Whole life insurance: the phrase itself evokes images of long-term security and financial planning. But beyond the traditional perception, lies a complex world of options, benefits, and considerations. This guide delves into the intricacies of whole life insurance, providing a clear and concise understanding of its mechanics, advantages, and potential drawbacks, empowering you to make informed decisions about your financial future.

We’ll explore the core features of whole life policies, differentiating them from term life insurance and examining the crucial role of cash value accumulation. We’ll also analyze various policy types, assess the long-term financial implications, and discuss tax advantages and potential limitations. By the end, you’ll possess a comprehensive understanding of how whole life insurance can fit into your overall financial strategy.

Defining Whole Life Insurance

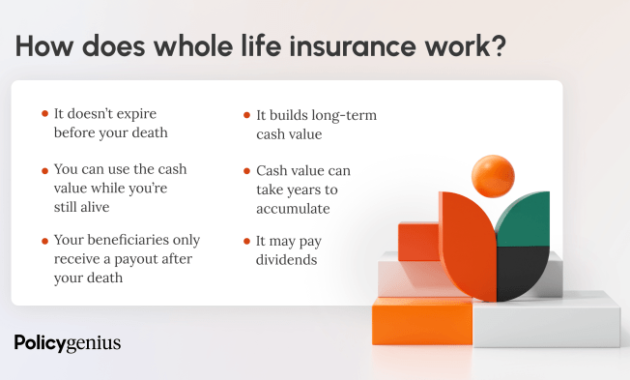

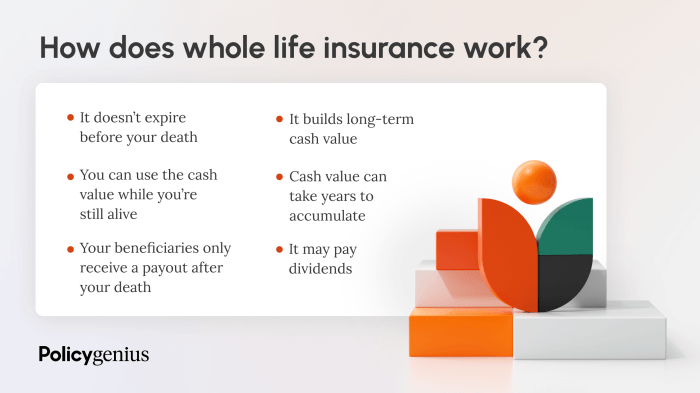

Whole life insurance is a type of permanent life insurance policy designed to provide lifelong coverage as long as premiums are paid. Unlike term life insurance, which covers a specific period, whole life insurance offers coverage for your entire life, and it also builds a cash value component that grows over time. This cash value can be borrowed against or withdrawn under certain circumstances.

Whole life insurance offers several core features. It provides a death benefit, a guaranteed amount paid to your beneficiaries upon your death. It also accumulates cash value, which grows tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw them. Finally, it offers a fixed premium, meaning your premium payment remains the same throughout the life of the policy.

Whole Life Insurance vs. Term Life Insurance

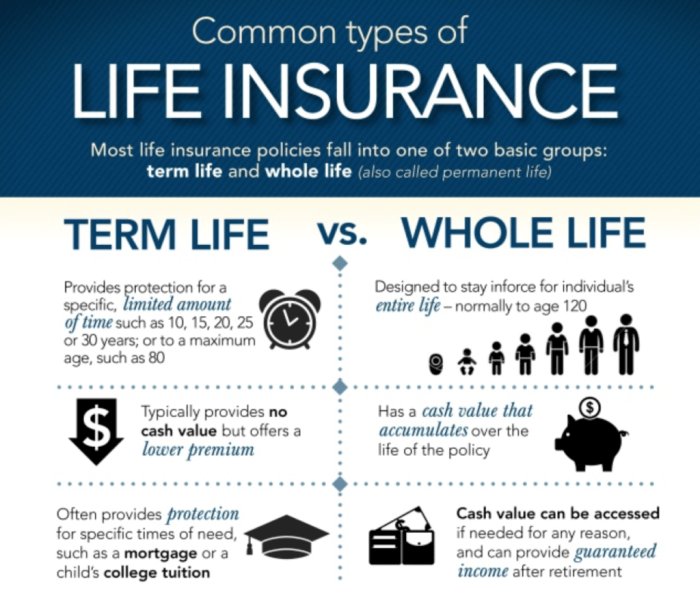

The primary difference between whole life and term life insurance lies in the duration of coverage. Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years. If you die within that term, your beneficiaries receive the death benefit. If you outlive the term, the coverage expires, and you need to renew or purchase a new policy. Whole life insurance, on the other hand, provides lifelong coverage as long as premiums are paid, offering continuous protection. Term life insurance is generally less expensive than whole life insurance due to its limited coverage period. The choice between term and whole life depends on individual needs and financial goals.

Cash Value Component in Whole Life Insurance

The cash value component of a whole life insurance policy is a significant feature that distinguishes it from term life insurance. This cash value grows tax-deferred over time, thanks to the policy’s investment component. A portion of your premium payments contributes to the cash value, which grows at a rate determined by the insurance company’s investment performance (for variable whole life) or at a fixed rate (for some whole life policies). This cash value can be accessed through borrowing (loans against the policy) or withdrawals, though withdrawals may reduce the death benefit and impact future cash value growth. It’s important to understand the terms and conditions associated with accessing the cash value. For instance, borrowing against the cash value typically incurs interest charges. A common misconception is that it is an investment vehicle; while it offers a cash value component, it is primarily a life insurance product with the cash value being a secondary feature.

Types of Whole Life Insurance Policies

The following table compares various types of whole life insurance policies:

| Policy Type | Premium | Cash Value Growth | Participation in Company Profits |

|---|---|---|---|

| Participating Whole Life | Potentially higher | May vary; influenced by company performance | Yes; dividends may be paid |

| Non-Participating Whole Life | Generally lower | Fixed rate; predictable growth | No |

| Variable Whole Life | Potentially higher | Varies; based on investment performance of underlying sub-accounts | No |

Benefits and Drawbacks of Whole Life Insurance

Whole life insurance offers a unique blend of financial protection and investment potential, unlike term life insurance which only provides coverage for a specific period. Understanding both the advantages and disadvantages is crucial before making a purchase decision. This section will explore the long-term financial benefits, tax advantages, potential drawbacks, and cost comparisons to help you make an informed choice.

Long-Term Financial Benefits of Whole Life Insurance

Whole life insurance provides lifelong coverage, ensuring your beneficiaries receive a death benefit regardless of when you pass away. Beyond the death benefit, the cash value component grows tax-deferred over time. This cash value can be accessed through loans or withdrawals, providing a source of funds for various financial needs, such as retirement, education expenses, or unexpected emergencies. The guaranteed cash value growth offers a degree of predictability, unlike market-dependent investments. For example, a policyholder might borrow against the cash value to fund a child’s college education, knowing the death benefit remains intact to protect their family.

Tax Advantages Associated with Whole Life Insurance

The growth of the cash value in a whole life policy is tax-deferred. This means you don’t pay taxes on the accumulated interest until you withdraw it. Furthermore, death benefits are generally tax-free to beneficiaries, providing a significant tax advantage compared to other investment vehicles where capital gains taxes might apply. This tax-deferred growth allows for potentially greater accumulation of wealth over time. Consider a scenario where an individual invests the same amount in a taxable account versus a whole life policy. Over decades, the tax-deferred growth in the whole life policy could lead to a significantly larger accumulated value.

Potential Drawbacks and Limitations of Whole Life Insurance

Whole life insurance premiums are typically higher than term life insurance premiums because of the lifelong coverage and cash value component. The cash value growth rate is often lower than the returns offered by other investments, such as stocks or mutual funds, although it carries less risk. Liquidity can be a concern; accessing the cash value may involve loans with interest charges or surrender charges that reduce the overall value. For example, withdrawing a significant portion of the cash value early could significantly impact the death benefit. Also, the policy’s performance is tied to the insurance company’s financial stability.

Cost Comparison of Whole Life Insurance to Other Investment Options

The cost of whole life insurance varies considerably depending on factors such as age, health, policy amount, and the insurance company. Generally, it’s more expensive than term life insurance, but the inclusion of a cash value component makes direct comparison to other investments challenging. While whole life insurance offers a guaranteed minimum cash value growth, other investments like stocks or mutual funds have the potential for higher returns but also carry greater risk of loss. A detailed financial analysis, considering your risk tolerance and financial goals, is essential before choosing between whole life insurance and other investment options. For instance, a young, healthy individual with a high-risk tolerance might find that investing in stocks offers greater potential returns compared to the slower, steadier growth of a whole life policy’s cash value.

Illustrative Examples and Case Studies

Understanding the practical applications of whole life insurance is crucial. The following case studies illustrate the long-term benefits and diverse uses of this type of policy, highlighting its potential for wealth accumulation and estate planning.

Long-Term Cash Value Growth of a Whole Life Policy

Let’s consider Sarah, a 30-year-old who purchases a $250,000 whole life insurance policy with an annual premium of $2,500. This policy features a guaranteed cash value growth rate of 3% per annum. Over 30 years, assuming consistent premium payments and the guaranteed rate, Sarah’s cash value will accumulate significantly. This growth is not subject to market fluctuations, unlike investments in stocks or mutual funds, providing a stable foundation for long-term financial planning. This example demonstrates the potential for tax-deferred growth within a whole life policy. After 30 years, Sarah’s cash value would likely be substantially higher than the total premiums paid.

Whole Life Insurance for a Young Family

A young family, let’s say John and Mary with two young children, might benefit from a whole life policy offering a substantial death benefit to cover mortgage payments, children’s education expenses, and other financial obligations in case of an untimely death of either parent. Furthermore, the policy’s cash value component can serve as a long-term savings vehicle, providing funds for college tuition or other future needs. This policy could be structured with a death benefit significantly exceeding the policy’s cash value to provide maximum protection. Regular premium payments contribute to both the death benefit and the cash value, creating a dual benefit of protection and savings. John and Mary could also consider adding riders to the policy to further customize its benefits and adapt to their family’s changing needs over time.

Whole Life Insurance in Estate Planning

Consider a scenario where Robert, a successful entrepreneur, uses a whole life policy as a key component of his estate plan. The policy’s death benefit provides a significant amount of liquidity upon his death, allowing his heirs to pay estate taxes, cover business debts, or manage other financial obligations without needing to liquidate assets such as real estate or business interests. The policy’s cash value can also be accessed during Robert’s lifetime for various needs, offering flexibility in financial management. The policy can be structured to minimize estate taxes and ensure a smooth transfer of wealth to his beneficiaries, contributing to the overall efficiency of his estate plan.

Visual Representation of Cash Value Growth

Understanding the visual representation of cash value growth over time is important.

Imagine a graph with time on the horizontal axis (in years) and cash value on the vertical axis (in dollars). The line representing cash value growth would start at zero and gradually increase over time, reflecting the accumulation of cash value within the policy.

- Initial Years: The initial growth might be relatively slow, as the early years primarily focus on building the death benefit and establishing the policy’s cash value foundation.

- Mid-Term Growth: As time passes, the impact of compounding interest becomes more significant, leading to accelerated cash value growth.

- Long-Term Accumulation: Over the long term, the line representing cash value growth would show a steadily increasing trend, illustrating the substantial accumulation potential of a whole life insurance policy. The slope of the line would depend on factors such as the policy’s interest rate and the amount of premiums paid.

Conclusion

Securing your financial future requires careful consideration and planning. Whole life insurance, with its unique blend of life insurance coverage and cash value accumulation, offers a powerful tool for achieving long-term financial goals. By understanding the nuances of policy types, riders, and associated costs, you can make an informed decision that aligns with your individual needs and aspirations. Remember to consult with a qualified financial advisor to personalize your strategy and ensure your chosen policy effectively protects your loved ones and secures your financial legacy.

Questions and Answers

What is the difference between participating and non-participating whole life insurance?

Participating whole life insurance policies pay dividends to policyholders, while non-participating policies do not. These dividends are not guaranteed and can fluctuate based on the insurer’s performance.

Can I borrow against the cash value of my whole life insurance policy?

Yes, most whole life policies allow you to borrow against the accumulated cash value. However, interest accrues on these loans, and borrowing excessively can reduce the death benefit or even lead to policy lapse.

How does the cash value in a whole life policy grow?

Cash value grows through a combination of premium payments and investment earnings. The rate of growth varies depending on the type of policy and the insurer’s investment performance. Some policies offer fixed interest rates, while others offer variable rates linked to market performance.

What happens if I stop paying premiums on my whole life insurance policy?

If you stop paying premiums, your policy may lapse, meaning the coverage ends. However, depending on the policy and accumulated cash value, you may have options like paid-up insurance or extended term insurance.