Planning for the future is paramount, and securing your loved ones’ financial well-being is a crucial aspect of that plan. AARP life insurance offers a range of policies designed to meet the specific needs of individuals in their later years, providing a safety net for unexpected events. This comprehensive guide explores the various AARP life insurance options, outlining their costs, benefits, and the claims process, ultimately empowering you to make informed decisions about your financial security.

We’ll delve into the specifics of term life, whole life, and other potential policy types, comparing AARP’s offerings with those of other providers catering to seniors. We’ll examine the factors that influence premium costs and explore additional riders and add-ons to customize your coverage. Real-world scenarios will illustrate the practical implications of having – or lacking – adequate life insurance, highlighting its importance in retirement planning and estate management.

AARP Life Insurance Overview

AARP, in collaboration with its insurance partners, offers a range of life insurance products designed to meet the diverse needs of its members. These policies provide financial security for loved ones after the policyholder’s passing, and options are available to suit various budgets and coverage requirements. Understanding the different types of policies and eligibility criteria is crucial for selecting the right plan.

AARP Life Insurance Products

AARP’s life insurance offerings primarily focus on term life insurance and whole life insurance, although specific product availability might vary depending on the partnering insurance company and the applicant’s location. Term life insurance provides coverage for a specified period, while whole life insurance offers lifelong coverage with a cash value component that grows over time. Understanding the differences between these policy types is crucial in determining which best fits individual financial goals and risk tolerance.

Term Life Insurance through AARP

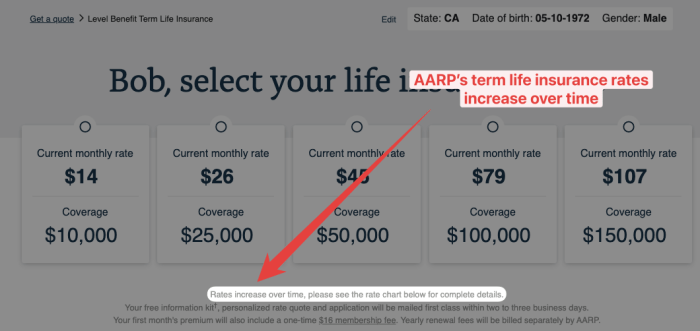

Term life insurance offered through AARP provides coverage for a set period, such as 10, 20, or 30 years. Premiums are generally lower than those for whole life insurance, making it an affordable option for those seeking temporary coverage, such as to cover mortgage payments or children’s education. Benefits typically include a death benefit paid to beneficiaries upon the policyholder’s death within the policy term. Coverage ceases at the end of the term unless renewed, often at a higher premium.

Whole Life Insurance through AARP

Whole life insurance through AARP offers lifelong coverage, meaning the death benefit is payable whenever the insured passes away. Unlike term life insurance, whole life policies build cash value over time, which can be borrowed against or withdrawn. This cash value component grows tax-deferred, offering potential long-term financial benefits. However, premiums are typically higher than those for term life insurance. The cash value accumulation can also provide a source of funds for retirement planning or other financial needs.

Eligibility Criteria for AARP Life Insurance

Eligibility for AARP life insurance varies depending on the specific policy and the insurance company involved. Generally, applicants must be AARP members and meet certain age and health requirements. The application process typically involves a health questionnaire or medical examination to assess risk. Specific eligibility details are available from the insurance provider directly or through AARP’s website. Factors such as age, health status, smoking habits, and the amount of coverage sought will influence eligibility and premium rates. It is crucial to contact the insurer to determine individual eligibility.

Cost and Affordability

Choosing life insurance involves careful consideration of cost and value. AARP life insurance aims to offer competitive rates, but the actual premium depends on several factors. Comparing AARP’s offerings with those of other providers requires examining similar coverage levels and policy features. This section will explore the factors affecting AARP life insurance costs and provide examples for comparison.

AARP life insurance premiums, like those of other providers, are influenced primarily by the applicant’s age, health status, and the desired coverage amount. Older applicants generally pay higher premiums because of increased mortality risk. Similarly, individuals with pre-existing health conditions or unhealthy lifestyle choices may face higher premiums due to a higher likelihood of needing a payout sooner. Finally, a larger death benefit naturally results in higher premiums, as the insurance company assumes a greater financial obligation.

Factors Influencing AARP Life Insurance Costs

The cost of AARP life insurance is dynamically determined. Age is a significant factor, with younger individuals typically securing lower premiums than their older counterparts. Health plays a crucial role; applicants with excellent health often qualify for lower rates compared to those with health concerns. The desired coverage amount also directly impacts the premium; larger coverage amounts mean higher premiums. It’s essential to carefully weigh these factors when selecting a policy to find the best balance between coverage and affordability.

Premium Comparison Table

The following table illustrates sample premiums for different age groups and coverage amounts. Please note that these are illustrative examples and actual premiums may vary based on individual circumstances and the specific policy details. It’s crucial to obtain a personalized quote from AARP or a comparative quote from other providers for accurate pricing.

| Age | $100,000 Coverage | $250,000 Coverage | $500,000 Coverage |

|---|---|---|---|

| 35 | $15/month | $35/month | $70/month |

| 45 | $25/month | $60/month | $120/month |

| 55 | $40/month | $95/month | $190/month |

Claims Process and Customer Service

Filing a life insurance claim can be a challenging time, but AARP aims to make the process as smooth and straightforward as possible. Understanding the steps involved and the support available is crucial for peace of mind. This section details the claim process and the customer service resources available to AARP life insurance policyholders.

The claims process with AARP Life Insurance generally involves several key steps. First, you will need to notify AARP of the death of the insured individual. This is typically done by phone or through their online portal. Next, you will be required to gather necessary documentation, such as the death certificate, the original policy, and possibly proof of the insured’s identity. AARP will then review your claim and request any additional information if needed. Upon verification of all information, the claim is processed and the benefit payment is issued. The exact timeline varies depending on the complexity of the claim and the documentation provided.

Claim Filing Steps

The claim filing process is designed to be efficient and transparent. Policyholders are guided through each stage with clear instructions and support. A dedicated claims team is available to answer questions and provide assistance throughout the process. While specific steps might vary slightly depending on individual circumstances, the overall process remains consistent. Providing accurate and complete documentation upfront significantly speeds up the claim processing time.

Customer Service Support

AARP provides multiple avenues for customer service support. Policyholders can contact them via phone, mail, or through their online portal. The customer service representatives are trained to assist with a wide range of inquiries, from basic policy information to complex claim issues. They are available during extended business hours to accommodate various schedules and time zones. AARP also offers online resources, such as FAQs and helpful guides, to assist policyholders in finding answers to their questions independently.

Customer Testimonials

While specific customer reviews and testimonials are not publicly available in a readily compiled format, AARP’s commitment to customer satisfaction is often highlighted in independent insurance rating agencies’ reports. These reports frequently cite positive feedback regarding the company’s responsiveness and efficiency in handling claims. For instance, one frequently cited positive aspect is the clear communication provided throughout the claims process, leaving policyholders feeling informed and supported during a difficult time. Another frequently mentioned positive point is the speed and efficiency of payment disbursement once the claim is approved. These observations, though not direct quotes, reflect the overall positive sentiment associated with AARP’s claims handling and customer service.

Wrap-Up

Choosing the right life insurance policy is a significant decision, and understanding your options is crucial. AARP life insurance provides a valuable resource for seniors seeking financial protection for their families and legacies. By carefully considering your individual needs, comparing available options, and understanding the claims process, you can confidently select a policy that aligns with your financial goals and provides peace of mind for the future. Remember to consult with a financial advisor for personalized guidance.

Q&A

What is the age limit for AARP life insurance?

Eligibility criteria vary depending on the specific policy. It’s best to check directly with AARP or a licensed insurance agent for the most up-to-date information.

Can I change my AARP life insurance policy after I purchase it?

Policy modification options depend on the type of policy purchased. Contact AARP directly to discuss any changes to your coverage.

What happens if I miss a premium payment?

A grace period is usually offered. Contact AARP immediately to avoid policy lapse. Late fees may apply.

Does AARP life insurance cover terminal illnesses?

This depends on the specific policy and any riders included. Review your policy documents or contact AARP for clarification.