Securing affordable and comprehensive health insurance can feel like navigating a complex maze. The Florida Health Insurance Marketplace, however, offers a pathway to access a range of plans designed to meet diverse needs and budgets. This guide provides a clear and concise overview of the marketplace, its functionalities, and the crucial steps involved in obtaining coverage. We’ll explore the various plan options, eligibility criteria, financial assistance programs, and consumer protections to empower you to make informed decisions about your healthcare.

Understanding the intricacies of the Florida Health Insurance Marketplace is key to securing the right health insurance plan. From enrollment procedures and available subsidies to plan selection and consumer rights, this guide serves as a comprehensive resource to simplify the process and ensure you’re equipped to navigate this important aspect of your well-being.

Overview of Florida Health Insurance Marketplace

The Florida Health Insurance Marketplace, also known as the Florida HealthCare.gov, is a government-run online platform designed to help Floridians find and enroll in affordable health insurance plans that meet their individual needs. Its purpose is to simplify the process of obtaining health coverage, making it more accessible and transparent for consumers. The marketplace offers a range of plans from various insurers, allowing individuals to compare options and choose the best fit for their budget and health requirements.

Types of Health Insurance Plans Available

The Florida Health Insurance Marketplace offers several types of health insurance plans, each with varying levels of coverage and cost. These typically include Bronze, Silver, Gold, and Platinum plans. The metal tiers represent the percentage of costs the plan will cover; Bronze plans have the lowest cost-sharing but the highest out-of-pocket expenses, while Platinum plans have the highest cost-sharing but the lowest out-of-pocket maximums. Catastrophic plans are also available for those who meet specific age and income requirements. Each plan type offers a different balance between premiums (monthly payments) and out-of-pocket costs. Understanding these differences is crucial for selecting a suitable plan.

Eligibility Requirements for Enrollment

Eligibility for enrollment in the Florida Health Insurance Marketplace depends primarily on residency, citizenship or immigration status, and income. Residents of Florida who are U.S. citizens or legal residents are generally eligible. Income levels are assessed based on federal poverty guidelines; individuals and families with incomes within a specific range may qualify for subsidies to reduce their premium costs. Those who have recently experienced a qualifying life event, such as marriage, divorce, birth of a child, or job loss, may also be eligible for a special enrollment period outside of the annual open enrollment period. It is important to check the specific eligibility criteria on the Healthcare.gov website for the most up-to-date information.

Key Features of the Marketplace Website

The Florida Health Insurance Marketplace website offers several key features to aid consumers in their search for health insurance. These features are designed to make the process of comparing plans and enrolling in coverage as efficient and user-friendly as possible.

| Feature | Description | Benefits | Potential Drawbacks |

|---|---|---|---|

| Plan Comparison Tool | Allows users to compare different health insurance plans side-by-side based on factors like premium costs, deductibles, co-pays, and network providers. | Enables informed decision-making by providing a clear overview of plan differences. | Can be overwhelming for users unfamiliar with health insurance terminology. |

| Eligibility Checker | A tool that determines whether an individual qualifies for financial assistance or subsidies based on their income and household size. | Helps users understand their eligibility for cost-reducing programs. | Requires accurate and complete personal information input. |

| Secure Online Enrollment | Provides a secure platform for users to apply for and enroll in health insurance plans online. | Convenient and efficient enrollment process. | Requires internet access and technical proficiency. |

| Customer Support | Offers various avenues for customer support, including phone, email, and online chat. | Assists users with any questions or issues they may encounter during the enrollment process. | Wait times for assistance may vary depending on demand. |

Enrollment Process and Procedures

Navigating the Florida Health Insurance Marketplace can seem daunting, but the enrollment process is designed to be straightforward. Understanding the steps involved and the necessary documentation will ensure a smooth and efficient experience. This section details the process, required documents, and key deadlines.

The enrollment process for the Florida Health Insurance Marketplace involves several key steps. It’s crucial to carefully review each step and gather the necessary documentation beforehand to expedite the process.

Required Documentation for Verification of Eligibility

Verification of eligibility requires providing certain documents to confirm your identity, income, and household composition. This ensures you are enrolled in the appropriate plan and receive the correct level of financial assistance, if eligible. Providing accurate and complete information is vital for a successful application.

Examples of required documentation include:

- Proof of identity (such as a driver’s license or passport).

- Social Security numbers for all household members.

- Proof of income (such as pay stubs, tax returns, or W-2 forms).

- Proof of citizenship or legal residency.

- Information on any current health coverage.

Enrollment Periods and Deadlines

The Florida Health Insurance Marketplace follows specific enrollment periods and deadlines. Missing these deadlines could result in a delay in coverage or inability to enroll until the next open enrollment period. It’s crucial to understand these timelines and plan accordingly.

The Marketplace generally offers an annual Open Enrollment Period (OEP) and Special Enrollment Periods (SEPs) for qualifying life events. Missing the OEP typically means waiting for a SEP, unless you qualify for an exception. The specific dates for these periods are announced annually by the Marketplace and are subject to change.

Step-by-Step Enrollment Process

The enrollment process is designed to guide you through each stage systematically. It is important to follow each step carefully to ensure accuracy and avoid delays.

- Create an Account: Begin by creating an account on the official Florida Health Insurance Marketplace website. You will need to provide personal information to establish your account.

- Provide Information: Complete the application by providing detailed information about yourself and your household members, including income, employment status, and household size. Accuracy is paramount at this stage.

- Review Plan Options: Once your application is processed, you will be presented with a list of health insurance plans available in your area based on your eligibility. Compare plans based on factors like cost, coverage, and provider networks.

- Select a Plan: Carefully review the available plans and choose the one that best suits your needs and budget. Consider factors such as premiums, deductibles, co-pays, and out-of-pocket maximums.

- Enroll and Pay: After selecting a plan, you will be guided through the enrollment process, which includes providing payment information. You will receive confirmation of your enrollment once the process is complete.

- Verify Coverage: After enrollment, verify your coverage by checking your plan details and ensuring your information is accurate. Contact the Marketplace if you have any questions or discrepancies.

Plan Selection and Comparison

Choosing the right health insurance plan can feel overwhelming, but understanding the key factors and plan types will simplify the process. This section will guide you through comparing plans based on your individual needs and budget. Consider this your roadmap to making an informed decision.

Factors to Consider When Selecting a Health Insurance Plan

Several crucial factors influence the suitability of a health insurance plan. These include your budget, anticipated healthcare needs, preferred doctors and hospitals, and the level of coverage you require. A thorough assessment of these elements ensures you select a plan that aligns with your circumstances. For instance, a young, healthy individual might prioritize a lower premium, while someone with pre-existing conditions might focus on comprehensive coverage. Similarly, proximity to network providers is crucial for convenience and cost-effectiveness.

Comparison of Different Health Insurance Plan Types

The Florida Health Insurance Marketplace offers various health insurance plans, each with distinct characteristics. Understanding these differences is essential for selecting the right fit.

HMO (Health Maintenance Organization) plans typically require you to choose a primary care physician (PCP) within the network. Referrals from your PCP are usually needed to see specialists. HMO plans generally have lower premiums but more restricted access to out-of-network providers.

PPO (Preferred Provider Organization) plans offer greater flexibility. You can see specialists without a referral and visit out-of-network providers, although at a higher cost. PPO plans usually have higher premiums than HMO plans but provide more choice.

EPO (Exclusive Provider Organization) plans are similar to HMOs in that they require you to select a PCP within the network. However, unlike HMOs, EPOs typically do not allow access to out-of-network providers, except in emergency situations. EPO premiums are usually somewhere between HMO and PPO premiums.

Key Plan Features: Deductibles, Co-pays, and Out-of-Pocket Maximums

Understanding key plan features like deductibles, co-pays, and out-of-pocket maximums is vital. The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Co-pays are fixed amounts you pay for doctor visits or other services. The out-of-pocket maximum is the most you will pay in a year for covered services. Once this limit is reached, your insurance company covers 100% of the costs for covered services.

Sample Plan Comparison

The following table compares three sample plans—a hypothetical HMO, PPO, and EPO—to illustrate these key features and costs. Remember that actual plan details and costs vary by insurer and location.

| Feature | Sample HMO Plan | Sample PPO Plan | Sample EPO Plan |

|---|---|---|---|

| Monthly Premium | $300 | $450 | $375 |

| Annual Deductible | $1,500 | $3,000 | $2,000 |

| Doctor’s Visit Co-pay | $25 | $50 | $35 |

| Specialist Visit Co-pay | $50 (with referral) | $75 | $60 (with referral) |

| Out-of-Pocket Maximum | $6,000 | $8,000 | $7,000 |

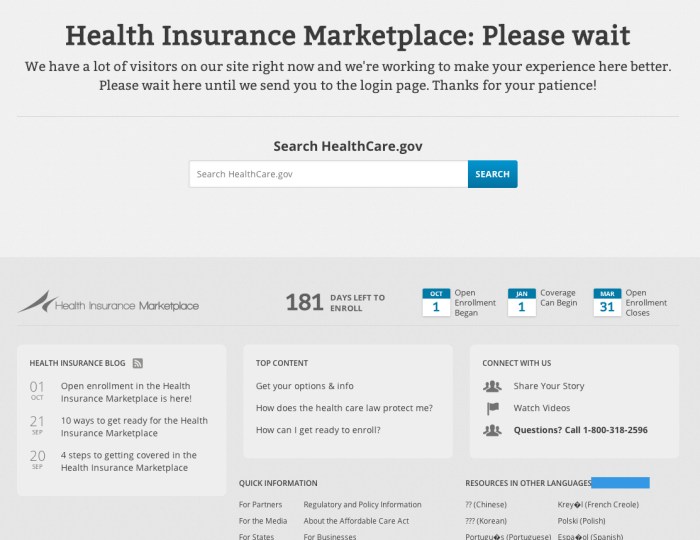

Navigating the Florida Health Insurance Marketplace Website

The Florida Health Insurance Marketplace website is designed to guide users through the process of selecting a health insurance plan. Its intuitive interface and comprehensive search tools aim to simplify what can be a complex process. The website offers various features to assist users in finding the best plan based on their individual needs and budget.

The website’s user interface is generally straightforward, featuring a clean layout and clear navigation. Information is presented in a logical order, allowing users to easily find what they need. The site is responsive, adapting seamlessly to different screen sizes, making it accessible on desktops, tablets, and smartphones.

Website Features for Plan Searching and Comparison

The Florida Health Insurance Marketplace website offers several robust features to aid in plan selection. These tools help users compare plans based on various factors, including premiums, deductibles, co-pays, and network coverage. Users can filter search results based on their specific requirements, such as preferred doctors or hospitals. The website also provides a clear summary of each plan’s benefits and limitations. This comprehensive comparison feature enables users to make informed decisions.

Accessing Customer Support and Resources

The website provides multiple avenues for accessing assistance. A comprehensive FAQ section addresses frequently asked questions. Contact information for customer service representatives is prominently displayed, offering users the ability to speak with a representative via phone or email. Additionally, the site may offer live chat support during peak enrollment periods, providing immediate assistance. Numerous helpful guides and tutorials are available to walk users through the enrollment process step-by-step.

Step-by-Step Guide to Finding and Comparing Plans

Finding and comparing plans on the Florida Health Insurance Marketplace website is a straightforward process. Follow these steps:

- Create an Account: Begin by creating an account on the website. This involves providing basic personal information to ensure a secure and personalized experience.

- Provide Necessary Information: The system will then prompt you to enter essential information, such as your zip code, household income, and the number of people needing coverage. Accurate information is crucial for receiving appropriate plan recommendations.

- View Plan Options: Once you’ve provided the necessary information, the website will display a list of available plans in your area. This list will include details about each plan’s premium, deductible, and network coverage.

- Compare Plans: Use the website’s comparison tools to compare plans side-by-side. You can easily see how different plans stack up against each other based on your priorities.

- Review Plan Details: Click on each plan for a detailed description of its coverage, benefits, and limitations. Carefully review this information before making your selection.

- Enroll in a Plan: Once you’ve chosen a plan, follow the instructions on the website to enroll. This typically involves providing additional information and confirming your selection.

Consumer Protections and Rights

Purchasing health insurance through the Florida Health Insurance Marketplace offers several crucial consumer protections designed to ensure fair and transparent transactions. These safeguards protect individuals from unfair practices and ensure access to quality healthcare coverage. Understanding these rights empowers consumers to make informed decisions and seek recourse if necessary.

The Affordable Care Act (ACA) provides a foundation for many of these consumer protections. These protections are designed to prevent discriminatory practices, ensure access to essential health benefits, and provide avenues for resolving disputes. They aim to create a level playing field where consumers can confidently choose a health plan that best meets their needs.

Filing a Complaint or Appeal

Consumers who believe they have been unfairly treated by an insurance company or the Marketplace itself have several avenues for recourse. The first step is typically to contact the insurance company directly to attempt to resolve the issue. If this fails, a formal complaint can be filed with the Florida Office of Insurance Regulation (OIR). The OIR investigates complaints and can take action against insurers who violate state laws. Consumers may also appeal decisions made by the Marketplace regarding eligibility or plan enrollment. The appeal process usually involves submitting a written request outlining the reasons for the appeal and providing supporting documentation. The Marketplace then reviews the appeal and provides a decision in writing. Detailed instructions on filing a complaint or initiating an appeal are usually available on the Marketplace website and the OIR website.

Consumer Assistance Programs

Several programs offer assistance to consumers navigating the Marketplace and understanding their rights. These programs often provide free assistance with enrollment, plan selection, and understanding consumer protections. Navigating the complexities of health insurance can be daunting, and these programs offer valuable support. Many organizations offer free or low-cost assistance, including non-profit groups, community health centers, and state-sponsored programs. These programs often employ trained navigators who can help individuals understand their options and make informed decisions. Information on these programs is typically available on the Marketplace website or through a simple online search.

Summary of Consumer Rights and Protections

- Protection from discrimination based on health status, age, or other factors.

- Access to a comprehensive range of essential health benefits.

- The right to appeal Marketplace decisions regarding eligibility or plan enrollment.

- Assistance with understanding your policy and filing complaints.

- The ability to choose from a variety of plans to find one that meets your needs and budget.

- Guaranteed issue: Insurance companies cannot deny coverage based on pre-existing conditions.

- Access to consumer assistance programs that provide free or low-cost help.

- Transparency in pricing and plan benefits.

Closure

Successfully navigating the Florida Health Insurance Marketplace requires careful planning and understanding. By familiarizing yourself with the enrollment process, available financial assistance, plan options, and consumer protections, you can confidently secure a health insurance plan that aligns with your individual needs and financial capabilities. Remember to utilize the marketplace’s resources and seek assistance when needed to ensure a smooth and successful experience. Taking proactive steps to understand your options will lead to peace of mind and access to quality healthcare.

Q&A

What happens if I miss the open enrollment period?

There are limited circumstances where you may qualify for a Special Enrollment Period outside of the regular open enrollment. These typically involve life changes such as marriage, birth, or job loss. Check the marketplace website for details.

Can I keep my current doctor if I switch plans?

Whether you can keep your current doctor depends on the type of plan you choose (HMO, PPO, etc.) and whether your doctor participates in the plan’s network. Carefully review the plan’s provider directory before enrolling.

What if I can’t afford the premiums even with subsidies?

The marketplace offers various assistance programs beyond subsidies. Contact the marketplace directly or seek advice from a health insurance navigator to explore options like payment plans or alternative programs.

How do I appeal a decision made by the marketplace?

The marketplace provides a detailed appeals process. This usually involves submitting a formal request outlining your concerns and supporting documentation. Instructions are available on the marketplace website.