Securing the right insurance coverage is paramount in Florida, a state known for its susceptibility to hurricanes and other severe weather events. Understanding the complexities of Florida’s insurance market, from the various types of policies available to the state’s unique regulations, is crucial for both residents and newcomers. This guide aims to demystify the process, providing a clear and concise overview of insurance in Florida, empowering you to make informed decisions to protect your assets and well-being.

From homeowner’s insurance safeguarding against hurricane damage to auto insurance navigating Florida’s roads, we will explore the key factors influencing insurance costs, the process of choosing a provider, and the procedures for filing claims. We’ll also delve into Florida’s specific regulations and laws, helping you understand your rights and responsibilities as a policyholder. This comprehensive guide provides the essential information you need to confidently navigate the world of insurance in the Sunshine State.

Types of Insurance in Florida

Florida’s diverse climate and population necessitate a wide range of insurance options to protect individuals and businesses from various risks. Understanding the different types of insurance available and their respective coverages is crucial for securing adequate protection. This section details several common insurance types in Florida, highlighting key features, costs, and exclusions.

Homeowners Insurance

Homeowners insurance in Florida protects your home and its contents against various perils, such as fire, windstorms, and theft. Coverage typically includes dwelling protection, personal property coverage, liability protection, and additional living expenses if your home becomes uninhabitable due to a covered event. However, coverage specifics and costs vary significantly based on factors like location, property value, and the chosen policy’s deductible. Hurricane coverage is a particularly important consideration in Florida, often requiring separate or enhanced coverage due to the state’s vulnerability to hurricanes. Costs can be substantially higher in hurricane-prone areas.

Auto Insurance

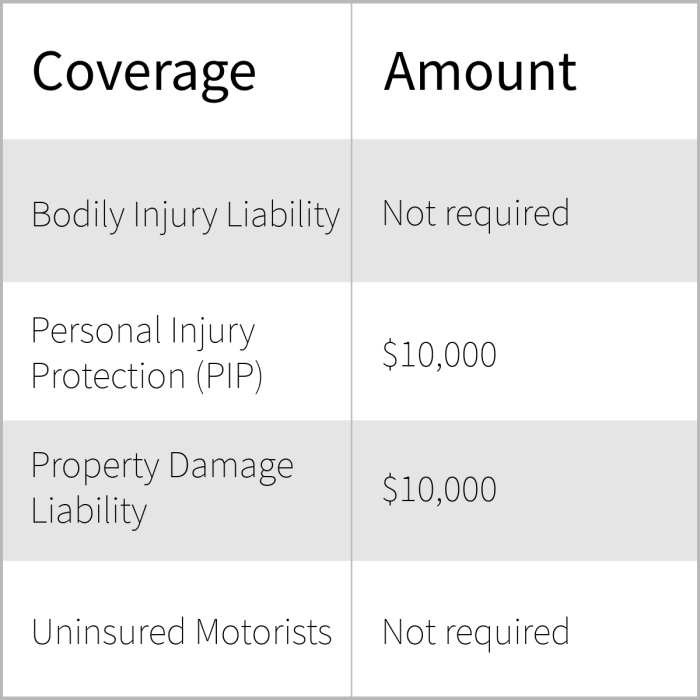

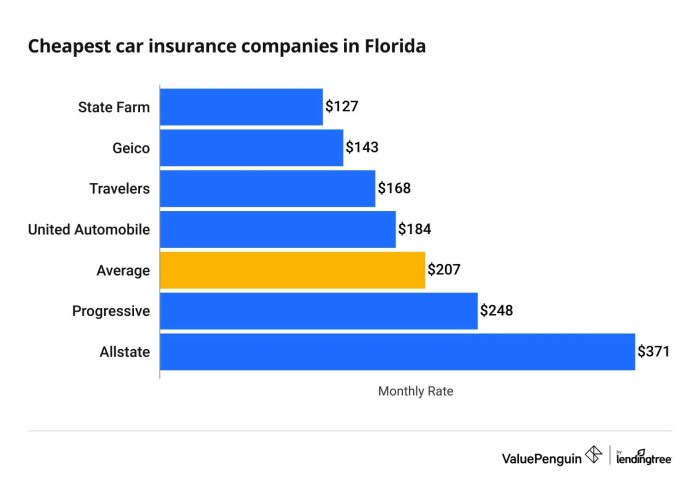

Auto insurance in Florida is mandatory, providing financial protection in the event of an accident. Minimum coverage requirements include Personal Injury Protection (PIP) and Property Damage Liability (PDL). PIP covers medical expenses and lost wages for you and your passengers, regardless of fault. PDL covers damages to another person’s vehicle or property. Comprehensive and collision coverage are optional but highly recommended. Comprehensive covers damage from non-accidental events like theft or vandalism, while collision covers damage from accidents. Factors such as driving history, vehicle type, and age influence the cost of auto insurance. Drivers with a history of accidents or traffic violations will typically pay higher premiums.

Flood Insurance

Flood insurance is crucial in Florida, a state highly susceptible to flooding. Standard homeowners insurance policies generally do not cover flood damage. Flood insurance is usually purchased separately through the National Flood Insurance Program (NFIP) or private insurers. Coverage includes damage to the structure of your home and its contents. The cost of flood insurance varies depending on factors such as the flood risk of your location and the value of your property. Properties located in high-risk flood zones will have significantly higher premiums.

Health Insurance

Health insurance in Florida is essential for covering medical expenses. Options include plans offered through the Affordable Care Act (ACA) marketplace, employer-sponsored plans, and private plans. Coverage varies depending on the plan chosen, with different levels of deductibles, copays, and out-of-pocket maximums. Factors such as age, health status, and the plan’s network of providers influence the cost. Pre-existing conditions are generally covered under the ACA. Florida’s health insurance landscape is dynamic, and understanding the different plan options and their coverage details is critical for making informed decisions.

| Insurance Type | Key Features | Average Annual Cost (Estimate) | Common Exclusions |

|---|---|---|---|

| Homeowners | Dwelling, personal property, liability, additional living expenses | $2,000 – $5,000+ (Highly variable) | Flood, earthquake, intentional damage |

| Auto | Liability, PIP, comprehensive, collision | $1,000 – $3,000+ (Highly variable) | Damage caused by wear and tear, driving under the influence |

| Flood | Structure and contents coverage | $500 – $2,000+ (Highly variable based on risk) | Damage from other perils (e.g., fire, wind) |

| Health | Hospital, doctor visits, prescription drugs | $500 – $10,000+ (Highly variable based on plan) | Cosmetic procedures, pre-existing conditions (in some plans) |

Florida’s Insurance Regulations and Laws

Navigating the insurance landscape in Florida requires understanding the complex web of regulations and laws governing the industry. The state’s unique geographical location and vulnerability to hurricanes significantly influence its insurance regulations, leading to a system distinct from many other states. This section will explore the key regulatory bodies, significant legislation, and the implications of recent changes.

The Florida Department of Financial Services (DFS) plays a central role in overseeing the state’s insurance market.

The Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) is the primary regulatory body for the insurance industry in Florida. Its responsibilities encompass licensing and monitoring insurance companies, agents, and adjusters; investigating consumer complaints; and ensuring compliance with state insurance laws. The DFS aims to protect consumers by promoting a stable and competitive insurance market. This involves setting and enforcing regulations related to rates, policy forms, and claims handling practices. The DFS also plays a crucial role in responding to major catastrophic events, such as hurricanes, by coordinating the claims process and ensuring timely payments to policyholders. The department’s actions directly impact the availability and affordability of insurance in the state.

Significant Insurance Laws Impacting Florida Residents

Several key laws significantly impact Florida residents’ access to and experience with insurance. These laws often address issues specific to the state, such as hurricane risk and property insurance. For example, the Florida Hurricane Catastrophe Fund is a crucial element of the state’s insurance system, providing a reinsurance mechanism to help insurers cover catastrophic losses from hurricanes. Other significant legislation focuses on consumer protection, rate regulation, and the solvency of insurance companies. These laws constantly evolve to address emerging challenges and adapt to changing market conditions. For example, recent legislation has focused on addressing issues related to assignment of benefits (AOB) abuse, which has driven up insurance costs.

Key Differences Between Florida’s Insurance Regulations and Those of Other States

Florida’s insurance regulatory environment differs substantially from that of many other states. The high frequency and severity of hurricanes in Florida necessitate unique approaches to risk assessment and mitigation. This leads to higher insurance premiums compared to states with less severe weather risks. Furthermore, Florida’s regulations regarding property insurance, particularly concerning issues like assignment of benefits (AOB) and litigation, are more stringent than in many other states. These differences stem from the state’s unique challenges and the need to protect consumers from excessive costs and fraudulent claims. The regulatory approach in Florida often involves a more active role in managing the insurance market, aiming to balance consumer protection with the stability of the insurance industry.

Implications of Recent Legislative Changes on the Insurance Market in Florida

Recent legislative changes in Florida have significantly impacted the insurance market. For example, reforms aimed at curbing AOB abuse have sought to reduce litigation and lower insurance costs. These changes, while intended to stabilize the market, have also faced challenges and criticism. Some argue that the reforms have not been fully effective in reducing costs or improving the availability of insurance, while others believe they have gone too far in restricting consumer rights. The ongoing debate highlights the complexity of balancing consumer protection with the need for a stable and affordable insurance market in Florida. The long-term effects of these recent legislative changes are still unfolding, and their impact on insurance availability and affordability remains a subject of ongoing discussion and analysis. The changes have, however, undoubtedly reshaped the Florida insurance landscape.

Factors Affecting Insurance Costs in Florida

Understanding the factors that influence insurance premiums in Florida is crucial for consumers seeking to secure affordable coverage. Several interconnected elements contribute to the overall cost, impacting both the availability and price of insurance policies. These factors range from individual circumstances to broader environmental and economic conditions.

Several key factors significantly influence the cost of insurance in Florida. These factors interact in complex ways, leading to considerable variations in premiums across the state.

Location

Geographic location is a paramount factor determining insurance costs in Florida. Coastal areas, particularly those vulnerable to hurricanes and storm surges, command significantly higher premiums than inland regions. Properties situated in flood zones or areas with a history of significant wind damage face increased risk assessments, directly translating to higher insurance costs. For example, a home in Miami Beach will typically have a much higher homeowners insurance premium than a comparable home in Orlando due to the higher risk of hurricane damage. This is because insurers consider the likelihood of claims based on historical weather data and proximity to vulnerable coastal areas.

Age and Driving Record

For auto insurance, age and driving history are critical factors. Younger drivers, particularly those with limited driving experience or a history of accidents or traffic violations, are considered higher-risk and therefore face higher premiums. Conversely, older drivers with clean driving records often qualify for lower rates. Insurance companies use sophisticated actuarial models that analyze vast amounts of data to predict the likelihood of accidents and claims based on age and driving history. A driver with multiple speeding tickets or a DUI conviction will almost certainly pay more than a driver with a spotless record.

Weather-Related Events

Florida’s susceptibility to hurricanes and other severe weather events profoundly impacts insurance costs. The frequency and intensity of hurricanes, along with the resulting damage, directly influence insurance premiums. After a major hurricane, insurers experience a surge in claims, leading them to increase premiums to offset losses and maintain profitability. For example, following Hurricane Irma in 2017, many insurers significantly raised premiums in affected areas, reflecting the increased risk and the massive payouts for damage claims. Similarly, flood insurance costs are significantly higher in areas identified as high-risk flood zones by the Federal Emergency Management Agency (FEMA).

Regional Variations in Insurance Costs

Insurance costs vary considerably across different regions of Florida. Coastal counties, particularly those in South Florida, tend to have significantly higher premiums than inland areas due to the heightened risk of hurricane damage and flooding. Areas with higher population densities and greater property values may also see increased insurance costs. For instance, homeowners insurance in areas like Miami-Dade County often exceeds that in more rural parts of the state like the Panhandle, reflecting the differential in risk profiles.

Bulleted List of Significant Cost Drivers

- Location: Coastal proximity, flood zones, and historical weather data significantly impact premiums.

- Age and Driving Record (Auto Insurance): Younger drivers and those with poor driving records pay more.

- Weather-Related Events: Hurricane frequency and intensity directly influence premium increases.

- Type of Coverage: Comprehensive coverage is generally more expensive than liability-only coverage.

- Deductible Amount: Higher deductibles generally lead to lower premiums.

- Credit Score: In many cases, credit score is a factor considered by insurers.

Insurance Fraud in Florida

Insurance fraud poses a significant problem in Florida, impacting both individuals and the insurance industry. It drives up premiums for honest policyholders and undermines the integrity of the insurance system. Understanding the various types of fraud, their consequences, and preventative measures is crucial for protecting yourself and contributing to a fairer insurance market.

Types of Insurance Fraud in Florida

Several types of insurance fraud are prevalent in Florida. These include, but are not limited to, fraudulent claims, staged accidents, arson for profit, and premium fraud. Fraudulent claims involve exaggerating losses or fabricating events to receive a larger payout. Staged accidents are pre-planned events designed to generate fraudulent insurance claims. Arson for profit involves intentionally setting fire to property to collect insurance money. Premium fraud involves misrepresenting information on an application to obtain lower premiums. These actions are illegal and carry severe consequences.

Legal Consequences of Committing Insurance Fraud in Florida

Committing insurance fraud in Florida is a serious crime with significant legal repercussions. Penalties can include hefty fines, imprisonment, and a criminal record, all of which can have long-term consequences. The severity of the punishment depends on the nature and extent of the fraud. For example, a minor misrepresentation on an application might result in a fine, while a large-scale staged accident scheme could lead to substantial prison time. Furthermore, convicted individuals may face difficulty obtaining insurance in the future. The state actively investigates and prosecutes insurance fraud, working to deter such activities.

Committing insurance fraud in Florida is a serious crime with significant penalties, including fines, imprisonment, and a criminal record. The severity of punishment varies depending on the nature and extent of the fraudulent activity.

Protecting Yourself from Insurance Fraud

Protecting yourself from becoming a victim of insurance fraud requires vigilance and informed decision-making. Thoroughly research insurance companies before purchasing a policy. Keep accurate records of your belongings and their value, including photographs and receipts. Be wary of unsolicited offers or suspiciously low premiums. If you suspect fraud, report it immediately to the appropriate authorities, such as the Florida Department of Financial Services’ Division of Insurance Fraud. Remember that honesty and accurate reporting are crucial in maintaining a fair insurance system. Being proactive and informed can significantly reduce your risk of becoming a victim.

Last Recap

Successfully navigating the insurance landscape in Florida requires a thorough understanding of the various policy types, state regulations, and cost factors. By carefully comparing quotes, understanding policy terms, and being aware of potential fraud, you can secure the appropriate coverage to protect your assets and financial future. Remember, proactive planning and informed decision-making are key to ensuring you have the right insurance protection tailored to your specific needs in Florida’s unique environment.

Detailed FAQs

What is the role of the Florida Department of Financial Services (DFS)?

The DFS regulates and oversees the insurance industry in Florida, ensuring consumer protection and market stability.

How do I compare insurance quotes effectively?

Use online comparison tools, contact multiple insurers directly, and carefully compare coverage, deductibles, and premiums before making a decision.

What are the typical claim processing times in Florida?

Processing times vary depending on the type of claim and the insurer, but generally range from a few days to several weeks.

What should I do if my insurance claim is denied?

Review your policy, gather supporting documentation, and contact your insurer to appeal the decision. If necessary, consult with an attorney.

Are there any specific discounts available for Florida residents?

Yes, many insurers offer discounts for various factors, such as home security systems, driver safety courses, and bundling multiple insurance policies.