Navigating the world of car insurance can feel like driving through a maze, especially in a state like South Carolina. Premiums vary wildly, and finding the absolute cheapest car insurance often requires more than just a quick online search. This guide unravels the complexities of the South Carolina car insurance market, providing you with the knowledge and tools to secure the most affordable coverage without sacrificing essential protection.

We’ll explore the factors influencing insurance costs, compare major providers, and arm you with strategies to lower your premiums. From understanding minimum coverage requirements to leveraging discounts and negotiating rates, we’ll equip you to make informed decisions and save money on your car insurance.

Understanding South Carolina’s Car Insurance Market

Navigating the car insurance landscape in South Carolina can feel complex, but understanding the key factors influencing costs and the various coverage options available is crucial for securing the right protection at the best price. This section will break down the South Carolina car insurance market, helping you make informed decisions about your coverage.

Factors Influencing Car Insurance Costs in South Carolina

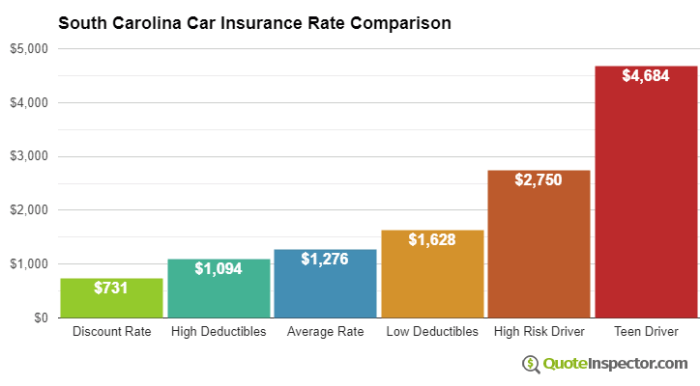

Several factors significantly impact the cost of car insurance in South Carolina. These include your driving record (accidents and traffic violations), age and driving experience (younger drivers generally pay more), the type of vehicle you drive (sports cars and luxury vehicles are typically more expensive to insure), your location (insurance rates vary by zip code due to factors like crime rates and accident frequency), and your credit history (in many states, including South Carolina, credit-based insurance scores are used to assess risk). Your chosen coverage level also plays a substantial role, with higher coverage limits resulting in higher premiums.

Types of Car Insurance Coverage in South Carolina

South Carolina, like other states, offers various types of car insurance coverage. These can be broadly categorized into liability coverage, which protects you if you cause an accident, and collision and comprehensive coverage, which protect your vehicle.

Liability coverage is mandatory in South Carolina and includes bodily injury liability (covering medical bills and other damages to those injured in an accident you caused) and property damage liability (covering damage to another person’s vehicle or property). Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage covers damage to your vehicle from events other than collisions, such as theft, vandalism, or weather-related damage. Medical payments coverage helps pay for medical expenses for you and your passengers, regardless of fault. Personal injury protection (PIP) coverage, while not mandatory, provides coverage for your medical bills and lost wages, regardless of fault.

Minimum Coverage Requirements vs. Recommended Coverage

South Carolina mandates minimum liability coverage of $25,000 for bodily injury to one person, $50,000 for bodily injury to multiple people in one accident, and $25,000 for property damage. While meeting these minimum requirements is legally sufficient, it may not provide adequate protection in the event of a serious accident. A more comprehensive coverage plan, including higher liability limits and collision and comprehensive coverage, offers significantly greater financial security. Consider the potential costs associated with severe injuries or extensive vehicle damage when determining your coverage level. For example, a single serious injury could easily exceed the minimum $25,000 limit.

Common Car Insurance Discounts in South Carolina

Many South Carolina insurance providers offer various discounts to reduce your premium. These include good driver discounts (for drivers with clean driving records), multi-car discounts (for insuring multiple vehicles with the same company), safe driver discounts (for drivers who participate in telematics programs that monitor their driving habits), good student discounts (for students maintaining a certain GPA), and bundling discounts (for combining car insurance with other types of insurance, such as homeowners or renters insurance). Senior citizen discounts may also be available for drivers over a certain age. Always inquire about available discounts when obtaining quotes from different insurance providers.

Finding the Cheapest Car Insurance Providers

Securing affordable car insurance in South Carolina requires diligent research and comparison shopping. Several factors influence your premium, including your driving record, the type of vehicle you drive, your location, and the coverage you select. Understanding these factors and the pricing strategies of different insurers is crucial to finding the best deal.

Major Car Insurance Companies in South Carolina

Several major car insurance companies operate extensively within South Carolina. These companies often compete aggressively, leading to varied pricing structures and coverage options. It’s beneficial to explore offerings from multiple providers to find the best fit for your individual needs and budget. Five examples include State Farm, Geico, Progressive, Allstate, and Nationwide. These companies represent a mix of national and regional providers, offering a range of coverage types and discounts.

Comparison of Pricing Strategies

Each of these major insurance companies employs distinct pricing strategies. For example, Geico is often known for its competitive online quoting process and aggressive advertising aimed at attracting price-conscious consumers. State Farm, with its extensive agent network, may offer personalized service and potentially more nuanced pricing based on individual risk assessments. Progressive utilizes a sophisticated algorithm for risk assessment and often offers discounts based on driving behavior tracked through telematics programs. Allstate and Nationwide also offer a range of coverage options and discounts, but their pricing may vary depending on location and specific risk factors. Direct comparison is difficult without specific individual details, as pricing is highly personalized.

Obtaining Quotes from Multiple Insurers

The process of obtaining quotes is generally straightforward. Most major insurers offer online quote tools on their websites. You’ll need to provide information about yourself, your vehicle, and your desired coverage. This information usually includes your driving history, address, vehicle details (make, model, year), and the level of coverage you want (liability, collision, comprehensive, etc.). After providing this information, the insurer’s system will generate a quote. It’s recommended to obtain quotes from at least three to five different companies to compare prices and coverage options effectively. You can also contact insurance agents directly for personalized quotes.

Comparison of Quotes

| Company Name | Price (Example) | Coverage (Example) | Discount Availability (Example) |

|---|---|---|---|

| State Farm | $100/month | 25/50/25 Liability, Uninsured Motorist | Good Driver, Multi-Policy |

| Geico | $90/month | 25/50/25 Liability, Collision, Comprehensive | Good Student, Anti-theft Device |

| Progressive | $110/month | 50/100/50 Liability, Collision, Comprehensive | Safe Driver (Telematics), Homeowner |

| Allstate | $105/month | 25/50/25 Liability, Uninsured Motorist, Collision | Good Driver, Bundled Services |

| Nationwide | $95/month | 25/50/25 Liability, Comprehensive | Multi-car, Defensive Driving |

Factors Affecting Insurance Premiums

Several key factors influence the cost of car insurance in South Carolina, impacting how much you ultimately pay each year. Understanding these factors can help you make informed decisions to potentially lower your premiums. These factors are interconnected, and changes in one area can affect others.

Driving History

Your driving record significantly impacts your insurance rates. Insurance companies view a clean driving record as a low-risk profile, resulting in lower premiums. Conversely, accidents and traffic violations are seen as indicators of higher risk. A single at-fault accident can lead to a substantial premium increase, often lasting several years. Multiple accidents or serious violations like DUI convictions will result in even higher premiums, or potentially policy cancellations in some cases. For example, a speeding ticket might increase your premiums by 10-20%, while a DUI could lead to a 50% or greater increase. The severity of the accident and the number of claims filed also influence the impact on your rates.

Age and Gender

Statistically, younger drivers, particularly those under 25, are involved in more accidents than older drivers. This higher risk translates to higher insurance premiums for younger drivers. Insurance companies often use age-based risk assessment models, with rates decreasing as drivers age and gain experience. Gender also plays a role, although this varies between insurance companies and states. Historically, males have been statistically associated with a higher risk profile than females, potentially leading to slightly higher premiums for young men. However, this difference tends to diminish as drivers age.

Vehicle Type and Value

The type of vehicle you drive is a major factor in determining your insurance costs. Sports cars and high-performance vehicles are generally more expensive to insure due to their higher repair costs and increased likelihood of theft. Conversely, smaller, less expensive vehicles typically have lower insurance premiums. The value of your vehicle also plays a role; insuring a new luxury car will be significantly more expensive than insuring an older, less valuable vehicle. The vehicle’s safety features, such as anti-lock brakes and airbags, can also influence the premium, with vehicles equipped with advanced safety features often receiving discounts.

Credit Score

In many states, including South Carolina, insurance companies use your credit score as a factor in determining your insurance rates. This practice is controversial, but it’s based on the statistical correlation between credit score and insurance claims. Individuals with good credit scores are generally considered lower-risk and receive lower premiums, while those with poor credit scores may face higher premiums. It’s important to note that while your credit score is a factor, it’s not the only one, and other factors like driving history and vehicle type still carry significant weight. Improving your credit score can potentially lead to lower insurance premiums over time.

Saving Money on Car Insurance

Securing affordable car insurance in South Carolina requires a proactive approach. By understanding the factors influencing your premiums and implementing effective strategies, you can significantly reduce your annual costs without compromising coverage. This section details several methods for achieving substantial savings.

Strategies for Lowering Insurance Premiums

Several readily available strategies can help lower your insurance premiums. These involve making choices that demonstrate lower risk to insurance providers.

- Maintain a Good Driving Record: A clean driving record is the single most impactful factor in determining your insurance rates. Avoid accidents and traffic violations to maintain a low-risk profile. Even a single at-fault accident can significantly increase your premiums for several years.

- Bundle Your Insurance Policies: Many insurance companies offer discounts when you bundle your car insurance with other policies, such as homeowners or renters insurance. This is often a substantial saving opportunity.

- Increase Your Deductible: Choosing a higher deductible (the amount you pay out-of-pocket before your insurance coverage kicks in) will generally lower your premium. However, ensure you can comfortably afford the higher deductible in case of an accident.

- Shop Around and Compare Quotes: Don’t settle for the first quote you receive. Obtain quotes from multiple insurers to compare prices and coverage options. Use online comparison tools to streamline this process.

- Consider Your Vehicle Choice: The make, model, and year of your vehicle directly impact your insurance premiums. Safer vehicles with lower theft rates and repair costs generally result in lower insurance costs. Older cars, while less expensive to purchase, might not offer the same savings in insurance as a newer, safer model.

- Maintain a Good Credit Score: In many states, including South Carolina, your credit score can influence your insurance premiums. A good credit score demonstrates financial responsibility, which insurers view favorably.

Improving Driving Habits to Reduce Risk

Safe driving habits are crucial for lowering your insurance premiums and, more importantly, for your safety. These habits demonstrate a commitment to responsible driving and minimizing accident risk.

- Defensive Driving: Practice defensive driving techniques, such as maintaining a safe following distance, scanning the road ahead, and anticipating potential hazards. This reduces the likelihood of accidents.

- Avoid Distracted Driving: Put away your phone and avoid other distractions while driving. Distracted driving is a leading cause of accidents.

- Obey Traffic Laws: Strictly adhere to traffic laws and speed limits. Traffic violations can lead to increased premiums.

- Regular Vehicle Maintenance: Ensure your vehicle is properly maintained to minimize the risk of mechanical failures that could lead to accidents.

Effectively Comparing Insurance Quotes

A systematic approach to comparing insurance quotes is essential for finding the best deal. Consider these factors to make an informed decision.

- Coverage Levels: Compare quotes based on similar coverage levels. Don’t just focus on price; ensure the coverage meets your needs.

- Deductibles: Consider the impact of different deductibles on both your premium and your out-of-pocket expenses in case of a claim.

- Discounts: Check for available discounts, such as good driver discounts, multi-car discounts, or discounts for safety features in your vehicle.

- Customer Service: Consider the insurer’s reputation for customer service. A good insurer will provide prompt and helpful assistance when you need it.

- Online Tools: Utilize online comparison websites to easily compare quotes from multiple insurers simultaneously. Many sites offer unbiased comparisons and allow you to filter results based on your specific needs.

Bundling Insurance Policies for Savings

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often result in significant savings. Insurers frequently offer discounts for bundling policies, as it simplifies their administration and reduces their risk. For example, if you bundle your car insurance with your homeowners insurance through the same company, you might receive a discount of 10-15% or more on your overall premium. This discount can add up to substantial savings over the course of a year.

Understanding Policy Details

Securing the cheapest car insurance in South Carolina is only half the battle. Understanding the specifics of your chosen policy is equally crucial to ensuring you’re adequately protected and not paying for coverage you don’t need or won’t utilize. Failing to thoroughly review your policy can lead to unexpected costs and inadequate protection in the event of an accident or other covered incident.

It is vital to carefully read the fine print of your car insurance policy. Insurance policies, while often lengthy and complex, contain critical information regarding coverage limits, exclusions, and procedures for filing claims. Overlooking crucial details can leave you vulnerable financially and legally. Don’t hesitate to seek clarification from your insurer if anything is unclear.

Common Exclusions and Limitations

Car insurance policies typically exclude certain events or circumstances from coverage. Understanding these limitations is essential to avoid disappointment or financial burden during a claim. Common exclusions include damage caused by wear and tear, intentional acts, or driving under the influence of alcohol or drugs. Policies also often limit coverage for specific types of vehicles or drivers, such as those with a history of accidents or violations. For example, a policy might exclude coverage for damage caused while driving a vehicle not listed on the policy. Furthermore, coverage limits define the maximum amount the insurer will pay for a particular claim. These limits vary depending on the type of coverage and the chosen policy. Understanding these limitations helps policyholders manage expectations and avoid potential financial shortfalls in the event of a significant claim.

Key Questions to Ask Insurance Providers

Before committing to a car insurance policy, it’s beneficial to proactively gather information to ensure the policy aligns with your needs and expectations. This involves asking specific questions about coverage details, exclusions, and the claims process. For instance, confirming the specific coverage amounts for liability, collision, and comprehensive coverage is crucial. Inquiring about the deductible amount and how it affects out-of-pocket expenses is also essential. Additionally, understanding the process for filing a claim, including required documentation and timelines, is important. Finally, clarifying any exclusions or limitations to coverage, particularly concerning specific driving situations or vehicle types, helps prevent unexpected costs and ensures a clear understanding of the policy’s scope.

Typical Car Insurance Policy Coverage Details

A typical car insurance policy in South Carolina includes several key coverages. Understanding these details ensures you are adequately protected.

- Liability Coverage: This pays for damages to others’ property or injuries to others if you are at fault in an accident. It typically includes bodily injury liability and property damage liability.

- Collision Coverage: This covers damage to your vehicle caused by an accident, regardless of fault. This includes collisions with other vehicles or objects.

- Comprehensive Coverage: This covers damage to your vehicle from events other than collisions, such as theft, vandalism, fire, or hail damage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with an uninsured or underinsured driver.

- Medical Payments Coverage (Med-Pay): This covers medical expenses for you and your passengers, regardless of fault, up to the policy limit.

- Personal Injury Protection (PIP): (Often required in South Carolina) This covers medical bills and lost wages for you and your passengers, regardless of fault.

Closing Notes

Securing the cheapest car insurance in South Carolina is achievable with careful planning and a proactive approach. By understanding the factors influencing premiums, comparing quotes diligently, and implementing cost-saving strategies, you can significantly reduce your insurance expenses without compromising on necessary coverage. Remember, the key is informed decision-making, and this guide provides the roadmap to navigate the South Carolina insurance landscape effectively.

FAQ Summary

What is the minimum car insurance coverage required in South Carolina?

South Carolina mandates minimum liability coverage of $25,000 per person and $50,000 per accident for bodily injury, and $25,000 for property damage. However, this minimum is often insufficient to cover significant accidents. More comprehensive coverage is strongly recommended.

How does my credit score affect my car insurance rates?

In South Carolina, as in many states, insurers often consider your credit score when determining your premiums. A higher credit score generally translates to lower rates, reflecting a perceived lower risk.

Can I get car insurance if I have a DUI on my record?

Yes, but it will likely be significantly more expensive. Insurers view DUIs as high-risk events. You’ll need to shop around and be prepared to pay higher premiums.

What is Uninsured/Underinsured Motorist coverage and why is it important?

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle repairs even if the other driver cannot afford to compensate you.