florida

Florida requires drivers to carry a minimum amount of liability insurance, which covers injuries or damages you cause to others. Beyond this minimum requirement, various optional coverages offer additional protection. These include collision coverage (repairs or replacement of your vehicle after an accident, regardless of fault), comprehensive coverage (protects against damage from events other than collisions, such as theft, vandalism, or hail), uninsured/underinsured motorist coverage (protects you if you’re involved in an accident with an uninsured or underinsured driver), and medical payments coverage (pays for medical expenses for you and your passengers, regardless of fault). The specific coverages you choose directly influence your premium; more extensive coverage translates to a higher cost.

Common Misconceptions About Cheap Auto Insurance

One common misconception is that the cheapest policy is always the best. This is often untrue. Extremely low premiums frequently come with significantly reduced coverage limits, leaving you financially vulnerable in the event of a serious accident. Another misconception is that online quotes always reflect the final price. Factors like your driving record and credit score can influence the final cost, sometimes resulting in a higher premium than initially quoted. Finally, many believe that raising your deductible automatically makes insurance cheaper without considering the potential out-of-pocket expenses in the event of a claim. While a higher deductible does lower premiums, it also means you’ll pay more if you need to file a claim.

Potential Risks of Extremely Low-Cost Insurance

Choosing the absolute cheapest auto insurance policy carries significant risks. Inadequate liability coverage could leave you financially responsible for substantial medical bills or property damage if you cause an accident. Insufficient uninsured/underinsured motorist coverage puts you at risk if you’re involved in a collision with a driver who lacks sufficient insurance. Limited or nonexistent collision and comprehensive coverage means you would bear the full cost of repairing or replacing your vehicle after an accident or damage from other events. Essentially, opting for extremely cheap insurance prioritizes short-term savings over long-term financial security. In the event of a significant accident, the cost of not having adequate coverage could far outweigh the initial premium savings.

Finding Affordable Auto Insurance in Florida

Securing affordable auto insurance in Florida can feel like navigating a maze, but with the right knowledge and strategies, it’s entirely achievable. Understanding the various factors that influence your premium and employing effective comparison techniques can significantly reduce your annual costs. This section will guide you through the process of finding and securing the best possible rates for your needs.

Comparing Auto Insurance Quotes

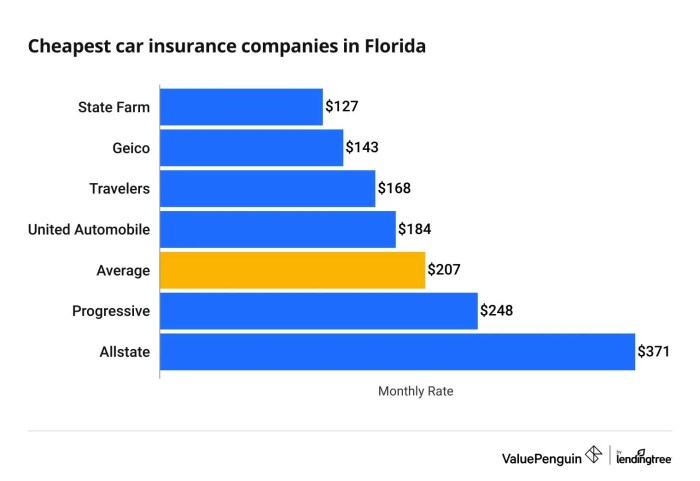

Comparing quotes from multiple insurance providers is crucial for securing the most competitive rate. Different insurers utilize varying algorithms and assess risk differently, resulting in a wide range of premiums for seemingly similar coverage. Failing to compare quotes could mean paying significantly more than necessary. The following table provides a sample comparison (note: prices and reviews are illustrative and will vary based on individual circumstances and time of quote).

| Insurer Name | Price (Annual) | Coverage Details | Customer Reviews (Sample) |

|---|---|---|---|

| Sunshine State Auto | $1200 | $100,000/$300,000 Bodily Injury, $50,000 Property Damage, Uninsured Motorist | “Good customer service, easy online portal.” |

| Florida Family Insurance | $1500 | $250,000/$500,000 Bodily Injury, $100,000 Property Damage, Comprehensive & Collision | “Slightly higher price but comprehensive coverage.” |

| Coastal Auto Protect | $1100 | $100,000/$300,000 Bodily Injury, $25,000 Property Damage, Uninsured Motorist | “Affordable, but some report difficulty with claims.” |

| Palm Tree Insurance | $1350 | $200,000/$400,000 Bodily Injury, $50,000 Property Damage, Comprehensive | “Good value for the coverage provided.” |

Strategies for Lowering Auto Insurance Premiums

Several strategies can significantly reduce your auto insurance premiums. These strategies focus on minimizing risk and demonstrating responsible driving behavior to insurers.

Implementing these strategies can result in substantial savings over the long term. For example, a driver with a clean driving record and a car equipped with anti-theft devices might save hundreds of dollars annually compared to a driver with multiple accidents and an older vehicle. Bundling home and auto insurance with the same provider often leads to additional discounts.

Obtaining Auto Insurance Quotes Online

Obtaining auto insurance quotes online is a straightforward process that can save considerable time and effort.

- Visit multiple insurer websites: Begin by visiting the websites of several major insurance providers operating in Florida.

- Provide necessary information: You will be prompted to provide information such as your driving history, vehicle details, and desired coverage levels.

- Compare quotes: Once you have received quotes from several insurers, carefully compare the prices and coverage details. Pay close attention to deductibles and policy limits.

- Review policy details: Before committing to a policy, thoroughly review the terms and conditions. Understand what is and is not covered.

- Purchase the policy: Once you have chosen a policy, you can typically purchase it online through the insurer’s website.

Understanding Policy Details

Choosing the right auto insurance policy in Florida involves understanding the key terms and conditions. This section clarifies common policy elements to help you make informed decisions about your coverage. Failing to understand these details can lead to inadequate protection or unexpected costs in the event of an accident.

Policy Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally result in lower premiums, while lower deductibles mean higher premiums. Consider your financial situation and risk tolerance when choosing a deductible. For example, a $500 deductible means you’ll pay the first $500 of any covered repair costs after an accident, while your insurance company covers the rest. A $1000 deductible would lower your premium but increase your out-of-pocket expense in the event of a claim.

Liability Limits

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It’s expressed as a three-number limit, such as 25/50/25. This means your insurance will pay up to $25,000 per person injured, up to $50,000 total for all injuries in a single accident, and up to $25,000 for property damage. Higher liability limits offer greater protection, but also come with higher premiums. Consider the potential costs of serious injuries or extensive property damage when selecting your liability limits. A low liability limit might leave you personally liable for significant expenses if you cause a serious accident.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle repairs, even if the at-fault driver lacks sufficient insurance. Given the prevalence of uninsured drivers in Florida, this coverage is highly recommended. For example, if an uninsured driver causes an accident resulting in $50,000 in medical bills and vehicle repairs, your uninsured/underinsured motorist coverage would cover those costs up to your policy’s limits.

Comprehensive and Collision Coverage

Comprehensive coverage pays for damage to your vehicle caused by events other than collisions, such as theft, vandalism, or weather damage. Collision coverage pays for damage to your vehicle resulting from a collision with another vehicle or object. While these coverages are not mandatory in Florida, they are highly recommended to protect your investment. For example, comprehensive coverage would cover damage to your car from a hailstorm, while collision coverage would cover damage from a fender bender.

Filing a Claim

The claims process typically begins with contacting your insurance company’s claims department immediately after an accident. You’ll need to provide details about the accident, including the date, time, location, and involved parties. Your insurer will guide you through the necessary steps, which may include providing a police report, getting estimates for repairs, and attending a claims adjuster’s inspection. Thoroughly document the accident scene, taking photos and recording witness information, if possible.

Understanding Your Policy Documents

Your insurance policy is a legal contract outlining your coverage details, terms, and conditions. Carefully review your policy documents to understand your rights and responsibilities. Pay close attention to the definitions of covered events, exclusions, and limits of liability. If you have any questions or need clarification on any aspect of your policy, contact your insurance company directly. Many insurers offer online portals where you can access and review your policy documents.

Concluding Remarks

Finding cheap FL auto insurance doesn’t have to be a daunting task. By understanding the factors influencing premiums, diligently comparing quotes, and employing smart strategies, you can secure affordable protection without compromising on essential coverage. Remember, the cheapest option isn’t always the best; prioritize adequate coverage tailored to your individual needs and risk profile. Armed with the information presented here, you can confidently navigate the Florida auto insurance market and find a policy that provides both peace of mind and financial prudence.

Commonly Asked Questions

What is SR-22 insurance and do I need it?

SR-22 insurance is proof of financial responsibility mandated by the state after certain driving infractions (like DUI). You only need it if required by the Department of Highway Safety and Motor Vehicles (DHSMV).

Can I bundle my home and auto insurance for a discount?

Yes, many insurers offer discounts for bundling your home and auto insurance policies. This is a common strategy to reduce your overall premiums.

How often should I review my auto insurance policy?

It’s advisable to review your policy annually, or whenever significant life changes occur (new car, address change, etc.), to ensure it still meets your needs.

What happens if I get into an accident and don’t have enough coverage?

Insufficient coverage can leave you personally liable for any costs exceeding your policy limits. This could result in significant financial burdens.

How do I file a claim with my insurance company?

The process varies by insurer, but generally involves contacting your provider immediately after the accident and following their specific claim procedures.