How to get car insurance takes center stage as we embark on a journey to navigate the complexities of securing this essential protection. Understanding the intricacies of car insurance, from coverage types to premium factors, is crucial for making informed decisions that safeguard your financial well-being and provide peace of mind on the road.

This guide aims to demystify the world of car insurance, providing insights into the various types of coverage available, the factors influencing premium costs, and the essential steps involved in obtaining a policy that aligns with your individual needs. By equipping you with knowledge and practical tips, we empower you to confidently navigate the insurance landscape and secure the best possible protection for yourself and your vehicle.

Understanding Car Insurance Basics

Car insurance is a crucial aspect of responsible vehicle ownership, offering financial protection against potential risks and liabilities. Understanding the fundamentals of car insurance can help you make informed decisions about your coverage and ensure you have adequate protection in case of an accident or other unforeseen events.

Types of Car Insurance Coverage

Car insurance policies typically offer a variety of coverage options to cater to different needs and risks. The most common types of car insurance coverage include:

- Liability Coverage: This coverage is essential and usually required by law. It protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. Liability coverage typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your damages.

- Medical Payments Coverage: This coverage helps pay for medical expenses for you and your passengers, regardless of who is at fault, in case of an accident.

- Personal Injury Protection (PIP): This coverage, often required in certain states, covers medical expenses, lost wages, and other expenses related to injuries sustained in an accident, regardless of fault.

Factors Influencing Car Insurance Premiums

Several factors determine the cost of your car insurance premiums. These factors include:

- Age and Driving History: Younger drivers and those with a history of accidents or traffic violations generally pay higher premiums due to their higher risk profiles.

- Vehicle Type: The type of vehicle you drive significantly impacts your premium. High-performance cars, luxury vehicles, and expensive cars tend to have higher insurance costs due to their higher repair and replacement costs.

- Location: The location where you live influences your premium. Areas with higher crime rates, traffic congestion, or a greater number of accidents tend to have higher insurance premiums.

- Credit Score: In some states, your credit score can affect your insurance premiums. Individuals with lower credit scores may be considered higher risks and pay higher premiums.

- Driving Habits: Your driving habits, such as your mileage, driving frequency, and commuting distance, can also influence your premium. Drivers who commute long distances or drive frequently may pay higher premiums due to their increased exposure to potential accidents.

Components of an Insurance Policy

A typical car insurance policy includes several components that Artikel the terms and conditions of your coverage. These components include:

- Declarations Page: This page provides basic information about the policy, including the policyholder’s name, address, vehicle information, coverage limits, and premium amounts.

- Coverage Sections: These sections detail the specific types of coverage included in the policy, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage. They also specify the coverage limits and any exclusions or limitations.

- Exclusions and Limitations: This section Artikels situations or events that are not covered by the policy, such as intentional acts, driving under the influence, or racing.

- Conditions: This section Artikels the policyholder’s responsibilities, such as reporting accidents promptly, cooperating with the insurance company, and maintaining a safe driving record.

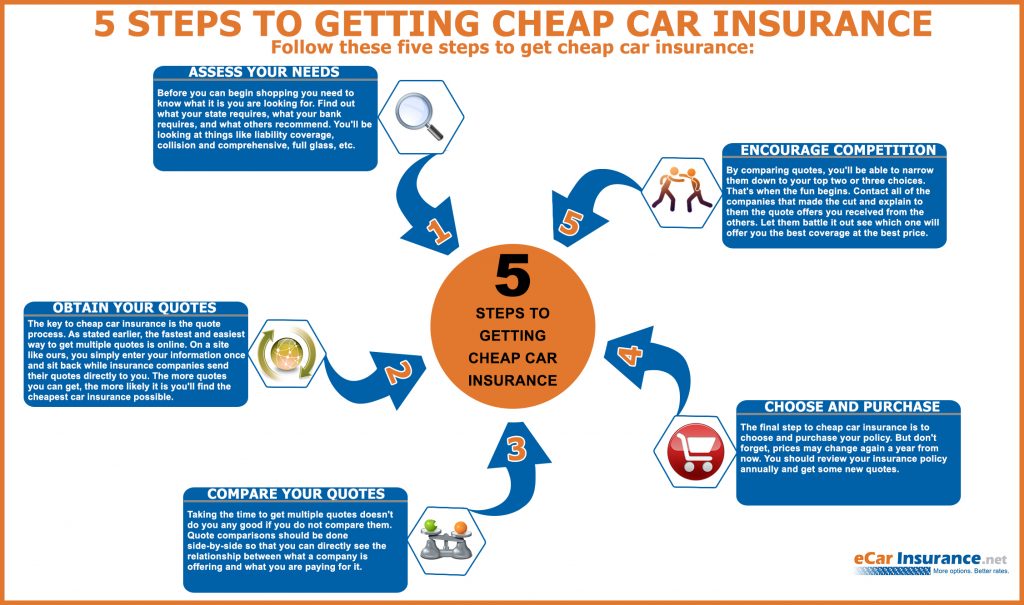

Getting Quotes and Comparing Options: How To Get Car Insurance

Now that you understand the basics of car insurance, it’s time to start getting quotes and comparing options. This process can seem overwhelming, but it’s essential to find the best coverage at the right price.

Finding Reputable Insurance Providers

You can start your search by asking friends, family, and colleagues for recommendations. You can also use online resources like insurance comparison websites, consumer reviews, and financial publications to identify reputable providers. When choosing a provider, consider factors like financial stability, customer service ratings, and claims handling experience.

Comparing Quotes

Once you have a list of potential providers, it’s time to start getting quotes. You can do this online, over the phone, or in person. Be sure to provide accurate information about your vehicle, driving history, and coverage needs.

Here’s a table comparing quotes from different insurance companies:

| Company | Monthly Premium | Deductible | Coverage Limits |

|---|---|---|---|

| Company A | $100 | $500 | $100,000 |

| Company B | $120 | $1,000 | $250,000 |

| Company C | $80 | $250 | $50,000 |

Understanding Deductibles and Coverage Limits

When comparing quotes, it’s important to consider deductibles and coverage limits. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically means a lower monthly premium, while a lower deductible means a higher monthly premium. Coverage limits refer to the maximum amount your insurance company will pay for a covered claim. Higher coverage limits generally mean higher premiums.

It’s important to choose a deductible and coverage limits that fit your budget and risk tolerance.

Choosing the Right Coverage

Choosing the right car insurance coverage is essential for protecting yourself financially in case of an accident or other unforeseen event. The level of coverage you need will depend on several factors, including your personal needs, financial situation, and the value of your vehicle.

Factors to Consider, How to get car insurance

Your personal needs, financial situation, and the value of your vehicle are crucial factors to consider when choosing the right level of coverage.

- Personal Needs: If you have a family, you may want to consider higher coverage limits to ensure that your loved ones are financially protected in case of an accident.

- Financial Situation: If you have a limited budget, you may want to choose a more basic coverage plan. However, if you have a high net worth, you may want to consider more comprehensive coverage to protect your assets.

- Vehicle Value: The value of your vehicle will also affect the level of coverage you need. If you have a newer or more expensive car, you will likely need more coverage to ensure that you are fully compensated in case of a total loss.

Types of Coverage

Different types of coverage offer varying levels of protection and come with their own advantages and disadvantages.

- Liability Coverage: This is the most basic type of car insurance and is required by law in most states. It covers damages to other people’s property or injuries to others in an accident that you cause. Liability coverage is typically divided into two parts: bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it can be beneficial if you have a newer or more expensive vehicle.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by something other than an accident, such as theft, vandalism, or a natural disaster. This coverage is also optional, but it can be beneficial if you live in an area with a high risk of these types of events.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. This coverage is optional, but it can be essential if you live in an area with a high number of uninsured drivers.

Examples of Coverage Benefits

Here are some examples of situations where specific types of coverage might be particularly beneficial:

- Liability Coverage: If you are involved in an accident that causes significant damage to another vehicle or injuries to the other driver, liability coverage will help you pay for the damages and medical expenses.

- Collision Coverage: If you are involved in an accident that damages your vehicle, collision coverage will pay for repairs or replacement, regardless of who is at fault. This can be helpful if you have a newer or more expensive vehicle, as the cost of repairs can be significant.

- Comprehensive Coverage: If your vehicle is damaged by a natural disaster, such as a flood or hail storm, comprehensive coverage will pay for repairs or replacement. This coverage can also be helpful if your vehicle is stolen or vandalized.

- Uninsured/Underinsured Motorist Coverage: If you are involved in an accident with an uninsured driver, this coverage will help you pay for your damages and medical expenses. It can also help you if you are involved in an accident with a driver who does not have enough insurance to cover your damages.

Pros and Cons of Different Insurance Options

- Higher Coverage Limits: Higher coverage limits will provide you with more financial protection in case of an accident. However, they will also come with higher premiums.

- Lower Deductibles: Lower deductibles will mean that you will have to pay less out of pocket if you need to file a claim. However, they will also come with higher premiums.

- Additional Coverage Options: Some insurance companies offer additional coverage options, such as roadside assistance, rental car reimbursement, and gap insurance. These options can provide you with additional peace of mind, but they will also come with higher premiums.

Understanding Your Policy

Once you’ve chosen a car insurance policy, it’s crucial to understand its details to ensure you’re getting the coverage you need and are aware of any limitations.

Key Provisions and Exclusions

Your car insurance policy will Artikel the specific events and situations it covers. Understanding these provisions and exclusions is essential to know what you’re protected against and what you’re responsible for.

- Liability Coverage: This protects you financially if you cause an accident that injures someone or damages their property. It covers the other party’s medical bills, lost wages, and property damage up to the limits of your policy.

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of who is at fault. You’ll need to pay a deductible, which is the amount you’re responsible for before the insurance kicks in.

- Comprehensive Coverage: This covers damage to your vehicle from non-collision events, such as theft, vandalism, fire, hail, or natural disasters. You’ll also pay a deductible for this coverage.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It helps cover your medical bills and property damage.

- Personal Injury Protection (PIP): This coverage, often required in certain states, helps cover your medical expenses and lost wages after an accident, regardless of fault.

Your policy will also specify exclusions, events or situations not covered by your insurance. Common exclusions include:

- Driving without a valid license: If you’re driving without a valid license, your insurance may not cover you.

- Driving under the influence of alcohol or drugs: Insurance typically doesn’t cover accidents caused by driving while intoxicated.

- Intentional acts: If you intentionally damage your car or cause an accident, your insurance likely won’t cover the costs.

- Certain types of modifications: Some modifications to your car, like racing modifications, may void your insurance coverage.

Filing a Claim

If you’re involved in an accident or experience another covered event, you’ll need to file a claim with your insurance company.

- Report the accident: Contact your insurance company immediately to report the accident. Provide them with the necessary details, such as the date, time, location, and involved parties.

- Gather information: Collect information from all parties involved, including names, addresses, phone numbers, insurance information, and details about the accident. Take pictures of the damage to your vehicle and the accident scene.

- File a claim: Follow your insurance company’s instructions for filing a claim. They will likely provide you with a claim form to complete and submit.

- Cooperate with the insurance company: Provide any requested information and documentation, and attend any scheduled appointments or inspections. Be honest and truthful in your interactions with the insurance company.

Keeping Accurate Records

Maintaining accurate records of your insurance policy and any relevant documentation is crucial for several reasons:

- Proof of coverage: In case of an accident, you’ll need to provide proof of insurance to the authorities. Having a copy of your policy readily available is essential.

- Claim processing: When filing a claim, you’ll need to provide documentation related to the event, such as police reports, medical bills, and repair estimates. Having these records organized will make the claim process smoother.

- Policy renewal: Keeping track of your policy details, including coverage limits, deductibles, and renewal dates, will help you make informed decisions about your insurance needs.

Saving Money on Car Insurance

Car insurance is a necessity for most drivers, but it can be a significant expense. Fortunately, there are many ways to save money on your premiums. By understanding your options and making smart choices, you can lower your insurance costs without compromising your coverage.

Lowering Your Premiums

Here are some effective strategies for reducing your car insurance premiums:

- Drive Safely: A clean driving record is one of the most significant factors influencing your insurance rates. Avoiding accidents, speeding tickets, and other traffic violations can significantly reduce your premiums.

- Maintain a Good Credit Score: Surprisingly, your credit score can affect your car insurance rates. Insurers often use credit scores as an indicator of your financial responsibility, and those with higher scores generally receive lower premiums.

- Bundle Insurance Policies: Many insurance companies offer discounts for bundling multiple policies, such as car insurance, home insurance, or renters insurance. By combining your policies with the same provider, you can often save money on your premiums.

- Shop Around for Quotes: It’s always a good idea to compare quotes from multiple insurance companies to find the best rates. Online comparison tools can help you quickly and easily get quotes from different providers.

- Increase Your Deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can often lower your premiums, but be sure to choose a deductible you can afford.

- Choose a Safe Vehicle: The type of car you drive also influences your insurance premiums. Vehicles with a good safety rating and anti-theft features often have lower insurance costs.

- Consider a Telematics Device: Some insurance companies offer discounts for using telematics devices that track your driving habits. These devices can monitor your speed, braking, and other driving behaviors, and those who demonstrate safe driving practices may receive lower premiums.

Insurance Discounts

Insurance companies offer a variety of discounts to their policyholders. Here’s a comparison of common discounts and their potential benefits and drawbacks:

| Discount Type | Benefits | Drawbacks |

|---|---|---|

| Good Student Discount | Lower premiums for students with good grades. | May not apply to all students or all insurance companies. |

| Safe Driver Discount | Lower premiums for drivers with a clean driving record. | May not apply to all drivers or all insurance companies. |

| Multi-Car Discount | Lower premiums for insuring multiple vehicles with the same company. | May not apply to all vehicles or all insurance companies. |

| Anti-Theft Discount | Lower premiums for vehicles equipped with anti-theft devices. | May not apply to all vehicles or all insurance companies. |

| Loyalty Discount | Lower premiums for long-term policyholders. | May not apply to all policyholders or all insurance companies. |

Driving Habits and Vehicle Modifications

Your driving habits and any modifications you make to your vehicle can significantly impact your insurance costs.

- Driving Habits: Frequent driving, driving in high-risk areas, or driving at night can increase your insurance premiums.

- Vehicle Modifications: Modifications that enhance performance or alter the vehicle’s appearance, such as engine upgrades or custom paint jobs, can increase your insurance costs.

Navigating Insurance Claims

Accidents happen, and when they do, having car insurance can be a lifesaver. Knowing how to file a claim and navigate the process is essential. This section will guide you through the steps involved in filing a claim, different types of claims, and tips for communicating effectively with your insurance company.

Filing a Claim

After an accident, the first step is to contact your insurance company. They will guide you through the claim filing process, which typically involves:

- Reporting the accident: Provide details about the incident, including date, time, location, and parties involved.

- Providing documentation: This may include a police report, photos of the damage, and medical records.

- Submitting a claim form: This form will request information about the accident and your insurance policy.

It’s important to act quickly and provide accurate information to expedite the claims process.

Types of Claims

Car insurance claims can be categorized based on the type of incident:

- Collision claims: These occur when your vehicle collides with another vehicle or object. They typically involve damage to your car, and you may be covered for repairs or replacement.

- Comprehensive claims: These cover damage to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or animal strikes.

- Liability claims: These involve situations where you are responsible for damage or injury to another party. Your insurance company will cover the costs of the other party’s damages or injuries up to your policy limits.

Communicating with Your Insurance Company

Clear and timely communication is crucial after an accident. Here are some tips for communicating with your insurance company:

- Be polite and professional: Even in stressful situations, maintain a respectful tone.

- Be accurate and detailed: Provide complete and accurate information about the accident.

- Keep a record of all communication: This includes dates, times, and content of phone calls, emails, and letters.

- Ask questions: Don’t hesitate to clarify any confusion or seek further explanation.

Summary

As we conclude our exploration of how to get car insurance, remember that securing the right coverage is an ongoing process that requires periodic review and adjustments. Staying informed about industry trends, policy updates, and potential savings opportunities ensures you maintain optimal protection and financial stability. By embracing proactive measures and engaging with your insurance provider, you can navigate the complexities of car insurance with confidence and peace of mind.

Questions Often Asked

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or more frequently if there are significant life changes, such as a new driver in the household, a change in your driving habits, or a major vehicle purchase.

What is a deductible, and how does it affect my insurance premium?

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible generally translates to a lower premium, while a lower deductible results in a higher premium. You need to weigh the trade-off between the cost of a higher deductible and the potential savings on your premium.

What are some tips for lowering my car insurance premium?

Several strategies can help lower your car insurance premium, including maintaining a good driving record, bundling insurance policies, choosing a vehicle with safety features, and keeping a good credit score.

What should I do if I’m in an accident?

In the event of an accident, prioritize safety and seek medical attention if necessary. Then, contact your insurance company to report the incident and follow their instructions for filing a claim.