Securing your family’s financial future is a paramount concern, and understanding your life insurance options is a crucial step in achieving that peace of mind. The world of life insurance can seem complex, with various policies and features designed to cater to diverse needs and circumstances. This guide aims to demystify the process, providing you with a clear understanding of the different types of life insurance available, the factors influencing their costs, and how to choose the policy that best aligns with your individual goals.

From the fundamental differences between term and whole life insurance to the nuances of variable options and the importance of estate planning, we’ll explore the key considerations involved in making an informed decision. We will also address common questions and concerns, equipping you with the knowledge to confidently navigate this important financial aspect of your life.

Types of Life Insurance

Choosing the right life insurance policy can feel overwhelming, given the variety of options available. Understanding the key differences between the main types is crucial to making an informed decision that aligns with your individual financial goals and risk tolerance. This section will explore the four primary types of life insurance: term, whole, universal, and variable universal.

Term Life Insurance

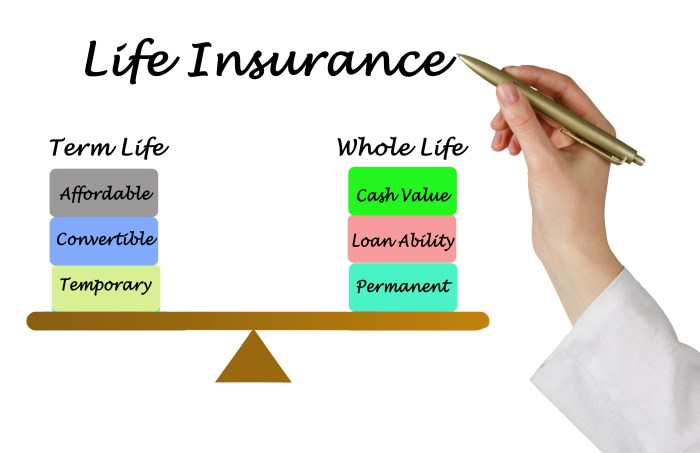

Term life insurance provides coverage for a specific period, or “term,” such as 10, 20, or 30 years. If the insured dies within the term, the death benefit is paid to the beneficiaries. If the insured survives the term, the policy expires, and no further coverage is provided unless renewed (often at a higher premium).

Term life insurance is generally less expensive than permanent life insurance options because it only covers a defined period. The lower premiums make it an attractive option for individuals with specific short-term needs, such as covering mortgage payments or providing for children’s education during their formative years. However, a significant drawback is that coverage ends at the end of the term, leaving the insured without protection unless a new policy is purchased, potentially at a higher cost due to increased age and health risks. Another potential downside is that no cash value accumulates, meaning there’s no savings component.

Whole Life Insurance versus Universal Life Insurance

Whole life insurance and universal life insurance are both types of permanent life insurance, meaning they offer lifelong coverage as long as premiums are paid. However, they differ significantly in how premiums are structured and how cash value accumulates.

Whole life insurance policies typically have fixed premiums that remain constant throughout the policy’s life. These policies build cash value that grows at a predetermined rate, often linked to a guaranteed minimum interest rate. The cash value component can be borrowed against or withdrawn, but this will reduce the death benefit. The predictability of premiums is a key advantage, but the fixed nature might mean the policy isn’t as flexible or efficient as other options, particularly if interest rates rise.

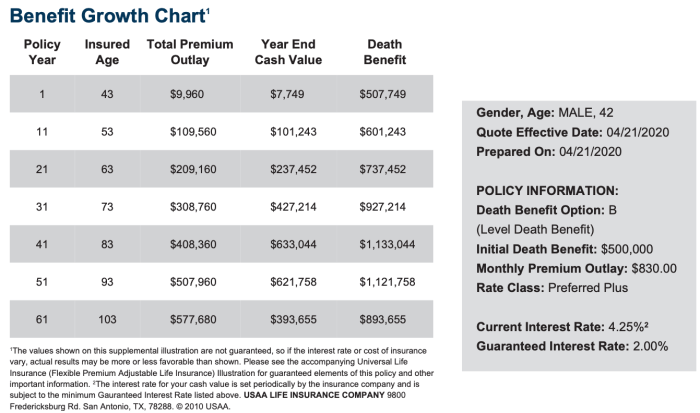

Universal life insurance offers more flexibility. Premiums are typically adjustable, allowing policyholders to increase or decrease payments depending on their financial circumstances. The cash value also grows, but the interest rate is often tied to market performance, meaning it can fluctuate. This flexibility can be advantageous, but it also introduces more uncertainty regarding the policy’s cost and cash value growth over time. It’s important to carefully consider the risks associated with fluctuating interest rates and the potential for higher premiums in the future.

Variable Life Insurance and Variable Universal Life Insurance

Variable life insurance and variable universal life insurance are both types of permanent life insurance where the cash value growth is invested in separate sub-accounts, similar to mutual funds. This allows for the potential for higher returns compared to whole or universal life insurance, but it also carries a higher level of risk because the value of the investments can fluctuate.

Variable life insurance generally has a fixed premium, while variable universal life insurance allows for flexible premium payments, similar to universal life insurance. The investment options within the sub-accounts offer a degree of control over the investment strategy, but it requires a greater understanding of the market and a higher level of risk tolerance. These policies are best suited for individuals who are comfortable with market volatility and are seeking the potential for higher returns on their cash value.

Comparison of Life Insurance Types

| Type | Premium | Cash Value | Risk |

|---|---|---|---|

| Term Life | Generally low, fixed for term | None | Low, but coverage expires |

| Whole Life | Fixed, higher than term | Guaranteed minimum growth, predictable | Low, lifelong coverage |

| Universal Life | Adjustable, can fluctuate | Growth varies with interest rates | Moderate, lifelong coverage, but premiums can increase |

| Variable Universal Life | Adjustable, can fluctuate | Growth varies with market performance, potential for higher returns | High, lifelong coverage, but significant market risk |

Factors Influencing Life Insurance Costs

The price you pay for life insurance, known as your premium, isn’t arbitrary. Insurance companies use a complex system to assess risk and determine individual premiums. Several key factors contribute to this calculation, ensuring that premiums accurately reflect the likelihood of a claim being made. Understanding these factors can help you make informed decisions about your life insurance needs and potentially save money.

Several factors significantly influence the cost of life insurance. These factors are carefully weighed by insurance companies to assess the risk associated with insuring an individual. The greater the perceived risk, the higher the premium.

Age

Age is a primary factor in determining life insurance premiums. Statistically, the older a person is, the higher the risk of death. Therefore, premiums generally increase with age, reflecting this increased risk. A 30-year-old will typically pay significantly less than a 60-year-old for the same coverage amount, all other factors being equal. This is because younger individuals statistically have a longer life expectancy.

Health and Lifestyle

An individual’s health and lifestyle choices significantly impact premium rates. Insurance companies consider factors such as Body Mass Index (BMI), blood pressure, cholesterol levels, and the presence of pre-existing conditions. Those with a history of serious illnesses, such as heart disease or cancer, will likely face higher premiums. Similarly, unhealthy lifestyle choices, like smoking, excessive alcohol consumption, or a lack of physical activity, can lead to increased premiums. For instance, a smoker will typically pay a substantially higher premium than a non-smoker of the same age and health status.

Coverage Amount

The amount of coverage you choose directly affects your premium. A larger death benefit means a greater financial obligation for the insurance company should you pass away. Consequently, higher coverage amounts typically result in higher premiums. Choosing a smaller death benefit can help lower your monthly payments, but it’s crucial to select an amount that adequately protects your loved ones’ financial future. For example, a $500,000 policy will generally be more expensive than a $250,000 policy.

Family History

A family history of certain diseases can influence your life insurance premium. If you have a family history of heart disease, cancer, or diabetes, the insurer might consider you a higher risk, leading to higher premiums. This is because genetic predispositions can increase the likelihood of developing these conditions. For example, someone with a strong family history of heart disease might face a higher premium than someone with no such history, even if both individuals are currently healthy.

Ways to Potentially Lower Life Insurance Premiums

Understanding how insurers assess risk empowers you to take steps that might reduce your premiums.

- Maintain a healthy lifestyle: Regular exercise, a balanced diet, and avoiding smoking and excessive alcohol consumption can significantly improve your health profile, potentially leading to lower premiums.

- Improve your credit score: Some insurers consider credit history when determining premiums. A good credit score can positively impact your rates.

- Shop around and compare quotes: Different insurers use different underwriting criteria. Comparing quotes from multiple companies can help you find the most competitive rates.

- Consider a shorter policy term: Term life insurance policies offer coverage for a specific period, and premiums are generally lower than for whole life policies.

- Increase your deductible or co-pay (if applicable): Some life insurance policies may offer options to adjust deductibles or co-pays, potentially lowering the overall premium.

Understanding Policy Features and Benefits

Choosing a life insurance policy involves more than just selecting a coverage amount. Understanding the policy’s features and benefits is crucial for making an informed decision and ensuring your loved ones are adequately protected. This section will clarify the application process, premium payments, policy lapses, and cash value options.

The Life Insurance Application Process

Applying for life insurance typically involves completing an application form, providing necessary documentation, and undergoing a medical examination. The application form requests detailed personal information, including your health history, lifestyle habits (such as smoking), and occupation. Required documentation may include proof of identity (like a driver’s license or passport), and sometimes financial records depending on the policy type and amount. A medical examination, often involving blood and urine tests and a physical, helps the insurer assess your health risk and determine your premium. The insurer uses this information to assess the risk involved in insuring your life and to determine the appropriate premium rate. The length of the application process varies depending on the insurer and the complexity of the application.

Grace Periods and Missed Premiums

Most life insurance policies include a grace period, typically 30 days, during which you can pay your premium without penalty. If the premium remains unpaid after the grace period, the policy may lapse. However, the specific consequences of a missed premium will depend on the policy’s terms and conditions. Some policies may allow for reinstatement after a lapse, often requiring evidence of insurability and payment of back premiums with interest. Others may offer a reduced paid-up policy or extended term insurance. It’s vital to understand your policy’s specific provisions regarding missed payments to avoid unintended consequences.

Policy Lapses and Available Options

A policy lapse occurs when premiums are not paid and the grace period expires. The consequences of a lapse can significantly impact the benefits for your beneficiaries. Options available to policyholders after a lapse vary depending on the type of policy and the insurer’s rules. These options may include reinstatement of the policy (often requiring a medical examination and payment of back premiums), converting the policy to a reduced paid-up policy with a lower death benefit, or extending the term of the policy for a shorter period with the same death benefit. Understanding these options is crucial to mitigating the financial impact of a lapse. For example, a term life insurance policy that lapses will simply cease coverage. A whole life policy might allow for a surrender value or other options.

Policy Surrender Values and Cash Value Withdrawals

Permanent life insurance policies, such as whole life and universal life insurance, accumulate cash value over time. This cash value represents the policy’s accumulated savings component. Policy surrender value refers to the amount you receive if you choose to surrender (cancel) the policy. This value is typically less than the total premiums paid, as insurers deduct expenses and charges. Cash value withdrawals allow you to access a portion of the accumulated cash value without surrendering the policy. However, withdrawals may reduce the policy’s death benefit and may incur charges or fees. For example, a whole life policy might allow for partial withdrawals of cash value without affecting the death benefit, but these withdrawals may be subject to interest charges. The specific terms and conditions for surrender values and cash value withdrawals are detailed in the policy document.

Life Insurance and Estate Planning

Life insurance plays a crucial role in comprehensive estate planning, offering a multifaceted approach to protecting assets and ensuring the financial well-being of beneficiaries after death. It provides a structured method for transferring wealth and mitigating potential financial burdens on loved ones. This section explores how life insurance facilitates various aspects of estate planning, from asset protection to business succession.

Protecting Assets and Providing for Beneficiaries

Life insurance proceeds can serve as a significant financial resource for beneficiaries, helping to cover immediate expenses such as funeral costs, outstanding debts, and ongoing living expenses. The policy’s death benefit provides a predictable sum of money, offering financial security during a difficult time. This liquidity ensures that beneficiaries can maintain their lifestyle or meet financial obligations without having to liquidate other assets, potentially at unfavorable market conditions. For example, a family relying on a single income earner could use life insurance to ensure the mortgage is paid off and the children’s education is funded even after the death of the primary breadwinner. The policy’s death benefit acts as a safety net, preventing the forced sale of assets like the family home.

Life Insurance in Estate Tax Planning

In situations where an estate exceeds certain thresholds, estate taxes can significantly reduce the inheritance received by beneficiaries. Life insurance can be a valuable tool in mitigating these taxes. The death benefit, paid tax-free to the beneficiaries, can be used to cover the estate tax liability, ensuring that a larger portion of the estate remains intact for the heirs. For instance, a high-net-worth individual might use a life insurance policy with a death benefit large enough to cover the anticipated estate tax, preventing the forced liquidation of valuable assets like real estate or business holdings to pay the tax. This strategy allows the estate to pass on a greater net worth to the intended recipients.

Funding Business Succession Plans

For business owners, life insurance can be instrumental in ensuring a smooth transition of ownership and minimizing financial disruption upon the death of a key stakeholder. A life insurance policy can provide the funds necessary to buy out the deceased owner’s share from their business partners or family members, preventing disputes and maintaining the business’s stability. This prevents the forced sale of the business, which can be detrimental to its value and employees. For example, a partnership agreement might stipulate that if one partner dies, the remaining partners can use the death benefit of a life insurance policy to purchase the deceased partner’s share, ensuring a seamless continuation of the business.

Life Insurance to Cover Outstanding Debts

Let’s consider a hypothetical scenario: John, a homeowner with a significant mortgage and outstanding credit card debt, dies unexpectedly. John’s family is now burdened not only with grief but also with the substantial financial obligations he left behind. However, if John had a life insurance policy with a death benefit sufficient to cover these debts, his family would receive the funds to settle the mortgage and credit card balances, freeing them from immediate financial distress. This prevents the foreclosure of the family home and allows the family to focus on grieving and adjusting to their new reality without the added pressure of mounting debt. The life insurance policy acts as a financial safety net, protecting the family from the devastating consequences of his untimely death.

Illustrative Examples

Understanding life insurance can be easier with concrete examples. Let’s explore scenarios showcasing different life insurance types and their applications.

Young Family Choosing Term Life Insurance

A young couple, Sarah and Mark, both aged 30, have a one-year-old child and are starting their careers. They choose a 20-year term life insurance policy with a substantial death benefit. Their reasoning is straightforward: they need affordable coverage for a significant period, ensuring their child’s financial security should either parent unexpectedly pass away. The term life insurance’s lower premiums allow them to allocate more of their budget towards other financial priorities, such as saving for their child’s education and their own retirement. The large death benefit provides sufficient funds to cover mortgage payments, living expenses, and potential childcare costs until their child reaches adulthood. This approach prioritizes maximum coverage at a manageable cost during their most financially vulnerable years.

Whole Life Insurance for Long-Term Financial Stability

John, a 45-year-old successful entrepreneur, chooses a whole life insurance policy. His primary goal is to leave a lasting legacy for his family and secure their financial future, regardless of when he passes away. Whole life insurance offers a lifelong death benefit and a cash value component that grows tax-deferred over time. This cash value can be accessed for various needs, such as supplementing retirement income or funding future educational expenses for his children. The predictable, albeit higher, premiums provide John with peace of mind, knowing his family will always be protected financially, and he has a long-term savings vehicle integrated with his life insurance plan. The long-term growth potential of the cash value component adds to its attractiveness as a long-term financial strategy.

Life Insurance Funding College Education

The Miller family used a life insurance policy as part of their college savings plan for their two children. They purchased a life insurance policy with a death benefit large enough to cover the projected cost of their children’s college education. Should either parent pass away, the death benefit would be used to fund their children’s college expenses, ensuring their educational goals are not compromised by unforeseen circumstances. This approach combined life insurance protection with a form of estate planning, securing a crucial element of their children’s future. They viewed it as a safeguard against financial hardship that could derail their children’s academic plans.

Visual Representation of Term vs. Whole Life Insurance Premiums

Imagine a bar graph. The horizontal axis represents the 20-year period, divided into years. The vertical axis represents premium payments in monetary units (e.g., thousands of dollars). Two sets of bars are shown for each year: one for term life insurance and one for whole life insurance. The term life insurance bars would be relatively short and consistent throughout the 20-year period, representing the lower and stable premiums. The whole life insurance bars would be significantly taller than the term life insurance bars and remain consistently tall across the entire 20-year period, illustrating the higher and constant premiums. The visual difference clearly highlights the trade-off between lower premiums and limited coverage (term) versus higher premiums and lifelong coverage (whole life). A legend clearly identifying each bar set completes the visual representation.

Ultimate Conclusion

Choosing the right life insurance policy is a significant financial decision that requires careful consideration of your individual circumstances and long-term goals. By understanding the various types of policies available, the factors influencing costs, and the importance of regular review, you can effectively protect your loved ones and secure their financial well-being. Remember, seeking professional advice from a qualified financial advisor can provide personalized guidance and ensure you make the best choice for your unique needs.

Commonly Asked Questions

What is the difference between a beneficiary and a policy owner?

The policy owner is the person who purchases and maintains the life insurance policy. The beneficiary is the person or entity designated to receive the death benefit upon the policy owner’s death.

Can I change my beneficiary?

Yes, you can usually change your beneficiary at any time by notifying your insurance company and completing the necessary paperwork. The process varies by insurer.

What happens if I miss a premium payment?

Most policies include a grace period (typically 30 days) to make a missed payment before the policy lapses. However, interest may be charged. If the payment remains unpaid after the grace period, the policy may lapse.

How often should I review my life insurance needs?

It’s recommended to review your life insurance coverage at least annually, or whenever there are significant life changes such as marriage, birth of a child, job change, or major debt changes.