The question, “Do I need life insurance?” is a crucial one, impacting financial security for you and your loved ones. It’s not a simple yes or no; rather, it’s a question that necessitates careful consideration of your personal circumstances, financial goals, and risk tolerance. This guide delves into the intricacies of life insurance, helping you navigate the complexities and make an informed decision.

We’ll explore various types of policies, from term life to whole life and universal life, outlining their features and suitability for different life stages and financial situations. We’ll also examine how factors like age, income, dependents, and existing assets influence your need for coverage, guiding you through a process of calculating your ideal insurance amount.

Understanding Your Need for Life Insurance

Life insurance serves a fundamental purpose: providing financial security for your loved ones in the event of your death. It acts as a safety net, ensuring they can maintain their lifestyle, pay off debts, and cover future expenses without facing immediate financial hardship. The benefits extend beyond simple financial protection; it offers peace of mind, knowing your family’s future is secured.

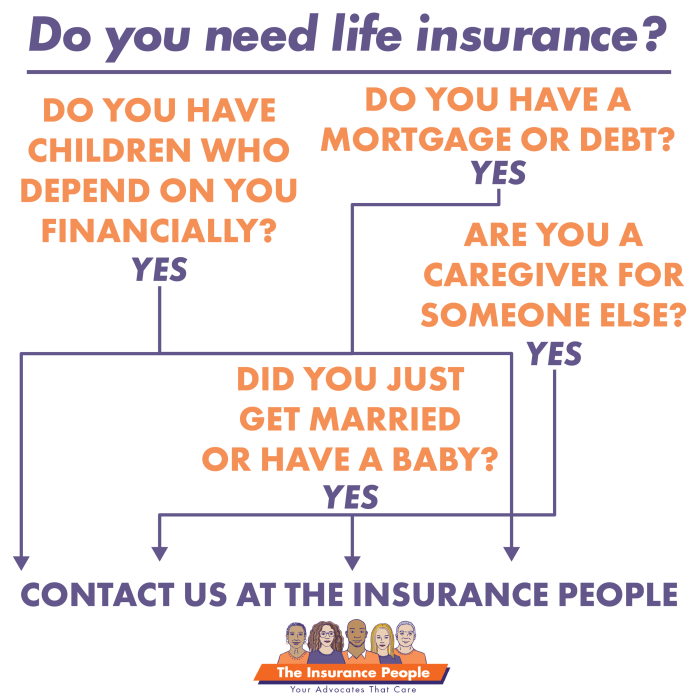

Life insurance is particularly crucial in various scenarios. For example, if you are the primary breadwinner in your family, life insurance replaces your lost income, allowing your dependents to continue paying their mortgage, children’s education, and other essential living expenses. Similarly, if you have significant debts, such as a mortgage or outstanding loans, life insurance can cover these obligations, preventing your family from inheriting financial burdens. Furthermore, life insurance can fund significant future expenses, like college tuition for your children or long-term care for elderly parents.

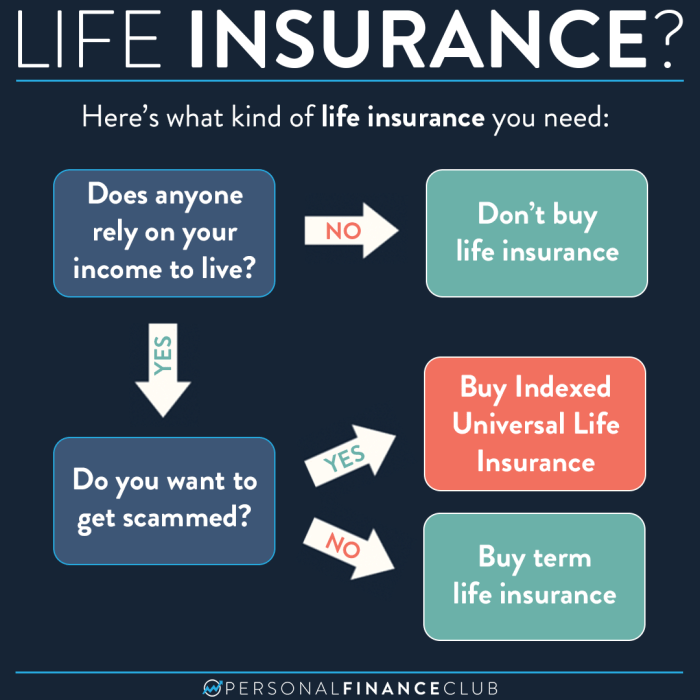

Types of Life Insurance Policies

Several types of life insurance policies cater to different needs and budgets. Understanding their key features is essential for making an informed decision.

| Policy Type | Coverage Duration | Cost | Key Benefits |

|---|---|---|---|

| Term Life Insurance | Specific period (e.g., 10, 20, 30 years) | Relatively low | Provides affordable coverage for a set period, ideal for temporary needs like mortgage protection. |

| Whole Life Insurance | Lifetime coverage | Higher premiums | Offers lifelong protection and builds cash value that grows tax-deferred. |

| Universal Life Insurance | Lifetime coverage | Flexible premiums | Combines lifetime coverage with adjustable premiums and cash value growth, offering more flexibility than whole life. |

| Variable Life Insurance | Lifetime coverage | Higher premiums | Offers lifetime coverage with cash value that grows based on investment performance, carrying higher risk and potential reward. |

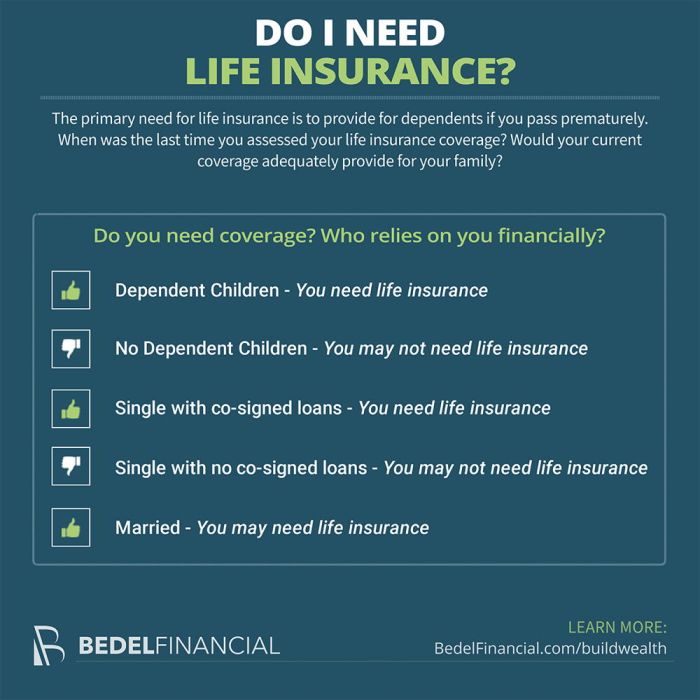

Assessing Your Personal Circumstances

Determining your need for life insurance involves a careful consideration of your unique financial situation and personal goals. Several key factors contribute to this assessment, allowing you to determine the appropriate coverage amount, if any, that aligns with your circumstances.

Your personal circumstances significantly influence your life insurance needs. Understanding these factors allows for a more accurate assessment of your coverage requirements. Failing to consider these elements could lead to either insufficient or excessive coverage, both of which can have significant financial consequences.

Age and Health

Age and health status are primary factors affecting life insurance premiums and eligibility. Younger, healthier individuals typically qualify for lower premiums due to a statistically lower risk of early death. Conversely, older individuals or those with pre-existing health conditions may face higher premiums or even be denied coverage altogether. For example, a 30-year-old non-smoker in excellent health will likely receive a much more favorable rate than a 60-year-old with a history of heart disease. This highlights the importance of securing life insurance early, while premiums are lower and eligibility is more likely.

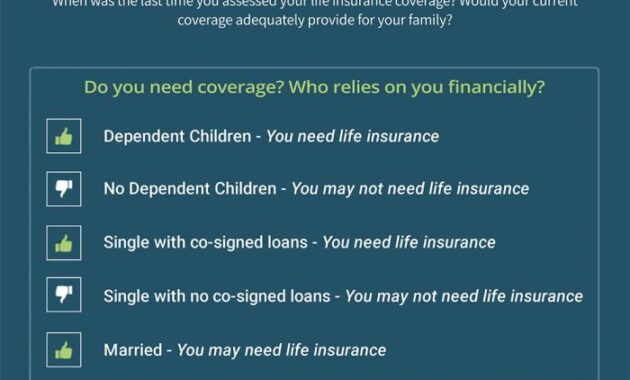

Income and Dependents

Your income level directly impacts your ability to replace lost income should you die unexpectedly. The presence of dependents, such as children or elderly parents, further increases the need for life insurance. The amount of coverage needed is generally tied to the amount of income your dependents rely on, plus additional funds for expenses like education or long-term care. For instance, a single parent with two young children will require substantially more life insurance than a childless couple with stable incomes and significant savings.

Debt and Existing Assets

Outstanding debts, such as mortgages, loans, and credit card balances, significantly impact your life insurance needs. Life insurance can provide the funds necessary to pay off these debts, preventing financial hardship for your loved ones after your death. Conversely, significant existing assets, such as savings, investments, and retirement accounts, can reduce the need for life insurance. These assets can serve as a financial safety net for your dependents, lessening the reliance on life insurance proceeds. A family with substantial savings and a paid-off mortgage might require less life insurance than a family with a large mortgage and limited savings.

Estate Planning

Estate planning plays a crucial role in determining your life insurance needs. Life insurance can be a vital component of a comprehensive estate plan, ensuring that your assets are distributed according to your wishes and minimizing potential estate taxes. For high-net-worth individuals, life insurance can be used to offset estate taxes, ensuring that the maximum amount of wealth is passed on to heirs. Conversely, individuals with smaller estates may find that life insurance is less critical in their estate planning strategy.

Flowchart: Determining Life Insurance Needs

The following flowchart illustrates a simplified decision-making process for determining life insurance needs:

[Diagram description: The flowchart begins with a central question: “Do you have dependents or significant debts?” A “Yes” answer leads to a further question: “Do you have sufficient assets to cover these obligations?” A “Yes” answer leads to a smaller box indicating “Possibly less life insurance needed.” A “No” answer leads to a box indicating “Consider significant life insurance coverage.” A “No” answer to the initial question leads to a box indicating “Life insurance may be less critical, but consider other needs.”]

Calculating Your Life Insurance Needs

Determining the appropriate amount of life insurance requires careful consideration of your financial obligations and the financial well-being of your dependents. Several methods can help you arrive at a suitable figure, ensuring your loved ones are adequately protected in the event of your passing. These methods provide a framework; you may need to adjust the final amount based on your unique circumstances.

Methods for Calculating Life Insurance Needs

Two primary methods assist in determining your life insurance needs: the multiple-of-income method and the needs-based approach. The multiple-of-income method offers a simpler, quicker calculation, while the needs-based approach provides a more detailed and personalized assessment.

Multiple-of-Income Method

This method estimates your life insurance needs based on a multiple of your annual income. A common approach is to aim for 5 to 10 times your annual income. For example, if your annual income is $75,000, a 7-times multiple would suggest a $525,000 life insurance policy. This method is straightforward but doesn’t account for specific debts or future expenses. It’s best suited for individuals with simpler financial situations.

Needs-Based Approach

The needs-based approach provides a more comprehensive calculation, taking into account all your financial responsibilities and future goals. This method involves meticulously listing all your financial obligations and anticipated future expenses, then summing them up to determine your total insurance needs.

Step-by-Step Guide to Estimating Life Insurance Needs

A step-by-step approach helps ensure all relevant factors are considered.

- Calculate Final Expenses: Include funeral costs, outstanding medical bills, and any estate taxes.

- Debt Consolidation: List all outstanding debts, such as mortgages, loans, and credit card balances. Include interest payments over the loan term.

- Income Replacement: Determine the amount of income your dependents rely on and calculate how many years of income replacement they would need. Consider inflation.

- Future Expenses: Estimate the costs of children’s education, including college tuition and other related fees. Also, factor in other long-term care expenses.

- Other Needs: Consider any other financial needs your dependents might have, such as paying for a wedding or other significant life events.

- Total Calculation: Sum up all the figures calculated in the previous steps to arrive at your total life insurance needs.

Examples Based on Different Scenarios

Let’s illustrate with examples:

Single Individual

A single individual with a $60,000 annual income, a $150,000 mortgage, and $10,000 in credit card debt might aim for a policy covering the mortgage, debts, and perhaps 5 times their annual income ($300,000), resulting in a total need of approximately $460,000.

Married Couple with Children

A married couple with two children, a $300,000 mortgage, $20,000 in debt, and combined annual income of $150,000, might need coverage for the mortgage, debts, and potentially 10-15 years of their combined income to support the family until the children are financially independent, plus funds for college education. This could easily reach $1 million or more.

Blended Family

A blended family with complex financial situations requires careful planning. Consider each spouse’s income, assets, liabilities, and children’s needs from both previous and current relationships. This scenario often necessitates a more detailed needs-based approach, potentially involving professional financial advice.

Exploring Affordable Life Insurance Options

Securing life insurance doesn’t have to break the bank. Numerous strategies and options exist to make life insurance coverage attainable for individuals with varying budgets. Understanding the different types of policies, comparing providers, and making informed choices about your coverage level are crucial steps in finding an affordable plan that meets your needs.

Finding affordable life insurance involves careful consideration of various factors. This includes comparing different insurance providers and their pricing structures, identifying ways to reduce premiums, and thoroughly evaluating policy terms and conditions. By strategically navigating these aspects, you can obtain the necessary protection without unnecessary financial strain.

Life Insurance Provider Comparison and Pricing Structures

Different life insurance companies offer varying pricing structures based on factors like age, health, lifestyle, and the type of policy. For example, term life insurance, which provides coverage for a specific period, generally tends to be more affordable than whole life insurance, which offers lifelong coverage. Online comparison tools can help you quickly see premiums from multiple providers for similar policies, allowing for a direct comparison. Remember to look beyond the initial premium; consider the potential for premium increases over time, especially with certain types of policies. A seemingly lower initial premium might become significantly more expensive later on. Consider reputable companies with strong financial ratings to ensure the stability and security of your policy.

Strategies for Reducing Life Insurance Premiums

Several lifestyle choices and policy options can impact the cost of your life insurance premiums. Maintaining a healthy lifestyle, including regular exercise and a balanced diet, can often lead to lower premiums. This is because insurers assess risk based on health factors. Similarly, non-tobacco use significantly reduces premiums as smokers are considered higher-risk individuals. Choosing a shorter policy term (e.g., 10-year term life insurance versus 20-year) will generally result in lower premiums, although coverage ends after the specified term. Consider increasing your deductible or opting for a higher co-pay if offered, as this can potentially lower your premium. Finally, bundling your life insurance with other insurance policies, like auto or home insurance, from the same provider may offer discounts.

Evaluating Policy Terms and Conditions

Before committing to a life insurance policy, meticulously review the policy’s terms and conditions. Pay close attention to details like the coverage amount, the policy’s duration, any exclusions or limitations, and the process for filing a claim. Understand any riders or add-ons that might increase the premium but also expand coverage. Compare policies from different companies side-by-side, using a checklist to ensure you’re making an apples-to-apples comparison. Look for policies with clear and straightforward language, avoiding complicated jargon that could be confusing. Ensure the policy aligns with your specific financial goals and risk tolerance.

Tips for Finding Affordable Life Insurance

Understanding the factors that influence the cost of life insurance can help you find a suitable and affordable plan. Here are some key tips:

- Shop around and compare quotes from multiple insurers. Don’t settle for the first quote you receive.

- Consider term life insurance for shorter-term needs. It’s generally more affordable than permanent life insurance.

- Maintain a healthy lifestyle. This can significantly reduce your premiums.

- Avoid tobacco use. Smoking drastically increases insurance premiums.

- Increase your deductible or co-pay if possible. This can lower your premium.

- Explore bundling options with other insurance policies. Some insurers offer discounts for bundled coverage.

- Review your policy regularly and adjust coverage as needed. Your needs may change over time.

Final Summary

Ultimately, the decision of whether or not you need life insurance is deeply personal. By carefully evaluating your individual circumstances, exploring different policy options, and understanding the various methods for calculating your coverage needs, you can arrive at a decision that aligns with your financial goals and provides the necessary security for your family’s future. Remember, securing adequate life insurance is an investment in peace of mind and financial stability for those you cherish most.

User Queries

What is the difference between term and whole life insurance?

Term life insurance provides coverage for a specific period (term), while whole life insurance offers lifelong coverage and builds cash value.

How often should I review my life insurance needs?

It’s recommended to review your life insurance needs at least annually, or whenever significant life changes occur (marriage, birth of a child, job change, etc.).

Can I get life insurance if I have a pre-existing health condition?

Yes, but it may affect your eligibility and premiums. Insurers assess risk based on health history, so disclosure is crucial. You might qualify for a policy with adjusted rates.

What happens to my life insurance policy if I stop paying premiums?

The policy will lapse, and coverage will cease unless it has a grace period. The specifics depend on the policy type and insurer.