Finding affordable rental insurance shouldn’t feel like navigating a minefield. Many renters mistakenly believe comprehensive coverage necessitates a hefty price tag, leading to unnecessary risks. This guide demystifies cheap rental insurance, exploring how to balance cost-effectiveness with adequate protection for your belongings and peace of mind.

We’ll delve into the nuances of various policy types, comparing features and prices from different providers to help you make an informed decision. Learn how to identify essential coverage, understand exclusions, and proactively minimize risks to lower your premiums. Ultimately, we aim to empower you to secure affordable yet effective rental insurance that aligns with your specific needs and budget.

Defining “Cheap Rental Insurance”

Securing affordable rental insurance is a priority for many renters. “Cheap rental insurance,” however, isn’t simply about the lowest price; it’s about finding a policy that offers adequate coverage at a price point that fits your budget. This requires understanding the factors that influence cost and comparing policies based on features and price.

Factors influencing the cost of rental insurance are numerous and interconnected. The primary determinant is the level of coverage you choose. Higher coverage limits for personal belongings, liability, and additional living expenses naturally translate to higher premiums. Your location also plays a significant role; areas with higher crime rates or a greater risk of natural disasters will typically command higher premiums. Your credit score can also influence the cost, with better credit often leading to lower rates. Finally, the insurer’s own pricing structure and the specific terms of the policy will also affect the final cost.

Types of Rental Insurance and Price Ranges

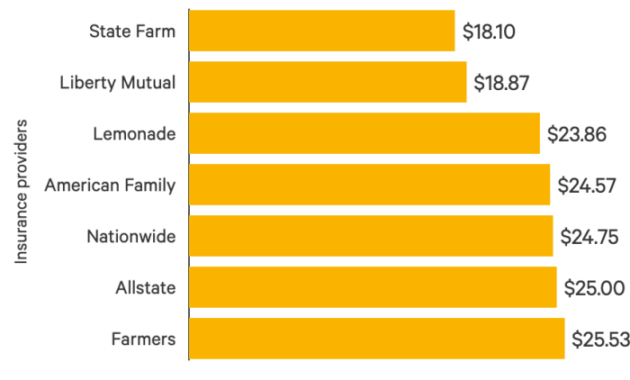

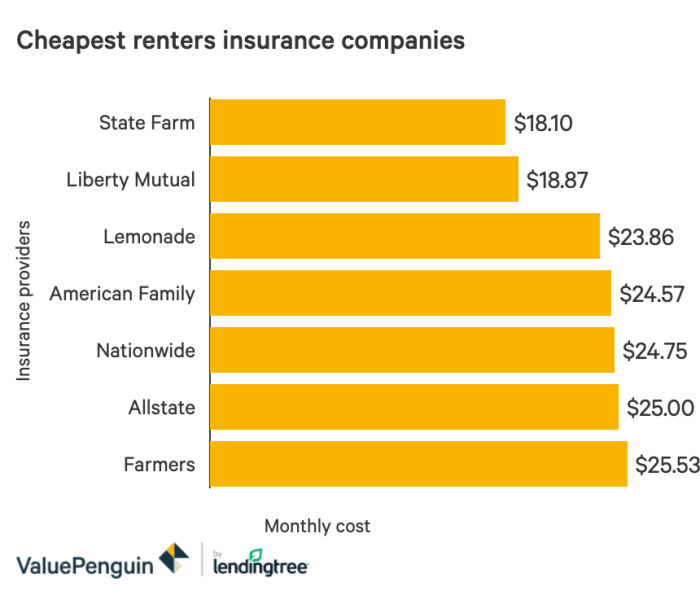

Rental insurance policies typically fall into several categories, each with varying coverage and cost. Basic renter’s insurance, offering liability and personal property coverage, usually starts around $15-$20 per month. This basic coverage might have lower limits for personal belongings and liability. More comprehensive policies, including additional living expenses coverage (covering temporary housing if your rental is uninhabitable due to a covered event), can range from $25-$50 per month or more, depending on coverage limits and other factors. High-value policies, tailored for renters with significant assets, can cost substantially more. These higher-priced policies may include additional features like identity theft protection or coverage for specific valuable items.

Feature Comparison at Different Price Points

The table below illustrates a simplified comparison of features offered at different price points for hypothetical rental insurance policies. Remember that actual prices and features will vary greatly depending on the insurer, location, and individual circumstances.

| Feature | Basic Policy ($15-$20/month) | Standard Policy ($25-$40/month) | Comprehensive Policy ($40-$70+/month) |

|---|---|---|---|

| Personal Property Coverage | $10,000 – $20,000 | $25,000 – $50,000 | $50,000+ |

| Liability Coverage | $100,000 | $300,000 | $500,000+ |

| Additional Living Expenses | Not Included | Limited Coverage (e.g., $5,000) | Extended Coverage (e.g., $20,000+) |

| Other Features | None | Possible coverage for certain valuable items | Identity theft protection, coverage for water backup |

Finding “cheap” rental insurance requires careful consideration of your needs and budget. Don’t solely focus on the lowest price; ensure the policy provides adequate protection for your belongings and liability.

Finding Affordable Rental Insurance Options

Securing affordable rental insurance doesn’t require extensive research or complex financial maneuvering. By employing a strategic approach to comparison shopping and understanding your coverage needs, you can find a policy that fits both your budget and your requirements. This involves carefully reviewing quotes from multiple providers, understanding the nuances of coverage, and asking the right questions.

Finding the best value in rental insurance involves a systematic comparison of quotes from different providers. This process requires careful consideration of several factors, ensuring you secure comprehensive protection without overspending.

Comparing Rental Insurance Quotes

To effectively compare quotes, start by obtaining quotes from at least three to four different insurance providers. Many companies offer online quote tools for quick and easy comparison. When reviewing these quotes, pay close attention to the specific coverage details, including the amount of liability coverage, personal property coverage, and additional living expenses coverage. Note the deductibles and premiums for each policy. Also, check customer reviews and ratings to gauge the company’s reputation for claims processing and customer service. This comprehensive approach ensures you’re making an informed decision based on both price and quality.

Rental Insurance Provider Comparison

The following table provides a sample comparison of four hypothetical rental insurance providers. Remember that actual prices and coverage may vary depending on location, coverage limits, and individual circumstances. Always verify details directly with the provider.

| Provider | Liability Coverage | Personal Property Coverage | Monthly Premium (Example) |

|---|---|---|---|

| Insurer A | $100,000 | $10,000 | $15 |

| Insurer B | $300,000 | $20,000 | $25 |

| Insurer C | $200,000 | $15,000 | $20 |

| Insurer D | $150,000 | $12,000 | $18 |

Note: This table uses hypothetical data for illustrative purposes only. Actual premiums and coverage limits will vary significantly depending on the insurer, location, and specific policy details.

Questions to Ask Potential Insurers

Before committing to a rental insurance policy, it’s crucial to ask specific questions to ensure the policy meets your needs and expectations. These questions help clarify potential ambiguities and avoid unexpected costs or limitations in coverage.

A comprehensive list of questions should include inquiries about the specific coverage details, the claims process, and the insurer’s financial stability and reputation. For instance, you should clarify what constitutes covered events and what exclusions might apply. Understanding the claims process—including the required documentation and the typical processing time—is also essential. Finally, investigating the insurer’s financial strength and customer satisfaction ratings helps assess their reliability and responsiveness.

Understanding Coverage and Exclusions

Securing cheap rental insurance is a smart financial move, but understanding exactly what’s covered and what’s excluded is crucial. A basic policy might seem like a bargain, but insufficient coverage can lead to significant financial hardship in the event of an unforeseen incident. This section clarifies the typical inclusions and exclusions to help you make an informed decision.

A basic rental insurance policy typically covers the most common risks associated with renting a property. This usually includes protection against damage to your personal belongings caused by events like fire, theft, or vandalism. Some policies may also offer liability coverage, protecting you against claims made by others for injuries or damages that occur on your property. For example, if a guest trips and injures themselves, liability coverage could help pay for their medical expenses and legal fees. Coverage amounts vary greatly depending on the policy and the chosen coverage level; however, it’s vital to understand that the level of protection often reflects the premium paid. More comprehensive policies will naturally offer broader coverage, but at a higher cost.

Typical Coverage in Basic Rental Insurance

While the specific coverage details vary by insurer and policy, basic rental insurance typically includes protection for your personal possessions against a range of perils. These commonly include fire, smoke damage, water damage (excluding flooding from natural causes in many policies), theft, and vandalism. Liability coverage, although not always standard in the cheapest plans, is a significant consideration as it protects you against financial losses resulting from accidents or injuries that occur on your rented premises.

Common Exclusions in Cheap Rental Insurance Plans

It’s essential to understand that “cheap” often comes with limitations. Many inexpensive rental insurance policies exclude specific events or types of damage. This is where a thorough review of the policy document becomes critical. Common exclusions frequently include damage caused by floods, earthquakes, or other natural disasters. Wear and tear, gradual deterioration of belongings, and certain types of insects or pest infestations are also often excluded. Furthermore, intentional acts or negligence on the part of the renter may not be covered. For instance, damage resulting from a deliberate act of vandalism by the renter themselves would likely not be compensated.

Consequences of Inadequate Coverage

Underestimating the risks and opting for the cheapest rental insurance without carefully considering the exclusions can have severe financial consequences. Imagine a scenario where a burst pipe causes significant water damage to your belongings, and your policy excludes water damage from plumbing issues. You would then be responsible for the entire cost of replacing your damaged possessions, potentially amounting to thousands of dollars. Similarly, if you’re found liable for a guest’s injury and lack sufficient liability coverage, you could face substantial legal and medical expenses. Choosing a policy that aligns with your specific needs and risk tolerance, even if it means paying a slightly higher premium, is a far more prudent approach than risking significant financial loss due to inadequate coverage.

Minimizing Risk and Saving Money

Renters insurance, while offering crucial protection, can be made more affordable by actively minimizing the risks you face. Proactive steps to prevent damage or loss can significantly reduce your premiums and potentially even eliminate the need for a claim. This proactive approach not only saves you money but also provides peace of mind.

By implementing preventative measures and understanding common claim causes, you can substantially lower your insurance costs and enjoy the benefits of coverage without the high premiums. This section Artikels practical strategies for risk reduction and cost savings.

Preventative Measures to Lower Premiums

Implementing certain preventative measures can demonstrate to your insurer that you are a low-risk renter, potentially leading to lower premiums or discounts. These actions show your commitment to protecting your belongings and the property you rent.

- Installing smoke and carbon monoxide detectors: Many insurers offer discounts for having properly installed and functioning smoke and carbon monoxide detectors. These devices are crucial for early detection of dangerous situations, preventing significant property damage and potential injury.

- Upgrading locks and security systems: Installing high-quality locks on all exterior doors and windows, and considering a security system, can significantly reduce the risk of burglary. Insurance companies often recognize these improvements with reduced premiums, reflecting the lower risk.

- Regular maintenance and inspections: Regularly checking for and addressing potential hazards such as water leaks, faulty wiring, or damaged appliances can prevent costly repairs and claims. This demonstrates responsible homeownership and can influence premium calculations.

Common Causes of Renter Insurance Claims and Avoidance Strategies

Understanding the most common causes of renter insurance claims allows for targeted preventative measures. Addressing these issues proactively can significantly reduce your risk and keep your premiums lower.

- Water damage: Leaks from pipes, appliances, or even overflowing bathtubs are a leading cause of claims. Regularly inspect plumbing, ensure appliances are properly maintained, and promptly address any leaks to prevent extensive water damage.

- Fire damage: Fires, whether from cooking accidents or electrical malfunctions, can cause devastating losses. Maintaining appliances, avoiding overloaded electrical outlets, and having functioning smoke detectors are crucial preventative measures.

- Theft: Burglaries can result in significant losses. Securing your apartment with strong locks, a security system, and storing valuables safely can greatly minimize this risk.

- Wind and storm damage: Depending on your location, wind and storm damage can be a concern. Securing loose items outside, and ensuring windows and doors are properly sealed, can mitigate potential damage.

The Importance of Reading the Fine Print

Securing cheap rental insurance is a smart financial move, but the true value lies not just in the low premium, but in understanding exactly what that premium covers. Failing to thoroughly review your policy documents before signing can lead to significant financial and personal setbacks later. Taking the time to understand the terms and conditions is crucial to ensuring you’re adequately protected.

Carefully examining your rental insurance policy before signing is paramount. Overlooking critical clauses can result in unexpected out-of-pocket expenses in the event of a covered incident. Furthermore, a lack of understanding could leave you vulnerable to situations where you believe you are covered, only to discover otherwise when you need to file a claim. This could lead to disputes with your insurer and significant financial hardship. Understanding the policy’s nuances is as important as securing a low price.

Key Clauses and Potential Areas of Concern

A thorough review should focus on several key areas. First, carefully examine the definition of covered perils. Does it explicitly list events such as fire, theft, and water damage? Are there any exclusions, such as flood damage or earthquake damage, that are typically covered by separate policies? Second, scrutinize the liability coverage section. This part of the policy Artikels the insurer’s responsibility to cover damages you might cause to others or their property. Understand the limits of this coverage, and consider whether it aligns with your potential liability. Finally, pay close attention to the claims process. How do you file a claim? What documentation is required? What are the timelines involved? Understanding these steps beforehand will streamline the process in case of an emergency.

Let’s consider a sample policy excerpt: “This policy covers accidental direct physical loss to the insured’s personal property caused by fire, but excludes loss caused by flood or earthquake unless specifically endorsed.” In this excerpt, the key clause is the exclusion of flood and earthquake damage. This highlights the importance of understanding what is *not* covered. If you live in a flood-prone area, this exclusion could be a significant concern, and you might need to consider supplemental coverage. Another potential area of concern is the phrase “accidental direct physical loss.” This implies that damage resulting from negligence might not be covered. A clear understanding of these nuances will prevent unpleasant surprises later.

Illustrating Coverage Scenarios

Understanding the different coverage levels offered by rental insurance is crucial for choosing a policy that suits your needs and budget. The following scenarios illustrate the benefits of both comprehensive and basic policies, highlighting the potential payouts in various situations.

Comprehensive Coverage Scenario: Fire Damage

Imagine a devastating kitchen fire caused by a faulty appliance. The fire spreads rapidly, causing significant damage to your apartment. The fire department’s report estimates the cost of repairs to be $20,000, including damage to walls, floors, cabinets, and appliances. Your personal belongings, including furniture, clothing, electronics, and irreplaceable items like family photos, are also severely damaged or destroyed, totaling an additional $15,000 in losses. With comprehensive rental insurance, covering both property damage and personal belongings, you would likely receive a payout close to the full $35,000, allowing you to cover repairs and replace your belongings. The specific payout would depend on your policy’s limits and deductible, but a comprehensive policy would significantly mitigate your financial burden.

Basic Coverage Scenario: Theft

Consider a scenario where a burglar breaks into your apartment, stealing your laptop and a valuable piece of jewelry. The laptop cost $1,500 and the jewelry is valued at $1,000. A basic rental insurance policy, which usually offers limited coverage for personal belongings, might cover up to $2,000 worth of stolen items, but this would depend on the policy’s specific limits and any deductibles. Therefore, you would receive a payout of approximately $2,000 (less your deductible, if any) to replace these items. While this is less than the full value of the stolen property, it offers some financial relief.

Visual Representation of Coverage Differences

Let’s illustrate the difference between the two scenarios using a simple text-based comparison:

| Scenario | Cost of Damages | Insurance Coverage (Comprehensive) | Insurance Coverage (Basic) |

|—————–|—————–|————————————|—————————|

| Fire Damage | $35,000 | ~$35,000 (less deductible) | Potentially significantly less, possibly only covering personal liability. |

| Theft | $2,500 | ~$2,500 (less deductible) | ~$2,000 (less deductible) |

This table shows that while a basic policy might be sufficient for minor incidents like theft, a comprehensive policy offers far greater protection against significant losses resulting from events like fires or floods. The actual payout will always depend on the specifics of the policy and the claim.

Conclusion

Securing cheap rental insurance is about finding the right balance between cost and coverage. By carefully comparing providers, understanding policy details, and taking preventative measures, you can significantly reduce your risk while staying within your budget. Remember, a little proactive planning can go a long way in protecting your valuable possessions and ensuring your financial security as a renter. Don’t hesitate to ask questions and prioritize understanding your policy before signing.

FAQs

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV pays for the depreciated value of your belongings, while replacement cost coverage pays for the cost of replacing them with new items.

Can I get rental insurance if I have a pet?

Yes, but some insurers may charge higher premiums or have restrictions depending on the type and breed of pet.

What happens if I forget to renew my policy?

Your coverage will lapse, leaving you unprotected. Most insurers offer automatic renewal options to avoid this.

Does my landlord’s insurance cover my belongings?

No, your landlord’s insurance typically only covers the building itself, not your personal property.

How long does it take to file a claim?

The claim process varies by insurer but generally involves contacting your provider, providing details of the incident, and potentially undergoing an inspection.