Navigating the world of car insurance can feel like driving through a maze. Premiums vary wildly, and finding the best deal requires understanding the factors that influence cost. This guide provides a clear roadmap to help you secure affordable car insurance without sacrificing necessary coverage. We’ll explore everything from understanding your insurance options and identifying potential discounts to negotiating rates and maintaining safe driving habits.

From exploring different coverage types and leveraging online comparison tools to mastering the art of negotiating with insurance companies, we’ll equip you with the knowledge and strategies to significantly reduce your car insurance expenses. This isn’t just about saving money; it’s about making informed decisions to protect yourself and your finances.

Understanding Car Insurance Costs

Securing affordable car insurance requires a thorough understanding of the factors that influence premiums. Knowing what impacts your cost allows you to make informed decisions and potentially save money. This section will break down the key elements that determine your insurance rate, the various types of coverage available, and a typical cost breakdown.

Factors Influencing Car Insurance Premiums

Several factors contribute to the final cost of your car insurance. These factors are assessed by insurance companies to determine your risk profile. A higher risk profile generally translates to higher premiums. Key factors include your driving history (accidents and violations), age and driving experience, the type of vehicle you drive (make, model, and safety features), your location (crime rates and accident statistics in your area), your credit score (in many states), and the coverage levels you choose. For instance, a young driver with a history of accidents driving a high-performance sports car in a high-crime area will likely pay significantly more than an older driver with a clean record driving a smaller, safer car in a low-crime area.

Types of Car Insurance Coverage

Understanding the different types of coverage is crucial for choosing the right policy. Common types include liability coverage (which protects you financially if you cause an accident injuring someone or damaging their property), collision coverage (which covers damage to your vehicle in an accident, regardless of fault), comprehensive coverage (which covers damage to your vehicle from events other than collisions, such as theft or vandalism), uninsured/underinsured motorist coverage (protecting you if you’re involved in an accident with an uninsured or underinsured driver), and medical payments coverage (covering medical expenses for you and your passengers, regardless of fault). The level of coverage you choose (e.g., liability limits) directly affects your premium.

Common Car Insurance Costs

The cost of car insurance can vary widely depending on the factors mentioned previously. However, a typical breakdown might include premiums paid periodically (monthly, quarterly, or annually), potential deductibles (the amount you pay out-of-pocket before your insurance coverage kicks in), and additional fees or surcharges. For example, you might have a monthly premium of $100, a $500 deductible for collision coverage, and a $100 surcharge for a speeding ticket. These costs add up to your overall insurance expense.

Average Insurance Costs Across Different Age Groups

The age of the driver is a significant factor in determining insurance premiums. Younger drivers, due to higher risk, generally pay more. The table below shows estimated average annual costs, recognizing these are broad averages and vary greatly by location and other factors.

| Age Group | Average Annual Cost (Estimate) |

|---|---|

| 16-25 | $2000 – $3500 |

| 26-35 | $1500 – $2500 |

| 36-55 | $1000 – $1800 |

| 55+ | $800 – $1500 |

Finding Affordable Insurance Options

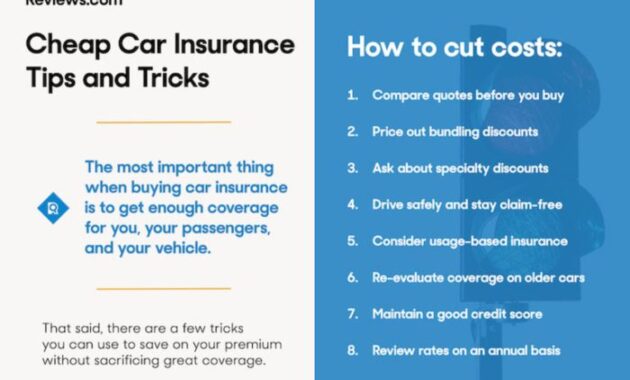

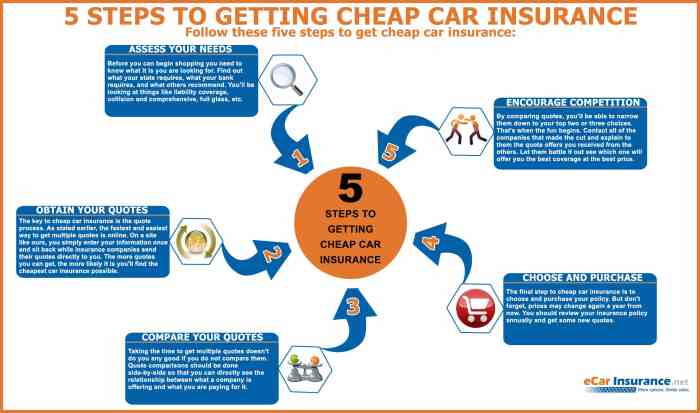

Securing affordable car insurance requires a proactive approach and a thorough understanding of the factors influencing premiums. By implementing several strategies, you can significantly reduce your annual costs and still maintain adequate coverage. This section details practical steps to achieve lower insurance premiums.

Finding the right car insurance policy involves more than just selecting the first offer you see. It requires careful comparison shopping and a strategic approach to minimizing costs while maintaining sufficient protection.

Lowering Car Insurance Premiums

Several factors directly influence your car insurance premium. By addressing these, you can potentially save a substantial amount of money. For instance, choosing a vehicle with a high safety rating often translates to lower premiums due to reduced risk of accidents. Similarly, opting for a car with a lower repair cost can also impact your insurance rate positively. Consider features like anti-theft devices and safety features which can further reduce premiums. Maintaining a good driving record is crucial; accidents and traffic violations can significantly increase your premiums. Finally, consider increasing your deductible; a higher deductible means lower premiums, but be prepared to cover more out-of-pocket in case of an accident.

Bundling Insurance Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, is a common strategy for saving money. Many insurance companies offer discounts for bundling policies, as it simplifies administration and reduces their risk. For example, if you bundle your car insurance with your homeowner’s insurance from the same provider, you might receive a discount of 10-15%, depending on the insurer and your specific circumstances. This discount represents a considerable saving over the course of a year.

Comparing Car Insurance Quotes

Obtaining quotes from multiple insurance providers is essential for finding the most competitive rates. Don’t just rely on a single quote; shop around and compare prices, coverage options, and customer reviews. Online comparison tools can simplify this process by allowing you to enter your information once and receive quotes from several companies simultaneously. Remember to compare apples to apples; ensure that the coverage levels are similar across all quotes before making a decision. A small difference in price might mean a significant difference in coverage.

Impact of Driving History on Insurance Rates

Your driving history is a primary factor in determining your car insurance rates. A clean driving record with no accidents or traffic violations results in lower premiums. Conversely, accidents and tickets, particularly serious ones like DUI or reckless driving, can drastically increase your rates. Insurance companies view a history of accidents and violations as an indicator of higher risk, leading to higher premiums to compensate for the increased likelihood of future claims. Maintaining a clean driving record is the most effective long-term strategy for keeping your car insurance costs low.

Negotiating with Insurance Companies

Securing the most affordable car insurance often involves more than just comparing quotes online. A proactive approach to negotiating directly with insurance companies can yield significant savings. Understanding your leverage and employing effective communication strategies are key to successfully lowering your premiums.

Negotiating lower insurance rates requires a strategic approach. It’s not about being aggressive, but rather informed and persuasive. By presenting a compelling case and demonstrating your responsible driving history, you can increase your chances of securing a better deal.

Strategies for Negotiating Lower Premiums

Several strategies can help you negotiate lower car insurance rates. These techniques focus on highlighting your positive attributes as a driver and leveraging your existing relationship with the insurer. Remember to be polite and professional throughout the negotiation process.

- Bundle your insurance policies: Many insurers offer discounts when you bundle your car insurance with other types of insurance, such as homeowners or renters insurance. Bundling demonstrates your loyalty and provides the insurer with a more comprehensive picture of your risk profile, often leading to reduced premiums across the board. For example, combining your car and home insurance with the same provider could result in a 10-15% discount.

- Shop around and use competitor quotes as leverage: Obtaining quotes from multiple insurers allows you to compare prices and use the lower offers as leverage during negotiations with your current provider. Present these quotes as evidence of more competitive rates available in the market. For instance, if a competitor offers a rate $200 lower annually, this can be a powerful argument for a reduction.

- Highlight your safe driving record: Emphasize your clean driving history, including the absence of accidents and traffic violations. Provide details of any defensive driving courses completed, as these often lead to significant discounts. A consistent record of safe driving is a strong argument for lower premiums.

- Consider increasing your deductible: Raising your deductible can significantly lower your premium. This requires careful consideration of your financial capacity to cover a higher out-of-pocket expense in the event of an accident. However, it’s a common and effective negotiation tactic.

Effective Communication Techniques

Effective communication is crucial for successful negotiation. Clearly articulating your needs and presenting your case in a calm and professional manner increases the likelihood of a positive outcome.

- Be polite and respectful: Maintain a professional and courteous tone throughout the conversation, regardless of the outcome. A respectful approach fosters a more collaborative environment.

- Clearly state your intentions: Explain that you are seeking a lower premium due to [reason, e.g., a clean driving record, competitive quotes, bundling of policies]. Be direct and concise in your communication.

- Listen actively and ask clarifying questions: Pay attention to the insurer’s responses and ask questions to clarify any points you don’t understand. This shows your engagement and willingness to work collaboratively.

- Document the conversation: Keep records of all communication, including dates, times, and the names of individuals you spoke with. This documentation is valuable if further negotiation is needed.

Impact of Raising Your Deductible on Premiums

Increasing your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, directly impacts your premiums. A higher deductible generally translates to lower premiums. The relationship is not always linear, but it’s a consistent trend across most insurance providers. For example, increasing your deductible from $500 to $1000 might result in a 15-20% reduction in your premium. However, remember that you’ll have to pay a larger amount out-of-pocket in case of an accident.

Appealing a Rate Increase

If your insurer increases your rates, you have the right to appeal the decision. Present a clear and concise explanation of why you believe the increase is unjustified.

- Review your policy and driving record: Carefully examine your policy and driving record for any errors or inconsistencies that may have contributed to the rate increase. If you find any, address them directly in your appeal.

- Provide evidence of safe driving: If your rate increase is not justified by your driving record, provide evidence of your safe driving habits, such as completion of defensive driving courses or a long history of accident-free driving.

- Compare rates with other insurers: Obtain quotes from other insurers to demonstrate that your current rate is higher than the market average. This can be strong evidence to support your appeal.

- Contact your insurer’s customer service department: Clearly and politely explain your reasons for appealing the rate increase, providing supporting evidence. Maintain a professional and respectful tone throughout the process.

Maintaining Affordable Insurance

Securing affordable car insurance isn’t a one-time event; it’s an ongoing process requiring consistent effort and mindful choices. By proactively managing your driving habits and financial standing, you can significantly impact your premiums and keep your costs low over the long term. This section details strategies for maintaining affordable insurance rates.

Safe Driving Habits and Low Premiums

Safe driving is paramount to maintaining low car insurance premiums. Insurance companies heavily weigh your driving record when calculating your rates. A clean driving record, free of accidents and traffic violations, directly translates to lower premiums. Conversely, accidents and tickets lead to increased premiums, sometimes significantly. The cost of an accident extends beyond the immediate repair expenses; it impacts your insurance for years to come.

Avoiding Accidents and Traffic Violations

Preventing accidents and traffic violations requires a proactive approach to driving. Defensive driving techniques, such as maintaining a safe following distance, obeying speed limits, and avoiding distractions (like cell phones), are crucial. Regular vehicle maintenance ensures your car is in optimal condition, minimizing the risk of mechanical failures that could lead to accidents. Furthermore, being aware of your surroundings and anticipating potential hazards are key components of safe driving. Understanding and adhering to traffic laws is equally important; even minor infractions can accumulate and negatively affect your insurance rates.

The Role of Credit Score in Insurance Rates

In many states, your credit score plays a significant role in determining your car insurance premiums. Insurance companies use credit-based insurance scores (CBIS) to assess risk. A higher credit score generally indicates a lower risk profile, resulting in lower insurance premiums. Conversely, a poor credit score can lead to significantly higher premiums. This is because individuals with poor credit are statistically more likely to file insurance claims. Improving your credit score through responsible financial management can lead to considerable savings on your car insurance. This involves paying bills on time, keeping credit utilization low, and maintaining a positive credit history.

Maintaining Affordable Car Insurance Checklist

Maintaining affordable car insurance requires consistent attention. This checklist summarizes key actions:

- Drive Safely: Practice defensive driving techniques, obey traffic laws, and avoid distractions.

- Maintain Vehicle: Regular maintenance reduces the risk of accidents due to mechanical failure.

- Improve Credit Score: Pay bills on time, keep credit utilization low, and avoid excessive debt.

- Shop Around Regularly: Compare rates from different insurers annually to find the best deals.

- Bundle Insurance: Consider bundling your car insurance with other types of insurance, such as homeowners or renters insurance, to potentially receive discounts.

- Increase Deductible: A higher deductible means lower premiums, but you’ll pay more out-of-pocket in case of an accident. Weigh the trade-offs carefully.

- Consider Usage-Based Insurance: Some insurers offer programs that track your driving habits and reward safe driving with lower premiums.

- Maintain a Clean Driving Record: Avoid speeding tickets, accidents, and other driving violations.

- Review Coverage Regularly: Ensure your coverage meets your needs without overspending.

Illustrative Examples

Understanding the concepts discussed is easier with concrete examples. The following scenarios illustrate how various factors can significantly impact your car insurance premiums.

Bundling Home and Auto Insurance

Bundling your home and auto insurance with the same provider often results in substantial savings. Let’s say Sarah pays $1200 annually for auto insurance and $800 annually for homeowners insurance with separate companies. If she bundles these policies with a single insurer offering a 15% discount for bundling, her total annual cost would be reduced. Her auto insurance would cost $1020 ($1200 * 0.85), and her homeowners insurance would cost $680 ($800 * 0.85). This represents a total annual saving of $200 ($1200 + $800 – $1020 – $680). This discount is a common incentive offered by insurance companies to encourage customers to consolidate their policies.

Impact of a Clean Driving Record

A driver’s history significantly influences their insurance premiums. Consider John, a 25-year-old with a spotless driving record for five years. Compared to Mark, also 25, who has two speeding tickets and one at-fault accident in the same period, John will likely pay considerably less. Let’s assume John’s annual premium is $800, reflecting his excellent driving history. Mark, due to his less favorable record, might pay $1400 or more annually. This illustrates how maintaining a clean driving record translates to substantial long-term cost savings. The difference reflects the insurer’s assessment of risk. A driver with a history of accidents and violations is statistically more likely to file a claim, leading to higher premiums.

Choosing a Higher Deductible

Opting for a higher deductible can significantly lower your premium. Suppose Maria is considering two insurance plans with the same coverage. Plan A has a $500 deductible and an annual premium of $1000. Plan B offers the same coverage but with a $1000 deductible and an annual premium of $800. While Plan A seems less expensive upfront, if Maria doesn’t file a claim, she saves $200 annually with Plan B. However, if she does file a claim, she will pay $500 more out-of-pocket with Plan B. This illustrates the trade-off between premium cost and out-of-pocket expenses in case of an accident. The choice depends on her risk tolerance and financial situation.

Successful Negotiation with an Insurer

Negotiating your insurance rate can sometimes lead to surprising results. David contacted his insurer to discuss his premium, highlighting his consistent on-time payments and lack of claims over the past three years. The insurer, recognizing his responsible driving history, offered him a 10% discount, reducing his annual premium from $900 to $810. This demonstrates the potential for cost savings through proactive communication with your insurance provider. Often, insurers are willing to work with loyal customers who demonstrate responsible behavior.

Summary

Securing cheap car insurance is achievable with the right approach. By understanding the factors influencing premiums, actively seeking discounts, and maintaining a safe driving record, you can significantly lower your costs. Remember to compare quotes from multiple providers, negotiate effectively, and choose coverage that meets your specific needs. Taking a proactive approach to managing your car insurance will not only save you money but also provide peace of mind knowing you have the right protection in place.

FAQ Overview

What is the impact of my credit score on car insurance rates?

Many insurance companies use credit-based insurance scores to assess risk. A higher credit score generally translates to lower premiums, while a lower score can lead to higher rates.

How often should I shop around for car insurance?

It’s recommended to compare quotes from different insurers at least annually, or even more frequently if your circumstances change (e.g., new car, change in driving habits, address change).

Can I get car insurance without a driving history?

Yes, but it will likely be more expensive. Insurers will assess your risk based on other factors, such as your age and location. Consider taking a defensive driving course to demonstrate your commitment to safe driving.

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others’ property or injuries you inflict on others in an accident. Collision coverage pays for damage to your own vehicle, regardless of who is at fault.