The quest for affordable transportation often intersects with the equally important need for cost-effective car insurance. This guide delves into the multifaceted world of finding the cheapest insurance cars, exploring the factors that influence premiums and offering practical strategies to minimize your costs. We’ll examine vehicle characteristics, driver profiles, insurance provider options, and smart strategies to secure the best rates, empowering you to make informed decisions about your next vehicle purchase and insurance policy.

Understanding the interplay between car features, driver demographics, and insurance provider policies is crucial for securing the most affordable insurance. This guide provides a clear framework for navigating this complex landscape, empowering you to identify vehicles and insurance options that align with your budget and risk profile. From exploring specific car models known for lower premiums to leveraging various discount strategies, we aim to equip you with the knowledge to achieve significant savings.

Defining “Cheapest Insurance Cars”

Finding the cheapest car insurance isn’t just about the car’s make and model; it’s a complex interplay of factors. The term “cheapest insurance cars” refers to vehicles that statistically result in lower insurance premiums compared to others, due to a combination of inherent vehicle characteristics and the driver’s profile. Understanding these influences is key to finding affordable insurance.

Factors Influencing Car Insurance Costs

Several key factors significantly impact car insurance costs. These factors are considered by insurance companies when assessing risk and setting premiums. Understanding these elements allows drivers to make informed choices about vehicle selection and driving habits.

Car Features Affecting Insurance Premiums

Certain vehicle features are directly correlated with lower accident rates and repair costs, thus leading to lower insurance premiums. Insurance companies often reward safer vehicles with discounted rates.

- Safety Features: Cars equipped with advanced safety technologies, such as anti-lock brakes (ABS), electronic stability control (ESC), airbags, and advanced driver-assistance systems (ADAS) like automatic emergency braking (AEB) and lane departure warning (LDW), often receive lower premiums. These features demonstrably reduce the severity and frequency of accidents.

- Anti-theft Devices: Cars with factory-installed or aftermarket anti-theft systems, such as immobilizers or alarm systems, are less likely to be stolen, resulting in lower insurance costs. Insurance companies recognize the reduced risk of theft and adjust premiums accordingly.

- Repair Costs: Vehicles with readily available and relatively inexpensive parts tend to have lower repair costs, influencing insurance premiums. Cars with a history of high repair costs often command higher insurance rates.

Driver Demographics and Insurance Costs

Driver demographics play a crucial role in determining insurance premiums. Insurance companies use statistical data to assess risk profiles based on various factors.

- Age: Younger drivers, particularly those under 25, generally pay higher premiums due to their statistically higher accident rates. As drivers age and gain experience, their premiums typically decrease.

- Driving History: A clean driving record with no accidents or traffic violations significantly reduces insurance costs. Conversely, accidents and violations increase premiums, reflecting the higher risk associated with less experienced or less cautious drivers.

- Location: Geographic location influences insurance rates. Areas with higher crime rates or more frequent accidents may have higher insurance premiums due to the increased risk of theft or accidents.

Insurance Costs Across Car Types

Different vehicle types carry varying insurance costs due to inherent differences in size, safety features, and accident rates.

- Sedans: Sedans generally have lower insurance premiums compared to SUVs or trucks due to their smaller size, lower center of gravity, and often better fuel economy.

- SUVs: SUVs typically have higher insurance premiums than sedans due to their larger size, higher center of gravity, and increased potential for damage in accidents.

- Trucks: Trucks, especially larger pickup trucks, often have the highest insurance premiums due to their size, weight, and increased risk of causing significant damage in accidents.

Average Insurance Costs for Various Car Models

The following table provides estimated average annual insurance costs for selected car models. Note that these are estimates and actual costs can vary significantly based on location, driver profile, and coverage options.

| Car Model | Estimated Annual Cost (USD) | Car Type | Safety Features |

|---|---|---|---|

| Honda Civic | $1200 | Sedan | High |

| Toyota Corolla | $1150 | Sedan | High |

| Ford Escape | $1400 | SUV | Medium |

| Toyota RAV4 | $1350 | SUV | High |

| Ford F-150 | $1600 | Truck | Medium |

Identifying Affordable Car Makes and Models

Finding the cheapest car to insure doesn’t always mean sacrificing quality or features. Several manufacturers consistently produce vehicles that tend to attract lower insurance premiums. Understanding the factors that influence these premiums can help you make an informed decision.

Several factors contribute to a car’s insurance cost, with safety features playing a significant role. Cars with advanced safety technologies, such as anti-lock brakes (ABS), electronic stability control (ESC), and airbags, often receive lower insurance rates. This is because these features demonstrably reduce the risk of accidents and the severity of injuries, leading to fewer and less costly insurance claims. Conversely, vehicles with a history of high repair costs or frequent theft also command higher premiums.

Safety Features and Insurance Costs

The relationship between a vehicle’s safety features and insurance costs is directly proportional. Improved safety features generally translate to lower insurance premiums. For instance, cars equipped with advanced driver-assistance systems (ADAS), such as lane departure warning, automatic emergency braking, and adaptive cruise control, are often rewarded with lower rates due to their accident-prevention capabilities. Insurance companies recognize the statistical correlation between these features and a reduced likelihood of accidents and claims. The presence of these features demonstrates a commitment to safety, resulting in lower risk assessments and, subsequently, lower premiums for the consumer.

Comparison of Insurance Costs for Specific Models

The following table compares the estimated annual insurance costs for several models within a similar price range. Note that these are estimates and can vary based on individual factors such as driving history, location, and coverage level. These figures are illustrative and should not be considered definitive quotes.

| Model | Manufacturer | Approximate Price Range | Estimated Annual Insurance Cost (USD) |

|---|---|---|---|

| Honda Civic | Honda | $20,000 – $25,000 | $800 – $1200 |

| Toyota Corolla | Toyota | $20,000 – $25,000 | $750 – $1100 |

| Mazda3 | Mazda | $22,000 – $27,000 | $900 – $1300 |

| Hyundai Elantra | Hyundai | $19,000 – $24,000 | $700 – $1000 |

Common Features of Cars with Low Insurance Premiums

Cars with consistently lower insurance premiums often share several characteristics. These typically include a strong safety rating from organizations like the IIHS and NHTSA, a history of lower repair costs, and a lower theft rate. Furthermore, less powerful engines and smaller, more fuel-efficient vehicles often translate to lower insurance costs. The lower risk profile associated with these attributes contributes to reduced insurance premiums. For example, smaller sedans and hatchbacks generally fall into this category, compared to larger SUVs or sports cars. The overall design and engineering of the vehicle also play a role; simpler designs with fewer complex electronic systems can lead to lower repair costs and, consequently, lower insurance rates.

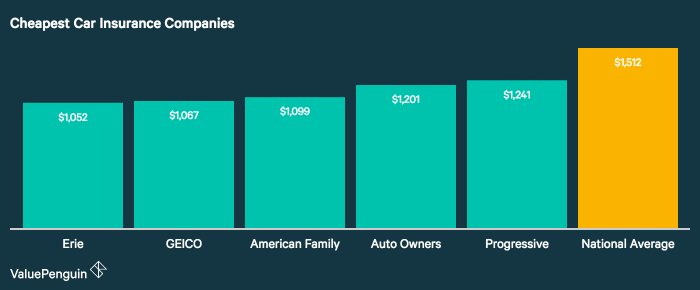

Exploring Insurance Provider Options

Securing affordable car insurance is a crucial step in owning a cheaper car. While the car’s make and model significantly impact premiums, the choice of insurance provider plays an equally vital role. Different companies utilize varying calculation methods, resulting in a wide range of quotes for the same vehicle. Understanding these differences is key to finding the best value.

Insurance quotes for the same car can vary significantly between providers. This variance stems from several factors, including the company’s risk assessment models, the specific coverage offered, and the driver’s profile. For example, a driver with a clean driving record might receive a substantially lower quote from one company compared to another, even for the same car and coverage level. Similarly, the same car might be categorized differently by different insurers based on their internal risk assessments, leading to price discrepancies.

Coverage Options and Pricing Structures

Major insurance companies offer a variety of coverage options, each impacting the overall premium. Basic liability coverage, which is legally mandated in most areas, typically costs less than comprehensive or collision coverage. Comprehensive coverage protects against damage from events outside of accidents (like hail or theft), while collision coverage protects against damage from accidents. Higher coverage limits naturally lead to higher premiums. For instance, a $100,000 liability limit will generally be more expensive than a $50,000 limit. Some insurers also offer additional features like roadside assistance or rental car reimbursement, which add to the cost. The pricing structure often involves a base premium adjusted by factors like the driver’s age, driving history, location, and the vehicle’s characteristics.

Discounts Offered by Insurance Companies

Many insurance companies offer discounts to incentivize safe driving and responsible behavior. These discounts can significantly reduce premiums. Common discounts include:

- Good Driver Discounts: Awarded for maintaining a clean driving record, typically free of accidents and traffic violations for a specified period.

- Safe Driver Discounts: Often based on telematics data collected through a device or app that monitors driving habits.

- Bundling Discounts: Offered when insuring multiple vehicles or combining auto insurance with other types of insurance, such as homeowners or renters insurance, under the same policy.

- Anti-theft Device Discounts: Awarded for installing anti-theft devices in the vehicle, demonstrating a commitment to vehicle security.

- Student Discounts: Provided to students who maintain a certain GPA or are enrolled in specific programs.

- Multi-car Discounts: Apply when insuring multiple vehicles under the same policy with the same insurer.

Insurance Provider Options and Key Features

Understanding the nuances of different insurance providers is crucial for finding the best deal. Below is a list highlighting some key features of several common insurance providers (note: specific features and pricing are subject to change and vary by location and individual circumstances). This is not an exhaustive list, and it’s vital to obtain personalized quotes from multiple insurers.

- Provider A: Known for competitive rates, especially for young drivers, but may offer fewer add-on options.

- Provider B: Offers comprehensive coverage options and a strong reputation for customer service, but premiums might be slightly higher.

- Provider C: Specializes in discounts for safe drivers and utilizes telematics technology to personalize rates. May have a more stringent underwriting process.

- Provider D: A large national provider with extensive coverage options and a wide network of repair shops, but premiums may be higher than smaller regional providers.

Strategies for Reducing Insurance Costs

Securing affordable car insurance involves proactive strategies beyond simply choosing a cheap car. By implementing these cost-saving measures, drivers can significantly reduce their premiums and maintain comprehensive coverage. This section Artikels several effective methods to lower your insurance costs.

Improving Driving Records to Lower Premiums

A clean driving record is a significant factor in determining insurance premiums. Insurance companies view a history of accidents and traffic violations as an increased risk. Maintaining a spotless record, therefore, directly translates to lower premiums. Strategies for achieving this include defensive driving courses, which can sometimes lead to discounts, and consistently adhering to traffic laws. Furthermore, avoiding speeding tickets and practicing safe driving habits significantly reduces the likelihood of accidents. The impact of a single accident or ticket can be substantial, often resulting in premium increases for several years.

Benefits of Bundling Insurance Policies

Bundling your home and auto insurance policies with the same provider often results in significant savings. Insurance companies incentivize bundled policies by offering discounts for combining multiple types of coverage. This is because managing a single customer’s multiple policies is more efficient than handling separate policies for different customers. The discount percentage varies depending on the insurer and the specific policies bundled, but it can amount to a substantial reduction in overall premiums. For example, a family might save 10-20% or more by bundling their homeowners and auto insurance.

Negotiating Lower Insurance Rates

Negotiating with insurance providers is a viable strategy to secure lower rates. It’s crucial to shop around and compare quotes from different companies before initiating negotiations. Armed with competing quotes, you can leverage this information to negotiate a better deal with your current provider or a prospective one. Highlight your clean driving record, years of continuous coverage, and any safety features in your vehicle as bargaining points. Loyalty can also be a factor, so mentioning your long-standing relationship with the company may sway their decision. Remember to be polite and professional throughout the negotiation process.

Impact of Increasing Deductibles on Premiums

Increasing your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, is a direct way to lower your premiums. A higher deductible signifies a lower risk to the insurance company, thus resulting in lower premiums. However, it’s crucial to weigh the financial implications of a higher deductible against the potential savings on premiums. Consider your emergency fund and ability to cover a larger out-of-pocket expense before making this decision. For example, increasing your deductible from $500 to $1000 could result in a noticeable reduction in your monthly premium, but you would be responsible for a larger payment if you were to file a claim.

Finding the Cheapest Car Insurance: A Step-by-Step Guide

Finding the cheapest car insurance involves a systematic approach. First, gather necessary information, including your driving history, vehicle details, and desired coverage levels. Second, utilize online comparison tools to obtain quotes from multiple insurance providers. These tools allow you to input your information and instantly compare prices and coverage options. Third, carefully review the quotes, paying attention to not only the price but also the coverage details. Fourth, contact the insurance providers directly to discuss your options and potentially negotiate lower rates. Finally, choose the policy that best balances cost and coverage based on your individual needs and risk tolerance.

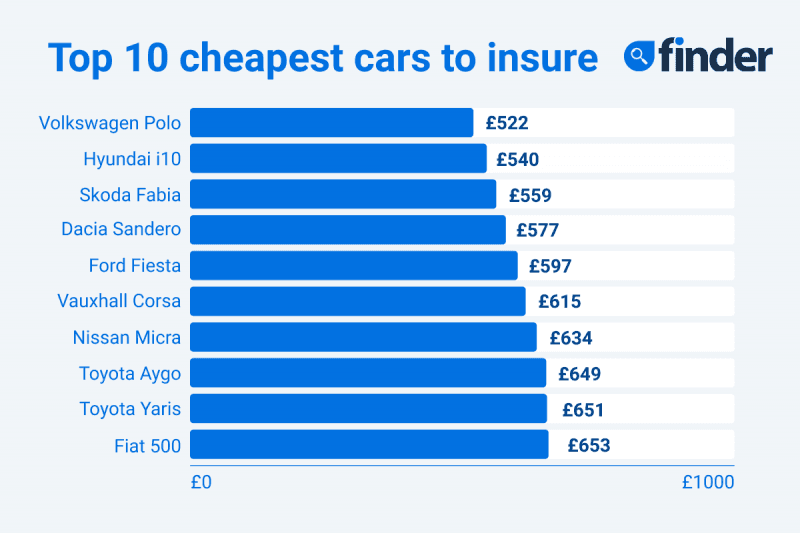

Illustrative Examples of Cost-Effective Cars

Choosing a car with inherently lower insurance premiums can significantly reduce your overall transportation costs. Several factors influence insurance rates, including the vehicle’s safety features, theft rate, repair costs, and its overall claim history. By selecting a model known for its affordability and safety, you can save money on your insurance premiums without compromising on essential features.

Cost-Effective Car Models and Their Key Features

The following examples illustrate vehicles frequently associated with lower insurance costs. These descriptions focus on features that directly impact insurance premiums.

Honda Civic: The Honda Civic consistently ranks high in reliability and safety ratings. Imagine a sleek, silver Civic sedan, its clean lines emphasizing aerodynamic efficiency. Its compact size makes it easy to maneuver and park, reducing the risk of accidents. Key safety features often include multiple airbags, anti-lock brakes (ABS), electronic stability control (ESC), and a robust chassis designed for impact absorption. The image of this car would highlight its unassuming yet dependable design, showcasing details like the integrated headlights and the sturdy-looking bumper. Its overall aesthetic communicates reliability and safety, contributing to its lower insurance profile.

Toyota Corolla: Known for its exceptional fuel efficiency and longevity, the Toyota Corolla is another popular choice for drivers seeking lower insurance costs. Picture a vibrant blue Corolla hatchback, its sporty design hinting at its nimble handling. This model, like the Civic, often boasts a comprehensive suite of safety features, including advanced driver-assistance systems (ADAS) such as lane departure warning and automatic emergency braking. The image should emphasize these safety features, perhaps showing a close-up of the dashboard with the ADAS controls illuminated. The Corolla’s reputation for reliability also contributes to its lower insurance premiums.

Mazda3: The Mazda3 offers a blend of style and practicality, making it an attractive option for budget-conscious drivers. Visualize a sophisticated red Mazda3 sedan, its curves and sporty design capturing attention. While offering a more dynamic appearance than the Civic or Corolla, the Mazda3 still maintains a strong safety profile, often including features like blind-spot monitoring and rear cross-traffic alert. An image showcasing its sleek lines and sophisticated interior would underscore its appeal while highlighting safety elements subtly integrated into its design.

Fuel-Efficient Vehicles with Low Insurance Rates: Detailed Specifications

Fuel efficiency is another key factor influencing insurance premiums, as it often correlates with lower mileage and, consequently, reduced accident risk.

Toyota Prius (Hybrid): The Toyota Prius, a well-known hybrid vehicle, boasts exceptional fuel economy. Its specifications typically include a combined engine output around 120-130 horsepower, depending on the model year, featuring a gasoline engine paired with an electric motor. Key safety features commonly include Toyota Safety Sense, a suite of ADAS features such as pre-collision system with pedestrian detection, lane departure alert, and adaptive cruise control. Its hybrid powertrain contributes to lower running costs, which indirectly impacts insurance premiums.

Honda Insight (Hybrid): Similar to the Prius, the Honda Insight is a hybrid vehicle known for its fuel efficiency and safety. Its specifications vary slightly depending on the model year but generally feature a combined engine output in a similar range to the Prius, usually around 150 horsepower. Safety features are also comprehensive, often mirroring those of the Prius, with systems such as collision mitigation braking system, lane keeping assist system, and adaptive cruise control. The lower fuel consumption directly contributes to reduced running costs and lower insurance premiums.

End of Discussion

Securing the cheapest car insurance doesn’t require sacrificing safety or compromising on essential features. By carefully considering the factors Artikeld in this guide – from choosing the right car model to selecting a suitable insurance provider and employing effective cost-reduction strategies – you can significantly reduce your insurance premiums without compromising your needs. Remember, proactive planning and informed decision-making are key to achieving long-term savings on your auto insurance.

Common Queries

What is considered a “cheap” car insurance rate?

A “cheap” rate is relative to your individual risk profile and location. It’s a rate significantly lower than the average for your circumstances.

Does my credit score affect car insurance rates?

Yes, in many jurisdictions, credit history is a factor in determining insurance premiums. A good credit score can lead to lower rates.

Can I get cheaper insurance with a higher deductible?

Yes, opting for a higher deductible generally lowers your premium, as you’re agreeing to pay more out-of-pocket in the event of a claim.

How often should I shop around for car insurance?

It’s recommended to compare rates from different insurers annually, or even more frequently, to ensure you’re getting the best possible price.

What is the impact of driving infractions on insurance rates?

Driving infractions such as speeding tickets or accidents significantly increase your insurance premiums. Maintaining a clean driving record is crucial for keeping costs low.