Navigating the world of car insurance can feel like driving through a maze. Understanding insurance quotes is crucial to securing the right coverage at the best price. This comprehensive guide demystifies the process, empowering you to make informed decisions and find the perfect policy to fit your needs and budget. We’ll explore the factors influencing your quote, different coverage options, and effective strategies for securing the most favorable rates.

From online tools to in-person consultations, we’ll cover all the avenues for obtaining car insurance quotes. We’ll also delve into the intricacies of policy documents, highlighting key terms and helping you understand what your coverage truly entails. Ultimately, this guide aims to transform you from a confused consumer into a savvy insurance shopper.

Obtaining Car Insurance Quotes

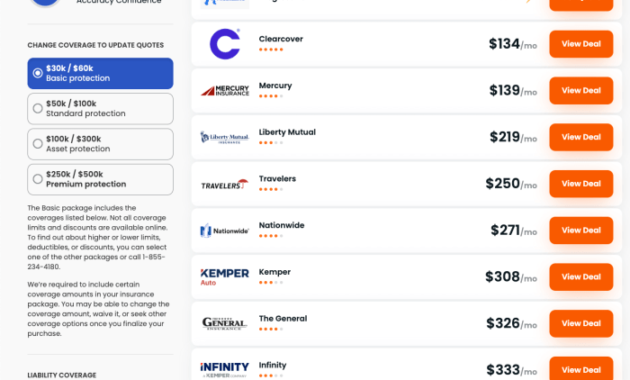

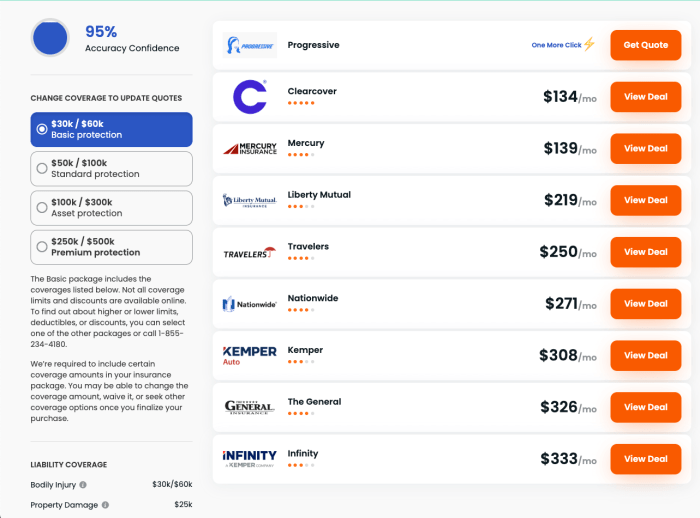

Securing the best car insurance involves more than just picking the first policy you see. A thorough comparison of quotes from multiple insurers is crucial to finding the right coverage at the most competitive price. This process, while seemingly daunting, can be streamlined with a strategic approach.

Methods for Obtaining Car Insurance Quotes

There are several convenient ways to obtain car insurance quotes, each with its own advantages and disadvantages. Choosing the method that best suits your preferences and technological comfort level is key. You can gather quotes online, over the phone, or in person at an insurance agency.

Online Quote Acquisition

Many insurance companies offer online quote tools. These typically involve completing a short form with details about your vehicle, driving history, and desired coverage. The advantage is speed and convenience; you can receive multiple quotes within minutes from the comfort of your home. However, the lack of direct human interaction may limit your ability to ask clarifying questions or negotiate specific policy details.

Phone-Based Quote Acquisition

Calling an insurance company directly allows for a more personalized experience. An agent can answer your questions, explain different coverage options, and help you tailor a policy to your needs. This method is particularly helpful for those who prefer a more interactive approach or require assistance navigating complex insurance terminology. However, it can be more time-consuming than online methods.

In-Person Quote Acquisition

Visiting an insurance agency provides the most personalized service. You can meet with an agent face-to-face, discuss your needs in detail, and build a rapport that can be beneficial throughout your policy duration. This method is ideal for those who value in-person interaction and prefer a more comprehensive explanation of insurance options. However, it requires scheduling an appointment and traveling to the agency’s location.

Tips for Finding the Best Car Insurance Deals

Finding the best car insurance deal involves more than just comparing prices. Several factors can significantly impact your premium, and understanding these factors allows for more effective negotiation and selection.

Comparing Multiple Quotes: Its Importance

Comparing multiple quotes is essential for securing the best possible price and coverage. Insurance companies use different rating models, leading to variations in premiums even for similar profiles. By comparing at least three to five quotes, you can identify the most competitive offers and avoid overpaying for your insurance. Failing to compare could result in significantly higher premiums than necessary.

Step-by-Step Guide for Obtaining Quotes from Different Insurers

1. Gather Necessary Information: Compile details about your vehicle (make, model, year), driving history (accidents, violations), desired coverage levels (liability, collision, comprehensive), and personal information (name, address, date of birth).

2. Select Insurers: Research and select at least three to five insurance companies to obtain quotes from. Consider a mix of large national companies and smaller regional insurers.

3. Obtain Online Quotes: Utilize online quote tools for quick and convenient comparisons.

4. Contact Insurers Directly: Call or visit insurance agencies to obtain quotes and discuss specific policy details.

5. Compare Quotes Carefully: Analyze the quotes, paying attention to premiums, deductibles, coverage limits, and policy exclusions.

6. Choose the Best Policy: Select the policy that best balances cost and coverage based on your individual needs and risk tolerance. Consider factors like your driving record and the value of your vehicle when making your decision.

Saving Money on Car Insurance

Securing affordable car insurance is a priority for many drivers. Fortunately, several strategies can significantly reduce your premiums. By understanding these methods and implementing them, you can save money without compromising necessary coverage. This section details effective ways to lower your car insurance costs.

Safe Driving Habits and Insurance Costs

Safe driving significantly impacts your insurance premiums. Insurance companies reward responsible drivers with lower rates. A clean driving record, free from accidents and traffic violations, is a key factor in determining your insurance cost. The fewer incidents you have, the lower your risk profile appears to the insurer, leading to lower premiums. For example, a driver with a history of speeding tickets might pay significantly more than a driver with a spotless record. Maintaining a good driving record involves adhering to traffic laws, practicing defensive driving techniques, and avoiding risky behaviors such as speeding or distracted driving. Many insurers offer discounts for completing defensive driving courses, further illustrating the link between safe driving and lower insurance costs.

Bundling Insurance Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, often results in substantial savings. Insurance companies frequently offer discounts for bundling policies, as it simplifies their administrative processes and reduces their overall risk. The exact discount varies by insurer and the specific policies bundled, but it can amount to a considerable percentage reduction in your total premiums. For instance, bundling your car and homeowners insurance with the same company might provide a 10-15% discount, leading to significant annual savings.

Impact of Discounts on Insurance Quotes

Numerous discounts can affect your final car insurance quote. These discounts vary widely depending on the insurer and your individual circumstances. Common discounts include those for good students, safe drivers (as previously discussed), multiple vehicles insured with the same company, anti-theft devices installed in your vehicle, and even discounts for being a member of certain organizations or professional groups. The cumulative effect of these discounts can significantly reduce your overall premium. For example, a good student discount combined with a multi-car discount could lead to a 20% or greater reduction in your premium, making a considerable difference in your annual insurance cost.

Epilogue

Securing affordable and comprehensive car insurance doesn’t have to be a daunting task. By understanding the factors that influence your premiums, diligently comparing quotes, and employing smart strategies, you can find the perfect balance between cost and coverage. Remember, taking the time to research and compare is an investment in your financial well-being and peace of mind. Armed with the knowledge in this guide, you are now equipped to confidently navigate the world of car insurance quotes and secure the best possible deal.

FAQ Insights

What is a car insurance deductible?

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums.

How often can I get a car insurance quote?

You can obtain car insurance quotes as often as you need. It’s recommended to compare quotes annually or whenever your circumstances change (e.g., new car, address change).

Can my credit score affect my car insurance rate?

In many states, your credit score is a factor considered by insurance companies when determining your rates. A good credit score can often lead to lower premiums.

What is uninsured/underinsured motorist coverage?

This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It helps cover your medical bills and vehicle repairs.