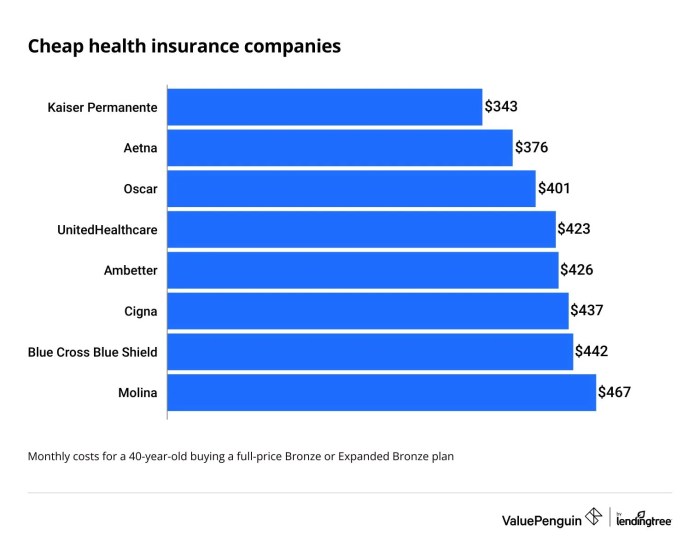

Securing affordable healthcare is a paramount concern for many, and understanding the landscape of health insurance low cost is crucial. This guide unravels the complexities of finding and managing low-cost health insurance plans, empowering you to make informed decisions about your healthcare coverage. We’ll explore various plan types, eligibility requirements, cost-saving strategies, and the overall impact of affordable healthcare access.

The rising cost of healthcare makes finding affordable insurance a significant challenge. However, various options exist, ranging from government-subsidized programs to private plans with lower premiums. This guide aims to provide a comprehensive overview of these options, equipping you with the knowledge to navigate the system and secure the best possible coverage for your needs and budget.

Eligibility and Qualification for Low-Cost Plans

Securing affordable health insurance can be a significant challenge, but various programs exist to assist individuals and families in accessing necessary medical care. Understanding the eligibility requirements for these programs is crucial to navigating the process successfully. This section Artikels the criteria for government-subsidized plans and provides a clearer picture of the application process.

Eligibility criteria for government-subsidized health insurance programs, such as the Affordable Care Act (ACA) marketplaces and Medicaid, primarily revolve around income and household size. These programs aim to provide affordable healthcare coverage to those who would otherwise struggle to afford it. Additional factors, such as citizenship status and residency, also play a role in determining eligibility.

Income Thresholds and Other Requirements

Government-subsidized health insurance plans have income limits that vary by state and household size. These limits are based on the Federal Poverty Level (FPL). For example, a family of four might qualify for Medicaid if their income falls below a certain percentage of the FPL, while those with slightly higher incomes may be eligible for subsidized plans through the ACA marketplaces. Beyond income, other requirements may include citizenship or legal immigration status, residency within a specific state, and sometimes, specific health conditions. Individuals should carefully review the specific requirements for their state and household situation. For instance, some states may expand Medicaid eligibility beyond the federal guidelines.

The Application Process for Low-Cost Programs

Applying for low-cost health insurance involves several steps. Generally, the process begins by determining eligibility through online tools or contacting state-level agencies. Once eligibility is established, applicants typically complete an application form, providing information about income, household size, and other relevant details. This application is then reviewed, and individuals are notified of their eligibility for specific plans and the level of subsidy they may receive. Subsidies reduce the monthly premiums, making the plans more affordable. The entire process can vary slightly depending on the specific program and state.

Real-World Examples of Successful Applications

Maria, a single mother of two living in California, successfully obtained subsidized coverage through Covered California, the state’s ACA marketplace. Her income was just above the Medicaid threshold, but below the income limit for subsidies. The subsidy significantly reduced her monthly premiums, making healthcare accessible for her family. Similarly, John, a self-employed carpenter in Texas, qualified for Medicaid due to his low income and a pre-existing condition. His application was straightforward, and he now has access to essential healthcare services. These are just two examples illustrating how individuals from various backgrounds have successfully obtained low-cost health insurance. It’s important to note that individual experiences can vary, and it’s recommended to thoroughly research the programs available in your area.

Finding and Choosing a Low-Cost Plan

Securing affordable health insurance can feel overwhelming, but a systematic approach simplifies the process. By understanding your options and employing effective comparison strategies, you can find a plan that fits your budget and healthcare needs. This section Artikels a step-by-step guide to navigate the complexities of choosing a low-cost health insurance plan.

Step-by-Step Guide to Finding Affordable Health Insurance

Finding the right affordable health insurance plan involves several key steps. First, you need to determine your eligibility for government assistance programs like Medicaid or the Affordable Care Act (ACA) marketplace subsidies. Next, carefully compare plans from different insurers, focusing on factors like premiums, deductibles, co-pays, and out-of-pocket maximums. Finally, thoroughly review the policy details to ensure it meets your specific healthcare requirements.

- Assess your eligibility for government assistance: Determine if you qualify for Medicaid or subsidies through the ACA marketplace. These programs can significantly reduce your monthly premiums and out-of-pocket costs.

- Use online marketplaces and comparison tools: Utilize websites like Healthcare.gov (for ACA plans) or state-based marketplaces to compare plans side-by-side. These tools allow you to filter by price, coverage, and network of doctors.

- Compare plans based on key factors: Pay close attention to premiums (monthly payments), deductibles (amount you pay before insurance kicks in), co-pays (fees for doctor visits), and out-of-pocket maximums (the most you’ll pay in a year). Consider your expected healthcare needs when weighing these factors.

- Review the provider network: Ensure your preferred doctors and hospitals are included in the plan’s network. Seeing out-of-network providers will typically result in higher costs.

- Read the policy details carefully: Before enrolling, thoroughly review the policy document to understand all aspects of coverage, including exclusions and limitations.

Comparison of Online Resources and Tools

Several online resources can assist in finding low-cost health insurance plans. These resources offer varying levels of detail and functionality, making it crucial to understand their strengths and limitations. Careful comparison helps you choose the most suitable tool for your needs.

| Resource | Description | Strengths | Weaknesses |

|---|---|---|---|

| Healthcare.gov | The official website for the Affordable Care Act (ACA) marketplace. | Comprehensive plan comparisons, subsidy eligibility check, secure enrollment. | Can be complex to navigate for first-time users. |

| State-based marketplaces | Many states operate their own marketplaces, offering similar functionalities to Healthcare.gov. | May offer state-specific programs and resources. | Functionality and features may vary by state. |

| Private comparison websites | Several private companies offer health insurance comparison tools. | May provide additional features or easier navigation. | May not include all plans available in your area, potential for bias due to advertising partnerships. |

Questions to Ask Insurance Providers

Direct communication with insurance providers clarifies uncertainties and ensures you select a plan that aligns with your needs. Asking specific questions helps in making an informed decision.

- What is the monthly premium for this plan?

- What is the deductible, and what services are covered before meeting the deductible?

- What are the co-pays for doctor visits and specialist visits?

- What is the out-of-pocket maximum for this plan?

- Which doctors and hospitals are in the plan’s network?

- What are the plan’s limitations or exclusions?

- What is the process for filing claims?

Interpreting Health Insurance Policy Details

Understanding the true cost of a health insurance plan requires careful examination of several factors beyond the monthly premium. A seemingly low premium might hide high deductibles or co-pays, resulting in unexpectedly high out-of-pocket expenses.

The true cost involves not only the monthly premium but also the deductible, co-pays, and out-of-pocket maximum. Consider your anticipated healthcare needs to estimate your total annual cost.

For example, a plan with a low monthly premium of $100 but a high deductible of $5,000 could be more expensive than a plan with a higher premium of $200 but a lower deductible of $2,000 if you anticipate needing significant medical care. Always compare the total estimated annual cost, considering your health history and anticipated healthcare utilization.

Final Conclusion

Gaining access to affordable healthcare shouldn’t be a daunting task. By understanding the factors influencing health insurance costs, exploring available options, and implementing cost-management strategies, you can secure a plan that meets your needs without breaking the bank. Remember to actively engage in your healthcare journey and utilize the resources available to maximize the value of your chosen plan. Your health and financial well-being are paramount, and making informed decisions about your health insurance is a crucial step in achieving both.

FAQ

What is a deductible?

A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance company starts paying.

What is a copay?

A copay is a fixed amount you pay for a covered healthcare service, like a doctor’s visit, at the time of service.

What is an out-of-pocket maximum?

The out-of-pocket maximum is the most you will pay out-of-pocket during a policy year for covered services. After reaching this limit, your insurance company pays 100% of covered expenses.

Can I change my health insurance plan during the year?

Generally, you can only change plans during the annual open enrollment period, unless you qualify for a special enrollment period due to a life event (e.g., marriage, job loss).

Where can I find help applying for government-subsidized health insurance?

You can typically find assistance through the Healthcare.gov website or your state’s health insurance marketplace.