Florida’s automobile insurance market is a dynamic landscape shaped by a unique blend of factors, from the state’s sizable population and diverse geography to its distinctive no-fault laws. Understanding the intricacies of this market is crucial for both residents and newcomers, as navigating the complexities of coverage options, premium calculations, and claims processes can significantly impact personal finances and overall well-being. This guide delves into the essential aspects of Florida automobile insurance, providing a clear and concise overview to empower informed decision-making.

From exploring the various types of coverage available and the factors influencing premium costs to understanding Florida’s no-fault system and the role of the Department of Financial Services, we aim to equip readers with the knowledge necessary to confidently navigate the Florida automobile insurance landscape. We’ll examine the competitive market, providing insights into finding affordable coverage and effectively managing claims.

Florida’s Insurance Market Overview

Florida’s automobile insurance market is a complex and dynamic landscape, significantly influenced by factors such as a high population density, a large number of older drivers, and a susceptibility to severe weather events. Understanding its intricacies is crucial for both insurers and consumers.

The market is characterized by high premiums and a significant number of uninsured drivers, contributing to a challenging environment for all stakeholders. This necessitates a deep dive into its size, competitive landscape, and regional variations.

Market Size and Key Characteristics

Florida boasts a substantial automobile insurance market, reflecting its large population and high vehicle ownership rates. Precise figures fluctuate, but millions of drivers require auto insurance coverage. The market is notable for its high frequency of claims, driven by factors like traffic congestion and weather-related incidents. This high claim frequency contributes to elevated premiums. The state’s regulatory framework also plays a considerable role, influencing insurer operations and consumer choices.

Insured Drivers and Average Premiums

While precise, up-to-the-minute statistics require access to real-time data from the Florida Department of Financial Services (DFS) and other reputable sources, it’s safe to say millions of drivers are insured. The average premium varies considerably based on location, coverage type, driving history, and other factors. However, Florida’s average premiums are consistently higher than the national average, often ranking among the highest in the United States. This disparity is influenced by the aforementioned factors, including high claim frequency and litigation costs.

Competitive Landscape

The Florida automobile insurance market is highly competitive, with a mix of large national insurers, regional companies, and smaller, niche players. Major national players like State Farm, Geico, and Progressive hold significant market share, leveraging their brand recognition and extensive distribution networks. However, a substantial number of smaller, regional insurers also compete, often specializing in specific demographics or risk profiles. This competition influences pricing and the range of available products and services. Market share fluctuates based on various factors, including pricing strategies, customer acquisition, and regulatory changes.

Regional Variations in Premiums

The following table illustrates the variation in average premiums across different regions of Florida. Note that these are illustrative examples and actual figures may vary depending on the data source and time period. The number of insurers operating in each region can also influence competition and pricing. Average claim costs, which are heavily impacted by factors like the frequency and severity of accidents in a particular region, are also shown to provide a more comprehensive picture.

| Region | Average Premium | Number of Insurers | Average Claim Cost |

|---|---|---|---|

| South Florida (Miami-Dade, Broward, Palm Beach) | $2,000 | 50 | $8,000 |

| Central Florida (Orlando, Tampa) | $1,800 | 45 | $7,500 |

| North Florida (Jacksonville, Gainesville) | $1,600 | 35 | $7,000 |

| Panhandle (Pensacola, Tallahassee) | $1,500 | 30 | $6,500 |

Types of Florida Auto Insurance Coverage

Choosing the right auto insurance coverage in Florida can seem daunting, but understanding the different types available is key to protecting yourself and your finances. This section will detail the various coverage options, the state’s minimum requirements, and the advantages and disadvantages of each. Remember, this information is for general understanding and should not be considered legal or financial advice. Always consult with an insurance professional for personalized guidance.

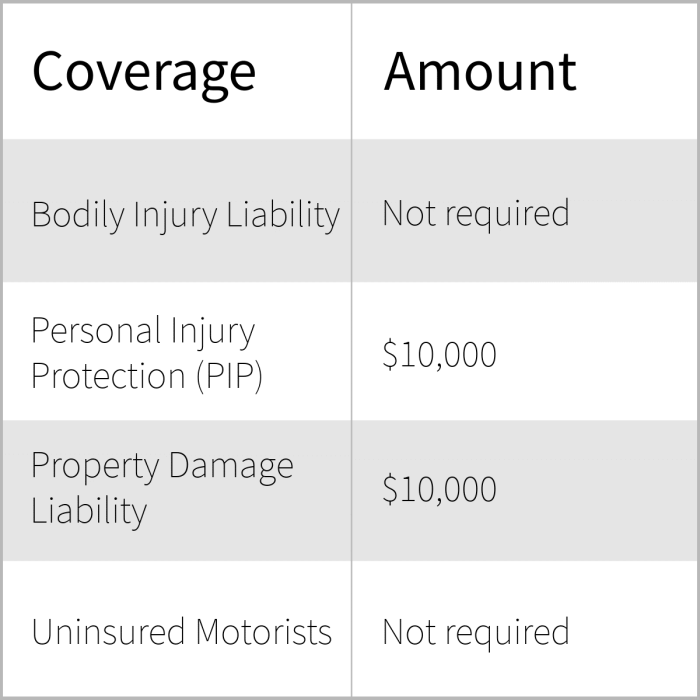

Florida law mandates specific minimum coverage levels, but drivers are encouraged to consider higher limits for enhanced protection. The types of coverage fall broadly into two categories: liability coverage (protecting others) and personal coverage (protecting yourself and your vehicle).

Liability Coverage

Liability insurance covers damages you cause to others in an accident. This includes bodily injury liability, which covers medical bills and lost wages of injured parties, and property damage liability, which covers repairs or replacement of damaged property. In Florida, the minimum required liability coverage is 10/20/10, meaning $10,000 per person for bodily injury, $20,000 total for bodily injury per accident, and $10,000 for property damage. Higher limits offer greater protection in the event of a serious accident. While liability coverage is mandatory, inadequate coverage could leave you personally liable for exceeding the limits in a significant accident.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle, regardless of fault, if it’s damaged in an accident. This coverage is optional but highly recommended. It covers damage from collisions with other vehicles, objects, or even rollovers. The deductible you choose (the amount you pay before insurance kicks in) will affect your premium. A higher deductible typically results in a lower premium. For example, a $500 deductible means you pay the first $500 of repair costs, and your insurance covers the rest.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage from events other than collisions. This includes things like theft, vandalism, fire, hail, and damage from animals. Like collision coverage, it’s optional but beneficial. It provides peace of mind knowing your vehicle is protected from a wider range of risks. Again, deductibles influence the premium; a higher deductible means lower premiums.

Personal Injury Protection (PIP)

PIP coverage pays for your medical bills and lost wages, regardless of fault, after an accident. It also covers medical expenses for your passengers. Florida requires a minimum of $10,000 in PIP coverage. While this coverage is mandatory, it’s often worth considering higher limits for more extensive protection. Many drivers find that the benefits of PIP outweigh the additional cost.

Uninsured/Underinsured Motorist (UM) Coverage

UM coverage protects you if you’re injured in an accident caused by an uninsured or underinsured driver. This is crucial because many drivers operate without sufficient liability insurance. UM coverage can help cover your medical bills, lost wages, and vehicle repairs. While not mandatory, it’s highly recommended. The coverage limit should ideally match or exceed your liability coverage.

Typical Exclusions in Standard Auto Insurance Policies

It’s important to understand that standard auto insurance policies usually exclude certain situations. Here are some common exclusions:

Understanding these exclusions is vital to avoid surprises when filing a claim. Review your policy carefully to fully understand what is and isn’t covered.

- Damage caused intentionally by the insured.

- Damage resulting from driving under the influence of alcohol or drugs.

- Damage caused while racing or participating in illegal activities.

- Damage to property owned by the insured.

- Damage resulting from wear and tear or mechanical breakdown.

- Damage caused by a nuclear event.

- Losses covered by other insurance policies.

Factors Affecting Florida Auto Insurance Rates

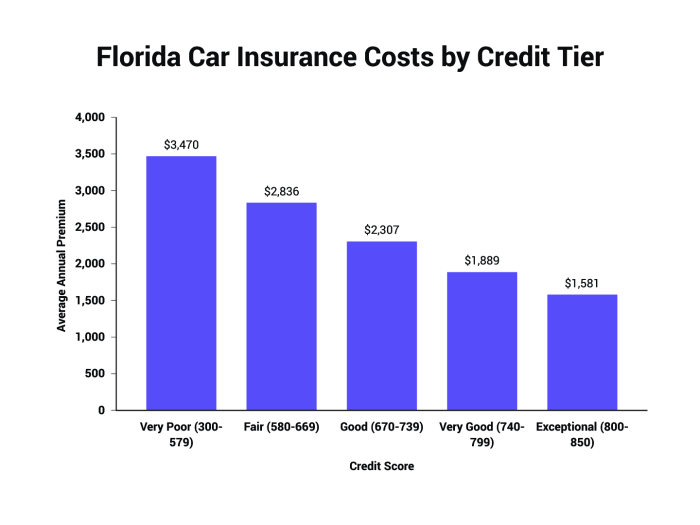

Understanding the factors that influence your Florida auto insurance premium is crucial for managing your budget and securing the best possible coverage. Several key elements contribute to the final cost, and being aware of them allows for informed decision-making. These factors interact in complex ways, sometimes amplifying or mitigating each other’s effects.

Driving Record

A clean driving record significantly impacts your insurance premiums. Insurance companies assess risk based on your history of accidents and traffic violations. More accidents and tickets generally lead to higher premiums, reflecting the increased likelihood of future claims. For example, a driver with multiple speeding tickets and a DUI conviction will likely face much higher rates than a driver with a spotless record. Conversely, maintaining a clean driving record for an extended period can earn you discounts and lower premiums.

Age and Driving Experience

Age is a major factor, with younger drivers typically paying more due to statistically higher accident rates. Inexperience contributes to this, as does riskier driving behavior often associated with youth. Older drivers, on the other hand, often benefit from lower rates due to their generally safer driving habits and longer accident-free history. However, very senior drivers might see slightly higher rates due to potential age-related driving challenges.

Vehicle Type

The type of vehicle you drive heavily influences your insurance costs. Sports cars and high-performance vehicles are generally more expensive to insure due to their higher repair costs and increased risk of theft. Conversely, smaller, less expensive vehicles typically result in lower premiums. Features like safety technology (e.g., anti-lock brakes, airbags) can also influence rates; vehicles with advanced safety features may qualify for discounts.

Location

Your location in Florida significantly impacts your insurance rates. Areas with higher crime rates, more accidents, and greater likelihood of severe weather events tend to have higher insurance premiums. This is because insurers assess the risk of claims based on geographical data. For instance, living in a densely populated urban area with a high accident frequency will likely result in higher premiums than residing in a rural area with a lower accident rate.

Claims History

Your claims history is a critical factor in determining your insurance rates. Filing claims, even for minor incidents, can increase your premiums. Insurers view claims as indicators of risk, and multiple claims within a short period can lead to significant rate increases or even policy cancellation. Conversely, a long period without claims can demonstrate responsible driving and potentially lead to lower rates. The type of claim also matters; a claim for a major accident will have a more significant impact than a claim for minor damage.

| Factor | Influence Level | Explanation | Example |

|---|---|---|---|

| Driving Record | High | Accidents and violations significantly increase premiums. | Multiple speeding tickets resulting in a 20% rate increase. |

| Age and Experience | High | Younger, less experienced drivers generally pay more. | A 25-year-old driver paying significantly more than a 45-year-old with a clean record. |

| Vehicle Type | Medium | Expensive, high-performance vehicles are costlier to insure. | A sports car costing more to insure than a compact sedan. |

| Location | Medium | High-risk areas have higher premiums due to increased claims frequency. | Living in a high-crime area resulting in a 10% rate increase. |

| Claims History | High | Filing claims increases premiums, especially multiple claims. | Two at-fault accidents within a year leading to a substantial rate increase. |

Finding Affordable Auto Insurance in Florida

Securing affordable auto insurance in Florida can feel like navigating a maze, but with careful planning and research, it’s achievable. Understanding the factors that influence your premiums and employing smart strategies can significantly reduce your costs. This section will provide practical advice and steps to help you find the best and most affordable insurance options for your needs.

Finding the right balance between comprehensive coverage and affordability is key. Many factors influence your premium, including your driving history, the type of vehicle you drive, and your location. However, there are several actionable steps you can take to control your costs and secure a better deal.

Strategies for Reducing Insurance Premiums

Maintaining a clean driving record is paramount in keeping your insurance premiums low. Insurance companies view drivers with fewer accidents and traffic violations as lower risks. Similarly, opting for a higher deductible can lead to lower premiums; however, it’s important to weigh the potential savings against the financial burden of a higher out-of-pocket expense in case of an accident. Bundling your auto insurance with other policies, such as homeowners or renters insurance, from the same company can often result in significant discounts. Furthermore, taking defensive driving courses can demonstrate your commitment to safe driving and may qualify you for premium reductions. Finally, consider the type of car you drive. Insurance premiums are often higher for high-performance vehicles or those with a history of theft or accidents.

The Role of Comparison Websites

Comparison websites offer a convenient way to obtain multiple quotes from different insurance providers simultaneously. These platforms allow you to input your information once and receive a range of quotes, simplifying the process of finding the most competitive pricing. It’s crucial, however, to carefully review the coverage details offered by each insurer, as the lowest price may not always equate to the best overall coverage. While comparison websites are a valuable tool, remember to verify the information presented with the insurance company directly before making a decision.

Obtaining an Auto Insurance Quote: A Step-by-Step Guide

- Gather Necessary Information: Compile information such as your driver’s license number, vehicle identification number (VIN), driving history (including accidents and violations), and desired coverage levels.

- Use Comparison Websites: Visit multiple comparison websites and enter your information to receive quotes from various insurers. Note that the quotes you receive are estimates and may vary slightly from the final policy price.

- Review Quotes Carefully: Compare quotes not only based on price but also on the coverage details offered. Consider factors such as deductibles, liability limits, and additional coverages.

- Contact Insurers Directly: Once you’ve identified a few promising options, contact the insurers directly to clarify any questions and discuss your specific needs. This allows you to verify the information and potentially negotiate a better rate.

- Review Policy Documents: Before purchasing a policy, carefully read all policy documents to ensure you fully understand the terms and conditions. Pay close attention to exclusions and limitations.

- Purchase and Maintain Coverage: Once you’ve chosen a policy, complete the purchase process and ensure you maintain continuous coverage to avoid penalties or gaps in protection.

Understanding Florida’s No-Fault Law

Florida’s no-fault insurance system, primarily governed by the Personal Injury Protection (PIP) coverage within your auto insurance policy, dictates how injuries sustained in car accidents are handled. This system aims to expedite the claims process and reduce the burden on the court system, but it has its complexities and limitations. Understanding these nuances is crucial for navigating the aftermath of a car accident in Florida.

Florida’s no-fault law requires all drivers to carry Personal Injury Protection (PIP) coverage. This coverage pays for your medical bills and lost wages, regardless of who caused the accident. However, the amount of PIP coverage is limited, and there are specific requirements for obtaining benefits. The system is designed to provide immediate financial relief for medical expenses and lost income following an accident, minimizing the need to immediately pursue a lawsuit against the at-fault driver. However, the system also has limitations, especially in cases involving serious injuries or significant damages.

PIP Coverage Benefits and Limitations

PIP coverage in Florida offers benefits such as payment for medical expenses (including doctor visits, hospital stays, and rehabilitation) and lost wages resulting from injuries sustained in a car accident. It also covers the medical expenses of passengers in your vehicle, regardless of fault. However, PIP coverage is limited to 80% of your medical bills and 60% of your lost wages, up to a policy limit, often $10,000. Furthermore, PIP does not cover pain and suffering unless you sustain a permanent injury or significant scarring. This means that even if you incur substantial medical expenses, your compensation might be limited, and you may not be compensated for the pain and suffering you experienced. Moreover, there is a waiting period before PIP benefits begin.

Filing a PIP Claim

Filing a PIP claim typically involves reporting the accident to your insurance company as soon as possible, usually within a specific timeframe Artikeld in your policy. You’ll then need to provide documentation, such as police reports, medical bills, and proof of lost wages. Your insurance company will review your claim and determine the amount of coverage you’re entitled to. Failure to follow the specific procedures and deadlines Artikeld in your policy could result in delays or denial of benefits. It’s important to thoroughly understand your policy and keep detailed records of all communications and documents related to your claim. Consider seeking legal advice if you encounter difficulties with your insurance company.

Situations Requiring Claims Beyond PIP Coverage

PIP coverage is primarily designed to address medical expenses and lost wages. However, there are situations where PIP coverage is insufficient, and you may need to pursue a claim against the at-fault driver’s insurance company or file a lawsuit. This is often the case when your injuries are severe and result in significant long-term medical expenses, substantial lost wages, or significant pain and suffering. Examples include serious injuries like broken bones requiring extensive surgery, traumatic brain injuries, or paralysis. If your medical bills exceed your PIP coverage limits, or if you’ve sustained a permanent injury, you may be able to pursue a claim for additional compensation beyond PIP benefits. Similarly, if you’ve suffered significant property damage, exceeding your collision coverage, a claim against the at-fault driver would be necessary. In such cases, you would likely need to engage an attorney specializing in personal injury law to navigate the complexities of the legal process.

Last Point

Securing adequate and affordable Florida automobile insurance requires careful consideration of individual needs and a thorough understanding of the state’s unique regulatory environment. By comparing quotes, understanding coverage options, and proactively managing risk, drivers can protect themselves financially and legally. This guide serves as a starting point for a more informed approach to insurance, enabling you to make choices that best suit your circumstances and provide the necessary peace of mind on Florida’s roads.

Clarifying Questions

What is the minimum liability coverage required in Florida?

Florida requires a minimum of $10,000 in Personal Injury Protection (PIP) and $10,000 in Property Damage Liability (PDL).

Can I get my car insurance through my employer?

Some employers offer group insurance plans with discounted rates, but it’s not universally available. You’ll need to check with your HR department.

What happens if I’m in an accident and am not at fault?

Even if you’re not at fault, your PIP coverage will typically cover your medical bills and lost wages first. You can then pursue a claim against the at-fault driver’s liability insurance.

How long do I have to file a claim after an accident?

This varies depending on the type of claim and your insurance policy, but it’s generally advisable to report the accident and begin the claims process as soon as possible.

What is Uninsured/Underinsured Motorist (UM/UIM) coverage?

UM/UIM coverage protects you if you’re injured in an accident caused by an uninsured or underinsured driver. It covers medical bills, lost wages, and other damages.