Navigating the world of insurance can feel like deciphering a complex code. Finding the cheapest insurance quotes isn’t simply about grabbing the lowest price; it’s about understanding your needs, comparing apples to apples, and recognizing potential hidden costs. This guide unravels the mysteries behind insurance pricing, empowering you to make informed decisions and secure the best coverage without breaking the bank.

From understanding the factors that influence premiums—like your age, driving history, and credit score—to mastering the art of comparing quotes from different insurers, we’ll equip you with the knowledge and strategies to find affordable insurance that meets your specific requirements. We’ll explore various insurance types, delve into the details of policy coverage, and reveal how to negotiate for better rates. Ultimately, our aim is to help you find the optimal balance between cost and comprehensive protection.

Understanding “Cheapest Insurance Quotes”

Securing the cheapest insurance quotes involves a careful understanding of various factors and a strategic approach to comparison shopping. Finding the lowest price isn’t always about simply choosing the cheapest option outright; it’s about finding the best value for your specific needs and risk profile. This requires understanding how insurers determine premiums and the different types of coverage available.

Factors Influencing Insurance Costs

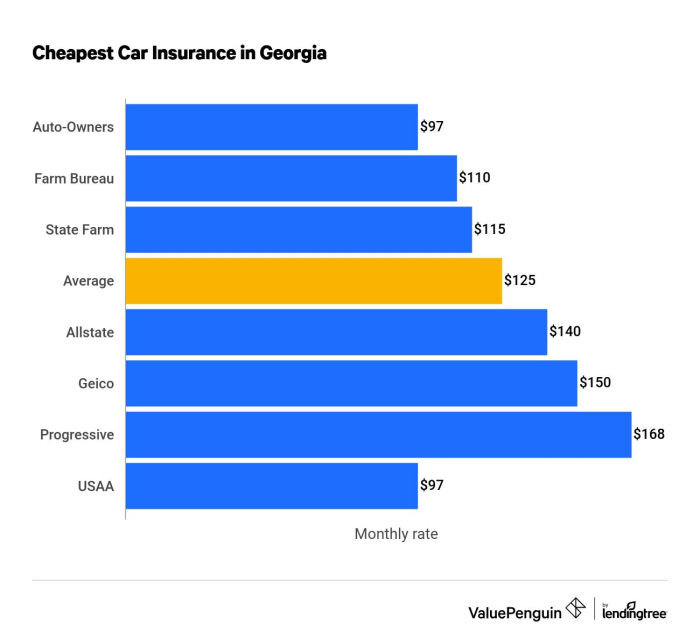

Several key factors significantly influence the cost of insurance premiums. These factors vary depending on the type of insurance, but common threads include individual risk assessment, claims history, and the coverage level selected. For example, a driver with a history of accidents will generally pay more for car insurance than a driver with a clean driving record. Similarly, a homeowner in a high-risk area (prone to natural disasters) will typically pay more for homeowners insurance than someone in a low-risk area. Credit scores, age, location, and the type of vehicle or home being insured also play a role in determining premiums. Insurers use sophisticated algorithms and statistical models to assess risk and calculate premiums accordingly.

Types of Insurance and Their Costs

Different types of insurance have varying cost structures. Auto insurance, for instance, considers factors like the vehicle’s make and model, driving history, and location. Homeowners insurance takes into account the home’s value, location, and construction materials. Health insurance costs are influenced by factors such as age, health status, chosen plan, and location. Life insurance premiums depend on the policy type (term or whole life), the death benefit amount, and the insured’s age and health. Each type of insurance has its own unique set of factors that contribute to the final cost.

Situations Where Cheapest Quotes Are Crucial

Finding the cheapest insurance quotes becomes especially crucial during times of financial constraint. For instance, young adults starting their careers may find it necessary to prioritize affordability when securing their first auto or renters insurance. Similarly, families with limited disposable income may need to carefully compare quotes to find the most cost-effective health insurance plan. Individuals facing job loss or unexpected expenses might also be highly motivated to secure the cheapest available options to manage their financial burdens. In such scenarios, balancing affordability with adequate coverage becomes a key consideration.

Strategies for Effective Quote Comparison

Comparing insurance quotes effectively involves a multi-step process. First, identify your insurance needs (auto, home, health, etc.) and the desired coverage levels. Then, utilize online comparison tools and contact multiple insurance providers directly to obtain quotes. Be sure to compare not only the premium costs but also the coverage details and policy exclusions. Consider factors like deductibles and co-pays to fully understand the total cost of ownership. Don’t hesitate to negotiate with insurers to potentially secure a lower premium. Finally, carefully review the policy documents before making a final decision to ensure you fully understand the terms and conditions.

Finding and Evaluating Quotes

Securing the cheapest insurance often involves comparing quotes from multiple providers. This process requires a systematic approach to ensure you’re making an informed decision based on accurate information and a thorough understanding of the policy details. Failing to do so could lead to unexpected costs or inadequate coverage.

Obtaining and evaluating insurance quotes is a crucial step in finding the best value for your money. A well-structured approach will save you time and ensure you don’t overlook important factors.

Step-by-Step Guide to Obtaining Quotes

Gathering quotes efficiently requires a structured process. The following steps Artikel a recommended approach to compare insurance options effectively.

- Identify Your Needs: Determine the type and amount of coverage you require. Consider factors like your vehicle’s value (for car insurance), the size of your home (for homeowners insurance), or your health needs (for health insurance).

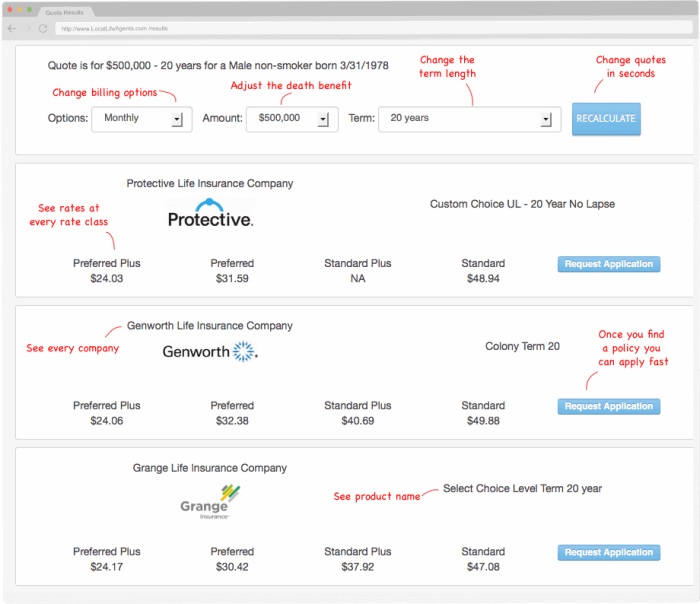

- Use Online Comparison Tools: Many websites allow you to enter your information once and receive quotes from multiple insurers simultaneously. This saves considerable time and effort.

- Contact Insurers Directly: While online tools are convenient, contacting insurers directly can provide more personalized service and allow you to ask specific questions about policy details.

- Provide Accurate Information: Ensure all information provided is accurate and complete. Inaccurate information can lead to incorrect quotes or policy cancellations.

- Compare Quotes Carefully: Don’t just focus on the price. Compare coverage details, deductibles, and any additional fees or limitations.

Insurance Quote Comparison Table

A comparison table helps visualize the differences between various insurance quotes. Below is an example; remember to replace this with your own research.

| Insurer | Coverage | Price (Annual) | Key Features |

|---|---|---|---|

| Insurer A | $50,000 Liability, $25,000 Property Damage | $800 | Accident Forgiveness, Roadside Assistance |

| Insurer B | $100,000 Liability, $50,000 Property Damage | $950 | 24/7 Claims Service, Rental Car Reimbursement |

| Insurer C | $75,000 Liability, $30,000 Property Damage | $750 | Telematics Program, Discount for Safe Driving |

| Insurer D | $100,000 Liability, $50,000 Property Damage, Uninsured Motorist | $1050 | Comprehensive Coverage, Gap Insurance Option |

Understanding Policy Details

Before selecting a plan, carefully review the policy documents. Don’t rely solely on summaries or sales pitches. Understanding the fine print is crucial to avoid unexpected expenses or inadequate protection.

Pay close attention to deductibles, premiums, coverage limits, exclusions, and any additional fees. For example, a policy might seem cheap initially but have a high deductible, meaning you’ll pay a significant amount out-of-pocket before the insurance company covers expenses. Similarly, certain types of damage or events might be excluded from coverage.

Potential Hidden Costs and Limitations

Cheap insurance policies may have hidden costs or limitations that negate their apparent affordability. These can significantly impact the overall cost and effectiveness of your coverage.

- High Deductibles: A lower premium often comes with a higher deductible, meaning you’ll pay more out-of-pocket before the insurance company starts covering claims.

- Limited Coverage: Some policies offer minimal coverage, leaving you vulnerable to significant financial losses in the event of a major accident or incident.

- Additional Fees: Be aware of potential fees for things like administrative charges, processing fees, or optional add-ons that can inflate the total cost.

- Restrictions on Claims: Some insurers may have strict rules or limitations on filing claims, making it difficult to get the coverage you need when you need it.

Navigating the Insurance Landscape

Finding the cheapest insurance quote is only half the battle. Understanding the insurance industry’s complexities and navigating its nuances is crucial to securing the best coverage at the most affordable price. This section will equip you with the knowledge and strategies needed to confidently manage your insurance needs.

Insurance Jargon and Terminology

Insurance policies are often filled with technical terms that can be confusing. Familiarizing yourself with common jargon will empower you to make informed decisions. For example, “premium” refers to the regular payment you make for your insurance coverage, while “deductible” is the amount you pay out-of-pocket before your insurance coverage kicks in. “Liability” refers to your responsibility for damages caused to others, and “coverage” defines the extent of protection offered by your policy. Understanding terms like “co-pay,” “coinsurance,” and “exclusion” is equally important for comprehending the specifics of your policy. A thorough review of your policy documents, or seeking clarification from your insurer, is always recommended.

Negotiating Lower Premiums

Several strategies can help you negotiate lower insurance premiums. Shop around and compare quotes from multiple insurers. Bundling your insurance policies (home and auto, for example) can often result in significant discounts. Maintaining a good driving record (for auto insurance) or a good credit score (for many types of insurance) can lead to lower premiums. Consider increasing your deductible; a higher deductible typically translates to lower premiums, although it means you’ll pay more out-of-pocket in the event of a claim. Finally, inquire about discounts offered for safety features in your home or vehicle, or for completing defensive driving courses. Remember to be polite and persistent when negotiating; insurers are often willing to work with customers who demonstrate a commitment to responsible insurance practices. For example, a driver with a clean record for five years might be able to negotiate a lower rate than a driver with multiple accidents or speeding tickets.

Filing a Claim and its Impact on Premiums

Filing a claim is a necessary step when an insured event occurs, but it can impact your future premiums. The process typically involves reporting the incident to your insurer, providing necessary documentation (police reports, medical bills, etc.), and cooperating with the insurer’s investigation. While a single, minor claim might not significantly affect your premiums, multiple claims or claims involving substantial costs can lead to premium increases. The insurer assesses the risk associated with insuring you based on your claims history. Therefore, it is crucial to only file legitimate claims and to avoid making unnecessary claims. Understanding your policy’s terms and conditions, including the deductible and coverage limits, is essential before filing a claim. For instance, filing a claim for minor damage that falls below your deductible might not be cost-effective.

Reputable Sources for Comparing Insurance Options

Comparing insurance options from various providers is essential for finding the best value. Several reputable sources can assist in this process.

- Independent insurance agents: These agents represent multiple insurance companies, allowing you to compare various options in one place.

- Online comparison websites: Many websites allow you to input your information and compare quotes from different insurers simultaneously.

- Directly contacting insurance companies: You can obtain quotes directly from individual insurance companies’ websites or by phone.

- Consumer advocacy groups: Organizations such as the National Association of Insurance Commissioners (NAIC) provide resources and information on insurance issues.

Using a combination of these resources will provide a comprehensive overview of available insurance options and help you make an informed decision.

Long-Term Cost Considerations

Securing the cheapest insurance quote initially might seem appealing, but focusing solely on the upfront price can lead to significant financial drawbacks in the long run. Understanding the broader implications of your insurance choices is crucial for long-term financial well-being. A comprehensive approach considers not just the immediate cost but also the potential for future expenses and the overall value received.

Consequences of Choosing the Cheapest Option

Prioritizing the absolute lowest premium without considering other factors can result in inadequate coverage, leaving you vulnerable to substantial out-of-pocket expenses in the event of a claim. For example, opting for a policy with a high deductible might save money upfront, but a major accident could lead to a crippling financial burden. Similarly, insufficient liability coverage could expose you to devastating lawsuits. The seemingly small savings on premiums can be easily dwarfed by the costs associated with underinsurance.

Insurer Financial Stability and Customer Service

The financial strength and reputation of the insurance company are paramount. Choosing a financially unstable insurer risks the possibility of them becoming insolvent and unable to pay claims. Similarly, a company with a poor customer service record can lead to frustrating claim processes and delays in receiving reimbursements. Researching an insurer’s ratings from independent agencies, such as A.M. Best, can provide valuable insights into their financial stability and reliability. Reading online reviews can also illuminate the experiences of other customers with the company’s claims process and customer support.

Impact of Life Changes on Insurance Costs

Life transitions significantly influence insurance premiums. Getting married, buying a home, having children, or changing jobs can all trigger adjustments to your insurance needs and costs. For example, adding a spouse to your car insurance policy will generally increase the premium, while purchasing a home necessitates homeowners insurance, adding another significant expense. Similarly, a career change might affect your income and therefore your eligibility for certain discounts or the type of coverage you can afford. Regularly reviewing your insurance needs and policies as your circumstances change is essential to ensure you maintain adequate coverage at a reasonable cost.

Visualizing Long-Term Insurance Costs

An infographic depicting the long-term cost implications of different insurance choices would utilize a line graph. The x-axis would represent time (in years, spanning, for example, 10-20 years). The y-axis would represent total cost (premium payments plus out-of-pocket expenses for claims). Three lines would be plotted: one representing the cheapest option (potentially showing a low initial cost but steeper rise due to high out-of-pocket expenses in the event of a claim), a second representing a moderately priced option with balanced coverage, and a third representing a more expensive option with comprehensive coverage. The infographic would clearly illustrate how, over time, the seemingly cheapest option might become the most expensive due to higher claim costs, while a more comprehensive policy, though initially pricier, could result in lower overall expenses over the long term, particularly if a significant claim arises. The visual comparison would highlight the importance of considering long-term value rather than solely focusing on the initial premium.

Final Review

Securing the cheapest insurance quotes requires a strategic approach that goes beyond simply selecting the lowest price. By understanding the intricacies of insurance pricing, diligently comparing quotes, and carefully examining policy details, you can confidently choose a plan that provides adequate coverage without unnecessary expenses. Remember, long-term value and the insurer’s financial stability are crucial considerations alongside initial cost. Armed with this knowledge, you can navigate the insurance landscape with greater confidence and secure the best possible protection for your future.

FAQ Guide

What is a deductible, and how does it affect my premium?

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles generally lead to lower premiums, as you’re assuming more of the risk. Conversely, lower deductibles result in higher premiums.

Can I get cheaper insurance if I bundle policies?

Yes, many insurers offer discounts for bundling multiple policies, such as auto and home insurance, under one provider. This is often a significant way to save money.

How often should I review my insurance policies?

It’s advisable to review your insurance policies at least annually, or whenever there’s a significant life change (marriage, new home, new car, etc.), to ensure you have the right coverage at the best price.

What if I have a poor driving record? Will this significantly impact my premiums?

Yes, a poor driving record (accidents, tickets) will likely result in higher insurance premiums. However, some insurers may offer programs to help drivers with less-than-perfect records.

Are there any resources to help me compare insurance quotes easily?

Several online comparison websites allow you to enter your information and receive quotes from multiple insurers simultaneously. However, always verify the information directly with the insurance companies.