Finding the right car insurance can feel like navigating a maze. The sheer number of providers, policies, and jargon can be overwhelming. This guide demystifies the process of obtaining a car insurance quote, empowering you to make informed decisions and secure the best coverage for your needs and budget. We’ll explore the factors influencing your quote, the different ways to obtain one, and what to look for when comparing options.

From understanding the various stages of the car insurance buying journey to deciphering the details of a quote, we aim to provide a clear and concise overview. Whether you’re a seasoned driver or a first-time car owner, this guide offers valuable insights to help you navigate the world of car insurance with confidence.

Understanding “Insurance Quote Car” Search Intent

The search term “insurance quote car” reveals a user actively seeking information to obtain a car insurance price estimate. This seemingly simple query belies a range of underlying needs and motivations, reflecting various stages in the car insurance buying journey. Understanding these nuances is crucial for effectively tailoring information and services to potential customers.

The user’s intent behind searching for “insurance quote car” encompasses several key aspects of their car insurance journey. This search indicates a progression towards purchasing a policy, ranging from initial exploration to final comparison. The level of detail sought and the urgency implied will vary considerably depending on the individual’s circumstances.

User Needs Behind “Insurance Quote Car” Searches

The diverse needs driving this search can be categorized. Some users are simply beginning their research, comparing prices from different providers before committing to a policy. Others may be nearing the end of their current policy and actively seeking renewal options. A further segment might be new car owners, navigating the insurance landscape for the first time. Finally, some may be switching providers due to dissatisfaction with their current insurer. Each scenario requires a slightly different approach to information delivery.

Stages of the Car Insurance Buying Process Reflected in the Search

The search term “insurance quote car” typically represents one of several stages in the car insurance buying process. This could be the initial awareness stage, where the user is just beginning to research options. Alternatively, it could reflect the comparison stage, where the user is actively comparing quotes from different insurers. The final stage represented could be the purchase stage, where the user is ready to purchase a policy. The user’s position in this process significantly impacts their information needs and expectations. For example, a user in the initial awareness stage might be looking for general information about car insurance, while a user in the purchase stage will likely be looking for specific details about policy coverage and pricing.

User’s Likely Level of Knowledge about Car Insurance

The user searching for “insurance quote car” likely possesses a variable level of knowledge about car insurance. Some users may be highly knowledgeable, possessing prior experience with insurance policies and a clear understanding of coverage options. Others may be completely new to the process, lacking understanding of terminology and policy details. Many will fall somewhere in between, having some basic understanding but requiring further clarification and comparison. Therefore, the information presented should be adaptable to various levels of comprehension, avoiding overly technical jargon while still providing sufficient detail for informed decision-making.

User Persona: Sarah, the New Driver

To illustrate a typical user, consider Sarah, a 22-year-old recent college graduate who just bought her first car. She has limited experience with insurance and is overwhelmed by the various options available. She’s looking for a simple, easy-to-understand way to compare car insurance quotes and find an affordable policy that meets her basic needs. She’s likely to prioritize price but also wants to ensure she has adequate coverage. Sarah represents a significant portion of users searching for “insurance quote car,” highlighting the need for clear, concise, and accessible information.

Factors Influencing Car Insurance Quotes

Car insurance premiums are not a one-size-fits-all proposition. Numerous factors contribute to the final cost, making it crucial to understand how these elements interact to determine your individual rate. This section will detail the key factors influencing your car insurance quote.

Age of the Driver

Age significantly impacts insurance premiums. Younger drivers, typically those under 25, are statistically involved in more accidents and thus represent a higher risk to insurance companies. This increased risk translates to higher premiums. Conversely, drivers in their 30s, 40s, and beyond often enjoy lower rates due to their improved driving experience and lower accident likelihood. Insurance companies use actuarial data to determine these age-based risk assessments, resulting in a tiered system of premiums. For example, a 20-year-old driver might pay significantly more than a 40-year-old driver with a similar driving record and vehicle.

Driving History

A clean driving record is a significant factor in obtaining favorable insurance rates. Accidents, speeding tickets, and DUI convictions all negatively impact your premium. Each incident increases your risk profile, leading to higher premiums. The severity of the offense also matters; a major accident will result in a more substantial increase than a minor fender bender. Insurance companies utilize a points system, where each violation adds points to your driving record, directly affecting your quote. For instance, a driver with multiple speeding tickets will likely pay considerably more than a driver with a spotless record.

Type of Car

The type of car you drive also influences your insurance cost. Luxury vehicles, sports cars, and high-performance vehicles are generally more expensive to insure due to their higher repair costs and greater potential for theft. Conversely, smaller, less expensive cars often command lower premiums. Features like safety technology (e.g., anti-lock brakes, airbags) can also impact your rates, often leading to lower premiums for vehicles equipped with advanced safety features. A high-value sports car will almost certainly have a higher insurance premium than a fuel-efficient compact car.

Location

Your location plays a crucial role in determining your car insurance premiums. Areas with high crime rates, frequent accidents, and higher vehicle theft rates typically have higher insurance costs. Insurance companies analyze claims data from specific geographic locations to assess risk levels. Living in a densely populated urban area might result in higher premiums compared to living in a rural area with lower accident rates. For example, a driver in a large city with a high crime rate will likely pay more than a driver in a smaller, quieter town.

| Factor | Impact on Premium | Driver Profile Comparison | Example |

|---|---|---|---|

| Age | Younger drivers generally pay more; older drivers pay less. | 20-year-old vs. 40-year-old: Significant premium difference, assuming similar driving records and vehicles. | A 20-year-old with a clean record might pay double what a 40-year-old with a similar record pays. |

| Driving History | Accidents, tickets, and DUI convictions increase premiums. | Driver with multiple speeding tickets vs. driver with clean record: Higher premium for the driver with violations. | Three speeding tickets could increase premiums by 50% or more. |

| Car Type | Expensive or high-performance cars have higher premiums. | Driver with a luxury sedan vs. driver with a compact car: Higher premium for the luxury sedan. | A luxury SUV could cost twice as much to insure as a comparable compact car. |

| Location | High-risk areas have higher premiums. | Driver in a high-crime city vs. driver in a rural town: Higher premium for the city driver. | A driver in a major metropolitan area might pay 20% more than a driver in a rural area. |

Navigating the Car Insurance Quote Process

Obtaining a car insurance quote might seem daunting, but with a structured approach, it becomes straightforward. This section details the steps involved in securing and comparing quotes to find the best coverage at the most competitive price. Understanding the process empowers you to make informed decisions about your car insurance.

Online Quote Acquisition Steps

The process of getting a car insurance quote online typically involves a series of simple steps. First, you’ll visit the insurer’s website. Then, you’ll be prompted to enter specific details about yourself, your vehicle, and your driving history. Finally, after submitting your information, the insurer’s system will calculate and display your personalized quote. This entire process is usually quick and easy, often taking less than 10 minutes.

Typical Questions Asked During the Quote Process

Insurers need specific information to accurately assess your risk and generate a quote. Common questions include details about your vehicle (make, model, year), your driving history (accidents, violations, years of experience), your address (used to determine risk factors based on location), your desired coverage levels (liability, collision, comprehensive), and your personal information (age, gender). Providing accurate and complete information is crucial for receiving an accurate quote.

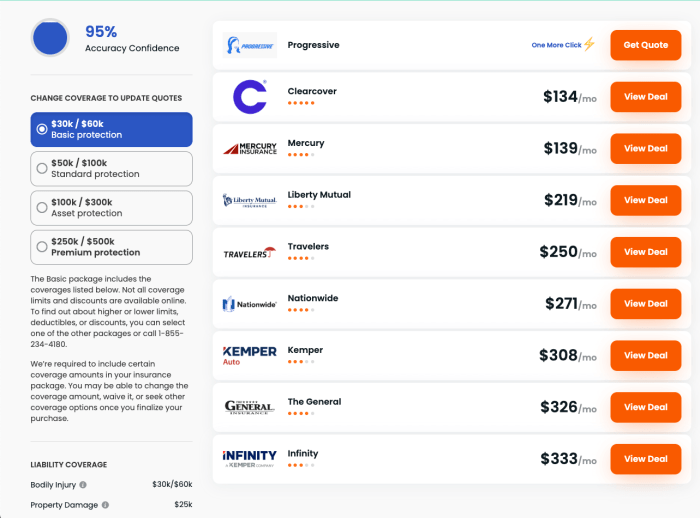

Comparing Car Insurance Quotes

Once you’ve received several quotes from different providers, comparing them is crucial. Focus on more than just the price. Consider the coverage offered, deductibles, and any additional benefits or discounts. A lower premium might mean less comprehensive coverage. A simple comparison table, listing premiums, deductibles, and key coverage features for each provider, is a useful tool. For example, compare a quote with a $500 deductible and basic liability coverage to one with a $1000 deductible and comprehensive coverage; the premium will differ, but the value proposition may not.

Understanding and Interpreting Car Insurance Quotes

A car insurance quote isn’t just a number; it’s a detailed document outlining the terms of your potential policy. Carefully review the quote, paying attention to the coverage limits for liability, collision, and comprehensive insurance. Understand the deductible amount you’ll have to pay out-of-pocket before your insurance coverage kicks in. Note any exclusions or limitations on coverage. If anything is unclear, contact the insurer directly for clarification before committing to a policy. For instance, a quote might detail coverage for accidents, but exclude damage caused by certain events, such as flooding. Understanding these details is vital for making an informed decision.

Illustrative Examples of Car Insurance Quotes

Understanding the components of a car insurance quote is crucial for making informed decisions. This section provides a sample quote illustration and explores scenarios that can significantly impact the final cost.

Sample Car Insurance Quote

This example illustrates the typical sections found in a car insurance quote. Remember, the actual amounts will vary depending on individual circumstances. The quote would begin with policyholder information, including name, address, and driver’s license details. Next, it would detail the covered vehicle, specifying the make, model, year, and Vehicle Identification Number (VIN). The policy period, typically a six-month or annual term, would be clearly stated. The core of the quote would be the breakdown of coverage options, including liability coverage (bodily injury and property damage), collision coverage, comprehensive coverage (covering damage not related to collisions), uninsured/underinsured motorist coverage, and personal injury protection (PIP). Each coverage would list its limits, explaining the maximum amount the insurer would pay for a claim. Deductibles, the amount the policyholder pays out-of-pocket before the insurance coverage kicks in, would be specified for each relevant coverage type. Finally, the quote would include the total premium, broken down into monthly or annual installments, and the payment options available.

Visual Representation of Cost Breakdown

Imagine a pie chart. The largest segment represents liability coverage, reflecting its significance. A substantial portion would be dedicated to collision and comprehensive coverage, depending on the chosen deductibles. Smaller segments would represent uninsured/underinsured motorist coverage and personal injury protection. A small segment could be allocated to administrative fees or other applicable charges. This visual representation emphasizes the relative cost of each coverage component.

Scenarios Affecting Car Insurance Quote Changes

Several factors can significantly alter a car insurance quote. For example, a change in driving record, such as receiving a speeding ticket or being involved in an accident, will likely lead to a higher premium. Similarly, changes in the vehicle itself, such as upgrading to a more expensive or higher-performance car, will also result in a higher premium due to increased risk. Moving to a higher-risk area, with higher rates of theft or accidents, could increase the quote. Changes in personal circumstances, such as getting married or adding a new driver to the policy, could also impact the quote. Finally, increasing or decreasing the coverage limits or deductibles will directly affect the premium amount. A driver with a spotless record who switches from a smaller, older car to a new sports car will see a substantial increase in their premium, while a driver with several accidents who switches to a safer, older vehicle might see a slight decrease, depending on the other factors.

Examples of Optional Coverages

Many insurers offer optional add-ons to enhance coverage. Roadside assistance, providing services such as towing and lockout assistance, is a common addition. Rental car reimbursement, covering the cost of a rental vehicle while the insured car is being repaired, is another popular option. Gap insurance, which covers the difference between the actual cash value of a vehicle and the outstanding loan amount in the event of a total loss, is beneficial for those with car loans. Lastly, some policies offer accident forgiveness, waiving rate increases after the first at-fault accident.

Beyond the Quote

Receiving a car insurance quote is just the first step in securing your vehicle’s protection. Understanding what happens next is crucial to ensuring you’re adequately covered and getting the best possible value for your money. The process involves careful review, informed decision-making, and a clear understanding of your policy’s terms and conditions.

Purchasing a Car Insurance Policy

After comparing quotes and selecting the policy that best suits your needs and budget, you’ll proceed to purchase the policy. This typically involves providing the insurance company with the necessary information, such as your driver’s license, vehicle registration, and payment details. The insurer will then issue a policy document outlining the coverage details, premiums, and other important terms. Online purchasing often involves a streamlined process with immediate confirmation, while traditional methods may require additional steps like mailing in forms or speaking with an agent. The process might also include providing proof of existing insurance if you’re switching providers.

Reviewing Policy Documents

Thoroughly reviewing your policy documents is paramount. Don’t just skim the surface; take the time to understand every aspect of your coverage. Pay close attention to the details of your liability coverage, collision and comprehensive coverage, deductibles, and any exclusions or limitations. Understanding these details will help you avoid unexpected costs or gaps in coverage down the road. For example, a seemingly small exclusion could have significant consequences in the event of a claim. Compare the policy details with the quote you received to ensure consistency.

Identifying Potential Red Flags

While reviewing your policy, be vigilant for any potential red flags. These could include discrepancies between the quote and the policy document, unclear or ambiguous language, unexpectedly high deductibles, or exclusions that seem unreasonable. If you find anything questionable, contact the insurance company immediately to clarify. For instance, if your quote stated a specific coverage amount but the policy shows a lower amount, it warrants immediate attention. Similarly, unclear language surrounding what constitutes a covered event could lead to disputes later. Don’t hesitate to seek clarification from the insurance company or a qualified insurance professional if needed.

Ending Remarks

Obtaining a car insurance quote is the first crucial step in securing adequate vehicle protection. By understanding the factors influencing your premium, exploring different quote acquisition methods, and carefully comparing options, you can make an informed choice that aligns with your financial situation and risk profile. Remember to thoroughly review your policy documents before finalizing your purchase to ensure complete understanding and avoid potential issues down the line. Driving safely and maintaining a clean driving record will further contribute to keeping your premiums affordable.

General Inquiries

What information do I need to get a car insurance quote?

Typically, you’ll need your driver’s license information, vehicle details (make, model, year), address, and driving history.

Can I get a car insurance quote without providing my driving history?

While some providers may offer preliminary quotes without full driving history, accurate and complete information is essential for an accurate final quote.

How often should I compare car insurance quotes?

It’s recommended to compare quotes annually, or even more frequently if your circumstances change significantly (e.g., new car, change of address, driving record changes).

What does “uninsured/underinsured motorist” coverage mean?

This coverage protects you in case you’re involved in an accident with an uninsured or underinsured driver. It covers your medical bills and vehicle damage.

What is the difference between liability and collision coverage?

Liability covers damages you cause to others, while collision covers damages to your own vehicle, regardless of fault.