Securing the right auto insurance in Florida can feel like navigating a complex maze. This guide unravels the intricacies of FL auto insurance, providing clarity on mandatory coverages, premium factors, and the often-misunderstood no-fault system. We’ll explore the various types of coverage available, helping you make informed decisions to protect yourself and your vehicle while staying within budget. Understanding these nuances is crucial for every Florida driver, regardless of experience.

From comparing insurance providers and obtaining competitive quotes to understanding the steps to take after an accident, we aim to empower you with the knowledge necessary to confidently manage your auto insurance needs. This guide will equip you with the tools to navigate the Florida insurance landscape with ease and assurance.

Understanding Florida Auto Insurance Basics

Navigating the world of Florida auto insurance can seem daunting, but understanding the basics is crucial for responsible driving. This section will clarify the mandatory coverage requirements, available coverage types, and regional cost variations to help you make informed decisions.

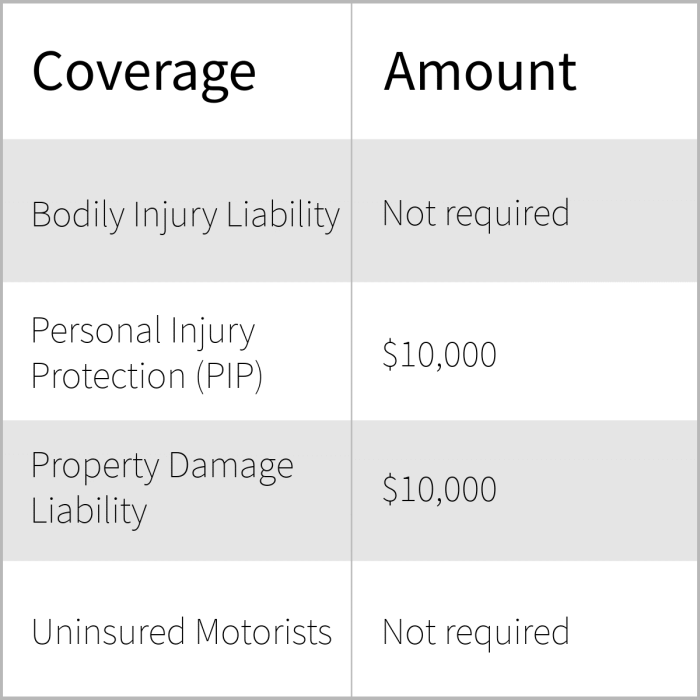

Mandatory Coverage Requirements in Florida

Florida law mandates that all drivers carry a minimum level of Personal Injury Protection (PIP) and Property Damage Liability (PDL) coverage. PIP covers medical bills and lost wages for you and your passengers, regardless of fault, up to a specified limit (currently $10,000). PDL covers damages to other people’s property resulting from an accident you caused. Failure to maintain this minimum coverage results in significant penalties.

Types of Auto Insurance Coverage in Florida

Several types of auto insurance coverage are available beyond the minimum requirements. These options offer varying degrees of protection and cost accordingly.

| Coverage Type | Description | Benefits | Drawbacks |

|---|---|---|---|

| Liability Coverage | Covers injuries and damages to others caused by you. | Protects you from significant financial losses if you cause an accident. | Doesn’t cover your own vehicle or medical expenses. Minimum limits may not be sufficient. |

| Personal Injury Protection (PIP) | Covers medical bills and lost wages for you and your passengers, regardless of fault. | Provides immediate medical coverage after an accident, regardless of who is at fault. | Coverage is limited; additional medical expenses may not be covered. |

| Property Damage Liability (PDL) | Covers damages to other people’s property. | Protects you from financial responsibility for damages to other vehicles or property. | Doesn’t cover damage to your own vehicle. |

| Collision Coverage | Covers damage to your vehicle in an accident, regardless of fault. | Repairs or replaces your vehicle after a collision, even if you’re at fault. | Can be expensive, especially for newer vehicles. Usually has a deductible. |

| Comprehensive Coverage | Covers damage to your vehicle from non-collision events (e.g., theft, vandalism, natural disasters). | Protects your vehicle from a wider range of incidents beyond accidents. | Can be expensive, especially for luxury vehicles. Usually has a deductible. |

Cost Variations of Auto Insurance in Florida

The cost of auto insurance in Florida varies significantly depending on several factors, including location, driving history, age, type of vehicle, and the level of coverage chosen. For example, drivers in densely populated urban areas like Miami tend to pay higher premiums than those in more rural areas due to higher accident rates and increased risk. Similarly, drivers with a history of accidents or traffic violations will generally face higher premiums. A young driver with a new sports car will typically pay more than an older, experienced driver with an older sedan. The specific cost will depend on the individual’s circumstances and the chosen insurance provider. It is advisable to obtain quotes from multiple insurers to compare prices.

Factors Affecting Florida Auto Insurance Premiums

Understanding the factors that influence your Florida auto insurance premiums is crucial for managing your costs effectively. Several key elements contribute to the final price you pay, and knowing these allows for better financial planning and potentially lower premiums. This section will detail the most significant factors insurance companies consider.

Driving Record

Your driving history significantly impacts your insurance premium. A clean record, free of accidents and traffic violations, will generally result in lower rates. Conversely, accidents, especially those resulting in injuries or significant property damage, will substantially increase your premiums. The severity of the violation also matters; a speeding ticket will likely have less impact than a DUI conviction. Insurance companies use a points system to assess risk, with more points leading to higher premiums. For example, a driver with multiple speeding tickets and an at-fault accident within a three-year period will face significantly higher premiums compared to a driver with a spotless record.

Age and Driving Experience

Insurance companies consider age and driving experience as strong indicators of risk. Younger drivers, particularly those with less than five years of driving experience, are statistically more likely to be involved in accidents. Therefore, they typically pay higher premiums. As drivers age and accumulate years of safe driving, their premiums tend to decrease, reflecting a lower perceived risk. This is because experience often translates to better driving habits and fewer accidents.

Vehicle Type

The type of vehicle you drive plays a considerable role in determining your insurance premium. Sports cars and high-performance vehicles are often more expensive to insure due to their higher repair costs and increased risk of theft. Conversely, smaller, less expensive vehicles typically have lower insurance premiums. Factors like the vehicle’s safety rating and anti-theft features also influence the premium. For example, a new SUV with advanced safety features will likely have a different premium than an older, less-equipped sedan.

Location

Where you live significantly impacts your insurance rates. Areas with high crime rates, a higher frequency of accidents, or more expensive car repairs generally have higher insurance premiums. Insurance companies analyze claims data and crime statistics for specific zip codes to assess the risk level associated with each location. A driver living in a high-risk area can expect to pay more than a driver in a lower-risk area, even if all other factors are the same.

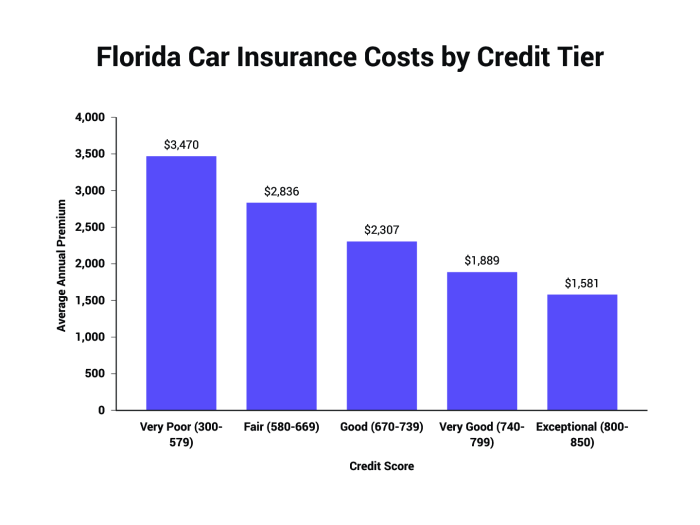

Credit Score

In many states, including Florida, your credit score can affect your auto insurance premiums. Insurance companies use credit-based insurance scores (CBIS) to assess risk. A lower credit score often correlates with a higher risk of insurance claims, leading to higher premiums. The rationale is that individuals with poor credit management may also exhibit less responsible behavior in other areas, including driving. While this practice is controversial, it is legal in Florida and used by many insurers. A good credit score can lead to significant savings on insurance premiums.

Prior Insurance Claims

Filing insurance claims, especially those where you are at fault, will almost certainly increase your premiums. Each claim adds to your risk profile, signaling to insurers a higher likelihood of future claims. The severity of the claim also matters; a minor fender bender will have a less significant impact than a major accident with substantial damages. Multiple claims within a short period can lead to significant premium increases or even policy cancellation. Maintaining a clean claims history is crucial for keeping premiums low.

Ways to Lower Your Florida Auto Insurance Premiums

Several strategies can help lower your auto insurance premiums. It’s important to remember that insurance companies use a complex formula, and these tips can affect different people differently.

- Maintain a clean driving record: Avoid accidents and traffic violations.

- Shop around and compare quotes: Different insurers offer different rates.

- Increase your deductible: A higher deductible typically lowers your premium.

- Bundle your insurance: Combining auto and home insurance can lead to discounts.

- Take a defensive driving course: Completing a certified course can often result in discounts.

- Consider a less expensive vehicle: Choosing a vehicle with lower repair costs and a good safety rating can save money.

- Improve your credit score: A higher credit score can lead to lower insurance premiums.

Understanding Florida’s No-Fault System

Florida operates under a no-fault insurance system, meaning that after a car accident, each driver’s insurance company will cover their own medical bills and lost wages, regardless of who caused the accident. This system primarily relies on Personal Injury Protection (PIP) coverage. Understanding how PIP works is crucial for navigating the aftermath of a car accident in Florida.

Florida’s no-fault system, specifically its PIP coverage, is designed to provide prompt medical and wage loss benefits to injured parties following a car accident, regardless of fault. This means you can seek compensation from your own insurance company, even if you were at fault for the accident. However, this system has limitations and certain circumstances affect its application.

PIP Coverage: Benefits and Limitations

PIP coverage in Florida typically pays for 80% of your medical bills and 60% of your lost wages up to a specified limit, often $10,000. Benefits include medical expenses like doctor visits, hospital stays, surgery, and physical therapy. Lost wages are compensated for time missed from work due to the accident. However, PIP does not cover pain and suffering unless there are significant injuries (like permanent scarring or significant disfigurement). Also, PIP coverage only applies to injuries sustained in a motor vehicle accident and only covers medical treatment that is considered “reasonable and necessary.” Furthermore, there are strict deadlines for submitting claims and documentation. Failure to comply with these deadlines can result in denial of benefits.

Situations Where PIP Coverage Applies

PIP coverage applies in various scenarios. For example, if you are injured in an accident while driving your own car, even if you caused the accident, your PIP coverage will help pay for your medical bills and lost wages. Similarly, if you are a passenger in someone else’s car and are injured, your own PIP coverage (if you have it) will apply. PIP also typically covers injuries sustained by family members living in your household who are injured while in your vehicle or as a pedestrian.

Situations Where PIP Coverage Does Not Apply

There are instances where PIP coverage may not apply. For instance, if you are injured while driving a vehicle that you do not own and do not have insurance on, your PIP coverage would not apply. Similarly, injuries sustained outside of a motor vehicle accident, such as a fall or a sporting injury, are not covered under PIP. Furthermore, if you are injured while driving under the influence of alcohol or drugs, your PIP coverage may be affected, or even denied. Claims for injuries resulting from intentional acts are also typically excluded.

Filing a PIP Claim in Florida

Filing a PIP claim typically involves notifying your insurance company as soon as possible after the accident. You will need to provide information about the accident, including the date, time, location, and other involved parties. You’ll also need to provide documentation of your medical treatment, such as bills and doctor’s notes. Your insurance company will review your claim and determine the amount of benefits you are entitled to receive. It is recommended to keep detailed records of all communication with your insurance company and to follow up on your claim regularly to ensure timely processing. Failure to comply with your insurance company’s requirements for submitting documentation can result in a delay or denial of benefits. In cases of dispute, you may need to consult with an attorney.

Dealing with Auto Accidents in Florida

Being involved in a car accident can be a stressful experience, but understanding the proper procedures in Florida can help minimize the complications. This section Artikels the necessary steps to take after an accident, from immediate actions to interacting with insurance companies.

Immediate Actions After a Car Accident

Following a car accident in Florida, your priority should be ensuring the safety of yourself and others involved. This involves taking specific steps to protect yourself and gather necessary information.

- Check for Injuries: Assess the condition of yourself and any passengers or other individuals involved. Call emergency services (911) if anyone is injured. Even minor injuries should be documented.

- Move to Safety: If possible and safe to do so, move your vehicle to the side of the road to prevent further accidents. Turn on hazard lights.

- Call Law Enforcement: Report the accident to the police, especially if there are injuries or significant property damage. Obtain a copy of the police report, as this is crucial documentation for your insurance claim.

- Exchange Information: Carefully exchange information with all other drivers involved. This includes names, addresses, phone numbers, driver’s license numbers, insurance company information, and license plate numbers. Note down the make, model, and year of each vehicle.

- Document the Scene: Take photographs or videos of the accident scene, including damage to all vehicles, the surrounding area, and any visible injuries. Note the weather conditions and road conditions as well.

- Obtain Witness Information: If there are any witnesses, collect their names and contact information. Their accounts can be helpful in supporting your claim.

Reporting the Accident to Your Insurance Company

Promptly reporting the accident to your insurance company is crucial. Failing to do so can negatively impact your claim.

- Contact Your Insurer: Call your insurance company as soon as possible after the accident. Follow their instructions regarding reporting the accident and providing the necessary information.

- Provide Accurate Details: Be accurate and thorough when providing details about the accident, including the date, time, location, and circumstances surrounding the incident. Be honest and avoid embellishments.

- File a Claim: Your insurance company will guide you through the process of filing a formal claim. Keep records of all communication with your insurer.

- Cooperate with the Investigation: Cooperate fully with your insurance company’s investigation. This may involve providing additional information, attending interviews, or submitting supporting documentation.

Negotiating with Insurance Adjusters

Insurance adjusters are responsible for investigating claims and determining the amount of compensation. Knowing how to interact with them is essential.

Keep detailed records of all communication, including emails, letters, and phone calls. Maintain a calm and professional demeanor during interactions. Present your case clearly and concisely, supported by evidence such as police reports, medical records, and photographs. If you are not comfortable negotiating directly with the adjuster, consider seeking legal counsel. Remember, you are not obligated to accept the first settlement offer.

Filing a Claim Step-by-Step

The process of filing an auto insurance claim in Florida generally follows these steps.

- Gather Documentation: Compile all relevant documents, including the police report, photos of the accident scene, medical records (if applicable), and repair estimates.

- Contact Your Insurer: Report the accident to your insurance company and request a claim form.

- Complete the Claim Form: Accurately and completely fill out the claim form, providing all requested information.

- Submit Supporting Documentation: Submit all supporting documentation along with the completed claim form.

- Follow Up: Follow up with your insurance company to check the status of your claim. Keep records of all communication.

Illustrative Examples of Florida Auto Insurance Scenarios

Understanding how Florida’s auto insurance system works in practice is best achieved through real-world examples. The following scenarios illustrate the claim process and the importance of various coverage types.

Minor Accident Claim Process

This scenario involves a minor fender bender. Imagine Sarah, driving her 2018 Honda Civic, gently bumps into another car at a stoplight, causing minimal damage – a small scratch on her bumper and a slightly dented taillight on the other vehicle. Both drivers exchange information, including insurance details. Sarah contacts her insurance company, providing a police report (if one was filed) and photos of the damage. Her insurer assesses the damage, determines it’s below her deductible, and advises her to handle repairs herself. The other driver’s insurance may also cover Sarah’s minor damage if she chooses to file a claim against them. This example highlights the importance of having adequate coverage and understanding your deductible. If the damage exceeded her deductible, Sarah would file a claim, her insurer would handle the repairs, and her premiums may increase slightly in the following year.

Major Accident with Significant Injuries

Consider a more serious scenario: John, driving his truck, is involved in a multi-vehicle accident on a highway. The accident results in significant damage to his truck and severe injuries to himself and another driver. John’s injuries require extensive medical treatment, including hospitalization and rehabilitation. The other driver sustains a broken leg requiring surgery. John’s insurance company will investigate the accident, handle communications with the other driver’s insurance company, and cover John’s medical bills up to his policy limits. His personal injury protection (PIP) coverage will cover his medical expenses and lost wages, regardless of fault. His bodily injury liability coverage will cover the other driver’s medical expenses and potential lawsuit settlements. If the damages exceed John’s liability coverage, he may face significant personal financial liability. This scenario emphasizes the crucial role of sufficient liability and PIP coverage in protecting against financial ruin following a serious accident.

Uninsured/Underinsured Motorist Coverage

Maria is stopped at a red light when an uninsured driver runs a red light and crashes into her car. The impact is severe, causing significant damage to her vehicle and resulting in whiplash and other injuries. Because the at-fault driver lacks insurance, Maria’s own uninsured/underinsured motorist (UM/UIM) coverage becomes critical. Her UM/UIM coverage will pay for her medical bills, lost wages, and vehicle repairs, even though the at-fault driver is uninsured. Without UM/UIM coverage, Maria would be responsible for all costs associated with the accident, a potentially devastating financial burden. This illustrates the importance of purchasing UM/UIM coverage, offering protection against accidents caused by drivers without adequate insurance.

Last Point

Successfully navigating the world of Florida auto insurance requires understanding its unique aspects, from the no-fault system to the various factors influencing premium costs. By carefully considering your individual needs, comparing providers, and proactively managing your policy, you can secure the optimal level of protection while optimizing your budget. Remember, proactive planning and informed decision-making are key to a smooth and secure driving experience in the Sunshine State.

Essential Questionnaire

What is Uninsured/Underinsured Motorist (UM/UIM) coverage?

UM/UIM coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle damage, even if the other driver is at fault and lacks sufficient insurance.

How often can I change my auto insurance policy in Florida?

You can typically change your auto insurance policy whenever you want, although there may be a short waiting period before a new policy takes effect. Contact your current provider to understand their cancellation policies.

What is the penalty for driving without auto insurance in Florida?

Driving without the legally required minimum auto insurance in Florida results in significant fines, license suspension, and potential vehicle impoundment. The penalties can be substantial and vary depending on the circumstances.

Can I get a discount on my FL auto insurance?

Yes, many insurers offer discounts for various factors such as good driving records, bundling insurance policies (home and auto), safety features in your vehicle, and completing defensive driving courses.