The cost of auto insurance can vary dramatically, leaving many drivers wondering, “How much is auto insurance, really?” This isn’t a simple question with a simple answer. Numerous factors influence your premium, from your age and driving record to the type of vehicle you drive and where you live. Understanding these factors is crucial to securing affordable and adequate coverage.

This guide delves into the complexities of auto insurance pricing, exploring the key elements that determine your premiums and offering practical strategies for saving money. We’ll examine different coverage types, compare quotes from various providers, and equip you with the knowledge to make informed decisions about your auto insurance.

Factors Influencing Auto Insurance Costs

Several key factors significantly influence the cost of auto insurance premiums. Understanding these factors can help drivers make informed decisions and potentially save money. These factors range from personal characteristics to the vehicle itself and even your geographical location.

Age and Driving History

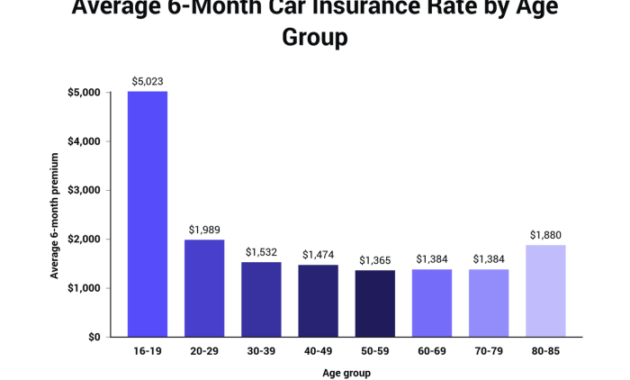

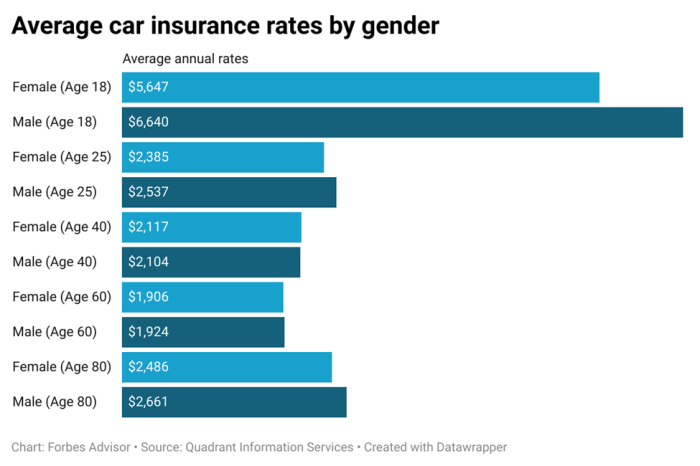

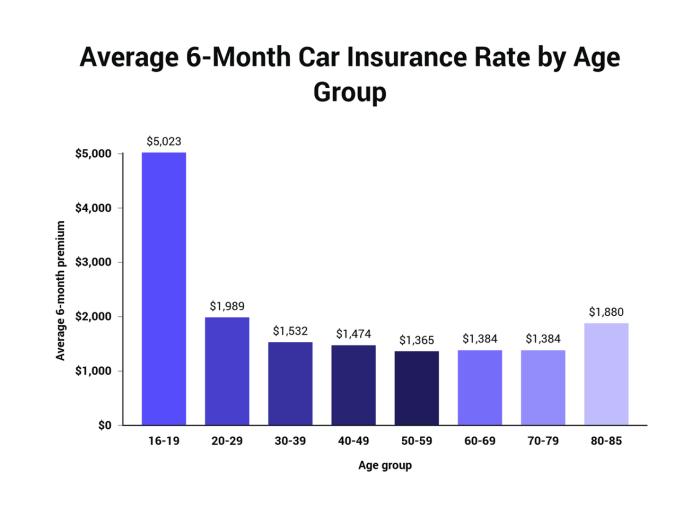

Age and driving history are strongly correlated with insurance risk. Younger drivers, particularly those with limited driving experience, statistically have a higher accident rate. Insurance companies reflect this increased risk by charging higher premiums for young drivers. Conversely, drivers with a clean driving record, meaning no accidents or traffic violations, typically qualify for lower rates. The longer a driver maintains a spotless record, the more their premiums may decrease. For example, a 20-year-old with a recent speeding ticket will likely pay significantly more than a 50-year-old with a 20-year history of accident-free driving.

Vehicle Type and Features

The type of vehicle you drive heavily influences your insurance costs. Sports cars and luxury vehicles are often more expensive to insure due to their higher repair costs and increased risk of theft. Features like anti-theft systems and safety technologies (e.g., airbags, anti-lock brakes) can positively impact your premiums. A safer vehicle with advanced safety features will generally result in lower insurance costs compared to an older model with fewer safety features. For instance, insuring a high-performance sports car will be substantially more expensive than insuring a fuel-efficient compact car.

State-Specific Insurance Rates

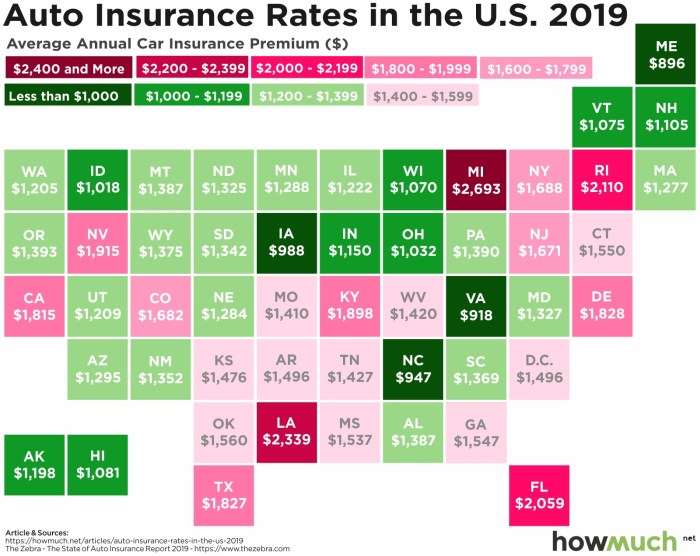

Insurance rates vary considerably across different states. Factors contributing to this variation include state-specific regulations, the density of population, the frequency of accidents, and the cost of healthcare. States with higher accident rates or stricter regulations tend to have higher average insurance premiums. For example, a driver in a state with a high population density and a high number of accidents might pay more than a driver in a state with a more rural population and lower accident rates.

Location Impact on Premiums

Your location plays a significant role in determining your insurance rates. Areas with higher crime rates, more frequent accidents, or higher repair costs will generally lead to higher premiums. Urban areas often have higher insurance rates than rural areas due to factors such as increased traffic congestion and higher risk of theft. A driver living in a high-crime urban area will likely pay more than a driver in a quiet suburban neighborhood.

Comparison of Insurance Costs for Different Driver Profiles

| Driver Profile | Age Range | Driving History | Estimated Annual Premium (Example) |

|---|---|---|---|

| Young Driver | 16-25 | Limited experience, potential violations | $2,000 – $3,500 |

| Experienced Driver | 30-50 | Clean driving record, 5+ years experience | $1,000 – $1,800 |

| Senior Driver | 65+ | Clean record, potential age-related adjustments | $1,200 – $2,200 |

Types of Auto Insurance Coverage

Understanding the different types of auto insurance coverage is crucial for protecting yourself financially in the event of an accident. Choosing the right coverage depends on your individual needs, risk tolerance, and budget. This section will Artikel the most common types, their benefits and drawbacks, and situations where they are most beneficial.

Liability Coverage

Liability coverage pays for damages and injuries you cause to others in an accident. It’s typically divided into bodily injury liability and property damage liability. Bodily injury liability covers medical bills, lost wages, and pain and suffering for those injured in an accident you caused. Property damage liability covers repairs or replacement of the other person’s vehicle or property. Liability coverage is usually required by law, and the minimum amounts vary by state. Failing to carry adequate liability coverage can lead to significant financial ruin if you cause a serious accident.

- Benefit: Protects you from potentially devastating financial losses if you’re at fault in an accident.

- Drawback: Does not cover your own vehicle’s damage or your medical bills.

- Beneficial Situations: Any time you drive a vehicle, as it protects others from your actions.

Typical Costs:

- Varies significantly based on factors like driving record, location, and the amount of coverage chosen. A typical range might be $200 to $800 annually for minimum coverage, but this can be much higher.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. This means even if you cause the accident, your insurance will help cover the cost of repairing or replacing your car.

- Benefit: Protects your vehicle from damage in an accident, regardless of who is at fault.

- Drawback: Typically has a deductible, meaning you pay a certain amount out-of-pocket before your insurance kicks in. Also, premiums can be relatively high.

- Beneficial Situations: Highly beneficial for newer vehicles or those with significant loan balances, as it protects your investment.

Typical Costs:

- Costs depend on the vehicle’s value, your deductible, and your driving record. Expect to pay several hundred dollars annually, potentially exceeding $1000 depending on factors.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or falling objects. This type of coverage goes beyond accidents.

- Benefit: Provides broad protection against a wide range of potential damages to your vehicle.

- Drawback: Like collision, it typically involves a deductible, and premiums can be substantial.

- Beneficial Situations: Particularly valuable in areas prone to severe weather events like hailstorms or areas with high rates of theft or vandalism.

Typical Costs:

- Costs are influenced by the vehicle’s value, location, and deductible choice. Expect a cost similar to collision coverage, potentially several hundred to over a thousand dollars annually.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle repairs, even if the other driver is at fault and lacks sufficient insurance.

- Benefit: Offers crucial protection in situations where the other driver is not adequately insured.

- Drawback: May not cover all damages, depending on policy limits and the extent of the accident.

- Beneficial Situations: Essential in areas with a high percentage of uninsured drivers or when driving older, less valuable vehicles where collision coverage might not be cost-effective.

Typical Costs:

- The cost is relatively moderate compared to collision and comprehensive, often adding a few hundred dollars annually to your premium.

Summary Table

| Coverage Type | What it Covers | Benefits | Typical Annual Cost Range |

|---|---|---|---|

| Liability | Damages and injuries you cause to others | Protects you from financial ruin if you cause an accident | $200 – $800+ |

| Collision | Damage to your vehicle in an accident, regardless of fault | Protects your vehicle investment | Several hundred to $1000+ |

| Comprehensive | Damage to your vehicle from non-collision events (theft, fire, etc.) | Broad protection against various risks | Several hundred to $1000+ |

| Uninsured/Underinsured Motorist | Damages caused by uninsured or underinsured drivers | Protection against financially irresponsible drivers | A few hundred dollars |

Obtaining Auto Insurance Quotes

Securing the best auto insurance rate involves a strategic approach to obtaining and comparing quotes from various providers. Understanding the process, utilizing available tools, and asking the right questions are crucial steps in finding affordable and comprehensive coverage.

The process of obtaining auto insurance quotes typically begins with providing basic information about yourself and your vehicle to potential insurers. This information usually includes your driving history, the make and model of your car, your address, and your desired coverage levels. You can obtain quotes through various channels, including online comparison websites, directly through insurance company websites, or by contacting insurance agents via phone or in person.

Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is essential to ensure you’re getting the most competitive rate. Different insurers use different algorithms to assess risk and price their policies. By comparing at least three to five quotes, you significantly increase your chances of finding a policy that best suits your needs and budget. Failing to compare quotes could result in overpaying for your insurance. For example, one insurer might prioritize safe driving history while another might weigh vehicle type more heavily.

Tips for Negotiating Lower Insurance Premiums

Several strategies can help you negotiate lower premiums. Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, is a common method for obtaining discounts. Maintaining a good driving record and completing defensive driving courses can also significantly reduce your premiums. Consider increasing your deductible; a higher deductible will typically lower your premium, though it increases your out-of-pocket expenses in the event of a claim. Finally, inquire about available discounts, such as those for good students, multiple car policies, or affiliations with certain organizations.

Questions to Ask Insurance Providers

Before committing to a policy, it’s vital to ask clarifying questions. Inquire about the specific coverage details of each policy, including deductibles, premiums, and any limitations or exclusions. Ask about the claims process, including how to file a claim and the expected processing time. It’s also important to understand the insurer’s financial stability and customer service reputation. For instance, ask about their customer satisfaction ratings or complaint resolution procedures. Finally, ask about any potential discounts or additional coverage options that may be available.

Using Online Comparison Tools

Online comparison tools streamline the process of obtaining and comparing quotes. These tools allow you to input your information once and receive quotes from multiple insurers simultaneously. Many comparison websites offer additional features, such as customer reviews and ratings, allowing you to make informed decisions. For example, websites like NerdWallet, The Zebra, and Insurance.com aggregate quotes from various providers, enabling quick and efficient comparison shopping. Remember to carefully review the details of each quote before making a decision, as the displayed rates might be estimates and subject to change based on further verification of your information.

Saving Money on Auto Insurance

Auto insurance is a necessary expense, but it doesn’t have to break the bank. Many strategies can significantly reduce your premiums, allowing you to keep more money in your pocket. By understanding these methods and taking proactive steps, you can achieve substantial savings without compromising essential coverage.

Methods for Reducing Auto Insurance Costs

Several factors influence your auto insurance premiums, and many are within your control. Careful consideration of your driving habits, vehicle choice, and insurance policy selection can lead to considerable savings. For example, choosing a less expensive car to insure can dramatically lower your premiums, particularly for high-performance vehicles. Similarly, opting for a higher deductible, while requiring a larger upfront payment in the event of a claim, can substantially reduce your monthly premiums. This is because you’re essentially sharing the risk with the insurance company.

Benefits of Maintaining a Good Driving Record

A clean driving record is arguably the most significant factor in determining your auto insurance rates. Insurance companies view drivers with a history of accidents and traffic violations as higher risks, resulting in significantly higher premiums. Conversely, maintaining a spotless record demonstrates responsible driving behavior and lowers your risk profile, leading to substantial discounts. Even a single accident or speeding ticket can lead to a premium increase that persists for several years. Therefore, defensive driving practices and adherence to traffic laws are crucial for long-term savings.

Examples of Discounts Offered by Insurance Companies

Insurance companies offer a wide array of discounts to incentivize safe driving and responsible behavior. These discounts can vary significantly depending on the insurer and your specific circumstances. Common examples include good student discounts (for students maintaining a certain GPA), multi-car discounts (for insuring multiple vehicles with the same company), and safe driver discounts (based on telematics data or years without accidents). Many insurers also offer discounts for features like anti-theft devices or advanced safety technologies in your vehicle. For example, a company might offer a 10% discount for having an anti-theft system installed or a 5% discount for having a vehicle with automatic emergency braking. Contacting your insurer directly to inquire about available discounts specific to your situation is highly recommended.

Strategies for Bundling Insurance Policies

Bundling your auto insurance with other types of insurance, such as homeowners or renters insurance, is a common and effective way to save money. Many insurance companies offer significant discounts for bundling policies, as it simplifies administration and reduces their overall risk. The discount amount can vary, but it often represents a substantial percentage reduction on your overall insurance costs. For instance, bundling your auto and home insurance might provide a 15-20% discount compared to purchasing each policy separately.

Actions Drivers Can Take to Lower Premiums

Several proactive steps can contribute to lower auto insurance premiums. These actions demonstrate responsible driving and risk management, which insurers reward with lower rates.

- Maintain a clean driving record.

- Choose a car with a lower insurance rating.

- Increase your deductible (while ensuring you can afford it).

- Bundle your insurance policies.

- Explore discounts offered by your insurer (good student, safe driver, etc.).

- Consider installing anti-theft devices.

- Shop around and compare quotes from multiple insurers.

- Maintain a good credit score (as credit history is sometimes considered).

Understanding Your Insurance Policy

Your auto insurance policy is a legally binding contract outlining the terms and conditions of your coverage. Understanding its intricacies is crucial for protecting yourself financially in the event of an accident or other covered incident. This section will clarify key policy elements, the claims process, coverage limits, and common exclusions.

Key Terms and Conditions

Auto insurance policies contain various terms and conditions that define the scope of coverage. These terms are often specific to the insurer and the type of policy purchased. Familiarizing yourself with these terms ensures you understand your rights and responsibilities. Common terms include the policy period (the duration of coverage), the named insured (the person(s) covered under the policy), and the premium (the cost of the insurance). Other important terms include deductibles, liability limits, and exclusions.

The Claims Process

In the event of an accident, reporting the incident promptly is vital. Most policies require you to contact your insurer within a specified timeframe (often 24-48 hours). The claims process typically involves providing details of the accident, including the date, time, location, and parties involved. You may be required to provide a police report, witness statements, and photographs of the damage. The insurer will then investigate the claim and determine liability. Once liability is established, the insurer will process the claim according to the policy’s terms and conditions. Repair or replacement costs, medical expenses, and lost wages may be covered depending on the policy and the circumstances of the accident.

Understanding Coverage Limits

Coverage limits define the maximum amount your insurer will pay for a specific type of claim. These limits are usually expressed as numerical values (e.g., $100,000 for bodily injury liability). Understanding your policy’s coverage limits is critical to avoid unexpected financial responsibility in the event of a significant accident. For example, if your liability coverage limit is $50,000 and you cause an accident resulting in $75,000 in damages, you would be personally liable for the remaining $25,000. Choosing adequate coverage limits is a crucial part of responsible insurance planning.

Common Exclusions and Limitations

Auto insurance policies typically exclude certain types of losses or circumstances. Common exclusions include damage caused by wear and tear, intentional acts, or driving under the influence of alcohol or drugs. Policies may also have limitations on coverage for certain types of vehicles or drivers. For example, many policies exclude coverage for damage caused while driving a vehicle not listed on the policy. Additionally, there may be limitations on coverage for rental cars or damage to certain types of property. Carefully reviewing your policy’s exclusions and limitations is essential to understanding the full extent of your coverage.

Common Policy Terms

| Term | Meaning | Example | Impact |

|---|---|---|---|

| Deductible | The amount you pay out-of-pocket before your insurance coverage begins. | $500 deductible for collision coverage | Reduces your premium but increases your out-of-pocket expenses in the event of a claim. |

| Liability Coverage | Covers bodily injury or property damage you cause to others. | $100,000/$300,000 liability limits | Protects you from significant financial losses if you are at fault in an accident. |

| Collision Coverage | Covers damage to your vehicle caused by an accident, regardless of fault. | Covers damage from a collision with another vehicle or an object. | Helps repair or replace your vehicle after an accident, even if you are at fault. |

| Comprehensive Coverage | Covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, or weather damage. | Covers damage from a hail storm or a broken windshield. | Provides broader protection against various types of vehicle damage. |

Closure

Securing the right auto insurance coverage at a price you can afford requires careful planning and research. By understanding the factors influencing your premiums, comparing quotes from multiple insurers, and taking advantage of available discounts, you can significantly reduce your costs while ensuring you have the protection you need. Remember, your auto insurance is a critical financial safeguard; investing time in understanding it is an investment in your financial well-being.

User Queries

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others in an accident. Collision coverage pays for repairs to your vehicle regardless of fault.

Can I get discounts on my auto insurance?

Yes, many insurers offer discounts for safe driving records, bundling policies, and installing anti-theft devices.

How often can I expect my insurance rates to change?

Rates can change annually, or even more frequently, depending on your driving record, claims history, and changes in the insurer’s risk assessment.

What happens if I don’t have auto insurance?

Driving without insurance is illegal in most places and can result in significant fines, license suspension, and difficulty obtaining insurance in the future.

How long does it take to get an auto insurance quote?

Online quotes are often instant, while quotes from agents may take a few days.