Navigating the Texas insurance market can feel like traversing a maze, especially when searching for the most affordable options. This guide demystifies the process, offering insights into factors influencing insurance costs, identifying budget-friendly providers, and equipping you with strategies to secure the cheapest insurance in Texas without sacrificing crucial coverage. We’ll explore various insurance types, from auto and home to health, and delve into the nuances of obtaining competitive quotes.

Understanding the interplay between your personal circumstances, insurance provider practices, and Texas’s unique regulatory landscape is key to securing the best deal. This guide provides a practical framework to help you make informed decisions and save money on your insurance premiums. We will explore the various factors that influence your insurance costs, allowing you to understand how to improve your standing and obtain better rates.

Understanding Texas Insurance Market

Navigating the Texas insurance market requires understanding the various factors influencing costs and the diverse range of insurance options available. This section provides an overview of the key aspects to consider when comparing insurance providers and policies across the state.

Several factors contribute to the cost of insurance in Texas. These include location (urban areas generally have higher premiums due to increased risk of theft and accidents), the type of coverage selected (comprehensive auto insurance will be more expensive than liability-only), the individual’s driving history (accidents and traffic violations significantly impact rates), credit score (insurers often use credit scores as an indicator of risk), and the age and value of the insured property (older homes may require more expensive coverage due to potential repairs).

Types of Insurance Available in Texas

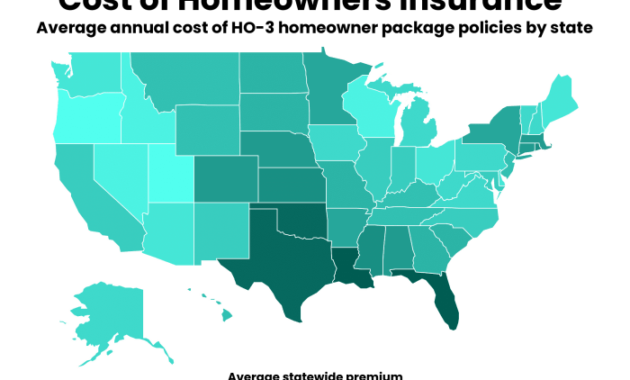

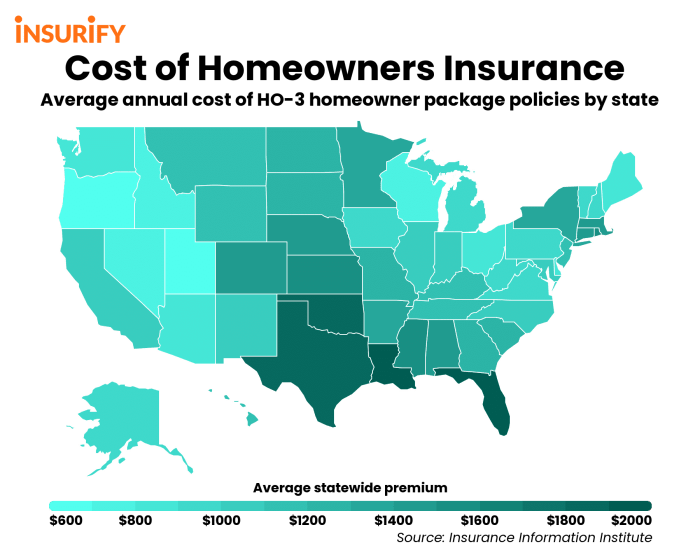

Texas offers a wide variety of insurance options to meet diverse needs. These include auto insurance (liability, collision, comprehensive, uninsured/underinsured motorist), homeowners insurance (covering dwelling, personal property, liability), renters insurance (protecting personal belongings and providing liability coverage), health insurance (through the Affordable Care Act marketplace or private insurers), life insurance (term life, whole life, universal life), and commercial insurance (for businesses). Choosing the right coverage depends on individual circumstances and risk assessment.

Insurance Regulations Across Major Texas Cities

While the Texas Department of Insurance regulates insurance across the state, local factors can influence pricing and availability. For example, cities with higher crime rates might see increased premiums for homeowners and auto insurance. Similarly, areas with higher traffic congestion may have higher auto insurance rates. Specific regulations regarding insurance requirements (such as minimum liability coverage for auto insurance) remain consistent statewide, but the application of those regulations and the resulting premiums can vary based on location-specific risk assessments. Direct comparison of regulations across cities is not easily summarized due to the complexity of actuarial calculations used by insurers, but the underlying principle of risk assessment remains consistent across all jurisdictions within Texas.

Average Insurance Premiums Across Texas Regions

The following table provides a comparison of average annual premiums for different insurance types across four representative Texas regions. These figures are estimates based on industry averages and may vary depending on individual circumstances and insurer. Note that these are averages and your actual premiums may differ significantly.

| Insurance Type | Austin Area | Dallas-Fort Worth Area | Houston Area | San Antonio Area |

|---|---|---|---|---|

| Auto Insurance (Liability Only) | $600 | $750 | $800 | $550 |

| Auto Insurance (Comprehensive) | $1200 | $1500 | $1600 | $1100 |

| Homeowners Insurance (Average Home) | $1500 | $1800 | $1650 | $1400 |

| Renters Insurance | $200 | $250 | $225 | $175 |

Identifying Cheapest Providers

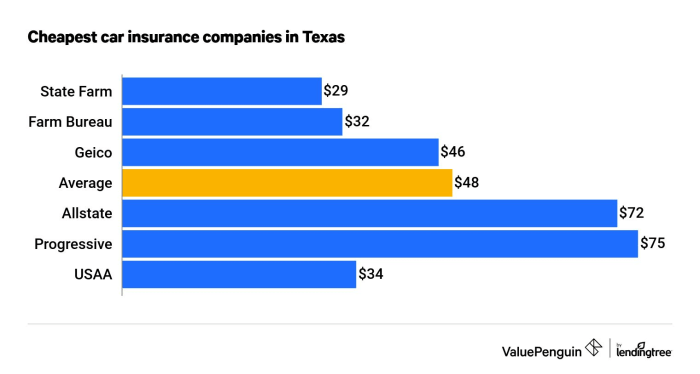

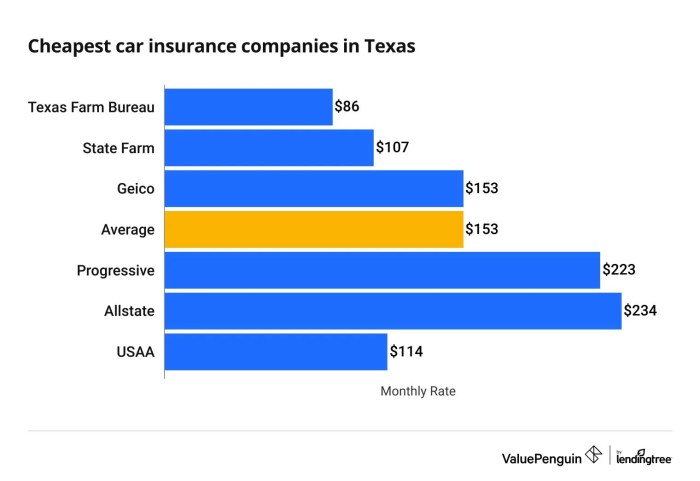

Finding the cheapest car insurance in Texas requires research and comparison. Several factors influence your final premium, and understanding these factors is key to securing the best possible rate. This section will highlight some insurers known for competitive pricing and delve into the specifics of obtaining personalized quotes.

Several insurance companies in Texas are known for offering competitive premiums. It’s crucial to remember that “cheapest” is relative and depends on individual circumstances. However, companies frequently cited for lower rates include Geico, State Farm, and USAA (membership required). These companies often leverage their size and market share to offer attractive pricing, but their actual cost will vary depending on your individual risk profile.

Comparison of Coverage Options from Budget-Friendly Insurers

Comparing coverage options across different insurers is essential to ensure you’re getting adequate protection at the best price. Let’s examine three budget-friendly options: Geico, State Farm, and Progressive. While specific coverage details and prices fluctuate, a general comparison can highlight key differences.

| Insurer | Liability Coverage (Typical Minimum) | Collision Coverage (Example) | Comprehensive Coverage (Example) |

|---|---|---|---|

| Geico | $30,000/$60,000 Bodily Injury, $25,000 Property Damage (rates vary widely) | Covers damage to your vehicle in an accident (price depends on vehicle and deductible) | Covers damage to your vehicle from non-collision events (price depends on vehicle and deductible) |

| State Farm | $30,000/$60,000 Bodily Injury, $25,000 Property Damage (rates vary widely) | Covers damage to your vehicle in an accident (price depends on vehicle and deductible) | Covers damage to your vehicle from non-collision events (price depends on vehicle and deductible) |

| Progressive | $30,000/$60,000 Bodily Injury, $25,000 Property Damage (rates vary widely) | Covers damage to your vehicle in an accident (price depends on vehicle and deductible) | Covers damage to your vehicle from non-collision events (price depends on vehicle and deductible) |

Note: The above is a simplified example and actual rates and coverage details will vary significantly based on factors discussed below. Always check directly with the insurer for accurate quotes.

Factors Determining Individual Insurance Quotes

Numerous factors contribute to the final cost of your car insurance premium. Understanding these factors allows you to make informed decisions and potentially lower your costs.

- Driving Record: Accidents and traffic violations significantly impact your premium. A clean driving record usually translates to lower rates.

- Age and Gender: Statistically, younger drivers and males tend to pay higher premiums due to higher risk profiles.

- Vehicle Type: The make, model, and year of your vehicle influence insurance costs. Expensive or high-performance vehicles generally cost more to insure.

- Location: Your address affects your premium because insurance companies consider the crime rate and accident frequency in your area.

- Credit Score: In many states, including Texas, your credit score can be a factor in determining your insurance rates. A higher credit score generally leads to lower premiums.

- Coverage Levels: The amount of coverage you choose (liability, collision, comprehensive) directly affects your premium. Higher coverage levels mean higher premiums.

Process of Obtaining Insurance Quotes

Getting insurance quotes is straightforward. The following flowchart illustrates the process:

Flowchart: Obtaining Insurance Quotes

Start –> Gather Personal Information (Driving history, vehicle details, address) –> Visit Insurer Websites or Contact Agents –> Request Quotes (Specify desired coverage levels) –> Compare Quotes –> Select Best Option –> Purchase Policy –> End

Finding and Comparing Quotes

Securing the cheapest auto insurance in Texas requires diligent comparison shopping. Don’t settle for the first quote you receive; actively seek out multiple offers to ensure you’re getting the best possible rate. This involves understanding how to effectively obtain and compare quotes from various insurers.

The process of obtaining and comparing auto insurance quotes is straightforward, but requires attention to detail to ensure accuracy and a fair comparison. By following a structured approach, you can efficiently identify the most suitable and cost-effective policy for your needs.

Online Quote Acquisition

Obtaining multiple online quotes is a simple and efficient method to compare insurance options. Many insurance companies offer online quote tools that allow you to quickly input your information and receive a preliminary quote. This eliminates the need for numerous phone calls and allows for side-by-side comparisons.

To obtain accurate quotes, you should visit the websites of several major insurance providers in Texas. Begin by navigating to the “Get a Quote” or similar section on each company’s website. You’ll typically be asked to provide personal information, vehicle details, and driving history. Once submitted, the system will generate a quote within minutes. Remember to repeat this process for at least three to five different insurers to get a broad picture of the market.

Importance of Comparing Policy Details

Simply comparing the premium amount isn’t enough. A lower premium might mask higher deductibles, limited coverage, or other unfavorable terms. Thoroughly reviewing policy details is crucial to make an informed decision. Look beyond the price tag and consider the overall value proposition of each policy.

Factors to compare include coverage limits (liability, collision, comprehensive), deductibles, discounts offered, and any exclusions or limitations. A policy with a slightly higher premium but superior coverage might ultimately offer better value if you’re involved in an accident. Understanding the fine print of each policy ensures you’re choosing a plan that truly protects your financial interests.

Required Information for Accurate Quotes

Providing accurate information is vital for receiving precise quotes. Inaccurate information can lead to misleading price estimates and potential problems later. Be prepared to provide the following details:

Accurate and complete information ensures you receive the most accurate insurance quote possible. Omitting or misrepresenting details could result in a higher premium or even policy cancellation later on. Take the time to gather all necessary information before starting the quote process.

- Personal Information: Name, address, date of birth, driver’s license number.

- Vehicle Information: Year, make, model, VIN number.

- Driving History: Driving record, including accidents, tickets, and prior insurance claims.

- Coverage Preferences: Desired coverage levels (liability, collision, comprehensive).

Sample Auto Insurance Quote Comparison

The following table illustrates a comparison of three hypothetical auto insurance quotes. Remember, these are examples and actual quotes will vary based on individual circumstances.

This table highlights the importance of comparing not only the premium but also the coverage details. Policy A may seem cheapest at first glance, but Policy C offers more comprehensive coverage for a slightly higher price. The best choice depends on your individual risk tolerance and financial situation.

| Insurance Company | Annual Premium | Liability Coverage | Deductible (Collision) |

|---|---|---|---|

| Company A | $800 | $30,000/$60,000 | $500 |

| Company B | $950 | $50,000/$100,000 | $500 |

| Company C | $1050 | $100,000/$300,000 | $250 |

Saving Money on Insurance

Securing affordable car insurance in Texas doesn’t necessitate sacrificing crucial coverage. Several strategies can significantly reduce your premiums without compromising your protection. By implementing these cost-saving measures, you can maintain comprehensive insurance while keeping your budget in check.

Bundling Insurance Policies

Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, is a common and effective way to save money. Insurance companies often offer discounts for customers who bundle multiple policies. This is because managing multiple policies for a single customer is more efficient for the company. The combined premium is usually lower than the sum of individual policies. For example, a homeowner who bundles their home and auto insurance might save 10-15% or more compared to purchasing each policy separately. The exact savings depend on the insurer and the specific policies bundled.

Maintaining a Good Driving Record

A clean driving record is one of the most significant factors influencing your car insurance premiums. Insurance companies view drivers with a history of accidents or traffic violations as higher risk, leading to increased premiums. Conversely, maintaining a spotless driving record demonstrates responsible driving habits, making you a lower-risk driver and thus eligible for significant discounts. A driver with no accidents or tickets in the past three to five years can expect substantially lower rates than someone with multiple incidents on their record. This discount can often amount to hundreds of dollars annually.

Utilizing Available Discounts

Many insurance companies offer a variety of discounts to incentivize safe driving practices and customer loyalty. These discounts can significantly reduce your overall premium. Common discounts include those for good students, safe drivers, and those who install anti-theft devices in their vehicles. Furthermore, some insurers offer discounts for bundling policies, paying premiums in full, or opting for paperless billing.

Visual Representation of Cost Savings

A bar chart illustrating potential savings would show several bars, each representing a different discount type. For instance, one bar might represent the savings from a “good student” discount (e.g., $100 per year), another for a “safe driver” discount (e.g., $150 per year), another for bundling (e.g., $200 per year), and a final bar showing the combined savings from all discounts (e.g., $450 per year). The height of each bar would directly correlate to the amount of money saved. This visual representation clearly demonstrates the cumulative effect of utilizing multiple discounts to achieve substantial cost savings. The chart’s x-axis would list the discount types, while the y-axis would represent the dollar amount saved.

Closing Notes

Securing the cheapest insurance in Texas requires diligent research, a clear understanding of your needs, and a proactive approach to cost reduction. By leveraging the strategies and insights Artikeld in this guide, you can confidently navigate the insurance market, compare quotes effectively, and obtain the most affordable policy that meets your specific requirements. Remember, securing the best rates often involves a combination of careful planning, comparison shopping, and a commitment to maintaining a strong insurance profile.

Detailed FAQs

What is the average cost of car insurance in Texas?

The average cost varies significantly based on factors like age, driving history, location, and the type of coverage. It’s best to obtain personalized quotes for accurate pricing.

Can I get car insurance without a driver’s license?

Generally, no. Most insurers require a valid driver’s license to issue a policy. However, there may be limited exceptions depending on the specific circumstances and the insurer.

How often can I change my insurance provider?

You can typically switch insurance providers whenever your current policy renews. There may be penalties for early cancellation, so it’s crucial to review your policy terms.

Does my credit score affect my insurance premiums?

Yes, in many cases, your credit score is a factor in determining your insurance rates. A higher credit score generally leads to lower premiums.