Navigating the world of car insurance can feel overwhelming, especially in a state as diverse as Georgia. Premiums vary wildly depending on a multitude of factors, leaving drivers searching for the best possible deal. This guide cuts through the confusion, providing a clear path to finding the cheapest car insurance in GA while ensuring you maintain adequate coverage. We’ll explore the intricacies of Georgia’s insurance market, helping you understand what influences costs and how to secure the most affordable policy without compromising your protection.

From understanding minimum coverage requirements to leveraging discounts and negotiating rates, we’ll equip you with the knowledge and strategies to make informed decisions. We’ll also delve into the impact of factors like driving history, credit score, and vehicle type on your premiums, allowing you to better anticipate and manage your insurance costs. This guide serves as your roadmap to securing affordable and reliable car insurance in Georgia.

Understanding Georgia’s Car Insurance Market

Navigating the car insurance landscape in Georgia can be complex, with a variety of coverage options and factors influencing costs. Understanding these aspects is crucial for securing adequate protection at a price that fits your budget. This section will provide a clear overview of the Georgia car insurance market, outlining coverage types, cost determinants, and minimum legal requirements.

Types of Car Insurance Coverage in Georgia

Georgia offers several types of car insurance coverage, each designed to protect you and your vehicle in different ways. Liability coverage is mandatory and protects others in the event you cause an accident. Collision coverage repairs your vehicle after an accident, regardless of fault. Comprehensive coverage protects against non-collision damage, such as theft or vandalism. Uninsured/Underinsured motorist coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. Medical payments coverage helps pay for medical bills resulting from an accident, regardless of fault. Personal injury protection (PIP) provides coverage for your medical expenses and lost wages, regardless of fault. The choice of coverage levels depends on individual needs and risk tolerance. Higher coverage limits offer greater protection but come with higher premiums.

Factors Influencing Car Insurance Costs in Georgia

Several factors significantly impact the cost of car insurance in Georgia. Your age plays a considerable role, with younger drivers generally paying more due to higher accident risk. Driving history is another key factor; a clean record with no accidents or tickets results in lower premiums, while a history of accidents or violations leads to higher costs. Your location also matters; areas with higher accident rates tend to have higher insurance premiums. The type of vehicle you drive influences your premium; expensive or high-performance cars are generally more costly to insure. Your credit score can also affect your insurance rate, as insurers use it as an indicator of risk. Finally, the amount and type of coverage you choose directly impact your premium; higher coverage limits will always result in a higher cost.

Minimum Insurance Requirements in Georgia

Georgia law mandates minimum liability coverage for all drivers. This includes $25,000 bodily injury liability for one person, $50,000 bodily injury liability for multiple people injured in the same accident, and $25,000 property damage liability. While these minimums are legally sufficient, they may not adequately cover significant damages in serious accidents. Consider purchasing higher coverage limits for enhanced protection. Failure to maintain the state-mandated minimum insurance can result in significant penalties, including fines, license suspension, and even vehicle impoundment.

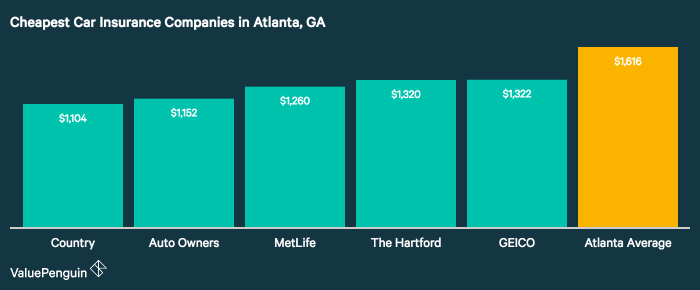

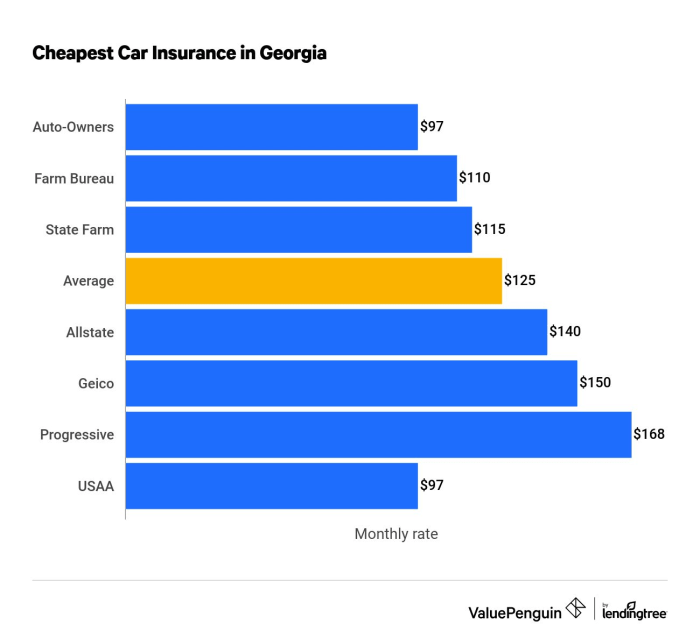

Average Car Insurance Premiums Across Major Georgia Cities

| City | Average Premium (Annual) | Minimum Coverage | Notes |

|---|---|---|---|

| Atlanta | $1500 | $25,000/$50,000/$25,000 | Higher due to traffic congestion and accident rates. |

| Savannah | $1200 | $25,000/$50,000/$25,000 | Moderate premiums reflecting a mix of urban and suburban areas. |

| Augusta | $1100 | $25,000/$50,000/$25,000 | Lower premiums compared to larger cities. |

| Macon | $1300 | $25,000/$50,000/$25,000 | Premiums slightly higher than Augusta, reflecting a moderate risk profile. |

*Note: These are average premiums and may vary depending on individual factors. Actual premiums will depend on the specific insurer, coverage selected, and individual driver profile.*

Finding the Best Deals on Car Insurance in Georgia

Securing affordable car insurance in Georgia requires a proactive approach. By understanding your options and employing effective strategies, you can significantly reduce your premiums and find a policy that suits your needs and budget. This section will guide you through the process of finding the best deals, focusing on utilizing online comparison tools, negotiating with insurers, and obtaining multiple quotes.

Reputable Online Car Insurance Comparison Websites

Several reputable online platforms allow Georgia residents to compare car insurance quotes from multiple providers simultaneously. These websites act as intermediaries, streamlining the quote-gathering process and saving you considerable time and effort. Examples include The Zebra, NerdWallet, and Policygenius. These platforms typically offer a wide range of insurers and allow you to filter results based on your specific needs and preferences, such as coverage levels and deductibles. Using these tools empowers you to make informed decisions based on a comprehensive comparison of available options.

Tips for Negotiating Lower Car Insurance Premiums

Negotiating your car insurance premiums can lead to substantial savings. Several strategies can improve your chances of securing a lower rate. For example, maintaining a clean driving record significantly impacts your premiums. Bundling your car insurance with other policies, such as homeowners or renters insurance, from the same provider often results in discounts. Exploring different coverage options and deductibles can also affect your premium. Increasing your deductible, for example, usually leads to lower premiums, though it increases your out-of-pocket expenses in the event of a claim. Finally, inquire about available discounts, such as those for good students, safe drivers, or those who install anti-theft devices. Remember to be polite and persistent during negotiations.

Step-by-Step Guide to Obtaining Car Insurance Quotes

Obtaining multiple car insurance quotes is crucial for finding the best deal. First, gather necessary information, including your driver’s license, vehicle information (year, make, model), and details about your driving history. Next, visit several online comparison websites or contact insurance providers directly. Provide accurate information to each insurer to ensure you receive accurate quotes. Carefully review each quote, paying close attention to coverage details, premiums, and deductibles. Finally, compare the quotes side-by-side to identify the most suitable and affordable option. Remember to check the insurer’s financial stability and customer service ratings before making a final decision.

Checklist of Questions to Ask Insurance Providers

Before committing to a car insurance policy, it’s essential to ask pertinent questions to ensure the policy meets your needs. These questions should cover aspects such as coverage details, premium costs, and the insurer’s claims process. For example, inquire about the specific coverage included in each policy, such as liability, collision, and comprehensive coverage. Clarify the process for filing a claim, including the required documentation and the expected timeframe for resolution. Also, inquire about any discounts or additional benefits offered. Finally, ask about the insurer’s customer service reputation and their accessibility for assistance. A thorough understanding of these aspects ensures you choose a policy that provides adequate protection and aligns with your financial capabilities.

Factors Affecting Car Insurance Costs

Several key factors influence the price of car insurance in Georgia. Understanding these factors can help you make informed decisions and potentially secure more affordable coverage. These factors interact in complex ways, so it’s not always a simple case of adding or subtracting individual impacts.

Driving History’s Impact on Premiums

Your driving record significantly impacts your insurance premiums. A clean driving history, free of accidents and traffic violations, will generally result in lower rates. Conversely, accidents and tickets, especially those involving significant damage or injuries, lead to higher premiums. Insurance companies view these incidents as indicators of higher risk. For example, a single at-fault accident might increase your premiums by 20-40%, while multiple incidents or serious offenses could result in even more substantial increases, potentially leading to difficulty finding coverage at all with standard insurers. The severity of the offense also matters; a speeding ticket is less impactful than a DUI conviction.

Credit Score’s Influence on Insurance Rates

In Georgia, as in many states, your credit score is a factor in determining your car insurance rates. Insurance companies use credit-based insurance scores (CBIS) which are different from your traditional FICO score, but are derived from similar information. A higher credit score generally translates to lower premiums, reflecting the perceived lower risk associated with individuals who demonstrate responsible financial behavior. Conversely, a lower credit score can lead to significantly higher premiums. This is because statistically, individuals with poor credit history tend to file more insurance claims. The exact impact varies among insurers, but it can be substantial – a difference of hundreds of dollars annually is not uncommon.

Insurance Rates for Different Vehicle Types

The type of vehicle you insure also plays a crucial role in determining your premiums. Generally, insuring a sports car or a high-performance vehicle will be more expensive than insuring a compact car or a family sedan. This is because these vehicles are often more expensive to repair and replace, and they are statistically involved in more accidents. Trucks and SUVs often fall somewhere in between, with larger trucks and SUVs tending to be more expensive to insure than smaller ones due to their size and potential for greater damage in an accident. The safety features of the vehicle also factor into the equation; cars with advanced safety technology might receive discounts.

Age and Gender’s Effect on Insurance Costs

Age and gender are statistical factors used in determining insurance rates. Younger drivers, particularly those under 25, generally pay higher premiums due to their statistically higher accident rates. As drivers gain experience and age, their premiums typically decrease. Gender also plays a role, with some studies suggesting that male drivers, particularly younger males, tend to have higher accident rates than female drivers. However, this is a complex issue and insurance companies consider many factors beyond simple gender statistics. It is important to note that this is a broad generalization, and individual driving records and other factors will significantly influence the final premium.

Discounts and Savings Opportunities

Securing the cheapest car insurance in Georgia often involves leveraging the numerous discounts offered by insurance providers. Understanding these discounts and how to access them is crucial for minimizing your premiums. Many factors influence eligibility, and comparing offers across different companies is key to finding the best deal.

Georgia’s car insurance market is competitive, with companies vying for customers by offering a range of discounts. These discounts can significantly reduce your overall cost, sometimes by hundreds of dollars annually. The application process varies by insurer, but generally involves providing supporting documentation to verify eligibility. Careful comparison shopping is essential to maximize savings.

Available Car Insurance Discounts in Georgia

Several categories of discounts are commonly available. Eligibility criteria vary by insurance company, so it’s vital to check directly with each provider for their specific requirements and limitations.

- Safe Driver Discount: Awarded for maintaining a clean driving record, typically free of accidents and traffic violations for a specified period (e.g., 3-5 years). Many insurers offer tiered discounts based on the length of your accident-free driving history.

- Good Student Discount: Offered to students who maintain a certain grade point average (GPA), usually a B average or higher. This discount recognizes the lower risk associated with responsible, academically successful young drivers. Proof of enrollment and GPA is usually required.

- Bundling Discount: Achieved by combining multiple insurance policies, such as auto and homeowners or renters insurance, with the same company. This discount incentivizes customer loyalty and simplifies policy management.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course often qualifies drivers for a discount. This demonstrates a commitment to safe driving practices and risk reduction.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as alarms or immobilizers, can significantly reduce your premium. This reflects the lower risk of theft and associated claims.

- Multi-car Discount: Insuring multiple vehicles under the same policy with the same company often leads to a discount. This reflects the reduced administrative overhead for the insurer.

- Vehicle Safety Features Discount: Vehicles equipped with advanced safety features, such as anti-lock brakes (ABS), airbags, and electronic stability control (ESC), may qualify for a discount. This reflects the lower risk of accidents associated with these features.

- Payment Plan Discount: Some insurers offer discounts for paying your premiums annually or semi-annually instead of monthly. This reflects reduced administrative costs for the insurer.

Applying for and Receiving Discounts

The process of obtaining discounts varies among insurance companies. Generally, you’ll need to provide supporting documentation during the application process or at renewal. For example, proof of a good driving record might involve a copy of your driving history from the Department of Motor Vehicles (DMV), while a good student discount requires transcripts or a letter from your school. Always confirm the specific requirements with your chosen insurer.

Comparison of Discount Offerings

Different insurance companies offer varying combinations and levels of discounts. Some may emphasize safe driver discounts, while others might prioritize bundling or good student discounts. It’s crucial to compare quotes from multiple insurers to identify the best overall value. For instance, one company might offer a higher safe driver discount but a lower bundling discount compared to another. A detailed comparison, considering all relevant discounts and your individual circumstances, is essential for making an informed decision.

Summary

Securing the cheapest car insurance in Georgia involves a combination of understanding your individual risk profile, diligently comparing quotes, and strategically leveraging available discounts. By carefully considering the factors that influence premiums and employing the tips and strategies Artikeld in this guide, you can confidently navigate the insurance market and find a policy that perfectly balances affordability and comprehensive protection. Remember, while saving money is important, ensuring you have adequate coverage to protect yourself and others remains paramount.

FAQ Guide

What is the minimum car insurance coverage required in Georgia?

Georgia mandates minimum liability coverage of $25,000 for injury or death to one person, $50,000 for injury or death to multiple people in one accident, and $25,000 for property damage.

Can I get car insurance without a driving history?

Yes, but expect higher premiums. Insurers will likely base your rates on statistical averages for drivers with similar profiles until you build a driving history.

How often can I get my car insurance rates reviewed?

You can request a rate review anytime, especially if your circumstances have changed (e.g., improved driving record, new car, address change). Many insurers offer annual reviews.

What happens if I don’t have car insurance in Georgia?

Driving without insurance in Georgia is illegal and carries significant penalties, including fines, license suspension, and potential court appearances.