Directors and Officers (D&O) liability insurance is a critical safeguard for businesses of all sizes. It protects the individuals leading an organization – its directors and officers – from financial ruin stemming from lawsuits alleging wrongful acts in their professional capacity. This insurance covers a wide range of potential claims, from shareholder disputes to regulatory investigations, offering a crucial safety net in today’s complex legal landscape. Understanding the nuances of D&O insurance is vital for any organization seeking to mitigate its risk exposure and protect its leadership team.

This comprehensive guide explores the essential components of D&O insurance, detailing its coverage, the claims process, and the factors influencing policy costs. We’ll examine who needs this type of insurance, exploring scenarios where it proves invaluable and highlighting the potential consequences of inadequate coverage. Ultimately, this resource aims to empower organizations to make informed decisions regarding their D&O insurance needs, ensuring appropriate protection for their leadership and the overall financial health of the business.

Defining “D and O Insurance”

Directors and Officers (D&O) liability insurance is a crucial type of coverage protecting company directors and officers from financial losses resulting from lawsuits alleging wrongful acts in their professional capacity. It’s a critical component of corporate risk management, shielding individuals and the organization from potentially devastating legal costs and judgments. This insurance policy acts as a safety net, mitigating the personal financial liability of those entrusted with the leadership of a company.

D&O insurance policies typically cover a range of claims arising from alleged wrongful acts committed by directors and officers in their official roles. This coverage extends to a wide spectrum of potential liabilities, ensuring comprehensive protection for the individuals and the organization.

Covered Claims Under a D&O Policy

A D&O policy typically covers claims alleging a variety of wrongful acts, including but not limited to breaches of fiduciary duty, mismanagement, negligence, fraud, and violations of securities laws. The specific coverage will vary depending on the policy’s terms and conditions, but generally aims to protect against claims related to the management and operation of the company. These claims can originate from shareholders, employees, customers, competitors, or regulatory bodies. For example, a claim might allege that directors failed to properly oversee financial reporting, leading to losses for investors. Another example could involve allegations of discriminatory employment practices leading to a lawsuit.

Situations Where D&O Insurance is Crucial

D&O insurance proves indispensable in numerous high-risk scenarios. For instance, a public company facing a shareholder derivative lawsuit alleging mismanagement would benefit immensely from this protection. Similarly, a company facing regulatory scrutiny due to alleged accounting irregularities would find D&O coverage critical in covering legal fees and potential settlements. A smaller company facing a lawsuit from a disgruntled customer over a product defect could also find this coverage invaluable in mitigating financial risk. The potential for significant financial losses associated with these scenarios highlights the importance of adequate D&O insurance.

Comparison with Other Liability Insurance

While D&O insurance shares similarities with other liability insurance types, key distinctions exist. Unlike general liability insurance, which covers bodily injury or property damage caused by a company’s operations, D&O insurance specifically targets claims against directors and officers for their actions in managing the company. It differs from errors and omissions (E&O) insurance, which covers professional negligence for service providers, by focusing solely on the actions of directors and officers within a corporate context. While there can be overlap, D&O insurance provides a unique layer of protection tailored to the specific risks faced by corporate leadership. The key difference lies in the specific individuals and the nature of the alleged wrongdoing being covered.

Who Needs D&O Insurance?

Directors and officers (D&O) insurance isn’t just for large corporations; it’s a crucial risk management tool for a wide range of organizations. The potential for lawsuits and financial losses stemming from management decisions is a significant concern for many businesses, regardless of size or structure. Understanding who benefits most from this coverage is key to effective risk mitigation.

Many organizations can significantly benefit from D&O coverage. The specific risks and potential exposures vary considerably depending on the organization’s structure, industry, and size. However, the common thread is the potential for liability arising from the actions or inactions of the organization’s leadership.

Types of Organizations Benefiting from D&O Coverage

Corporations, both large and small, frequently purchase D&O insurance. Larger corporations face potentially enormous financial losses from shareholder lawsuits, regulatory investigations, and other forms of litigation. Smaller corporations, while facing smaller potential losses, still benefit from the protection against potentially crippling lawsuits that could result from management decisions. Nonprofit organizations, while not driven by profit, are still subject to lawsuits related to mismanagement of funds, breach of fiduciary duty, or other claims. Similarly, partnerships and limited liability companies (LLCs) can also find D&O insurance beneficial to protect their members from personal liability.

Specific Risks Faced by Different Organizational Structures

Corporations face the risk of shareholder derivative lawsuits, alleging mismanagement that harmed the company’s value. Nonprofit organizations may face lawsuits alleging mismanagement of donations or failure to uphold their charitable mission. Smaller businesses might face lawsuits from customers or employees related to operational issues or employment practices. The potential severity of these risks varies depending on the size and complexity of the organization. Larger corporations often have more complex operations, leading to higher potential exposure and larger potential payouts in case of a lawsuit.

Industries Where D&O Insurance is Particularly Important

D&O insurance is particularly crucial in industries with high regulatory scrutiny, such as finance, healthcare, and pharmaceuticals. These industries often face complex regulations and a greater likelihood of lawsuits related to compliance issues or alleged misconduct. The technology sector, with its rapid innovation and potential for intellectual property disputes, also benefits significantly from D&O coverage. Furthermore, industries with high public profile and significant media attention are often more vulnerable to reputational damage and related litigation, making D&O insurance even more vital.

Hypothetical Scenario Illustrating the Need for D&O Insurance in a Small Business

Imagine a small bakery, “Sweet Success,” owned and operated by three partners. One partner, without consulting the others, decides to use a cheaper, unapproved ingredient, resulting in several customers experiencing allergic reactions. This leads to a lawsuit, with customers demanding significant compensation for medical expenses and emotional distress. Without D&O insurance, the partners face personal liability for the entire cost of the lawsuit, potentially leading to significant financial hardship or even bankruptcy. D&O insurance would cover the legal costs and potential settlements, protecting the partners’ personal assets.

The Claims Process

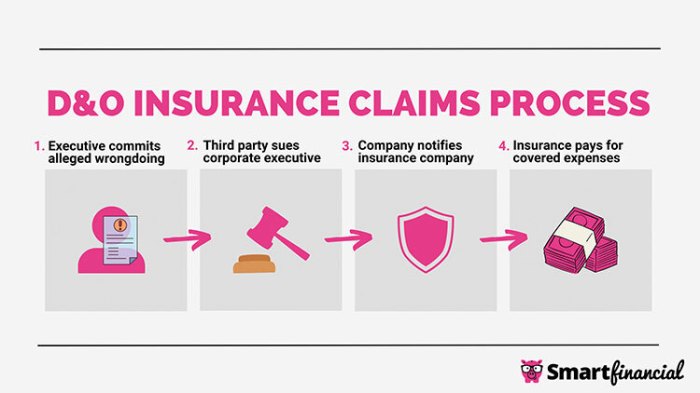

Filing a D&O insurance claim can seem daunting, but understanding the process can significantly ease the burden. This section Artikels the steps involved, the insurer’s role, the importance of record-keeping, and the potential consequences of delayed notification.

The D&O claims process is designed to protect both the insured and the insurer. It involves a structured approach to investigating and resolving claims, ensuring fairness and transparency throughout.

D&O Claim Filing Procedure

A D&O claim typically begins with a formal written notification to the insurer. This notification should include all relevant details surrounding the claim, including the nature of the allegation, the parties involved, and any supporting documentation. Prompt and thorough reporting is crucial for a smooth claims process. Failure to promptly report can jeopardize coverage.

- Initial Notification: Submit a detailed written notification to your insurer immediately upon becoming aware of a potential claim. This should include dates, names, locations, and a summary of the events.

- Claim Investigation: The insurer will conduct a thorough investigation, collecting information from various sources, including the insured, involved parties, and relevant documentation.

- Claim Evaluation: Based on the investigation, the insurer will evaluate the claim’s validity and potential liability.

- Settlement Negotiation: If liability is established, the insurer will negotiate a settlement with the claimant or proceed to litigation if necessary.

- Defense Costs: The policy typically covers defense costs, including legal fees and expert witness expenses, even if the claim is ultimately found to be without merit.

- Indemnification: If the claim is settled or a judgment is rendered against the insured, the insurer will provide indemnification up to the policy limits.

The Insurer’s Role in Claim Investigation and Handling

The insurer plays a crucial role in investigating and handling D&O claims. Their responsibilities extend beyond simply paying out settlements; they actively manage the entire claims process, ensuring that it is conducted fairly and efficiently. This includes:

- Assigning a claims adjuster to manage the claim.

- Conducting thorough investigations to determine the facts of the case.

- Negotiating settlements with claimants.

- Providing legal representation to the insured.

- Managing the defense of the claim, including the hiring of legal counsel and experts.

The Importance of Accurate Record-Keeping

Maintaining accurate and comprehensive records is paramount throughout the entire process. This documentation serves as crucial evidence during the insurer’s investigation and any subsequent legal proceedings. Detailed records significantly expedite the claims process and improve the likelihood of a favorable outcome. Examples of important records include meeting minutes, emails, contracts, and financial statements. Poor record-keeping can delay or even prevent coverage.

Impact of Delayed Claim Notification

Delayed notification of a claim can severely jeopardize coverage. Many D&O policies contain strict reporting requirements, often specifying a timeframe within which the insurer must be notified. Failure to meet these deadlines can result in the insurer denying coverage, leaving the insured liable for all costs and damages. For example, a company that delays reporting a securities class action lawsuit for several months might find its coverage denied due to a breach of the policy’s prompt notification clause. The consequences of a delayed notification can be financially devastating.

Conclusive Thoughts

Securing adequate D&O insurance is a strategic move that protects not only the individuals leading an organization but also its financial stability. By understanding the intricacies of coverage, claims processes, and policy considerations, organizations can effectively mitigate the risks associated with potential lawsuits and regulatory scrutiny. Proactive planning and careful selection of a D&O policy are essential to ensuring robust protection against unforeseen liabilities and maintaining the long-term success of the business. Remember to regularly review your coverage to ensure it aligns with your evolving risk profile.

Detailed FAQs

What is the difference between D&O insurance and general liability insurance?

D&O insurance specifically covers directors and officers for wrongful acts in their professional capacity, while general liability insurance covers bodily injury or property damage caused by the business’s operations.

How much does D&O insurance cost?

The cost varies greatly depending on factors such as the size and type of organization, industry, risk profile, and coverage limits.

What happens if I don’t have D&O insurance and a claim is filed against me?

You would be personally liable for all legal fees and any judgments awarded against you. This could lead to significant financial losses and personal bankruptcy.

Can I get D&O insurance if my company is a non-profit?

Yes, non-profit organizations can and often do purchase D&O insurance to protect their board members and officers from liability.

How long does it take to file a claim?

The claims process can vary, but it’s crucial to notify your insurer as soon as possible after a potential claim arises.