Navigating the world of insurance in New York can feel like traversing a maze. Premiums vary wildly, and understanding the factors that influence cost is crucial to securing affordable coverage. This guide delves into the intricacies of finding the cheapest insurance in NY, across auto, home, and health, empowering you to make informed decisions and save money.

We’ll explore the key elements that impact your insurance costs, from your driving record and credit score to the type of coverage you choose. We’ll also debunk common misconceptions and offer practical strategies to negotiate lower premiums and secure the best possible value for your money. Whether you’re a seasoned New Yorker or a newcomer, this guide will provide the knowledge you need to navigate the insurance landscape confidently and economically.

Understanding “Cheapest Insurance in NY”

Finding the cheapest insurance in New York requires understanding the various factors that influence premiums. The cost isn’t solely determined by the type of insurance; individual circumstances play a significant role. This understanding allows consumers to make informed decisions and potentially save money.

Factors Influencing Insurance Costs in New York

Several key factors contribute to the overall cost of insurance in New York. These factors are often intertwined and can significantly impact premiums. Understanding these elements is crucial for securing affordable coverage.

Factors Affecting Insurance Premiums

Several interconnected factors influence insurance costs. Location, for instance, plays a crucial role; areas with higher crime rates or a greater frequency of accidents tend to have higher premiums. Individual driving records, credit scores, and even the age and make of a vehicle all contribute to the final cost. For homeowners insurance, factors like the age and condition of the home, its location, and the presence of security systems all affect premiums. Finally, for health insurance, pre-existing conditions, age, and the chosen plan significantly influence monthly payments. Understanding these variables is crucial for effective cost management.

Types of Insurance in New York

New York residents commonly seek several types of insurance. Each type has its own cost structure and influencing factors.

Auto Insurance

Auto insurance is mandatory in New York. Premiums are determined by factors such as driving history (accidents, tickets), age, location, vehicle type, and coverage levels. Higher coverage limits (liability, collision, comprehensive) generally result in higher premiums. Discounts are often available for safe driving records, multiple-vehicle policies, and driver’s education completion.

Homeowners Insurance

Homeowners insurance protects against property damage and liability. Factors influencing premiums include the home’s location, age, value, construction materials, security systems, and the level of coverage selected. Homes in high-risk areas (e.g., flood zones, areas prone to wildfires) will typically have higher premiums. Bundling homeowners and auto insurance with the same provider can often result in discounts.

Health Insurance

Health insurance is essential for managing medical expenses. In New York, individuals can obtain coverage through the New York State of Health Marketplace, employers, or directly from insurance companies. Premiums are based on factors like age, location, the chosen plan (e.g., bronze, silver, gold, platinum), and pre-existing conditions. Healthier individuals generally pay lower premiums than those with pre-existing conditions.

Common Insurance Misconceptions

Several misconceptions can lead to higher insurance costs. Addressing these misconceptions is vital for securing affordable coverage.

Misconception: The Cheapest Policy is Always Best

This is often untrue. While cost is a significant factor, inadequate coverage can leave you financially vulnerable in the event of an accident or loss. It is crucial to balance cost with the level of protection needed. Choosing a policy with a lower premium but insufficient coverage could prove far more expensive in the long run.

Misconception: Only Accidents Affect Insurance Rates

This is incorrect. Traffic violations, such as speeding tickets, can also significantly impact premiums. Multiple violations can lead to substantial increases in insurance costs. Maintaining a clean driving record is crucial for keeping premiums low.

Misconception: Insurance Rates Remain Static

Insurance rates are not static; they can fluctuate based on various factors, including claims experience and market conditions. Regularly reviewing your policy and comparing rates from different providers is essential to ensure you are receiving the best value for your money. Failing to do so could result in overpaying for years.

Finding Affordable Auto Insurance in NY

Securing affordable auto insurance in New York can feel like navigating a maze, but understanding the key factors influencing premiums and comparing providers can significantly simplify the process. This section will explore how various factors affect your insurance costs and provide a comparison of several major providers.

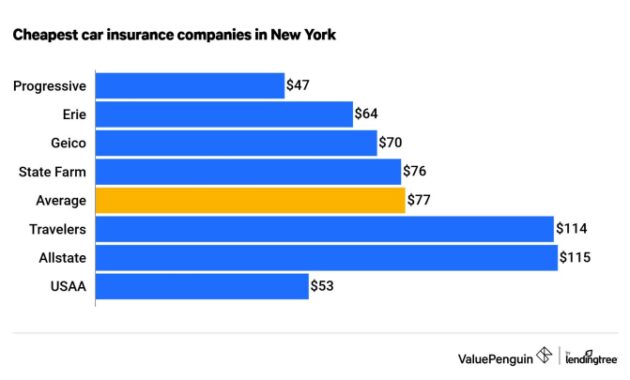

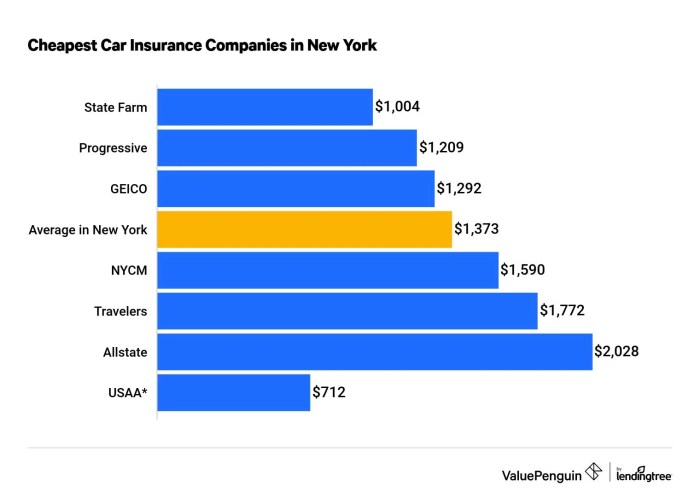

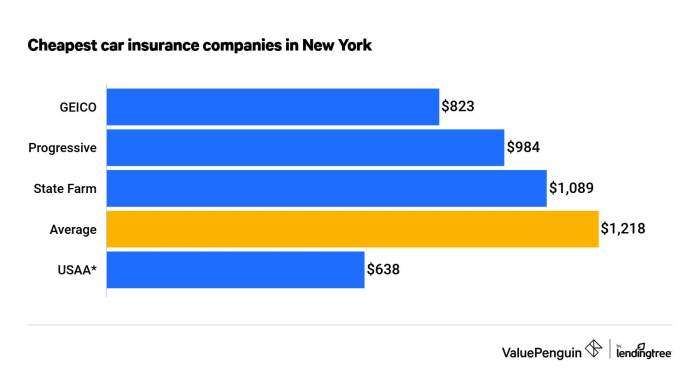

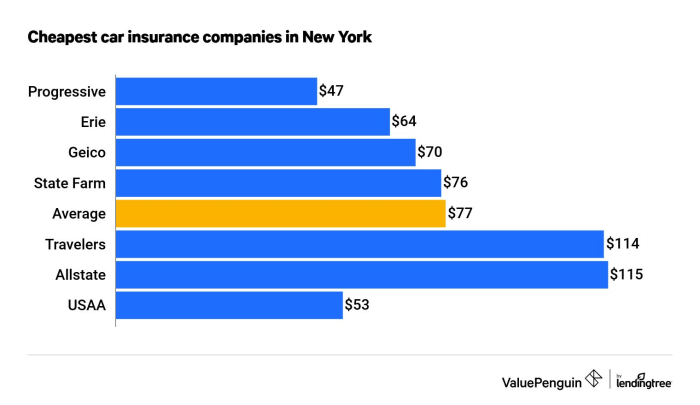

Auto Insurance Provider Comparison in New York

Several factors influence the price and coverage offered by different auto insurance providers in New York. These include the company’s overall risk assessment, the types of policies they specialize in, and their claims handling processes. Larger, nationally recognized companies often have broader coverage options and established claims procedures, but this may come at a higher cost. Smaller, regional companies might offer more competitive rates, but their coverage options might be more limited. It’s crucial to carefully compare policies to ensure you find the right balance between price and protection.

Impact of Driving History, Age, and Location on Premiums

Your driving history, age, and location significantly influence your auto insurance premiums in New York. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, accidents and tickets can substantially increase your rates. Younger drivers, statistically more prone to accidents, typically pay higher premiums than older, more experienced drivers. Location also plays a crucial role; areas with higher accident rates or crime statistics tend to have higher insurance premiums due to the increased risk to insurance companies. For example, a driver with a clean record living in a rural area will likely pay less than a young driver with several accidents living in a densely populated city like New York City.

Comparison of Auto Insurance Providers

The following table compares four major auto insurance providers in New York, showcasing their average rates and key coverage features. Note that these are average rates and actual premiums will vary based on individual factors.

| Provider | Average Annual Rate (Estimate) | Liability Coverage | Collision Coverage |

|---|---|---|---|

| Geico | $1200 | $25,000/$50,000/$10,000 (Bodily Injury/Property Damage) | Comprehensive and Collision available |

| State Farm | $1350 | Variable, customizable | Comprehensive and Collision available, various deductible options |

| Progressive | $1150 | Variable, customizable | Comprehensive and Collision available, Name Your Price® tool |

| Allstate | $1400 | Variable, customizable | Comprehensive and Collision available, various add-ons |

*Note: These rates are estimates and can vary significantly based on individual factors such as driving history, age, location, vehicle type, and coverage level. Contact each provider directly for accurate quotes.*

Health Insurance Options in NY

Navigating the world of health insurance in New York can feel overwhelming, but understanding the available options and their implications is crucial for securing affordable and adequate coverage. This section will explore the key aspects of health insurance in New York, focusing on the Affordable Care Act and the various plan types available.

The Affordable Care Act (ACA) and its Impact on New York

The Affordable Care Act (ACA), also known as Obamacare, significantly impacted the health insurance landscape in New York. The ACA expanded access to health insurance by establishing health insurance marketplaces (exchanges) where individuals and families can compare and purchase plans. It also mandated that most individuals obtain health insurance or pay a penalty (although this penalty was eliminated under the Tax Cuts and Jobs Act of 2017). The ACA’s impact on New York included increased insurance coverage rates and the creation of subsidies to make health insurance more affordable for lower-income individuals and families. These subsidies help offset the cost of premiums, making insurance accessible to a wider population. The ACA also established essential health benefits that all plans must cover, ensuring a minimum level of protection. While the ACA has faced challenges and legal battles, it continues to play a significant role in shaping health insurance availability and affordability in New York.

Different Health Insurance Plans Available in NY

New York offers a variety of health insurance plans, each with its own structure and cost implications. Understanding the differences between these plans is key to choosing the right one for your needs and budget.

Health Insurance Plan Comparison

The following table provides a simplified comparison of common health insurance plan types available in New York. Note that specific costs and network sizes can vary greatly depending on the insurer, plan details, and individual circumstances. These figures are illustrative examples and should not be considered definitive.

| Plan Name | Coverage Details | Average Monthly Cost (Estimate) | Network Size |

|---|---|---|---|

| HMO (Health Maintenance Organization) | Requires selecting a primary care physician (PCP) who coordinates care. Generally lower premiums, but limited choices of specialists and out-of-network care is typically not covered. | $300 – $600 | Large, but limited to in-network providers |

| PPO (Preferred Provider Organization) | Offers more flexibility; you can see any in-network doctor without a referral. Higher premiums than HMOs, but greater access to specialists and out-of-network coverage (at a higher cost). | $500 – $1000 | Very large, includes both in-network and out-of-network providers (with higher cost sharing for out-of-network) |

| EPO (Exclusive Provider Organization) | Similar to HMOs, but typically with a larger network of in-network providers. Out-of-network care is generally not covered. | $400 – $700 | Large, but limited to in-network providers |

| POS (Point of Service) | Combines features of HMOs and PPOs. Requires a PCP, but allows out-of-network care at a higher cost. | $450 – $800 | Large, includes both in-network and out-of-network providers (with higher cost sharing for out-of-network) |

Strategies for Lowering Insurance Costs

Securing affordable insurance in New York requires a proactive approach. By implementing smart strategies, you can significantly reduce your premiums without compromising coverage. This section details several effective methods to achieve lower insurance costs.

Negotiating Lower Insurance Premiums

Negotiating your insurance premiums can be surprisingly effective. Insurance companies often have some flexibility in their pricing, particularly for loyal customers or those with strong risk profiles. Begin by reviewing your current policy and comparing it to quotes from other insurers. Armed with this information, contact your current insurer and politely explain that you’ve found comparable coverage at a lower price. Highlight your history of on-time payments and any positive aspects of your risk profile (e.g., good driving record, homeownership). Don’t be afraid to ask for a discount; many companies are willing to negotiate to retain their customers. Remember to document all communication and any agreements reached.

Bundling Different Types of Insurance

Bundling your insurance policies – for example, combining auto and home insurance – is a common and effective way to lower your overall costs. Many insurance providers offer discounts for bundling, recognizing the reduced administrative costs and increased customer loyalty associated with this practice. This discount can be substantial, potentially saving you hundreds of dollars annually. For instance, a homeowner who bundles their home and auto insurance with the same company might receive a 10-15% discount on both premiums. Carefully compare bundled packages from different providers to ensure you are receiving the best value.

Impact of Driving Record and Credit Score on Insurance Rates

Maintaining a clean driving record and a good credit score are crucial for securing lower insurance premiums. Insurance companies use both factors to assess risk. A history of accidents, speeding tickets, or DUI convictions will significantly increase your premiums. Similarly, a poor credit score can signal higher risk to insurers, leading to higher rates. Conversely, a spotless driving record and a good credit score demonstrate lower risk, making you a more attractive customer and leading to lower premiums. For example, drivers with no accidents in the past five years often qualify for significant discounts, while those with multiple incidents can face premium increases of 50% or more. Similarly, a credit score improvement from poor to good can translate to noticeable premium reductions.

Illustrating Cost Savings

Choosing the right insurance plan in New York can significantly impact your overall costs. Understanding how different features and options affect your premium is key to finding the most affordable coverage without sacrificing necessary protection. Let’s examine a few scenarios to illustrate potential cost savings.

Higher Deductibles and Lower Premiums

Selecting a higher deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, directly influences your premium. A higher deductible means you assume more risk upfront, but in return, the insurance company charges you less for the coverage. For example, consider two auto insurance policies with identical coverage except for the deductible. Policy A has a $500 deductible and costs $1200 annually. Policy B has a $1000 deductible and costs $1000 annually. While Policy A offers a lower out-of-pocket expense in the event of a claim, Policy B saves you $200 annually. This savings could be substantial over several years, offsetting the higher deductible should a minor accident occur. However, it’s crucial to choose a deductible you can comfortably afford in case of an incident.

Bundling Auto and Home Insurance

Many insurance companies offer discounts for bundling your auto and home insurance policies. This practice leverages the combined risk assessment and often results in substantial savings. Let’s say your annual auto insurance premium is $1500 and your home insurance premium is $1000. Separately, this totals $2500. However, if you bundle these policies with the same insurer, you might receive a 15% discount. This discount would amount to $375 (0.15 * $2500), reducing your total annual cost to $2125, representing a considerable saving of $375. This scenario demonstrates the financial advantages of bundling policies. The exact discount percentage varies depending on the insurer and your specific risk profile.

Visual Comparison of Insurance Plans

Imagine a bar graph. The horizontal axis labels two insurance plans: “Plan X” and “Plan Y”. The vertical axis represents the annual cost in dollars. Plan X, offering comprehensive coverage with a low deductible of $250, has a tall bar representing an annual cost of $2000. Plan Y, with more limited coverage and a higher deductible of $1000, has a shorter bar representing an annual cost of $1200. This visual clearly illustrates how a less comprehensive plan, while potentially requiring a larger upfront payment in case of a claim, can result in lower annual premiums. The choice between Plan X and Plan Y depends on individual risk tolerance and financial capabilities.

Summary

Securing the cheapest insurance in NY requires proactive planning and a thorough understanding of the market. By carefully considering the factors influencing your premiums, comparing providers, and employing smart strategies like bundling policies and maintaining a good driving record, you can significantly reduce your insurance costs without sacrificing essential coverage. Remember, the cheapest option isn’t always the best, but with the right information and approach, you can find a balance between affordability and comprehensive protection.

Answers to Common Questions

What is the best way to compare insurance quotes in NY?

Use online comparison tools, contact multiple insurers directly, and be sure to provide accurate information for consistent quote accuracy.

Can I get insurance if I have a poor driving record?

Yes, but your premiums will likely be higher. Consider seeking out high-risk insurance providers or exploring options to improve your driving record.

How often can I change my insurance provider?

Generally, you can switch providers at any time, though there may be penalties depending on your policy terms. It’s advisable to check your policy’s specifics.

What is a deductible and how does it affect my premiums?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, and vice-versa.