Life insurance: a topic often shrouded in complexity, yet crucial for securing the financial well-being of loved ones. This guide demystifies the process of life insurance planning, offering a clear and concise path towards making informed decisions that align with your unique circumstances. We’ll explore various policy types, needs assessment strategies, and crucial considerations for building a robust financial safety net for your family.

From understanding the nuances of term versus whole life insurance to navigating the intricacies of beneficiary designation and estate planning, this comprehensive resource equips you with the knowledge necessary to confidently navigate the world of life insurance. We’ll delve into practical examples, actionable steps, and frequently asked questions, ensuring you’re well-prepared to protect your future.

Types of Life Insurance

Choosing the right life insurance policy can be a complex decision, as various types cater to different needs and financial situations. Understanding the key differences between these options is crucial for making an informed choice that aligns with your personal circumstances and long-term goals. This section will explore the primary types of life insurance: term life, whole life, universal life, and variable life insurance.

Term Life Insurance

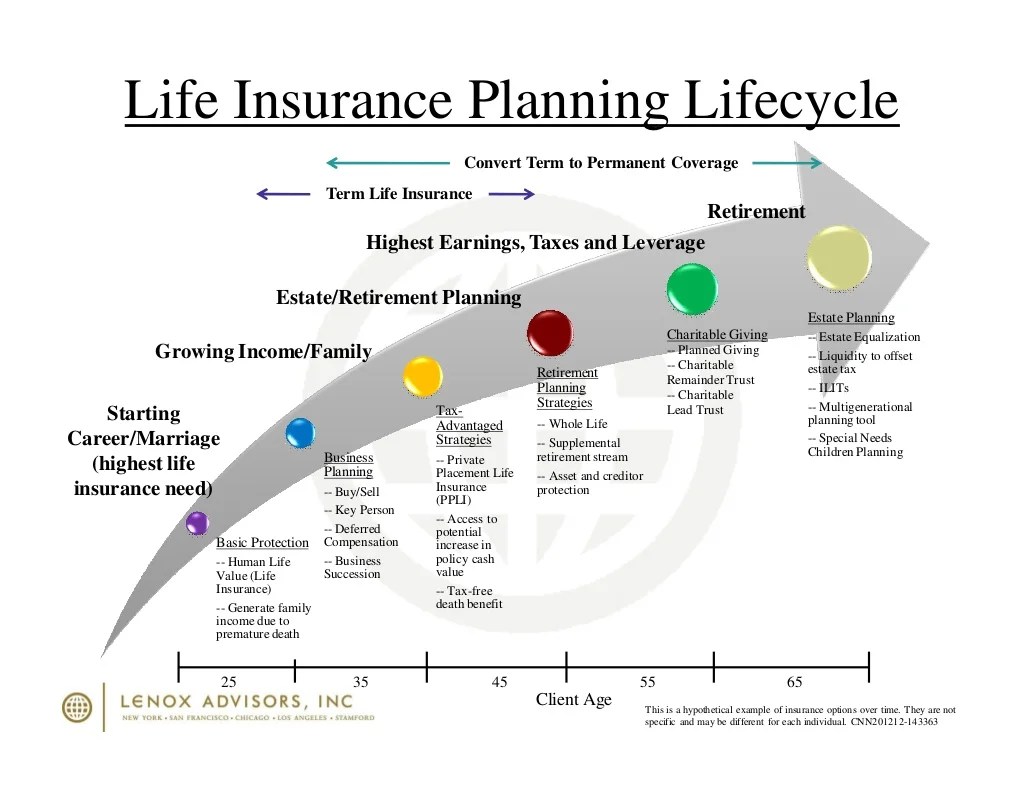

Term life insurance provides coverage for a specific period, or “term,” typically ranging from 10 to 30 years. Premiums are generally lower than other types of life insurance because the policy only covers a defined timeframe. If the policyholder dies within the term, the death benefit is paid to the beneficiaries. If the policyholder survives the term, the coverage expires, and the policyholder can choose to renew it (often at a higher premium) or let it lapse.

Whole Life Insurance

Whole life insurance provides lifelong coverage, meaning the policy remains in effect as long as premiums are paid. In addition to a death benefit, whole life insurance policies accumulate a cash value component that grows tax-deferred over time. This cash value can be borrowed against or withdrawn, although withdrawals and loans may impact the death benefit. Premiums for whole life insurance are generally higher than term life insurance due to the lifelong coverage and cash value accumulation.

Universal Life Insurance

Universal life insurance offers flexible premiums and a death benefit that can adjust over time. Policyholders can pay premiums above or below the minimum required amount, and the cash value grows tax-deferred based on the interest rate credited to the policy. The flexibility of universal life allows for adjustments to premiums and death benefits to match changing financial circumstances. However, the interest rate credited to the cash value is not fixed and can fluctuate.

Variable Life Insurance

Variable life insurance combines a death benefit with an investment component. Policyholders can allocate premiums to various sub-accounts, which invest in a range of options, such as stocks, bonds, and mutual funds. The death benefit and cash value fluctuate depending on the performance of the chosen investments. This offers the potential for higher returns but also carries greater investment risk compared to other types of life insurance.

Comparison of Life Insurance Types

| Type | Features | Benefits | Costs |

|---|---|---|---|

| Term Life | Coverage for a specific term; lower premiums; no cash value | Affordable coverage for a defined period; simple and straightforward | Relatively low premiums; coverage expires after the term |

| Whole Life | Lifelong coverage; cash value accumulation; fixed premiums | Lifelong protection; cash value grows tax-deferred; potential for loans or withdrawals | Higher premiums than term life; cash value growth may be limited |

| Universal Life | Flexible premiums; adjustable death benefit; cash value accumulation | Flexibility in premium payments; potential for higher cash value growth; adjustable death benefit | Premiums can fluctuate; interest rates on cash value are not guaranteed |

| Variable Life | Investment component; potential for higher returns; adjustable death benefit | Potential for higher returns; flexible investment options; adjustable death benefit | Higher premiums; investment risk; complex policy structure |

Circumstances for Each Type

Term life insurance is generally suitable for individuals who need temporary coverage, such as during periods of high financial responsibility like raising children or paying off a mortgage. Whole life insurance may be appropriate for those seeking lifelong coverage and the benefits of cash value accumulation. Universal life insurance can be a good option for individuals who anticipate changes in their financial situation and need flexibility in their premium payments. Variable life insurance might appeal to individuals with a higher risk tolerance who are comfortable managing investments and seek the potential for higher returns. The most appropriate type of life insurance depends on individual needs, risk tolerance, and financial goals.

Needs Assessment for Life Insurance

Determining the right amount of life insurance is crucial for securing your family’s financial future. A thorough needs assessment considers various factors to ensure the coverage adequately protects against unforeseen circumstances and supports your long-term goals. This process goes beyond simply choosing a policy; it’s about quantifying your family’s financial needs in the event of your death.

Factors Influencing Life Insurance Coverage

Several key factors significantly impact the appropriate level of life insurance coverage. These factors, when carefully considered, provide a comprehensive picture of your family’s financial vulnerabilities and future aspirations. Ignoring these factors could lead to inadequate coverage, leaving your loved ones financially exposed.

- Income: Your annual income is a primary factor. The amount of life insurance needed often correlates with your income, as it represents the potential loss of earnings for your dependents.

- Dependents: The number and ages of your dependents heavily influence coverage needs. Younger children require longer-term support, demanding higher coverage than older, nearly independent children.

- Debts: Outstanding debts, such as mortgages, loans, and credit card balances, must be factored into your needs assessment. Life insurance can provide the funds necessary to settle these debts, preventing financial strain on your family.

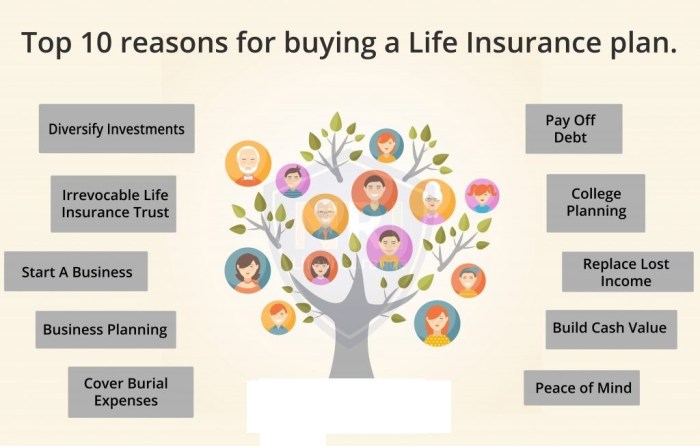

- Future Goals: Consider your future financial goals, such as children’s education, retirement planning, or other significant expenses. Life insurance can help ensure these goals are achieved even in your absence.

Calculating Life Insurance Needs: A Step-by-Step Process

A systematic approach is essential for accurately calculating your life insurance needs. This process ensures all relevant factors are considered, resulting in a comprehensive and appropriate coverage amount. The following steps provide a framework for this calculation.

- Calculate Current Expenses: Determine your household’s current annual expenses, including housing, food, transportation, clothing, healthcare, and other necessities. For example, a family might spend $60,000 annually.

- Estimate Future Expenses: Project future expenses, considering factors like inflation and potential increases in healthcare costs. A conservative estimate might be a 3% annual increase. Using the example, in 10 years, expenses might reach approximately $80,000.

- Identify Outstanding Debts: List all outstanding debts, including the remaining balance and interest rates. For example, a $200,000 mortgage and $10,000 in credit card debt.

- Determine Future Goals Costs: Estimate the cost of future goals, such as college education for children or retirement funds. For example, $100,000 for college and $50,000 for retirement.

- Calculate Total Needs: Sum up current and future expenses, outstanding debts, and the cost of future goals. In our example, this would be $60,000 (current expenses) + $80,000 (future expenses) + $200,000 (mortgage) + $10,000 (credit card debt) + $100,000 (college) + $50,000 (retirement) = $500,000.

- Adjust for Inflation and Investment Growth: Consider the impact of inflation and potential investment returns on the total needs. This requires adjusting the calculated amount to account for the time value of money. This step is best handled with the assistance of a financial advisor.

Note: This is a simplified example. A comprehensive needs assessment often requires professional financial advice to account for complexities such as taxes, investment strategies, and other individual circumstances.

Choosing a Life Insurance Policy

Selecting the right life insurance policy is a crucial step in securing your family’s financial future. This involves careful consideration of various factors, including your specific needs, budget, and the features offered by different insurance providers. Understanding the nuances of policy options and asking the right questions will empower you to make an informed decision.

Choosing a life insurance policy requires comparing different providers’ offerings. Features like premium amounts, policy types (term, whole, universal, etc.), death benefit payouts, and cash value accumulation options vary significantly.

Policy Feature Comparisons

Different life insurance providers offer various features designed to cater to diverse needs. For instance, some companies might offer lower premiums for non-smokers or individuals with healthy lifestyles, while others may prioritize policies with strong cash value growth potential. A comparison of these features should include the policy’s terms and conditions, the provider’s financial stability ratings (from agencies like AM Best or Moody’s), and customer service reviews. Consider policies with features that align with your long-term financial goals and risk tolerance. For example, a young family might prioritize a term life insurance policy with a high death benefit at a relatively low cost, while someone nearing retirement might prefer a whole life policy with cash value accumulation.

Policy Riders and Their Benefits

Policy riders are optional additions to your life insurance policy that enhance its coverage. They provide extra protection for specific circumstances or needs. Examples include accidental death benefit riders (doubling the death benefit if death is accidental), critical illness riders (providing a lump sum payment upon diagnosis of a critical illness), and long-term care riders (covering long-term care expenses). Each rider comes with an additional premium, so it’s crucial to assess whether the added cost justifies the potential benefits based on your individual circumstances and risk assessment. For example, a rider providing coverage for critical illnesses might be particularly beneficial for individuals with a family history of such conditions.

Questions to Ask Potential Insurance Providers

Before committing to a life insurance policy, a comprehensive checklist of questions should be addressed. This will ensure you fully understand the terms and conditions, and the policy’s suitability for your needs.

- What types of life insurance policies do you offer, and what are the key features and benefits of each?

- What are the premium amounts for each policy type, considering my age, health, and desired coverage amount?

- What is your company’s financial strength rating, and what does it indicate about your long-term stability?

- What are the available policy riders, and what are their associated costs and benefits?

- What is the claims process like, and how long does it typically take to receive benefits?

- What are your customer service policies, and how can I contact you with questions or concerns?

- What are the policy’s surrender charges and other fees, if any?

- Are there any exclusions or limitations in the policy’s coverage?

Review and Adjustment of Coverage

Life insurance, unlike many other financial products, isn’t a one-time purchase and forget. Your needs evolve throughout your life, and your life insurance policy should reflect those changes. Regularly reviewing your coverage ensures it remains adequate and continues to provide the necessary financial protection for your loved ones. Failing to do so could leave your family vulnerable in the event of your untimely death.

Regular review of your life insurance policy is crucial for maintaining appropriate coverage. This involves a periodic assessment of your current coverage against your evolving needs and circumstances. A proactive approach allows for timely adjustments, preventing gaps in protection or unnecessary overspending on premiums. The frequency of review should depend on the significance of life changes, but at least an annual review is recommended.

Factors Triggering a Coverage Review

Significant life events often necessitate a reassessment of your life insurance needs. These events can dramatically alter your financial responsibilities and the level of protection required for your dependents. Failing to adapt your policy to these changes could leave your beneficiaries inadequately protected.

Examples of Life Events Requiring Policy Review

The birth of a child, for instance, significantly increases financial obligations. New expenses related to childcare, education, and healthcare demand a higher level of life insurance coverage to ensure the child’s future is secure even in the event of a parent’s death. Similarly, marriage introduces a new dependent and shared financial responsibilities, requiring a reevaluation of the total coverage needed to protect both partners and any future children. A career change, whether a promotion resulting in increased income or a job loss leading to reduced income, may also impact the amount of coverage needed. A promotion may necessitate increased coverage to protect a larger estate, while a job loss may necessitate a review to ensure affordability. Other life events like divorce, purchasing a home, or significant debt accumulation also warrant a review of your life insurance coverage.

Developing a Plan for Coverage Evaluation

A structured approach to reviewing your life insurance coverage ensures thoroughness and prevents overlooking crucial aspects. This plan should involve a systematic evaluation of your current coverage, an assessment of your updated needs, and a comparison of the two to identify any discrepancies. This process can be facilitated by using a financial advisor or online calculators designed to estimate life insurance needs based on your specific circumstances. It is crucial to consider factors like your age, health, income, assets, debts, and the number of dependents when evaluating your needs.

Utilizing Financial Tools for Review

Many online tools and resources are available to help individuals assess their life insurance needs. These tools often incorporate factors such as income, expenses, debts, and the number of dependents to provide a personalized estimate of required coverage. While these tools can be helpful, it is recommended to consult with a financial advisor for personalized guidance, especially in complex situations. They can offer tailored advice and help you navigate the complexities of different policy types and options.

Understanding Policy Documents

Your life insurance policy is a legally binding contract, and understanding its contents is crucial. A thorough understanding ensures you know exactly what coverage you have, what your obligations are, and how to make claims should the need arise. This section will guide you through the key components of a typical policy document.

Key Sections of a Life Insurance Policy

A standard life insurance policy typically includes several key sections. These sections provide essential information regarding your coverage, premiums, and the conditions under which benefits will be paid. Familiarizing yourself with these sections will empower you to make informed decisions about your insurance.

- Policy Summary: This section provides a concise overview of your policy’s key features, including the death benefit amount, premium payments, and policy type.

- Coverage Details: This Artikels the specific types of coverage included in your policy, such as accidental death benefits or additional riders. It will detail the circumstances under which benefits will be paid.

- Premium Payment Schedule: This section details the amount and frequency of your premium payments. It may also include information on grace periods and late payment penalties.

- Beneficiary Designation: This critically important section specifies who will receive the death benefit upon your passing. It’s vital to regularly review and update this information as your life circumstances change.

- Exclusions and Limitations: This section clearly Artikels situations or events that are not covered by your policy. Understanding these limitations is essential to avoid any unexpected issues later on.

- Policy Loan Provisions (if applicable): If your policy allows for loans, this section details the terms and conditions governing those loans, including interest rates and repayment options.

- Policy Surrender Options: This section describes the options available if you decide to cancel your policy, including any surrender charges that might apply.

- Claims Procedures: This section explains the process for filing a claim in the event of a covered loss. It will Artikel the necessary documentation and steps to follow.

Glossary of Common Life Insurance Terminology

Understanding the language used in your policy is paramount. This glossary explains some common terms you’ll encounter.

| Term | Definition |

|---|---|

| Beneficiary | The person or people designated to receive the death benefit. |

| Death Benefit | The amount of money paid to the beneficiary upon the insured’s death. |

| Premium | The regular payment made to maintain the life insurance policy. |

| Cash Value (for certain policies) | The accumulated savings component within a permanent life insurance policy. |

| Rider | An add-on to a life insurance policy that provides additional coverage or benefits. |

| Grace Period | A short period after the premium due date during which a payment can be made without penalty. |

| Policy Lapse | The termination of a life insurance policy due to non-payment of premiums. |

| Insured | The person whose life is covered by the insurance policy. |

| Policyowner | The person who owns the life insurance policy and has the right to make changes to it. |

Step-by-Step Guide to Understanding Your Policy

Understanding your policy doesn’t have to be daunting. Follow these steps for a clear comprehension.

- Read the entire policy document carefully: Don’t just skim it; take your time to understand each section.

- Look up unfamiliar terms: Use the glossary provided or consult a dictionary or online resources.

- Pay close attention to the exclusions and limitations: Knowing what’s *not* covered is as important as knowing what is.

- Review the beneficiary designation: Ensure it reflects your current wishes.

- Understand your premium payment schedule and options: Know when payments are due and what happens if you miss one.

- Ask questions if you’re unsure: Contact your insurance agent or company if anything is unclear.

- Keep a copy of your policy in a safe place: This ensures easy access to the information when needed.

Illustrative Example: A Family with Young Children

Let’s consider the Jones family: John and Mary, both 35, with two young children, ages 3 and 6. John earns $80,000 annually, and Mary earns $60,000. They own their home, have some savings, and minimal debt. We’ll illustrate how to determine their life insurance needs and choose a suitable policy.

Determining the Jones family’s life insurance needs involves calculating the financial resources required to replace John’s and Mary’s income and cover other expenses if one or both were to die. This includes considering factors such as outstanding mortgage payments, children’s education costs, and ongoing living expenses.

Income Replacement

To replace John’s and Mary’s income, we need to estimate their combined annual income and project it over a specified period, such as until the youngest child reaches adulthood. This calculation usually involves considering inflation and potential salary increases. Assuming a conservative estimate, their combined annual income of $140,000 needs to be replaced for approximately 15 years (until the youngest child turns 18). This translates to a need for approximately $2,100,000 ($140,000 x 15). This figure doesn’t account for investment growth, but represents a significant need.

Outstanding Debt and Expenses

The Jones family also needs to account for their outstanding mortgage. If their mortgage balance is $250,000, this adds to their insurance needs. Other expenses such as funeral costs, potential estate taxes, and college fund shortfalls for the children should also be considered. A realistic estimate of these expenses could add another $100,000 to their total needs.

Total Life Insurance Needs

Combining income replacement and debt/expenses, the Jones family’s total life insurance needs might be estimated at approximately $2,200,000 ($2,100,000 + $100,000). This is a significant amount, highlighting the importance of comprehensive life insurance planning.

Suitable Policy Type

Given their need for a substantial death benefit and their relatively young age, a term life insurance policy with a long term (e.g., 20-30 years) could be appropriate for the Jones family. Term life insurance provides a fixed death benefit for a specific period, offering cost-effective coverage for a significant amount of time. A 20-year term policy would cover them until their children are nearing adulthood. The affordability of term life insurance is crucial for families with young children.

Adjusting Coverage as Children Grow Older

As the Jones children grow older and become more financially independent, the family’s life insurance needs will decrease. The mortgage will likely be paid off, and the need to fund college education might diminish. The Jones family can reduce their coverage as the children become self-sufficient, possibly shifting to a smaller term policy or a whole life policy with a lower death benefit. Regular review and adjustments to their policy are crucial to ensure they maintain appropriate coverage at each stage of their lives.

Closing Notes

Effective life insurance planning is not merely about purchasing a policy; it’s about proactively safeguarding your family’s financial future against life’s uncertainties. By carefully considering your individual needs, comparing policy options, and regularly reviewing your coverage, you can create a plan that provides peace of mind and lasting security for those you cherish most. Remember, a well-structured life insurance plan is a cornerstone of comprehensive financial planning, offering invaluable protection and a legacy for generations to come.

Detailed FAQs

What is the difference between a beneficiary and a policy owner?

The policy owner is the person who purchases and maintains the life insurance policy. The beneficiary is the person or entity designated to receive the death benefit upon the policy owner’s death.

Can I change my beneficiary at any time?

Yes, you can typically change your beneficiary at any time by submitting a written request to your insurance provider. However, specific procedures may vary depending on your policy.

How often should I review my life insurance coverage?

It’s recommended to review your life insurance coverage at least annually, or whenever significant life events occur, such as marriage, divorce, birth of a child, or a major career change.

What happens if I die without naming a beneficiary?

If you die without naming a beneficiary, the death benefit will typically be distributed according to the laws of your state, which may involve probate court proceedings and potentially delay distribution to your heirs.

What factors affect the cost of my life insurance premiums?

Several factors influence premium costs, including your age, health status, smoking habits, the type of policy, the death benefit amount, and the policy’s term length.