Securing your home is a significant investment, and choosing the right home insurance is crucial. This guide delves into the intricacies of Erie home insurance, providing a balanced overview of its offerings, costs, and the claims process. We’ll explore various policy types, coverage options, and factors influencing premium costs, helping you make an informed decision about protecting your most valuable asset.

From understanding policy terminology to navigating the claims process, we aim to equip you with the knowledge needed to confidently choose and utilize Erie home insurance. We’ll also compare Erie’s offerings to other insurers in the area and address common concerns based on customer feedback, ensuring a transparent and comprehensive understanding.

Understanding Erie Home Insurance

Erie Insurance, a prominent regional insurer, offers a range of home insurance policies designed to protect homeowners from various risks. Understanding the specifics of their coverage, cost, and exclusions is crucial for making an informed decision about your home insurance needs. This section will delve into the key aspects of Erie home insurance.

Types of Erie Home Insurance Policies

Erie Insurance provides several types of home insurance policies, catering to different homeowner needs and property types. These typically include standard homeowners insurance (often referred to as HO-3), which offers broad coverage for dwelling, personal property, and liability; condo insurance, tailored for condominium owners; and renters insurance, protecting renters’ personal belongings and providing liability coverage. Specific policy details and available coverages may vary depending on location and individual circumstances. It’s important to contact Erie Insurance directly or a licensed agent for precise policy details relevant to your situation.

Coverage Options Available for Erie Home Insurance Policies

Erie home insurance policies offer a range of coverage options to customize protection. These options typically include dwelling coverage (covering the structure of your home), personal property coverage (protecting your belongings), liability coverage (protecting you against lawsuits arising from accidents on your property), additional living expenses (covering temporary housing costs if your home becomes uninhabitable due to a covered event), and medical payments coverage (covering medical expenses for those injured on your property). Optional add-ons, such as flood insurance (usually purchased separately through the National Flood Insurance Program or a private insurer) and earthquake insurance, are also frequently available. The specific limits and deductibles for each coverage are customizable and will impact the overall premium.

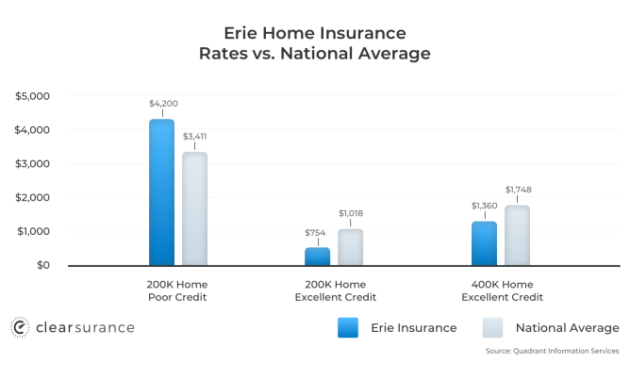

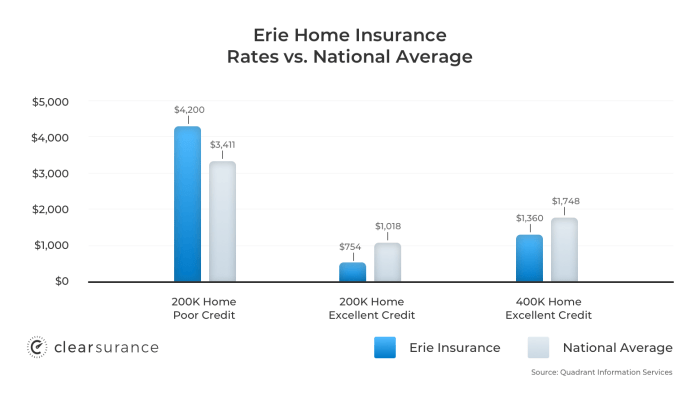

Comparison of Erie Home Insurance Premiums with Other Major Insurers in the Erie, PA Area

Direct comparison of Erie Insurance premiums with competitors in the Erie, PA area is difficult without specific policy details and individual risk profiles. Premium costs are influenced by factors such as the age and condition of the home, its location, the coverage amounts selected, the deductible chosen, and the homeowner’s claims history. To obtain accurate premium comparisons, it’s recommended to obtain quotes from multiple insurers, including Erie Insurance and other major companies operating in the Erie, PA region, using comparable coverage options and deductibles. Online comparison tools can be helpful, but it is always advisable to verify information with the insurance companies directly.

Common Exclusions Found in Erie Home Insurance Policies

Like most home insurance policies, Erie policies typically exclude certain events or damages. Common exclusions often include damage caused by floods, earthquakes, and normal wear and tear. Intentional acts, such as self-inflicted damage, are also typically excluded. Furthermore, specific exclusions related to certain types of property or situations may apply. It’s crucial to carefully review the policy documents to understand the specific exclusions applicable to your policy. Understanding these exclusions allows homeowners to take appropriate steps to mitigate potential risks or secure supplemental coverage if necessary. For example, separate flood insurance is often needed in flood-prone areas, even if you have a comprehensive homeowners policy.

Factors Affecting Erie Home Insurance Premiums

Several key factors influence the cost of your Erie home insurance premium. Understanding these elements allows for a more informed approach to securing adequate coverage at a competitive price. This section details the primary considerations impacting your insurance costs.

Location’s Influence on Erie Home Insurance Rates

Your home’s location significantly impacts your Erie home insurance premium. Areas with higher crime rates, a greater risk of natural disasters (such as flooding or wildfires), and proximity to fire hydrants and fire stations all contribute to the assessed risk. For example, a home situated in a flood-prone zone will command a higher premium than a similar home in a higher elevation area with better fire protection infrastructure. Furthermore, the density of the neighborhood and the type of construction materials prevalent in the area also factor into the risk assessment. A densely populated area with older wooden structures may present a higher risk profile compared to a sparsely populated area with predominantly brick homes.

Impact of Home Features on Premium Costs

The characteristics of your home itself play a crucial role in determining your insurance premium. The age of your home is a key factor; older homes, particularly those lacking modern safety features, generally carry higher premiums due to increased risk of structural issues and potential for damage. The size of your home directly correlates with the replacement cost, influencing the premium amount. Larger homes typically require higher premiums to cover the greater expense of rebuilding in case of a total loss. Security features such as alarm systems, fire suppression systems, and reinforced doors and windows can significantly reduce your premiums as they mitigate the risk of theft and property damage. The materials used in construction also affect premiums; homes constructed with fire-resistant materials may qualify for discounts.

Premium Differences Based on Coverage Levels

Different levels of coverage directly affect the cost of your Erie home insurance. Choosing a higher coverage limit, while offering greater protection, results in a higher premium. Conversely, opting for a lower coverage limit translates to a lower premium, but leaves you with less financial protection in the event of significant damage or loss. For example, selecting a policy that covers 100% of your home’s replacement cost will naturally be more expensive than a policy covering only 80%. It’s crucial to balance the desired level of protection with your budget to find a policy that best suits your needs and financial capabilities. It’s advisable to carefully consider the potential financial implications of underinsurance versus the added cost of comprehensive coverage.

Filing a Claim with Erie Home Insurance

Filing a claim with Erie Home Insurance can seem daunting, but understanding the process can make it significantly smoother. This section provides a step-by-step guide, examples of claimable situations, required documentation, and a helpful table summarizing the necessary information for a successful claim.

Step-by-Step Guide to Filing a Claim

Promptly reporting your loss is crucial. The sooner you contact Erie, the quicker the claims process can begin. Erie offers various methods for reporting, including online portals, phone calls, and potentially through your independent agent.

- Report the Loss: Contact Erie immediately after the incident. Note down the date, time, and circumstances of the event.

- Provide Initial Information: Be prepared to provide basic details about the incident, your policy information, and contact information.

- Claim Assignment: Erie will assign a claims adjuster to your case. This adjuster will be your primary contact throughout the process.

- Documentation Submission: Submit all required documentation to your assigned adjuster (details below).

- Investigation and Assessment: The adjuster will investigate the claim, assess the damage, and determine the coverage.

- Settlement Negotiation: The adjuster will work with you to reach a settlement agreement for the covered damages.

- Payment: Once the settlement is agreed upon, Erie will process the payment according to your policy terms.

Examples of Claimable Situations

Erie Home Insurance covers a wide range of events. Examples include damage from fire, windstorms, hail, vandalism, theft, and certain plumbing issues. Coverage specifics depend on your policy and endorsements. For instance, damage from a burst pipe might be covered, but damage caused by neglecting regular maintenance might not be. Similarly, flood damage may require a separate flood insurance policy.

Required Documentation

Gathering the necessary documentation efficiently will significantly expedite the claims process. Missing documents can delay your claim. Keep a well-organized record of all communication and submitted documentation.

| Document Type | Required Information | Where to Obtain | Deadline |

|---|---|---|---|

| Police Report (for theft or vandalism) | Report number, date, time, details of incident | Local Law Enforcement | As soon as possible after the incident |

| Photos and Videos of Damage | Clear images of all damaged property, including surrounding areas | Your Camera or Smartphone | Immediately after the incident, before cleanup |

| Repair Estimates | Detailed estimates from licensed contractors for repairs | Licensed Contractors | Within a reasonable timeframe as requested by adjuster |

| Inventory of Damaged Items | List of damaged items, descriptions, purchase dates, and receipts (if available) | Your Records | As soon as possible after the incident |

| Proof of Ownership | Deeds, titles, purchase receipts for affected property | Your Records | As soon as possible after the incident |

Bundling Erie Home and Auto Insurance

Bundling your home and auto insurance with Erie Insurance offers a smart way to potentially save money and simplify your insurance needs. By combining your policies, you can often secure a more comprehensive coverage package at a lower overall cost than purchasing each policy separately. This is due to the discounts and bundled pricing strategies offered by many insurance providers, including Erie.

Erie, like many insurers, recognizes the value of customer loyalty and bundled business. This often translates into significant financial advantages for policyholders. Bundling allows Erie to streamline administrative processes, reducing their operational costs, which are then passed on to the customer in the form of lower premiums. The savings can be substantial, making bundled insurance a financially attractive option for many homeowners and car owners.

Cost Savings from Bundling Erie Home and Auto Insurance

The exact amount you’ll save by bundling your Erie home and auto insurance will vary depending on several factors, including your individual risk profile, the coverage levels you choose, and your location. However, Erie frequently offers discounts of 10% or more for bundling policies. For example, a homeowner with a $1,000 annual home insurance premium and a $800 annual auto insurance premium might see a combined premium of $1,620 after a 10% bundle discount, resulting in a savings of $180. This illustrates the potential for significant cost reduction. To determine your potential savings, it’s best to obtain a personalized quote from Erie by contacting them directly or using their online quote tool.

Benefits Beyond Cost Savings

Beyond the financial advantages, bundling your Erie home and auto insurance offers several other benefits. The convenience of managing both policies under a single provider simplifies the administrative process. This means one payment, one renewal date, and a single point of contact for all your insurance needs. This streamlined approach can save you time and reduce the risk of overlooking important deadlines or coverage details. Furthermore, consistent coverage with a single provider often leads to a smoother claims process should you need to file a claim for either your home or your vehicle.

Comparison of Bundled vs. Separate Policies

To fully understand the value proposition of bundling, it’s helpful to compare the costs of purchasing separate policies versus a bundled package. Let’s consider a hypothetical example: Assume that individual premiums for home and auto insurance are $1,000 and $800 respectively. The total cost would be $1,800. Now, let’s assume Erie offers a 15% discount for bundling. The bundled premium would be $1,530 ($1,800 – ($1,800 * 0.15)). This represents a savings of $270. This example showcases the potential financial advantage of opting for a bundled insurance package with Erie. It is crucial to obtain personalized quotes to compare your specific circumstances.

Summary

Choosing the right home insurance can feel overwhelming, but understanding the details empowers you to make the best choice for your needs. This guide has provided a detailed look at Erie home insurance, covering policy types, cost factors, claims procedures, and customer experiences. By carefully considering the information presented, you can confidently assess whether Erie home insurance aligns with your requirements and budget, providing peace of mind knowing your home is protected.

Detailed FAQs

What discounts does Erie offer on home insurance?

Erie offers various discounts, including those for bundling home and auto insurance, having security systems, and being a long-term customer. Specific discounts vary by location and policy.

How does Erie handle claims related to mold or pest infestations?

Coverage for mold and pest infestations often depends on the policy’s specific wording and the cause of the infestation. It’s crucial to review your policy details or contact Erie directly to understand your coverage in these situations.

What is the process for canceling an Erie home insurance policy?

Contact Erie directly to initiate the cancellation process. They will provide instructions and guidance on the required steps and any applicable fees or penalties.

Does Erie offer rental insurance as part of its home insurance policies?

While Erie primarily focuses on homeowner’s insurance, they may offer options for renters insurance; contact them directly to inquire about availability in your area.