Securing your home and its contents is a significant financial responsibility, and understanding your home insurance policy is crucial. This guide delves into the intricacies of home insurance, demystifying complex terminology and providing practical advice to help you make informed decisions about protecting your most valuable asset.

From understanding coverage types and policy components to filing claims and choosing the right policy, we’ll cover essential aspects to empower you in managing your home insurance effectively. We’ll explore various scenarios, providing real-world examples and practical tips to ensure you’re well-prepared for any eventuality.

Understanding Home Insurance Policy Coverage

Choosing the right home insurance policy can feel overwhelming, given the variety of options and complexities involved. This section aims to clarify the different types of coverage, standard inclusions, and variations between insurers, ultimately helping you make an informed decision.

Home insurance policies are designed to protect your biggest investment – your home – against various unforeseen circumstances. Understanding the nuances of coverage is crucial to ensuring you have adequate protection.

Types of Home Insurance Coverage

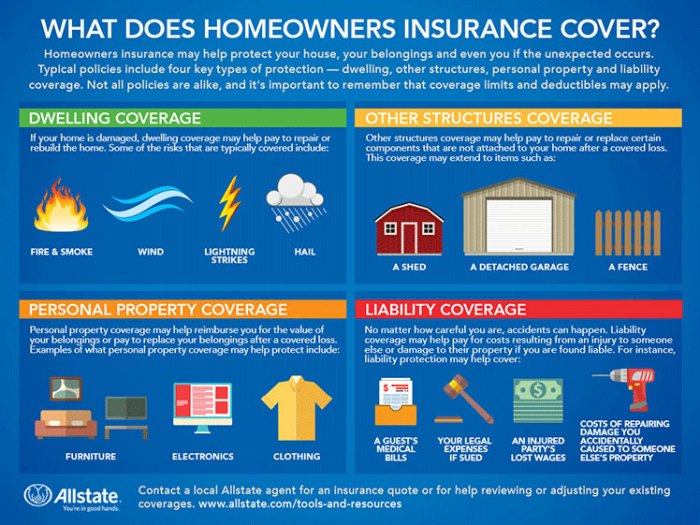

Home insurance policies typically offer several key types of coverage. These can vary slightly depending on the insurer and the specific policy, but generally include dwelling coverage (protecting the physical structure of your home), personal property coverage (covering your belongings), liability coverage (protecting you from lawsuits resulting from accidents on your property), and additional living expenses coverage (covering temporary housing and related costs if your home becomes uninhabitable due to a covered event). Some policies also offer specialized coverage such as flood insurance or earthquake insurance, which are often purchased as separate endorsements.

Standard Inclusions in a Home Insurance Policy

A typical home insurance policy includes several standard provisions. These often cover damage caused by fire, windstorms, hail, vandalism, and theft. However, it’s vital to carefully review the specific policy wording to understand the exact extent of coverage for each peril. For example, while fire damage is generally covered, there may be exclusions or limitations related to specific causes of the fire, or the value of items destroyed. Similarly, theft coverage may have limitations on the value of certain items, or require specific security measures to be in place.

Comparison of Coverage Offered by Different Insurers

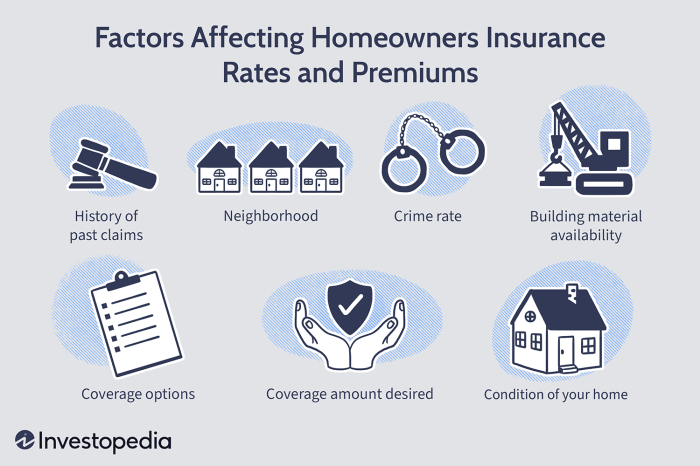

Different insurers offer varying levels of coverage and policy features. Some insurers may offer broader coverage for certain perils, while others may provide more competitive premiums. For instance, one insurer might offer a higher coverage limit for personal belongings, while another might offer a more comprehensive liability coverage. It’s essential to compare quotes from multiple insurers, paying close attention to the specific terms and conditions of each policy to determine which best suits your individual needs and budget. Factors like your location, the age and condition of your home, and your claims history can significantly impact the premiums and coverage offered.

Examples of Situations Where Home Insurance Provides Financial Protection

Home insurance provides a financial safety net in various scenarios. For example, if a fire destroys your home, your dwelling coverage will help rebuild or repair it. If a tree falls on your roof during a storm, causing damage, your policy will likely cover the repairs. If someone is injured on your property and sues you, your liability coverage will help pay for legal costs and any settlements. If your home becomes uninhabitable due to a covered event, such as a burst pipe, your additional living expenses coverage can help cover the cost of temporary housing, meals, and other essential expenses. In each of these situations, the financial burden without home insurance could be substantial, potentially leading to significant personal hardship.

Policy Components and Definitions

Understanding the key components of your home insurance policy is crucial for ensuring you have adequate coverage and are aware of your responsibilities. This section will define key terms and explain the importance of understanding policy limits and exclusions.

Key Terms in Home Insurance

Several key terms are fundamental to understanding your home insurance policy. These terms define the scope of your coverage and your financial responsibilities.

Liability: This refers to your legal responsibility to pay for damages or injuries caused to others. For example, if someone is injured on your property due to your negligence, your liability coverage would help pay for their medical bills and legal costs. The amount of liability coverage you carry is a critical decision and should be carefully considered based on your assets and potential risks.

Deductible: This is the amount of money you must pay out-of-pocket before your insurance coverage kicks in. For instance, if you have a $1,000 deductible and suffer $5,000 in damage from a covered event, you would pay the first $1,000, and your insurer would cover the remaining $4,000. A higher deductible typically results in lower premiums, while a lower deductible means higher premiums.

Premium: This is the regular payment you make to your insurance company to maintain your coverage. Premiums are calculated based on several factors, including the value of your home, your location, the coverage you select, and your claims history. A higher level of coverage generally translates to higher premiums.

Significance of Policy Limits and Exclusions

Understanding your policy limits and exclusions is just as important as understanding the key terms.

Policy Limits: These are the maximum amounts your insurance company will pay for a specific covered loss. For example, your policy might have a limit of $250,000 for dwelling coverage and $100,000 for liability. If the damage to your home exceeds $250,000, you would be responsible for the difference. It’s crucial to ensure your policy limits are sufficient to cover the full replacement cost of your home and possessions.

Exclusions: These are specific events or circumstances that are not covered by your insurance policy. Knowing these exclusions is vital to avoid surprises when you need to file a claim. Carefully reviewing your policy documents to understand what is and isn’t covered is crucial.

Examples of Common Exclusions

Many standard home insurance policies exclude certain types of damage or events. Understanding these common exclusions can help you prepare and potentially seek supplemental coverage if needed.

Some common exclusions include damage caused by floods, earthquakes, acts of war, or intentional acts by the policyholder. Specific exclusions vary by insurer and policy, so it is always best to refer to your specific policy document for the complete list of exclusions. Consider purchasing additional coverage, like flood insurance or earthquake insurance, if you live in a high-risk area.

Key Policy Components Summary

The following table summarizes key policy components and their implications:

| Component | Definition | Implications | Example |

|---|---|---|---|

| Premium | Regular payment for coverage | Higher coverage = higher premium; higher deductible = lower premium | Monthly payment of $150 |

| Deductible | Amount paid before coverage starts | Higher deductible = lower premium; lower deductible = higher premium | $1,000 deductible on a $10,000 claim |

| Liability Coverage | Protection against lawsuits for injuries or damages | Covers legal fees and settlements; amount varies based on risk | $300,000 liability coverage |

| Policy Limits | Maximum payout for a covered event | Ensures sufficient coverage; exceeding limits results in out-of-pocket costs | $250,000 dwelling coverage |

Filing a Claim

Filing a home insurance claim can seem daunting, but understanding the process can make it significantly less stressful. This section details the steps involved in reporting a covered loss and submitting the necessary documentation to your insurance provider. Remember to always refer to your specific policy documents for detailed information relevant to your coverage.

The Claim Filing Process

After experiencing a covered loss, promptly contact your insurance provider. This usually involves calling their claims hotline, which should be clearly listed in your policy documents. Following the initial contact, you will likely be assigned a claims adjuster who will guide you through the subsequent steps. This adjuster will be your primary point of contact throughout the claims process.

Documentation Required for a Claim

Providing comprehensive documentation is crucial for a smooth and efficient claims process. The specific documents required may vary depending on the nature of the loss, but generally include:

- Proof of Loss: This is a formal statement detailing the loss, its cause, and the estimated value of the damages. Your insurance provider will likely provide a form for this.

- Policy Information: Have your policy number readily available. This will expedite the process.

- Photographs and Videos: Thorough documentation of the damage is essential. Take multiple pictures and videos from various angles, capturing the extent of the damage.

- Repair or Replacement Estimates: Obtain estimates from qualified contractors for repairs or replacements. This provides your insurer with a clear understanding of the costs involved.

- Police Report (if applicable): If the loss resulted from a crime (e.g., theft or vandalism), a police report is necessary.

- Inventory of Damaged Property: Create a detailed list of all damaged or destroyed items, including their value and purchase dates (if possible). Receipts can be helpful in supporting your claim.

Claim Filing Flowchart

Imagine a flowchart. The first box would read “Covered Loss Occurs”. An arrow points to the next box, “Contact Insurance Provider”. From there, an arrow points to “Claims Adjuster Assigned”. The next box would be “Documentation Submitted”. An arrow from this box leads to “Claim Reviewed and Processed”. A final arrow points to “Settlement Offered”. Branching off from “Claim Reviewed and Processed” is a box that reads “Further Investigation Required”, looping back to “Documentation Submitted” to request more information.

Choosing the Right Policy

Selecting the appropriate home insurance policy is crucial for protecting your most valuable asset. The right policy will offer sufficient coverage at a price that fits your budget, safeguarding you against financial hardship in the event of unforeseen circumstances. Understanding the different policy types and coverage options available is the first step in making an informed decision.

Home Insurance Policy Types

Several types of homeowners insurance policies cater to different needs and living situations. Two common types are the HO-3 and HO-4 policies. The HO-3, or “special form” policy, provides broad coverage for damage to your home and belongings, protecting against most perils except those specifically excluded in the policy. In contrast, the HO-4, or “renters insurance” policy, covers your personal belongings and liability, but not the structure of the building itself, as you are renting and not owning the property. Other policies, such as HO-5 (comprehensive form) offer even broader coverage than an HO-3. The specific coverage details vary between insurers and states, highlighting the importance of carefully reviewing your chosen policy.

Determining Appropriate Coverage Amounts

Accurately assessing the value of your home and belongings is paramount in determining the appropriate coverage amounts. For your home, consider its replacement cost, not its market value. Replacement cost accounts for the expense of rebuilding your home to its current standards, which can be significantly higher than its market value, especially in areas with high construction costs. For your belongings, consider creating a detailed inventory, photographing valuable items, and using online tools or apps to estimate their value. Underinsuring can lead to significant financial losses in the event of a claim, as you may only receive a partial reimbursement for your damages. For example, a home valued at $300,000 might require $400,000 in coverage to account for potential rebuilding costs and inflation.

Importance of Reading Policy Documents

Before purchasing any home insurance policy, thoroughly reviewing the policy documents is essential. This involves understanding the definitions of covered perils, exclusions, deductibles, and coverage limits. Pay close attention to any limitations or conditions that may affect your claim eligibility. For instance, a policy might exclude coverage for damage caused by flooding or earthquakes, requiring separate flood or earthquake insurance. Understanding these details empowers you to make an informed decision and avoid unpleasant surprises later. Don’t hesitate to contact your insurance agent to clarify any ambiguities or uncertainties.

Evaluating Policy Options Based on Individual Needs

Choosing the right policy requires careful consideration of your individual circumstances and risk tolerance. Factors to consider include the age and condition of your home, the value of your belongings, your location’s susceptibility to natural disasters, and your personal financial situation. Compare quotes from multiple insurers, ensuring you’re comparing similar coverage levels. Don’t solely focus on price; prioritize a policy that adequately protects your assets and aligns with your risk profile. For example, someone living in a hurricane-prone area should prioritize policies offering comprehensive windstorm coverage, even if it costs slightly more. Someone with valuable collections might need higher coverage limits for personal property.

Policy Renewals and Changes

Your home insurance policy doesn’t last forever. Understanding the renewal process and how to make changes is crucial to maintaining adequate protection for your home and belongings. This section Artikels the key aspects of policy renewals and modifications.

Policy Renewal Procedures typically involve a notification from your insurer nearing the expiration date of your current policy. This notification will usually include your renewal premium, any changes to policy terms, and instructions on how to renew. Most insurers offer convenient online renewal options, alongside the possibility of contacting them directly via phone or mail. Failure to respond within a specified timeframe may result in your policy lapsing. It’s essential to review the renewal terms carefully before confirming your renewal to ensure the coverage still meets your needs and that the premium is acceptable.

Making Policy Changes

Modifying your existing home insurance policy is often straightforward. Contacting your insurer directly is usually the first step. They can guide you through the necessary paperwork and explain any potential impacts on your premium. Changes can range from minor adjustments, such as updating your address, to more significant alterations, such as increasing coverage limits or adding specific endorsements. Documentation supporting any changes, such as proof of renovations or new valuables, might be required. Be aware that changes to your policy, particularly those increasing coverage, may lead to a higher premium.

Implications of Non-Renewal

Allowing your home insurance policy to lapse leaves your property vulnerable to significant financial risks. In the event of damage or loss, you would be responsible for all repair or replacement costs without insurance coverage. Furthermore, obtaining new insurance after a lapse can be more challenging and expensive, as insurers may view it as a higher risk. Some insurers may even refuse coverage altogether. Maintaining continuous insurance coverage is therefore highly recommended for financial security.

Situations Requiring Policy Changes

Several circumstances might necessitate changes to your home insurance policy. For instance, significant home improvements, such as adding a swimming pool or extending your property, would require updated coverage to reflect the increased value and risk. Similarly, acquiring valuable items, like jewelry or art, might necessitate adding a specific endorsement or increasing your personal property coverage limit. A change in occupancy, such as renting out a portion of your home, may also require policy adjustments to ensure appropriate liability coverage. Finally, a change in your financial situation, such as a significant increase in your assets, might prompt a review of your coverage limits and premium.

Common Home Insurance Claims

Understanding the types of claims most frequently filed can help homeowners better understand their coverage and prepare for unexpected events. This section Artikels common claims, reasons for denials, and a detailed example to illustrate the claims process.

Common home insurance claims often involve significant property damage or loss. These events can be devastating, both financially and emotionally, highlighting the importance of adequate insurance coverage.

Types of Common Home Insurance Claims

The most frequently filed home insurance claims typically fall into several categories. These include damage caused by fire, severe weather events (such as hail, wind, or flooding), theft or vandalism, and water damage (including burst pipes and appliance malfunctions). Liability claims, arising from accidents on your property that injure someone else, also constitute a significant portion of claims.

Reasons for Claim Denials

Insurance companies have specific criteria for approving claims. Claims may be denied for various reasons, including failure to meet policy requirements (such as neglecting to disclose pre-existing conditions), fraudulent claims, or claims that fall outside the scope of coverage. For instance, damage resulting from normal wear and tear is generally not covered, nor is damage caused by intentional acts by the policyholder. Failing to take reasonable steps to mitigate damage after an event can also affect claim approval. Furthermore, if a policy has lapsed or been cancelled, claims will be denied.

Example Home Insurance Claim Scenario

Imagine a family living in a two-story colonial home with a charming front porch. A sudden, severe thunderstorm rolls in one evening. The wind howls fiercely, and a large, old oak tree in the front yard is uprooted by the gale force winds. The tree crashes directly into the home, smashing through the roof of the living room and the master bedroom above. Debris and rain flood both rooms. The family is unharmed but understandably shaken.

The homeowner immediately calls their insurance provider to report the incident. They file a claim, providing detailed photographs and a comprehensive description of the damage. The photographs show the massive oak tree lying across the house, the significant roof damage, and the water damage inside the living room and master bedroom. The description includes details such as the time of the event, the weather conditions, and a list of damaged belongings (furniture, flooring, ceiling, etc.).

An adjuster is dispatched to inspect the damage within a few days. The adjuster carefully assesses the extent of the damage to the house and its contents, documenting everything with photographs and detailed notes. The adjuster also reviews the policy to verify coverage. After the inspection, the adjuster prepares a detailed report outlining the estimated cost of repairs, including labor and materials. This report is then reviewed by the insurance company’s claims department. The homeowner receives a settlement offer based on the adjuster’s report and the terms of their policy. The offer covers the cost of roof repair, interior repairs, and replacement of damaged belongings, less any deductible. The homeowner accepts the offer and the repairs are scheduled. The entire process, from the initial claim to the completion of repairs, takes approximately six weeks. The outcome is a successful claim settlement, allowing the family to rebuild and restore their home to its previous condition.

Final Thoughts

Protecting your home is a priority, and a well-understood home insurance policy is your first line of defense. By carefully considering the factors influencing premium costs, understanding policy inclusions and exclusions, and knowing how to navigate the claims process, you can ensure you have the right coverage to safeguard your investment. Remember, proactive planning and a thorough understanding of your policy are key to peace of mind.

Questions Often Asked

What is the difference between actual cash value (ACV) and replacement cost coverage?

ACV considers depreciation when determining the payout for damaged property, while replacement cost coverage pays for the full cost of replacing damaged items without considering depreciation.

How often can I file a claim?

The frequency of claims you can file depends on your policy and the nature of the claims. Repeated claims for minor incidents may impact your future premiums. Consult your policy or insurer for specifics.

What happens if I don’t renew my home insurance policy?

Failing to renew leaves your home and belongings uninsured, exposing you to significant financial risk in the event of damage or loss. You’ll need to obtain new coverage before your current policy expires.

Can I add or remove coverage from my existing policy?

Yes, you can typically add or remove coverage as your needs change. Contact your insurer to discuss modifications to your policy. There may be additional premiums or adjustments to your existing premium.

What types of events are typically *not* covered by a standard home insurance policy?

Common exclusions include floods, earthquakes, and acts of war. These events often require separate, specialized insurance coverage.