Securing the right auto insurance is crucial, yet the process of obtaining quotes can feel overwhelming. This guide demystifies the world of insurance quotes for auto, offering a clear and concise path to finding the best coverage at the most competitive price. We’ll explore various coverage types, factors influencing costs, and effective strategies for comparing quotes from different providers.

Understanding your insurance needs and how different factors impact your premium is key to making an informed decision. From online tools to in-person consultations, we’ll equip you with the knowledge and resources to navigate the process confidently and secure the auto insurance that best suits your individual circumstances and budget.

Understanding “Insurance Quotes for Auto”

Obtaining an auto insurance quote is the first step in securing the right coverage for your vehicle. Understanding the components of these quotes and how they are calculated is crucial for making informed decisions and finding the best value for your needs. This section will clarify the various aspects of auto insurance quotes, enabling you to navigate the process with confidence.

Types of Auto Insurance Coverage

Auto insurance quotes typically include several types of coverage. These coverages protect you financially in various accident scenarios. Common types include liability coverage (which covers injuries or damages you cause to others), collision coverage (which covers damage to your vehicle in an accident, regardless of fault), comprehensive coverage (which covers damage to your vehicle from non-collision events like theft or vandalism), uninsured/underinsured motorist coverage (which protects you if you’re hit by an uninsured driver), and medical payments coverage (which covers medical expenses for you and your passengers, regardless of fault). The specific coverages offered and their limits will vary depending on the insurance provider and your chosen policy.

Factors Influencing Auto Insurance Quote Prices

Numerous factors contribute to the price of an auto insurance quote. Your driving record (including accidents and traffic violations), age and driving experience, the type of vehicle you drive (including its make, model, and year), your location (as rates vary by geographic area due to factors like crime rates and accident frequency), your credit score (in many states), and the coverage levels you select all play a significant role. For example, a driver with multiple speeding tickets will generally pay more than a driver with a clean record. Similarly, a high-performance sports car will typically command a higher premium than a fuel-efficient sedan.

Typical Components of an Auto Insurance Quote

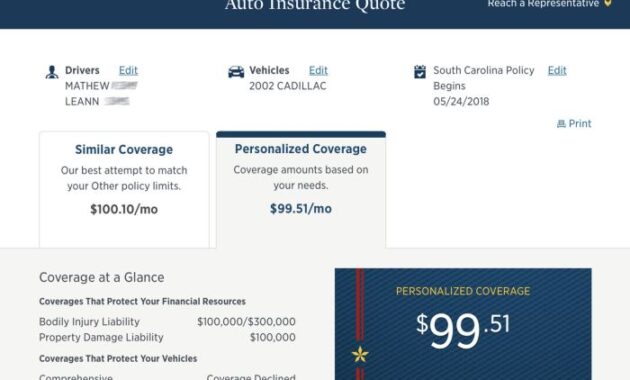

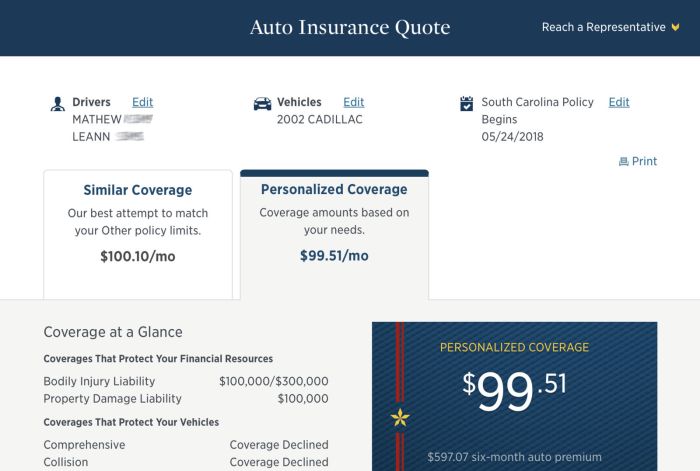

An auto insurance quote typically breaks down the cost of your insurance into several key components. These components usually include the premiums for each type of coverage you select, any applicable discounts (such as safe driver discounts or multi-car discounts), and taxes. Some quotes may also include details about optional add-ons, such as roadside assistance or rental car reimbursement. A clear understanding of these components allows for a comprehensive comparison of different quotes. For instance, one quote might offer lower liability coverage but higher collision coverage compared to another.

Comparing and Contrasting Quotes from Different Insurance Providers

Comparing quotes from different insurance providers is essential to finding the best deal. While the same coverage levels might appear similar across different companies, the prices can vary significantly. This variation is due to the differences in how each company assesses risk and sets its rates. It’s recommended to compare quotes from at least three to five different insurers to ensure a comprehensive comparison and identify the most cost-effective option. Factors like customer service reputation and claims handling processes should also be considered alongside price when making a final decision.

Key Information in an Auto Insurance Quote

The following table summarizes the key information typically found in an auto insurance quote. Remember that the specific details included may vary slightly between providers.

| Coverage Type | Coverage Limit | Premium | Deductible |

|---|---|---|---|

| Liability | $100,000/$300,000/$50,000 | $300 per year | N/A |

| Collision | $5,000 | $200 per year | $500 |

| Comprehensive | $5,000 | $150 per year | $500 |

| Uninsured/Underinsured Motorist | $100,000/$300,000 | $100 per year | N/A |

Obtaining Auto Insurance Quotes

Securing the best auto insurance involves more than just finding the cheapest policy. It requires a strategic approach to comparing quotes from different providers, ensuring you’re getting the right coverage at the right price. Understanding the various methods for obtaining quotes, the information needed, and effective comparison techniques is crucial for making an informed decision.

Methods for Obtaining Auto Insurance Quotes

There are several convenient ways to obtain auto insurance quotes. Each method offers different advantages and may suit different preferences. Choosing the method that best fits your needs and comfort level is important for a smooth process.

- Online Quotes: Many insurance companies offer online quote tools. These platforms typically involve filling out a short form with basic information about your vehicle, driving history, and desired coverage. The advantage is speed and convenience; quotes are often generated instantly. However, the level of personalization may be limited compared to other methods.

- Phone Quotes: Contacting insurance providers directly by phone allows for a more personalized experience. An agent can answer your questions, clarify details, and guide you through the process. This approach can be particularly helpful for those who prefer a more interactive and less automated experience. However, it may take longer than obtaining an online quote.

- In-Person Quotes: Visiting an insurance agency in person provides the most personalized service. You can discuss your needs in detail with an agent, ask questions, and receive tailored advice. This method is beneficial for those who prefer face-to-face interaction and want a comprehensive explanation of coverage options. However, it requires more time commitment.

Best Practices for Comparing Auto Insurance Quotes

Comparing auto insurance quotes effectively requires a systematic approach to ensure you’re making a well-informed decision. Don’t solely focus on price; consider the overall value proposition offered by each insurer.

- Compare Coverage: Ensure that you’re comparing similar coverage levels across different providers. A cheaper policy with less coverage might not be the best value in the long run.

- Check Deductibles: Higher deductibles typically lead to lower premiums, but you’ll pay more out-of-pocket in the event of an accident. Find a balance that suits your financial situation.

- Review Customer Reviews: Research the reputation and customer service ratings of different insurance companies before making a decision. Online reviews can provide valuable insights into the experiences of other policyholders.

- Consider Discounts: Many insurers offer discounts for safe driving, bundling policies (home and auto), or being a member of certain organizations. Inquire about all available discounts to potentially lower your premium.

Information Needed for Accurate Auto Insurance Quotes

Providing accurate information is crucial for receiving an accurate and relevant auto insurance quote. Inaccurate information can lead to higher premiums or even policy cancellation.

- Driver Information: This includes your age, driving history (including accidents and violations), and driving experience.

- Vehicle Information: Make, model, year, VIN number, and any modifications to the vehicle.

- Address: Your current address, as insurance rates can vary based on location.

- Coverage Needs: The level of liability, collision, and comprehensive coverage you require.

Step-by-Step Guide for Getting Auto Insurance Quotes

Getting auto insurance quotes can be streamlined by following these steps. This structured approach will ensure you gather the necessary information efficiently and compare quotes effectively.

- Gather Information: Collect all necessary information about yourself, your vehicle, and your desired coverage levels.

- Choose Your Method: Decide whether you prefer to obtain quotes online, by phone, or in person.

- Request Quotes: Contact multiple insurance providers and request quotes using your chosen method.

- Compare Quotes: Carefully compare the quotes, paying attention to coverage levels, deductibles, and premiums.

- Review Policies: Once you’ve chosen a provider, thoroughly review the policy documents before signing.

Checklist of Questions to Ask Insurance Providers

Asking the right questions is crucial to ensuring you understand the policy details and make an informed decision. These questions should be tailored to your specific needs and circumstances.

- What specific coverages are included in your policy?

- What are the deductibles for different types of claims?

- What discounts are available to me?

- What is your claims process like?

- What is your customer service rating and how can I access assistance if needed?

Factors Affecting Auto Insurance Quotes

Several interconnected factors influence the cost of your auto insurance. Understanding these elements allows you to make informed decisions and potentially secure more favorable rates. This section will detail the key aspects that insurance companies consider when calculating your premium.

Driver-Related Factors

Your personal characteristics significantly impact your insurance premium. Insurance companies assess risk based on your driving record, age, and even your credit history in some jurisdictions. Younger drivers, statistically, have higher accident rates and therefore pay more. Similarly, a history of accidents or traffic violations will lead to higher premiums. Conversely, maintaining a clean driving record and demonstrating responsible behavior can result in lower rates. Many insurers offer discounts for good students or those who complete defensive driving courses. Credit-based insurance scores, while controversial, are used in some states to assess risk, reflecting the idea that individuals with responsible financial habits might also be more responsible drivers.

Vehicle Type and Features

The type of vehicle you drive is a major factor in determining your insurance costs. Sports cars and high-performance vehicles are generally more expensive to insure due to their higher repair costs and increased risk of theft. Conversely, smaller, less powerful cars typically have lower insurance premiums. Vehicle safety features, such as anti-lock brakes, airbags, and electronic stability control, can also influence your rate. Cars with these features often qualify for discounts because they are associated with a reduced risk of accidents and injuries. The vehicle’s age and its value also play a significant role; newer, more expensive cars will usually cost more to insure.

Driving History and Claims

Your driving history is a crucial factor. A clean driving record with no accidents or tickets will result in lower premiums. Conversely, a history of accidents or traffic violations will significantly increase your insurance costs. The severity of the accidents and the number of claims filed also matter. Multiple claims in a short period suggest a higher risk profile, leading to higher premiums. Insurance companies track this information, and even minor incidents can impact your rates for several years. Some companies might even refuse to insure drivers with a poor driving record.

Location and Geographic Factors

Where you live significantly impacts your auto insurance rates. Insurance companies consider factors like the crime rate, the frequency of accidents in your area, and the average cost of vehicle repairs. Areas with high crime rates and frequent accidents typically have higher insurance premiums due to the increased risk of theft and collisions. The cost of living in a particular region also plays a role, as repair costs and medical expenses tend to be higher in some areas than others. Rural areas may have lower rates than densely populated urban areas due to lower accident frequency and lower repair costs.

Coverage Levels

The level of coverage you choose directly affects your insurance premium. Higher coverage limits, such as liability coverage, comprehensive coverage, and collision coverage, will result in higher premiums. While more expensive, higher coverage limits offer greater financial protection in the event of an accident or damage to your vehicle. Conversely, opting for lower coverage limits can reduce your premium but leaves you with less financial protection. It’s essential to find a balance between affordability and adequate protection.

Understanding Policy Details

Understanding your auto insurance policy is crucial for ensuring you’re adequately protected and know what to expect in the event of an accident. This section details common terms, the claims process, your responsibilities, and examples of covered situations.

Common Policy Terms and Conditions

Auto insurance policies contain various terms and conditions that define the coverage provided. Key terms include liability coverage (protecting you against claims from others), collision coverage (repairing your vehicle after an accident, regardless of fault), comprehensive coverage (covering damage from events other than collisions, like theft or vandalism), uninsured/underinsured motorist coverage (protecting you if involved with an uninsured driver), and medical payments coverage (covering medical expenses for you and your passengers). Deductibles, the amount you pay out-of-pocket before insurance coverage begins, and premiums, the regular payments you make for coverage, are also essential aspects of your policy. Policy limits define the maximum amount your insurance company will pay for a covered claim. Understanding these terms ensures you know the extent of your protection.

The Auto Insurance Claims Process

The claims process typically begins by contacting your insurance company immediately after an accident. You’ll need to provide details of the accident, including the date, time, location, and involved parties. Your insurer will then guide you through the necessary steps, which may include filing a police report, obtaining witness statements, and providing documentation such as photos of the damage. The insurer will investigate the claim, assess the damages, and determine the coverage applicable. After the investigation, they will either approve or deny the claim, and if approved, will provide compensation according to your policy’s terms and conditions. This process can vary in length depending on the complexity of the claim.

Responsibilities of the Insured Party in a Claim

As the insured party, you have several responsibilities during the claims process. This includes cooperating fully with your insurance company’s investigation, providing accurate and complete information, and promptly reporting the accident. You are also responsible for protecting the scene of the accident to the extent possible and obtaining necessary information from other parties involved, such as contact details and insurance information. Failing to meet these responsibilities could impact the processing of your claim.

Examples of Covered Situations

Auto insurance coverage applies to a wide range of situations. For instance, if your vehicle is damaged in a collision with another vehicle, your collision coverage would typically apply. If your car is stolen or vandalized, comprehensive coverage would likely cover the repair or replacement costs. If you are at fault in an accident and cause injury or damage to another person’s property, your liability coverage would protect you against financial responsibility. If an uninsured driver causes an accident resulting in your injuries, your uninsured/underinsured motorist coverage would assist with medical expenses and vehicle repairs. Medical payments coverage would cover medical expenses for you and your passengers, regardless of fault.

Filing an Auto Insurance Claim: A Step-by-Step Process

The following flowchart illustrates the typical steps involved in filing an auto insurance claim.

Flowchart: Filing an Auto Insurance Claim

Step 1: Accident Occurs -> Step 2: Contact Your Insurer Immediately -> Step 3: Gather Information (Police Report, Witness Statements, Photos) -> Step 4: File a Claim with Your Insurer -> Step 5: Insurer Investigates the Claim -> Step 6: Claim Approved or Denied -> Step 7: Claim Settlement (if approved)

Closure

Finding the perfect auto insurance quote involves careful consideration of coverage, cost, and provider reputation. By understanding the factors that influence premiums and employing effective comparison strategies, you can confidently navigate the process and secure a policy that offers the right balance of protection and affordability. Remember to thoroughly review policy details and ask questions to ensure complete understanding before making a final decision.

Detailed FAQs

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others, while collision coverage pays for damage to your own vehicle, regardless of fault.

How often should I shop for auto insurance quotes?

It’s advisable to compare quotes annually, or even more frequently if your circumstances change (e.g., new car, change in driving record).

Can I get an auto insurance quote without providing my driving history?

No, your driving history is a crucial factor in determining your premium. Insurance providers use this information to assess risk.

What happens if I don’t have auto insurance?

Driving without insurance is illegal in most places and can result in hefty fines, license suspension, and difficulty obtaining insurance in the future.