Navigating the world of car insurance can feel like driving through a fog. Premiums vary wildly, influenced by a complex interplay of factors. This guide cuts through the confusion, providing a clear understanding of how insurance rates for cars are determined, what coverage options exist, and how to secure the best possible rates for your individual needs. We’ll explore everything from the impact of your driving history to the characteristics of your vehicle and your geographic location, empowering you to make informed decisions about your car insurance.

From understanding the different types of coverage – liability, collision, comprehensive, and more – to mastering the art of comparing quotes and negotiating premiums, this guide offers practical strategies and insightful examples to help you save money and secure the right level of protection. We’ll also address common concerns, such as interpreting rate increase notices and appealing unjustified increases.

Factors Influencing Car Insurance Rates

Understanding the factors that determine your car insurance premiums is crucial for securing the best possible coverage at a competitive price. Several key elements contribute to the final cost, and being aware of these can help you make informed decisions about your insurance needs.

Top Five Factors Affecting Car Insurance Premiums

The cost of car insurance is influenced by a complex interplay of factors. Here are five of the most significant:

| Factor | Description | Impact on Rate | Example |

|---|---|---|---|

| Driving History | Your past driving record, including accidents, tickets, and claims. | High | Multiple speeding tickets will significantly increase your premiums. |

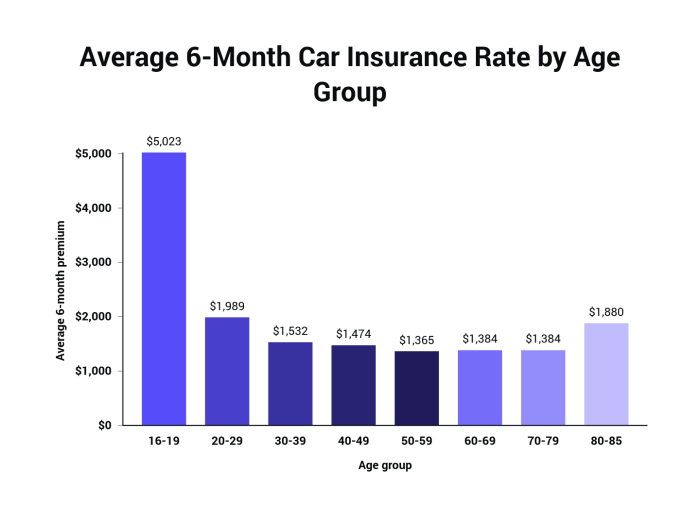

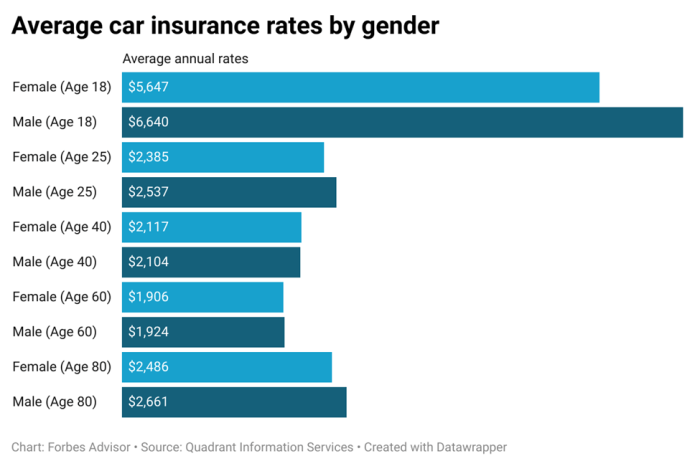

| Age and Gender | Statistically, younger drivers and males tend to have higher accident rates. | High | A 16-year-old male driver will typically pay more than a 40-year-old female driver. |

| Vehicle Type | The make, model, year, and safety features of your car. | Medium | A high-performance sports car will generally be more expensive to insure than a fuel-efficient sedan. |

| Location | Where you live impacts rates due to factors like accident frequency and theft rates. | Medium | Insurance in a densely populated urban area is often higher than in a rural area. |

| Credit Score | In many states, insurance companies use credit scores as an indicator of risk. | Medium | A lower credit score can lead to higher insurance premiums. |

The Role of Driving History in Determining Insurance Rates

Your driving history is a paramount factor in determining your insurance rates. A clean driving record with no accidents or violations will result in lower premiums. Conversely, accidents and tickets significantly increase your risk profile. For example, a single at-fault accident could raise your premiums by 20-40% or more, depending on the severity of the accident and your insurer. Multiple speeding tickets within a short period could lead to even higher increases, potentially resulting in your policy being canceled or non-renewed. Conversely, maintaining a spotless record for several years can earn you significant discounts.

Influence of Vehicle Characteristics on Insurance Costs

The type of vehicle you drive directly impacts your insurance costs. Insurance companies consider factors such as the vehicle’s make, model, year, safety features, and repair costs.

Here’s a comparison of insurance rates for different vehicle types:

- Sports Cars: Typically higher rates due to higher repair costs, higher risk of accidents, and higher theft rates.

- SUVs and Trucks: Rates vary depending on size and features; larger vehicles often have higher rates.

- Sedans: Generally have moderate insurance rates.

- Hybrid and Electric Vehicles: Often have lower rates due to lower repair costs and a perception of safer driving.

- Older Vehicles: May have lower premiums due to lower value, but potentially higher repair costs if safety features are lacking.

Location’s Impact on Car Insurance Rates

Geographic location significantly influences car insurance rates. States with higher accident rates, higher crime rates, or more expensive auto repair costs will generally have higher insurance premiums. For instance, insurance in major metropolitan areas is typically more expensive than in rural areas due to increased traffic congestion, higher accident frequency, and a greater likelihood of theft. Similarly, states with stricter regulations or higher legal costs associated with accidents may also see higher insurance premiums. Comparing rates across states can reveal substantial differences, reflecting these regional variations in risk.

Types of Car Insurance Coverage

Choosing the right car insurance coverage can seem daunting, but understanding the different types available is key to protecting yourself and your vehicle. This section will Artikel the various coverage options, highlighting their benefits and costs to help you make an informed decision.

Car insurance policies typically combine several types of coverage to create a comprehensive protection plan. The most common types include liability, collision, and comprehensive coverage. Beyond these core components, several optional add-ons can further enhance your protection.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the costs of medical bills, lost wages, and property repairs for the other party involved. Liability coverage is typically divided into bodily injury liability and property damage liability. Bodily injury liability covers medical expenses and other damages for injured individuals, while property damage liability covers repairs to the other person’s vehicle or property. The amounts of coverage are usually expressed as limits, such as 25/50/25, meaning $25,000 per person for bodily injury, $50,000 total for all bodily injuries in an accident, and $25,000 for property damage. This coverage is usually required by law, and the minimum limits vary by state.

Collision and Comprehensive Coverage

Collision and comprehensive coverage protect your own vehicle in various situations. Collision coverage pays for repairs or replacement of your car if it’s damaged in an accident, regardless of who is at fault. Comprehensive coverage covers damage to your car caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters. While collision coverage is often optional, it is highly recommended, especially if you have a loan or lease on your vehicle. Comprehensive coverage is also optional but offers valuable protection against unexpected events.

| Coverage Type | What it Covers | Cost Considerations |

|---|---|---|

| Liability | Damages to others (bodily injury and property damage) you cause in an accident. | Generally less expensive than collision and comprehensive, but minimum limits may not be sufficient. |

| Collision | Damage to your vehicle in an accident, regardless of fault. | Can be relatively expensive, especially for newer or more expensive vehicles. |

| Comprehensive | Damage to your vehicle from non-collision events (theft, vandalism, weather, etc.). | Usually less expensive than collision coverage but still adds to the overall premium. |

Full Coverage vs. Minimum Coverage

Full coverage typically refers to a policy that includes liability, collision, and comprehensive coverage. Minimum coverage only includes the state-mandated liability coverage. Choosing between full coverage and minimum coverage depends on several factors, including the age and value of your vehicle, your financial situation, and your risk tolerance.

Full coverage is beneficial if you have a newer or more expensive car, as it protects your investment against significant repair or replacement costs. For example, if your car is totaled in an accident not your fault, full coverage will compensate you for the vehicle’s value. Minimum coverage is suitable if you have an older vehicle with low value, and you are comfortable bearing the financial risk of repairs or replacement in case of an accident or damage. For instance, if your older car is damaged in a minor accident, minimum coverage would not cover the repairs, leaving you responsible for the cost.

Optional Coverage Options

Several optional coverage options can enhance your insurance protection. These add-ons provide extra financial security in specific situations.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you’re involved in an accident caused by an uninsured or underinsured driver. It can cover your medical bills, lost wages, and vehicle repairs, even if the at-fault driver lacks sufficient insurance. This is crucial because many drivers operate without adequate insurance, and underinsured motorist coverage helps to cover the gap in compensation.

Rental Car Reimbursement

Rental car reimbursement coverage helps cover the cost of a rental car while your vehicle is being repaired due to an accident or covered damage. This is particularly valuable if you rely on your car for commuting or other essential activities. The coverage typically pays for a rental car for a specified period, alleviating the inconvenience and additional expense of being without a vehicle.

Finding the Best Car Insurance Rates

Securing the most affordable car insurance requires a proactive approach. By understanding the factors influencing rates and employing effective comparison and negotiation strategies, you can significantly reduce your annual premiums. This section Artikels a systematic process for finding the best car insurance rates tailored to your individual needs.

Comparing Car Insurance Quotes

To effectively compare car insurance quotes, follow these steps. First, gather your personal information, including your driving history, vehicle details, and address. Next, obtain quotes from multiple insurers. Don’t limit yourself to just a few; a wider range of quotes gives you a better perspective on pricing. Finally, carefully analyze the quotes, comparing not only price but also coverage options and customer service ratings.

- Obtain quotes from at least three to five different insurers.

- Ensure you’re comparing similar coverage levels across all quotes.

- Check customer reviews and ratings for each insurer to gauge their reputation for claims handling and customer service.

- Consider the insurer’s financial stability – a financially strong company is less likely to default on claims.

Utilizing Online Comparison Tools

Online comparison tools offer a convenient way to gather multiple car insurance quotes simultaneously. These platforms allow you to input your information once and receive quotes from several insurers within minutes.

- Advantages: Convenience, time-saving, ability to compare a large number of insurers quickly.

- Disadvantages: The range of insurers presented may be limited, and the comparison may not account for all nuanced factors impacting your specific rate.

For example, using a popular comparison website, you might input your details (age, driving history, car model, etc.). The site would then display quotes from various insurers, allowing you to visually compare premiums and coverage options. Remember that the results are a starting point; you may need to contact the insurers directly to refine the quotes or address specific needs.

Negotiating Lower Premiums

Several strategies can help you negotiate lower insurance premiums. Leverage your clean driving record, and consider bundling services (home and auto insurance) for potential discounts. Explore options such as increasing your deductible (the amount you pay out-of-pocket before insurance coverage begins) to reduce your premium, but carefully weigh the trade-off against potential out-of-pocket costs in the event of an accident. Additionally, inquire about discounts for safety features in your car, such as anti-theft devices or advanced driver-assistance systems. Finally, consider completing a defensive driving course, which can demonstrate your commitment to safe driving and potentially lead to a lower premium.

Understanding Insurance Rate Increases

Car insurance rates are not static; they fluctuate based on various factors. Understanding why your rates might increase is crucial for managing your budget and ensuring you’re getting the best possible coverage. This section will explore the common causes of rate hikes, how to interpret your insurance company’s notification, and the process for appealing a rate increase you believe is unjustified.

Common Reasons for Car Insurance Rate Increases

Several factors contribute to increases in car insurance premiums. These factors are often interconnected and can influence each other. For example, a higher risk profile can lead to more claims, which in turn affects the overall cost of insurance for the company and subsequently, your premiums.

| Reason for Increase | Potential Impact | Example |

|---|---|---|

| Increased Claims in Your Area | Higher premiums for all drivers in the affected region due to increased payouts by the insurance company. | A rise in car thefts in a specific neighborhood could lead to higher premiums for residents. |

| Your Driving Record | Significant increases following accidents, speeding tickets, or other moving violations. | A speeding ticket resulting in a points accumulation on your driving record can lead to a 10-20% increase. |

| Changes in Your Vehicle | Increases based on the vehicle’s value, safety rating, and repair costs. | Switching to a more expensive or higher-performance vehicle typically results in higher premiums. |

| Changes in Your Personal Circumstances | Increases based on factors like age, marital status, and changes in your address. | Moving to an area with a higher crime rate might result in a premium increase. |

| Increased Insurance Company Costs | Premiums may increase to offset rising operational expenses, claims costs, and reinsurance costs. | Inflationary pressures affecting repair costs and medical expenses can lead to increased premiums. |

Understanding and Interpreting Rate Increase Notices

Insurance companies are required to provide clear and concise explanations for rate increases. These notices typically Artikel the specific reasons for the change, the amount of the increase, and the effective date. Carefully review the notice to understand the justification provided. If the explanation is unclear or you disagree with the increase, contact your insurance provider directly. For example, if the notice cites an increase due to a claim you believe was not your fault, you should immediately request clarification.

Appealing a Car Insurance Rate Increase

If you believe your rate increase is unjustified, you have the right to appeal the decision. The appeal process usually involves contacting your insurance company’s customer service department and providing documentation to support your case. For instance, if your increase is attributed to a driving violation that was dismissed or overturned in court, provide a copy of the court ruling as evidence. Successful appeals often involve providing compelling evidence that refutes the reasons cited for the increase. Another example: If your rate increase is based on an inaccurate address or vehicle information, providing updated documentation to correct these errors can lead to a successful appeal and a reduction in your premiums.

Illustrative Examples of Car Insurance Costs

Understanding how various factors influence car insurance premiums is crucial for making informed decisions. The following examples illustrate how seemingly small differences can significantly impact your costs. These are hypothetical scenarios, and actual costs will vary based on the specific insurer and individual circumstances.

Young Driver Insurance Costs

This example focuses on a 20-year-old driver, Alex, living in a densely populated urban area like Los Angeles, California. Alex drives a 2022 sports car (e.g., a Mustang GT). Alex has a clean driving record, but his age and the type of vehicle significantly influence the premium. The insurer considers his age a high-risk factor due to statistically higher accident rates among young drivers. The powerful sports car is also categorized as high-risk due to its potential for speed and its higher repair costs. Therefore, his annual premium might be around $3,500-$5,000, significantly higher than the average. If Alex had a minor accident or speeding ticket, this premium could increase substantially, possibly by 20-30%. Conversely, opting for a less powerful, safer vehicle, or completing a defensive driving course, could lead to a lower premium.

Older Driver Insurance Costs

In contrast, consider Maria, a 60-year-old driver with a clean driving record residing in a rural area of Montana. Maria drives a 2018 sedan. Due to her age and location, Maria’s risk profile is considered lower. Rural areas generally have fewer accidents than urban centers, and older drivers statistically have fewer accidents than younger drivers. Her vehicle type also contributes to a lower risk assessment. As a result, Maria’s annual premium might be significantly lower, perhaps in the range of $800-$1,200. This difference highlights the substantial impact of location, driving history, and vehicle choice on insurance costs. If Maria were to move to a larger city or change to a higher-performance vehicle, her premiums would likely increase. Maintaining a clean driving record, however, would continue to be a factor in keeping her premiums relatively low.

Wrap-Up

Securing affordable and appropriate car insurance is a crucial aspect of responsible car ownership. By understanding the key factors that influence rates, carefully comparing quotes, and leveraging available strategies, you can significantly reduce your premiums while ensuring you have the coverage you need. Remember, proactive research and informed decision-making are your best allies in navigating the complexities of car insurance. This guide provides the tools; now it’s time to put them to use and find the perfect policy for you.

FAQ Corner

What is the difference between liability and collision coverage?

Liability coverage pays for damages you cause to others’ property or injuries you inflict on others in an accident. Collision coverage pays for repairs to your vehicle regardless of fault.

How often can I expect my car insurance rates to change?

Rates can change periodically, often annually, based on factors like claims experience, changes in your driving record, or adjustments in the insurer’s risk assessment.

Can I get car insurance if I have a poor driving record?

Yes, but it will likely be more expensive. Insurers consider your driving history a significant factor. You might need to explore options with high-risk insurers.

What is an SR-22 form, and when is it required?

An SR-22 is a certificate of insurance that proves you maintain the minimum required liability coverage. It’s often required after serious driving offenses.

How can I lower my car insurance premiums without compromising coverage?

Consider increasing your deductible, bundling insurance policies (home and auto), taking a defensive driving course, and maintaining a good driving record.