Finding the right insurance can feel like navigating a maze. With countless providers and policies, it’s easy to feel overwhelmed. Fortunately, insurance comparison sites offer a streamlined solution, allowing consumers to compare quotes from multiple insurers in one place. But these platforms aren’t all created equal. This exploration delves into the user experience, functionality, marketing strategies, legal considerations, and future trends shaping the world of insurance comparison sites, providing a comprehensive understanding of their impact on the insurance market.

From the design of their user interfaces to the intricacies of their search algorithms, we examine the key elements that contribute to a successful comparison site. We also explore the crucial role these platforms play in empowering consumers to make informed decisions, ensuring they secure the most suitable and cost-effective insurance coverage for their individual needs.

User Experience on Insurance Comparison Sites

A positive user experience is paramount for insurance comparison websites. Success hinges on guiding users seamlessly through the process of finding suitable insurance, ultimately leading to a policy purchase. A poorly designed site can frustrate users, leading to abandonment and lost business for both the comparison site and the insurance providers listed. This section will examine key aspects of user experience on these platforms.

User Journey Map: Finding Insurance

A typical user journey on an insurance comparison site might begin with a search for a specific type of insurance (e.g., car insurance). The user then enters relevant details (age, location, vehicle details, etc.). The site processes this information and presents a range of options. The user compares prices, coverages, and policy details. They may refine their search based on additional criteria. Finally, they select a policy and are redirected to the insurer’s website to complete the purchase.

Pain points often arise from lengthy forms, confusing terminology, unclear pricing structures (hidden fees), and difficulty comparing policy details across different providers. Areas for improvement include streamlined forms, improved search filters, clear visual comparisons of key features, and readily available customer support. A user-friendly interface, intuitive navigation, and easily accessible FAQs are crucial for a positive experience.

Comparison of User Interfaces

Three leading comparison sites – (Note: Specific site names are omitted to maintain generality and avoid endorsement) – offer varying user interfaces. Site A excels in its clean, minimalist design and intuitive navigation. Its clear visual presentation of policy comparisons is a significant strength. However, its filtering options could be more robust. Site B prioritizes comprehensive search filters, offering granular control over search parameters. However, its design is somewhat cluttered, potentially overwhelming users. Site C strikes a balance, providing a functional interface with sufficient filtering options without sacrificing visual clarity. However, its information architecture could be improved to make key information more readily accessible.

Clear and Concise Language in Policy Details

The presentation of insurance policy details is crucial. Ambiguous or complex language can confuse users and lead to misunderstandings. Good practice involves using plain language, avoiding jargon, and presenting information in a clear, concise, and structured manner. For example, instead of stating “Comprehensive liability coverage with supplementary uninsured motorist protection,” a better approach would be “Full coverage for accidents you cause, plus coverage if you’re hit by an uninsured driver.”

Bad practice involves using legalistic language, burying key information within lengthy terms and conditions, or presenting information in a disorganized manner. For example, a poorly worded description might read: “In the event of a claim, the insured party shall be responsible for providing all relevant documentation as stipulated in clause 7.3 subsection B of the policy document,” while a better alternative would be: “If you need to make a claim, please provide us with the necessary documents as Artikeld in your policy.” Clear, concise language minimizes confusion and empowers users to make informed decisions.

Functionality and Features of Insurance Comparison Sites

Insurance comparison websites have revolutionized the way consumers shop for insurance, offering a convenient and efficient platform to compare policies from multiple providers. These sites leverage technology to streamline the process, providing users with a comprehensive overview of available options and enabling informed decision-making. Their functionality and features are key to their success and the overall user experience.

Feature Comparison Across Different Insurance Comparison Sites

The following table compares the features offered by four prominent insurance comparison websites. Note that features and specific offerings can change over time, so this is a snapshot of functionality at a particular point in time.

| Site Name | Features Offered | Ease of Use Rating (1-5 stars) | Unique Selling Proposition |

|---|---|---|---|

| Compare.com (Example) | Car, Home, Health, Life insurance comparison; policy details; customer reviews; agent finder; personalized recommendations; various filtering options; mobile app. | ★★★★☆ | Wide range of insurance types, extensive filtering options. |

| Insurify (Example) | Car, Home, Renters insurance comparison; instant quotes; claims history analysis; personalized recommendations; user-friendly interface; mobile app. | ★★★★☆ | Focus on ease of use and speed; innovative claims history analysis. |

| The Zebra (Example) | Car, Home, Renters, Motorcycle insurance comparison; detailed policy comparisons; customer reviews; multiple quote options; personalized recommendations; strong customer support. | ★★★★☆ | Emphasis on transparency and detailed policy information. |

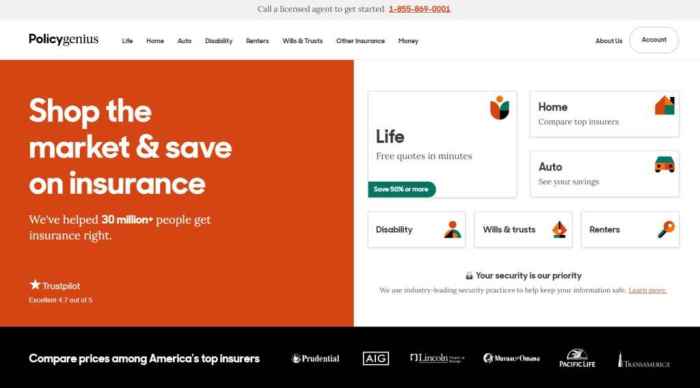

| Policygenius (Example) | Life insurance comparison; detailed policy information; personalized recommendations; expert advice; user-friendly interface; strong customer support. | ★★★★☆ | Specialization in life insurance with a focus on personalized guidance. |

The Role of Personalized Recommendations and Filtering Options

Personalized recommendations and robust filtering options are crucial for enhancing the user experience on insurance comparison sites. These features significantly reduce the time and effort required to find suitable policies. Effective implementations utilize user-provided data, such as age, location, driving history, and desired coverage levels, to generate tailored recommendations. For example, a site might suggest car insurance policies with specific discounts for good drivers or home insurance policies tailored to the user’s location and property type. Filtering options allow users to refine their search based on specific criteria, such as price range, coverage limits, and deductible amounts. This targeted approach ensures users see only the most relevant insurance options, improving satisfaction and efficiency.

Technical Aspects of the Search Algorithm

The search algorithm is the engine driving a comparison site’s functionality. Its accuracy and efficiency in matching users with relevant insurance products are paramount. A typical algorithm involves several steps: First, it takes user inputs (age, location, desired coverage, etc.). Second, it accesses a database of insurance products from various providers. Third, it applies a scoring system based on relevance, considering factors such as price, coverage, and user preferences. Fourth, it ranks the results according to the score, presenting the most suitable options to the user. The algorithm’s accuracy depends on the comprehensiveness of the database, the sophistication of the scoring system, and the effectiveness of data cleaning and validation processes. Efficiency is enhanced through optimized database queries and efficient indexing techniques. For example, using a well-structured database with appropriate indexes allows for faster retrieval of relevant insurance products, resulting in quicker response times for users. Regular updates and maintenance of the algorithm are also essential to ensure its continued accuracy and efficiency.

Legal and Regulatory Aspects of Insurance Comparison Sites

Insurance comparison websites operate within a complex legal and regulatory landscape, requiring adherence to various laws and guidelines to ensure fair practices, protect consumer data, and maintain market integrity. Failure to comply can result in significant penalties and reputational damage. This section Artikels key legal and regulatory requirements, data handling practices, and a sample privacy policy.

Key Legal and Regulatory Requirements

Insurance comparison sites must comply with a range of regulations, varying by jurisdiction. These typically include laws related to consumer protection, data privacy, advertising standards, and anti-competitive practices. For example, sites must accurately represent the insurance products they compare, avoiding misleading or deceptive statements. They must also clearly disclose any commissions or fees they receive from insurers, ensuring transparency for consumers. Violations can lead to fines, legal action from consumers, and damage to the site’s reputation. In some jurisdictions, regulatory bodies may even revoke operating licenses. For instance, a site falsely advertising a policy’s coverage could face legal action for misrepresentation, potentially resulting in substantial financial penalties and reputational harm. Similarly, failing to disclose commissions could lead to regulatory fines and loss of consumer trust.

User Data Privacy and Security

Handling user data is paramount for insurance comparison sites. Stringent measures must be in place to protect personal information, such as names, addresses, and financial details, in compliance with regulations like GDPR (in Europe) and CCPA (in California). Best practices include data encryption, secure storage, and robust access controls. Regular security audits and penetration testing are essential to identify and mitigate vulnerabilities. Risks associated with inadequate data protection include data breaches, identity theft, and significant financial penalties. A data breach exposing sensitive user information could result in hefty fines, legal challenges, and irreparable damage to the company’s reputation, potentially driving away customers. Implementing strong encryption protocols and multi-factor authentication minimizes these risks.

Sample Privacy Policy

This sample privacy policy Artikels how [Insurance Comparison Site Name] collects, uses, and shares user data.

We collect personal information necessary to provide our services, such as name, address, email, and date of birth. We use this information to match you with suitable insurance providers and to improve our services. We may share your data with insurance providers you select, but only with your explicit consent. We will not sell your data to third parties. We employ industry-standard security measures to protect your data. You have the right to access, correct, and delete your data. For more details, please refer to our full privacy policy.

The policy should also clearly state the site’s data retention policies, outlining how long user data is stored and under what circumstances it may be deleted. It should also detail the user’s rights regarding their data, including the right to access, correct, and delete their information. Finally, it should specify the site’s contact information for users to address any privacy-related concerns.

The Future of Insurance Comparison Sites

The insurance comparison landscape is poised for significant transformation in the coming years, driven by rapid technological advancements and evolving consumer expectations. The convergence of artificial intelligence, blockchain technology, and shifting consumer preferences will reshape how consumers find and purchase insurance, demanding adaptability and innovation from comparison sites.

The integration of emerging technologies will fundamentally alter the functionality and user experience of insurance comparison platforms.

Impact of Emerging Technologies

Artificial intelligence (AI) will play a crucial role in enhancing the accuracy and efficiency of insurance comparison sites. AI-powered algorithms can analyze vast datasets of customer information and insurance policies to provide highly personalized recommendations, predict risk more accurately, and automate many of the manual processes currently involved in comparing policies. For example, AI could instantly analyze a user’s profile and financial situation to recommend the most suitable coverage, significantly streamlining the comparison process. Blockchain technology, with its inherent security and transparency, offers the potential to create a more secure and trustworthy ecosystem for insurance transactions. This could lead to reduced fraud and increased efficiency in claims processing, ultimately benefiting both consumers and insurance providers. Imagine a system where policy details are securely stored on a blockchain, accessible only to authorized parties, minimizing the risk of data breaches and fraudulent claims.

Adaptation to Changing Consumer Behavior

Over the next five years, consumer behavior will continue to shift towards greater digital engagement and personalized experiences. Insurance comparison sites will need to adapt by offering seamless mobile experiences, intuitive interfaces, and personalized recommendations tailored to individual needs and preferences. This means investing in user-friendly mobile apps, incorporating advanced search filters, and leveraging data analytics to understand consumer preferences and provide targeted recommendations. For instance, a site might offer personalized quotes based on individual lifestyle factors like driving habits or home security measures, moving beyond basic demographic data. The rise of social media and online reviews will also influence consumer choices, making reputation management and online feedback mechanisms crucial for comparison sites.

Personalized and Proactive Insurance Solutions

The future of insurance comparison sites lies in their ability to offer more personalized and proactive insurance solutions. This involves leveraging data analytics and AI to anticipate customer needs and provide tailored recommendations before a problem arises. For example, a site could use location data to proactively alert users about upcoming severe weather events and offer temporary supplemental coverage. Similarly, the analysis of driving patterns could trigger recommendations for better insurance deals or safety features. This proactive approach will not only enhance customer satisfaction but also build stronger customer loyalty and drive engagement. This shift towards personalized and proactive services will move insurance comparison sites beyond simple price comparison towards comprehensive risk management and financial planning tools.

Conclusive Thoughts

In conclusion, insurance comparison sites have revolutionized the way consumers approach insurance purchasing. By providing a centralized platform for comparing policies, these sites have empowered individuals to make informed decisions and secure the best possible coverage. While challenges remain, particularly concerning data privacy and the evolving technological landscape, the future of insurance comparison sites appears bright, promising even more personalized and efficient solutions for consumers in the years to come. The continued development and refinement of these platforms will undoubtedly shape the future of the insurance industry, benefiting both consumers and providers alike.

Detailed FAQs

What information do I need to provide on an insurance comparison site?

Typically, you’ll need basic personal information (age, location, etc.) and details about the type of insurance you’re seeking (e.g., car, home, health).

Are the quotes on comparison sites guaranteed?

Quotes are generally indicative and may vary slightly from the final offer provided by the insurer. Always check the details directly with the insurer before committing.

How do insurance comparison sites make money?

Many sites earn commission from insurers for each lead or sale generated through their platform.

Is it safe to use insurance comparison sites?

Reputable sites employ robust security measures to protect user data. Look for sites with clear privacy policies and security certifications.