The search for the “cheapest and best” car insurance is a common quest, but one fraught with complexities. What constitutes “best” is inherently subjective, varying greatly depending on individual needs and circumstances. This guide navigates the intricacies of car insurance, helping you understand the factors influencing cost and coverage, empowering you to make informed decisions that align with your budget and risk tolerance.

We’ll delve into the various types of coverage, exploring their respective costs and benefits. Understanding the impact of demographics, vehicle type, and credit score on premiums is crucial. Furthermore, we’ll equip you with practical strategies for securing affordable insurance, including leveraging discounts, utilizing comparison tools, and negotiating effectively with providers.

Defining “Cheapest and Best”

Finding the “cheapest and best” car insurance can feel like searching for a mythical creature. The challenge lies in the inherent subjectivity of “best,” a term that varies greatly depending on individual needs and priorities. What constitutes the best policy for one driver might be completely unsuitable for another.

The perception of “best” is shaped by a complex interplay of factors. Cost is undoubtedly a primary concern for most people, but it’s rarely the only factor. Level of coverage, the reputation of the insurance company, the ease of filing a claim, and the availability of additional benefits all contribute to a consumer’s overall satisfaction and their assessment of whether a policy is “best” for them.

Factors Influencing the Perception of “Best” Car Insurance

Several key factors influence a consumer’s decision when choosing car insurance. These factors often interact, making the decision-making process more intricate than simply comparing prices. For example, a lower premium might be appealing, but inadequate coverage could leave the driver financially vulnerable in the event of an accident. Conversely, comprehensive coverage might provide peace of mind but come with a significantly higher price tag.

Types of Car Insurance Coverage and Their Costs

Car insurance policies typically offer various coverage types, each carrying different cost implications. Understanding these differences is crucial for making an informed decision. The cost of each type of coverage varies significantly depending on factors like your driving record, the type of vehicle you drive, your location, and the amount of coverage you choose.

| Coverage Type | Description | Typical Cost Range (Annual) | Cost Influencing Factors |

|---|---|---|---|

| Liability | Covers injuries or damages you cause to others. | $300 – $1500 | State minimum requirements, driving record, age |

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | $300 – $1000 | Vehicle value, deductible amount, driving record |

| Comprehensive | Covers damage to your vehicle from non-collision events (e.g., theft, vandalism, weather). | $100 – $500 | Vehicle value, deductible amount, location (theft risk) |

| Uninsured/Underinsured Motorist | Protects you if you’re hit by an uninsured or underinsured driver. | $100 – $500 | State requirements, driving record |

*Note: The cost ranges provided are estimates and can vary widely depending on individual circumstances.* It is crucial to obtain personalized quotes from multiple insurers to accurately assess costs.

Factors Affecting Car Insurance Costs

Several interconnected factors determine the cost of car insurance. Understanding these elements empowers consumers to make informed decisions and potentially secure more affordable coverage. This section details key demographic influences, the impact of vehicle type, the role of credit scores, and a comparison of pricing models across different insurance providers.

Demographic Factors Influencing Premiums

Age, driving history, and location significantly impact car insurance premiums. Younger drivers, statistically involved in more accidents, typically pay higher premiums than older, more experienced drivers. A clean driving record with no accidents or traffic violations leads to lower premiums, while past incidents increase costs. Location also plays a crucial role; areas with higher accident rates or theft rates generally have higher insurance premiums due to increased risk for insurers. For example, a young driver with a spotless record living in a rural area might pay less than an older driver with a few accidents living in a densely populated urban center with high crime rates.

Vehicle Type and Insurance Costs

The type of vehicle significantly influences insurance premiums. Generally, sports cars, luxury vehicles, and high-performance cars are more expensive to insure than sedans or smaller, economical cars. This is because these vehicles are often more costly to repair, have higher replacement values, and are more likely to be involved in serious accidents due to their performance capabilities. For instance, insuring a high-powered sports car will almost always cost more than insuring a fuel-efficient compact car, even if both drivers have identical driving records and live in the same location. The cost difference stems from the inherent risks associated with the vehicles themselves.

Credit Score and Insurance Premiums

In many jurisdictions, insurers use credit scores as a factor in determining insurance premiums. The rationale is that individuals with good credit are statistically less likely to file fraudulent claims or be involved in high-risk behaviors. A higher credit score generally correlates with lower insurance premiums, while a lower credit score can result in significantly higher premiums. This practice, however, remains controversial, with some arguing that it unfairly penalizes individuals with poor credit histories, regardless of their driving record. The impact of credit score varies widely among insurers and by state regulations.

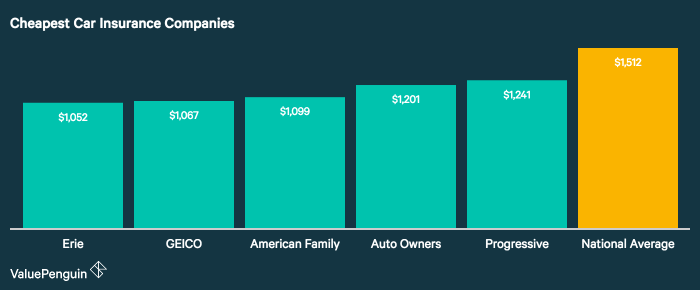

Comparison of Insurance Provider Pricing Models

Different insurance providers employ varying pricing models. Some may prioritize factors like driving history more heavily, while others may place greater emphasis on credit score or location. Some insurers use sophisticated algorithms incorporating numerous factors to generate personalized quotes, leading to significant price variations among providers for the same individual. For example, one insurer might offer a competitive rate to a young driver with a good credit score but a less favorable rate to a driver with a poor credit score, while another insurer might adopt a different weighting of these factors, resulting in different pricing outcomes. Consumers are encouraged to compare quotes from multiple providers to identify the most suitable and affordable option.

Finding Affordable Insurance Options

Securing the best car insurance at the most affordable price requires a proactive approach. By understanding various strategies and utilizing available resources, you can significantly reduce your premiums and find a policy that suits your needs and budget. This section Artikels effective methods for obtaining lower premiums and navigating the process of obtaining quotes.

Finding the cheapest car insurance doesn’t necessarily mean sacrificing quality. Many strategies can help you secure a lower premium without compromising coverage. This involves careful planning, comparison shopping, and leveraging available discounts.

Strategies for Lower Premiums

Several strategies can significantly reduce your car insurance premiums. These include bundling insurance policies, taking advantage of discounts, and maintaining a clean driving record.

- Bundling: Insuring multiple vehicles or combining auto insurance with home or renters insurance with the same provider often results in substantial discounts. The savings can be considerable, often exceeding the cost of individual policies.

- Discounts: Many insurers offer discounts for various factors, including good driving records, completing defensive driving courses, installing anti-theft devices, being a student with good grades, and belonging to certain professional organizations. Carefully review the available discounts offered by different providers.

- Driving Record: Maintaining a clean driving record is crucial. Accidents and traffic violations can significantly increase your premiums. Safe driving habits are not only essential for safety but also for cost savings.

- Vehicle Choice: The type of vehicle you drive significantly impacts your insurance cost. Safer, less expensive vehicles generally attract lower premiums. Consider the vehicle’s safety ratings and insurance group when making a purchase decision.

Utilizing Online Comparison Tools

Online comparison tools are invaluable resources for finding affordable car insurance. These tools allow you to quickly compare quotes from multiple insurers simultaneously, saving you time and effort.

- Effectiveness: While these tools are incredibly useful, remember that the quotes provided are estimates. The final premium may vary depending on individual factors assessed by the insurer during the application process.

- Examples: Popular comparison websites include The Zebra, NerdWallet, and Policygenius. These platforms aggregate quotes from numerous insurers, providing a comprehensive overview of available options. They often include features like filtering by coverage type and price range, allowing for efficient comparison.

Obtaining Car Insurance Quotes

A step-by-step guide ensures a smooth and efficient process when obtaining quotes from multiple providers.

- Gather Information: Collect necessary information, such as your driver’s license number, vehicle identification number (VIN), and driving history.

- Use Comparison Websites: Begin by using online comparison tools to obtain preliminary quotes from various insurers. Note that the quotes received are estimates.

- Visit Insurer Websites: Directly visit the websites of insurers that offer competitive quotes from the comparison sites to get more detailed information.

- Contact Insurers Directly: If needed, contact insurers directly to clarify details or request personalized quotes. This allows for more in-depth discussions about specific coverage needs.

- Compare Quotes Carefully: Thoroughly compare quotes from different providers, paying attention to coverage levels, deductibles, and premiums. Don’t solely focus on the cheapest option; ensure the coverage adequately protects you.

- Choose a Policy: Once you’ve compared quotes and selected a suitable policy, complete the application process with your chosen insurer.

Understanding Policy Details

Securing the cheapest and best car insurance involves more than just comparing premiums; a thorough understanding of your policy’s details is crucial to ensure you’re adequately protected and avoid unexpected costs. Failing to review your policy carefully can lead to significant financial burdens in the event of an accident or claim.

Carefully reviewing your policy documents is paramount. This allows you to understand your coverage limits, deductibles, exclusions, and any additional terms and conditions that might impact your claim process. Don’t hesitate to contact your insurer if anything is unclear; it’s far better to clarify doubts upfront than to face complications later.

Common Exclusions and Limitations

Insurance policies, while designed to protect you, typically exclude certain events or circumstances from coverage. Understanding these exclusions is vital to avoid disappointment during a claim. Common exclusions may include damage caused by wear and tear, intentional acts, driving under the influence of alcohol or drugs, or using your vehicle for unauthorized purposes (e.g., racing). Limitations might involve caps on the amount paid for specific types of damage, such as rental car reimbursement or towing expenses. For example, a policy might only cover rental car expenses for a limited period after an accident, or only reimburse towing costs up to a certain dollar amount. These limitations are usually clearly stated in the policy’s terms and conditions.

Potential Hidden Fees or Surcharges

Beyond the stated premium, various hidden fees or surcharges can inflate the total cost of your car insurance. These can include administrative fees, late payment penalties, or fees for adding or changing coverage options. Some insurers may also impose surcharges based on your driving record, location, or the type of vehicle you insure. For instance, a driver with multiple speeding tickets might face a surcharge, or someone living in a high-risk area might pay more. Always scrutinize the policy document for any mention of such additional charges to get a complete picture of the overall cost.

Interpreting Key Terms and Conditions

Let’s consider a hypothetical excerpt from a sample policy: “Comprehensive coverage includes damage caused by fire, theft, vandalism, or collision with an object not in motion, subject to a $500 deductible.” This clause defines the scope of comprehensive coverage and specifies the deductible. The deductible is the amount you’ll pay out-of-pocket before the insurance company covers the remaining costs. In this example, if your car is damaged by fire and the repair costs $2,500, you would pay $500, and the insurer would cover the remaining $2,000. Understanding such clauses ensures you know exactly what is and isn’t covered under your policy. Another example might be a clause limiting liability coverage to a specific amount, such as $100,000 per accident. This means the insurer will only pay up to this amount for injuries or damages caused to others in an accident you are at fault for. Therefore, a thorough understanding of such clauses is necessary to make informed decisions about your coverage needs.

Maintaining Coverage and Avoiding Lapses

Maintaining continuous car insurance coverage is crucial for several reasons, extending beyond simply avoiding legal repercussions. It protects your financial well-being in the event of an accident, ensures peace of mind, and can even impact your credit score. Failing to maintain coverage can lead to significant financial and legal difficulties. Understanding how to manage your payments and promptly update your information is key to preventing lapses in coverage.

Consistent car insurance coverage offers vital protection against unforeseen events. A lapse in coverage, even a short one, can leave you vulnerable to substantial financial losses should you be involved in an accident. Furthermore, driving without insurance is illegal in most jurisdictions and can result in hefty fines, license suspension, and even jail time depending on the circumstances. Proactive management of your policy is therefore essential for both financial security and legal compliance.

Managing Car Insurance Payments and Avoiding Late Fees

Effective management of car insurance payments involves setting up automatic payments, choosing a payment frequency that aligns with your budget (monthly, quarterly, or annually), and carefully monitoring your account for any changes or discrepancies. Setting up automatic payments through your bank or credit card significantly reduces the risk of late payments and associated fees. Many insurance companies offer discounts for paying premiums in full upfront, which can offset the inconvenience of a larger initial payment. Keeping accurate records of payment dates and amounts allows for quick resolution of any potential issues. Contacting your insurer immediately if you anticipate difficulties making a payment can often lead to payment arrangements that avoid late fees.

Consequences of Letting Car Insurance Lapse

The consequences of allowing your car insurance to lapse are far-reaching. Beyond the legal penalties, such as fines and license suspension, a lapse in coverage can impact your ability to obtain insurance in the future. Insurance companies view lapses negatively, often resulting in higher premiums or even denial of coverage when you attempt to reinstate your policy. In the event of an accident while uninsured, you would be solely responsible for all damages and medical expenses, potentially leading to substantial debt. Your credit score can also be negatively affected, impacting your ability to secure loans or credit in the future. For example, a driver involved in an accident without insurance might face thousands of dollars in repair costs and medical bills, and their driving privileges could be suspended for an extended period.

Updating Insurance Information After Life Events

Life changes necessitate prompt updates to your car insurance policy. Failing to do so can result in inadequate coverage or even invalidating your policy. Changes of address, vehicle ownership, or even significant changes in driving habits should all be reported to your insurer. For example, moving to a new neighborhood with a higher crime rate might lead to an increase in your premium, while purchasing a new car with enhanced safety features could potentially result in a lower premium. Similarly, adding a new driver to your policy, particularly a younger or less experienced driver, will almost certainly increase your premium. Contacting your insurer immediately upon any life event ensures your coverage remains accurate and appropriate. Most insurance companies provide online portals or phone lines for quick and easy updates.

Infographic: The Importance of Continuous Car Insurance Coverage

The infographic would visually depict the consequences of a lapse in car insurance coverage. A central image could show a car involved in an accident, with branching arrows leading to different consequences: a large dollar sign representing financial responsibility for damages and medical bills; a gavel representing legal penalties and court costs; a red “X” over a car representing the inability to drive legally; and a downward-pointing arrow representing a decrease in credit score. Each consequence would be further detailed with short, impactful text and possibly small icons or illustrations. The overall design would be clear, concise, and visually appealing, using a color scheme emphasizing the importance of continuous coverage (perhaps using shades of green for positive aspects and red for negative consequences). A strong call to action would encourage viewers to maintain continuous coverage to avoid these negative outcomes.

Conclusion

Securing the cheapest and best car insurance involves a careful balancing act between cost and comprehensive coverage. By understanding the factors that influence premiums, employing effective comparison strategies, and meticulously reviewing policy details, you can confidently navigate the insurance landscape. Remember, the “best” policy is the one that provides adequate protection while fitting comfortably within your budget. Proactive policy management, including timely payments and updates, ensures continuous coverage and avoids potential financial setbacks.

Essential FAQs

What is the difference between liability and collision coverage?

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. Collision coverage protects your own vehicle in the event of an accident, regardless of fault.

Can I get car insurance without a credit check?

Some insurers offer policies that don’t explicitly use credit scores, but your driving history and other factors will still significantly impact your premium.

How often should I review my car insurance policy?

It’s recommended to review your policy annually, or whenever there’s a significant life change (new car, address change, etc.), to ensure it still meets your needs.

What happens if I let my car insurance lapse?

Letting your insurance lapse can result in significant fines, difficulty obtaining future coverage, and potential legal repercussions if involved in an accident.

What discounts are commonly available for car insurance?

Common discounts include bundling home and auto insurance, safe driver discounts, good student discounts, and multi-car discounts.