Navigating the world of car insurance can feel overwhelming, especially in a state like Illinois with its specific requirements and diverse insurance providers. Securing affordable coverage without compromising essential protection is a priority for many drivers. This guide delves into the intricacies of finding the cheapest car insurance in Illinois, offering practical advice and actionable strategies to help you make informed decisions and potentially save money on your premiums.

We’ll explore the mandatory insurance coverages, factors influencing costs, methods for comparing quotes, and opportunities for discounts. Understanding these elements empowers you to confidently compare options and secure the most cost-effective car insurance policy that meets your needs and complies with Illinois law.

Understanding Illinois Car Insurance Requirements

Driving in Illinois requires understanding the state’s mandatory car insurance regulations. Failure to comply can result in significant penalties, impacting your driving privileges and financial stability. This section details the essential aspects of Illinois car insurance, including mandatory coverages, minimum liability limits, and penalties for non-compliance.

Mandatory Car Insurance Coverage in Illinois

Illinois is a “no-fault” state, meaning your insurance company will cover your medical bills and lost wages regardless of who caused the accident. However, this only applies to your own injuries and damages. The state mandates that all drivers carry a minimum amount of liability insurance to protect others involved in accidents you cause. This liability coverage is crucial because it protects you from potentially devastating financial consequences if you cause an accident resulting in injuries or property damage to others. It’s important to remember that even if you’re at fault, your liability insurance will cover the damages to the other party. Without sufficient liability coverage, you could face significant personal liability for the accident’s costs.

Minimum Liability Limits in Illinois

Illinois law mandates minimum liability insurance coverage of 25/50/20. This means:

- $25,000 for bodily injury to one person in an accident.

- $50,000 for bodily injury to multiple people in a single accident.

- $20,000 for property damage in an accident.

These are minimums; many drivers opt for higher limits to provide greater protection. Consider that medical bills and legal fees can quickly exceed these minimum amounts, leaving you personally responsible for the difference. Higher limits provide a safety net, reducing your exposure to significant financial risk in the event of an accident.

Penalties for Driving Without Insurance in Illinois

Driving without insurance in Illinois is a serious offense. Penalties include:

- Fines: Substantial fines can be imposed, varying depending on the circumstances and whether it’s a first or subsequent offense. These fines can significantly impact your budget.

- License Suspension: Your driver’s license can be suspended, preventing you from legally driving. This suspension can last for an extended period, depending on the severity of the violation and your driving record.

- Vehicle Impoundment: Your vehicle may be impounded, adding to the costs and inconvenience. Retrieving your vehicle will require additional fees and paperwork.

- Increased Insurance Premiums: Even after reinstatement, you will likely face significantly higher insurance premiums for years to come. This reflects the increased risk you represent to insurance companies.

- Court Costs: If you are involved in an accident without insurance, you may face court costs and legal fees, potentially leading to further financial hardship.

Comparison of Car Insurance Coverages

The following table compares different types of car insurance coverage and their typical costs. Note that these are estimates, and actual costs will vary based on individual factors like driving record, age, location, and the type of vehicle.

| Coverage Type | What it Covers | Typical Cost (Annual Estimate) | Importance |

|---|---|---|---|

| Liability | Damages to others (property and injury) caused by you. | $500 – $1500 | Mandatory in Illinois; protects you from financial ruin if you cause an accident. |

| Collision | Damage to your vehicle, regardless of fault. | $500 – $1000 | Repairs or replaces your car if it’s damaged in an accident, even if you’re at fault. |

| Comprehensive | Damage to your vehicle from non-collision events (theft, vandalism, weather). | $200 – $500 | Covers damage from events outside of accidents. |

| Uninsured/Underinsured Motorist | Damages caused by a driver without insurance or with insufficient coverage. | $100 – $300 | Protects you if you’re hit by an uninsured or underinsured driver. |

Finding the Cheapest Car Insurance Options

Securing affordable car insurance in Illinois is crucial, balancing cost-effectiveness with adequate coverage. Several factors influence your premium, including your driving record, the type of vehicle you drive, and your location. By understanding these factors and employing effective strategies, you can significantly reduce your insurance costs.

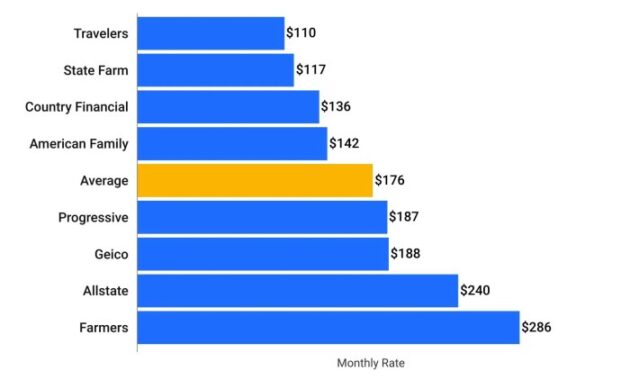

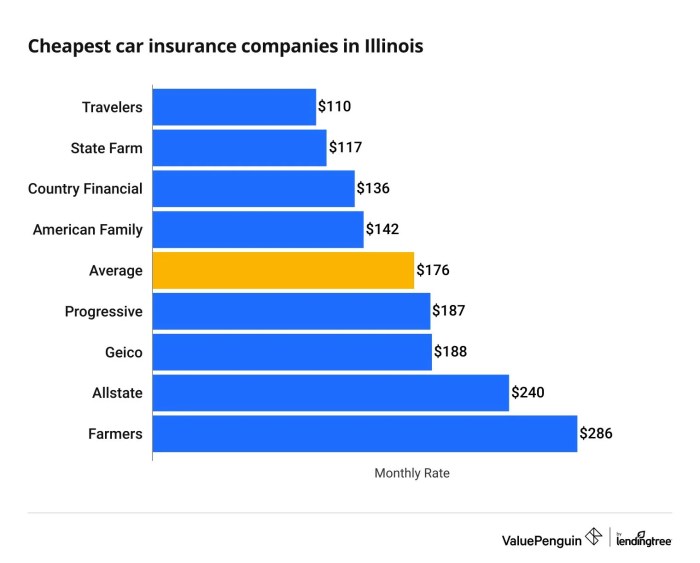

Reputable Car Insurance Companies in Illinois

Numerous reputable insurance companies operate within Illinois, each offering varying coverage options and price points. Choosing the right insurer depends on your individual needs and risk profile. Consider researching several companies before making a decision.

- State Farm: A major national insurer with a strong presence in Illinois, known for its comprehensive coverage options and competitive pricing.

- Allstate: Another large national insurer offering a wide range of coverage and services, often with bundled discounts available.

- GEICO: A well-known company that often advertises competitive rates, particularly for drivers with clean driving records.

- Progressive: Provides a variety of insurance options and is known for its online tools and ease of obtaining quotes.

- Farmers Insurance: A large insurer with a network of local agents, offering personalized service and potentially tailored rates.

Methods for Comparing Car Insurance Quotes

Comparing quotes from multiple insurers is essential to finding the best deal. Avoid relying solely on one company’s offer; a thorough comparison can reveal substantial savings.

- Utilize online comparison tools: Many websites allow you to enter your information once and receive quotes from several insurers simultaneously. This streamlines the process and saves time.

- Contact insurers directly: Call or visit the websites of individual companies to obtain quotes. This allows you to ask specific questions and explore coverage details beyond what comparison websites might provide.

- Review policy details carefully: Don’t solely focus on the price; compare the coverage levels and deductibles offered by each insurer to ensure you’re getting adequate protection for your needs.

Tips for Negotiating Lower Insurance Premiums

Negotiating lower premiums can be successful if approached strategically. Leverage your strengths and demonstrate your commitment to safe driving.

- Maintain a clean driving record: A history of accident-free driving significantly impacts your premium. Any accidents or traffic violations will likely increase your rates.

- Bundle your insurance policies: Many insurers offer discounts when you bundle your car insurance with other policies, such as homeowners or renters insurance.

- Increase your deductible: Choosing a higher deductible can lower your monthly premiums, but remember this means you’ll pay more out-of-pocket in the event of a claim.

- Explore discounts: Inquire about available discounts, such as those for good students, safe drivers, or those who install anti-theft devices.

- Shop around regularly: Insurance rates can change, so it’s advisable to compare quotes annually or even more frequently to ensure you’re getting the best possible rate.

Obtaining Car Insurance Quotes Online: A Step-by-Step Guide

The online process for obtaining quotes is generally straightforward and convenient.

- Visit an insurance comparison website or the website of an individual insurer.

- Provide the required information, including your driving history, vehicle details, and personal information. Be accurate and thorough in your responses.

- Review the quotes provided. Pay close attention to the coverage details and deductibles.

- Compare the quotes from different providers, focusing on both price and coverage.

- Select the policy that best meets your needs and budget. Carefully review the policy documents before purchasing.

- Complete the online application and make the necessary payment.

Understanding Policy Details and Coverage

Choosing the cheapest car insurance in Illinois is only half the battle. Understanding the details of your policy and the coverage it provides is crucial to ensuring you’re adequately protected in the event of an accident. Failing to grasp these details could leave you financially vulnerable.

A standard Illinois car insurance policy typically includes several types of coverage, each designed to protect you and your vehicle in different situations. These coverages work together to provide comprehensive protection, but the extent of that protection depends on your chosen policy limits and deductibles.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, and property repairs for the other party involved. This coverage is typically divided into bodily injury liability and property damage liability. Illinois requires a minimum of $25,000 bodily injury liability coverage per person and $50,000 per accident, and $20,000 in property damage liability. However, it’s advisable to carry higher limits, as a serious accident could easily exceed these minimums, leaving you personally liable for the difference.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident caused by an uninsured or underinsured driver. It covers your medical bills and vehicle repairs, even if the other driver is at fault and lacks sufficient insurance. It’s a vital protection in a state like Illinois, where uninsured drivers are a concern.

Personal Injury Protection (PIP)

PIP coverage pays for your medical expenses and lost wages, regardless of who caused the accident. It also covers medical expenses for your passengers. Illinois is a no-fault state, meaning your own insurance company will pay for your medical bills and lost wages, even if you were at fault. The amount of coverage you choose will impact how much your insurer will pay for these expenses.

Collision Coverage

Collision coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of who is at fault. This means your insurer will cover the cost of repairs even if you caused the accident. The deductible is the amount you pay out-of-pocket before your insurance kicks in.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or weather damage. Like collision coverage, it has a deductible you must meet before your insurer pays the remaining costs.

Understanding Policy Limits and Deductibles

Policy limits are the maximum amounts your insurance company will pay for covered losses. For example, a 100/300/100 liability policy means your insurer will pay up to $100,000 for injuries to one person, up to $300,000 for injuries to multiple people in a single accident, and up to $100,000 for property damage. Deductibles are the amounts you pay out-of-pocket before your insurance coverage begins. A higher deductible typically results in a lower premium, but you’ll pay more if you file a claim.

The Claims Process

Filing a car insurance claim usually involves contacting your insurance company as soon as possible after an accident. You’ll need to provide details about the accident, including the date, time, location, and the other driver’s information. You may also need to provide a police report and photos of the damage. Your insurer will then investigate the claim and determine the amount they will pay for repairs or medical expenses.

Collision vs. Comprehensive Coverage

Imagine two scenarios depicted side-by-side. On the left, a car has sustained damage from a collision with another vehicle – a dented fender and a broken headlight. This is a clear example of damage covered by collision insurance. On the right, the same car shows damage from a tree falling on it during a storm – a crushed roof and broken windshield. This illustrates damage covered under comprehensive coverage. The key difference lies in the cause of the damage: collision covers accidents with other vehicles or objects, while comprehensive covers damage from non-collision events. Both types of coverage typically have deductibles; the amount you pay before the insurance company covers the rest of the repair costs.

Closure

Ultimately, finding the cheapest car insurance in Illinois involves a careful balancing act between cost and coverage. By understanding the factors that influence premiums, diligently comparing quotes, and taking advantage of available discounts, Illinois drivers can significantly reduce their insurance costs without sacrificing necessary protection. Remember to regularly review your policy and adjust it as your needs and circumstances change to ensure you maintain optimal coverage at the most affordable price.

FAQ Resource

What happens if I’m caught driving without car insurance in Illinois?

Driving without insurance in Illinois results in significant penalties, including fines, license suspension, and potential vehicle impoundment. The penalties can be substantial and vary depending on the circumstances.

Can I get car insurance if I have a poor driving record?

Yes, but it will likely be more expensive. Insurers consider your driving history, and a poor record will increase your premiums. However, some insurers specialize in high-risk drivers.

How often should I shop around for car insurance?

It’s recommended to compare quotes annually, or even more frequently if your circumstances change (new car, change in address, improved driving record, etc.). Rates can fluctuate, so regular comparisons ensure you’re getting the best deal.

What is the difference between liability and collision coverage?

Liability coverage protects you if you cause an accident and injure someone or damage their property. Collision coverage protects your vehicle in case of an accident, regardless of fault.