Navigating the world of life insurance can feel daunting, especially when faced with the prospect of medical examinations. However, a growing number of insurers offer life insurance policies without the need for a medical exam, opening up access to vital financial protection for a wider range of individuals. This guide explores the various types of no-medical-exam policies, their eligibility criteria, and the factors that influence premium costs, empowering you to make informed decisions about your financial future.

Understanding the nuances of these policies is crucial for securing adequate coverage without unnecessary hurdles. We’ll delve into the application process, compare policy types, and highlight the advantages and disadvantages to help you determine the best fit for your unique circumstances. Whether you’re a young professional starting a family or an older individual seeking affordable coverage, this comprehensive overview will provide the clarity you need to confidently choose a policy that meets your specific needs.

Types of Life Insurance Policies Without Medical Exams

Securing life insurance without a medical exam is becoming increasingly accessible, offering a convenient alternative for those seeking coverage quickly. Several policy types cater to different needs and risk profiles, each with its own set of advantages and disadvantages. Understanding these differences is crucial for making an informed decision.

Simplified Issue Life Insurance

Simplified issue life insurance policies require less extensive medical underwriting than traditional policies. Applicants typically answer a short health questionnaire and may undergo a brief phone interview. This streamlined process allows for faster approval and issuance of the policy. However, the death benefit amounts may be lower, and premiums might be higher compared to fully underwritten policies.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance policies, as the name suggests, guarantee coverage regardless of health status. No medical exam or health questions are required. This makes it ideal for individuals with pre-existing health conditions who might struggle to qualify for other types of life insurance. The trade-off is significantly higher premiums and lower death benefit amounts compared to other options. Coverage typically starts after a waiting period (e.g., two years).

No Medical Exam Term Life Insurance

Term life insurance without a medical exam often falls under the simplified issue category. It provides coverage for a specified period (term), offering a balance between affordability and coverage. Premiums are typically lower than whole life insurance but higher than fully underwritten term life insurance policies. Death benefits are paid only if the insured dies within the policy term.

Comparison of Life Insurance Policies Without Medical Exams

| Policy Type | Premium Cost | Death Benefit Amount | Eligibility Requirements |

|---|---|---|---|

| Simplified Issue Life Insurance | Medium to High | $25,000 – $500,000 (typical range, varies by insurer and applicant) | Short health questionnaire, possibly a phone interview. |

| Guaranteed Issue Life Insurance | High | $10,000 – $50,000 (typical range, varies by insurer and applicant) | No medical exam or health questions. |

| No Medical Exam Term Life Insurance | Medium | $25,000 – $250,000 (typical range, varies by insurer and applicant) | Short health questionnaire, possibly a phone interview. |

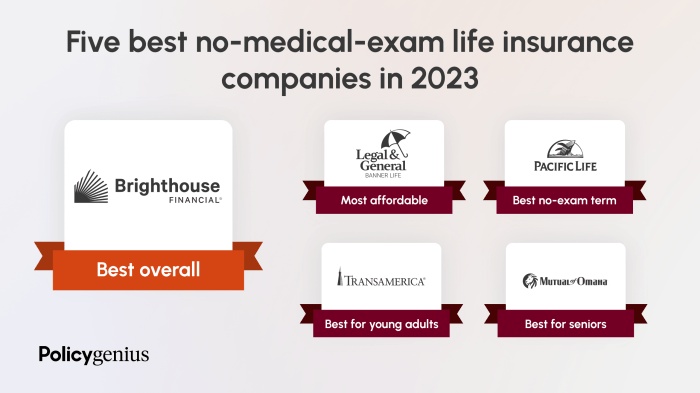

Examples of Insurers Offering No Medical Exam Policies

Several major insurance companies offer life insurance policies without medical exams. Specific offerings and details vary by insurer and state. Examples include, but are not limited to, companies like Mutual of Omaha, Gerber Life, and some branches of larger national insurers. It’s crucial to compare quotes from multiple providers to find the best fit for individual needs and circumstances. Remember that policy details and availability are subject to change, so it is always advisable to contact the insurance company directly for the most up-to-date information.

Eligibility Criteria and Application Process

Securing life insurance without a medical exam offers convenience and accessibility, but it’s crucial to understand the eligibility requirements and application procedure. These policies typically cater to a specific demographic and involve a streamlined process compared to traditional life insurance applications.

Eligibility for no-medical-exam life insurance policies hinges primarily on age and health status, although the specific criteria vary among insurers. Generally, these policies are designed for individuals within a specific age range, often up to a certain age (e.g., 60 or 65), and with relatively good health. Pre-existing conditions or significant health concerns might lead to rejection or a higher premium. Lifestyle factors, such as smoking habits, also play a role in determining eligibility and premium rates.

Eligibility Criteria Details

Applicants are typically assessed based on several key factors. Age is a primary determinant, with most insurers setting upper age limits for eligibility. A brief health history is often required, usually focusing on major illnesses or hospitalizations within a specific timeframe (e.g., the past five years). Lifestyle factors such as smoking, alcohol consumption, and occupation are also considered. Some insurers may ask about family medical history. Finally, the amount of coverage desired can influence eligibility. Larger coverage amounts often require a more thorough underwriting process, even for no-medical-exam policies.

Application Process Steps

The application process for no-medical-exam life insurance is considerably simpler than traditional policies. First, you’ll need to complete an online or paper application form. This form will request personal information such as your name, address, date of birth, and contact details. Next, you’ll be asked to provide a brief health history, focusing on key medical events. This typically involves answering questions about significant illnesses, hospitalizations, and current medications. You’ll also be asked about lifestyle factors, such as smoking, alcohol consumption, and occupation. This information is used to assess your risk profile. Unlike traditional policies, no physical exam or blood tests are required. Once the application is submitted and reviewed, the insurer will make a decision regarding approval and premium rates.

Information Required During Application

The information needed during the application is designed to assess the applicant’s risk profile without the need for a medical examination. This includes basic demographic information such as age, address, and occupation. A brief health history questionnaire will focus on major health issues, hospitalizations, and surgeries within a specified timeframe. Lifestyle factors such as smoking status, alcohol use, and participation in high-risk activities are also important. This streamlined approach allows for faster processing times compared to policies requiring extensive medical evaluations.

Factors Affecting Premiums

Several key factors influence the cost of premiums for life insurance policies that don’t require a medical exam. Understanding these factors can help you make informed decisions when comparing policies and choosing the best option for your needs. These factors interact to determine your individual premium rate.

Age’s Impact on Premium Costs

Age is a significant determinant of life insurance premiums. As you get older, your risk of mortality increases, leading to higher premiums. This is because statistically, older individuals have a greater chance of passing away within the policy’s coverage period. Insurers use actuarial tables to assess this risk, and these tables show a clear upward trend in mortality rates with increasing age. Therefore, a 30-year-old will typically pay considerably less than a 60-year-old for the same coverage amount.

Smoking Status and Premium Rates

Smoking significantly impacts life insurance premiums. Smokers face a higher risk of developing various health problems, including heart disease, lung cancer, and stroke, all of which increase the likelihood of early death. Consequently, insurers consider smoking status a major risk factor and charge smokers considerably higher premiums than non-smokers. This difference can be substantial, often representing a significant percentage increase in the overall premium cost. Quitting smoking can lead to lower premiums over time, though some policies may require a waiting period before a reduced rate is applied.

Occupation’s Influence on Premium Costs

Certain occupations are considered higher risk than others. Individuals in professions with elevated risks of injury or death, such as firefighters, police officers, or construction workers, may pay higher premiums. The increased risk associated with these occupations necessitates a higher premium to offset the potential for earlier claims. Conversely, those in less hazardous professions might receive lower premiums. The assessment of occupational risk often involves a review of the job’s inherent dangers and statistical data on mortality rates within those professions.

Premium Comparison: No Medical Exam vs. Medical Exam

The following table illustrates the potential differences in premium costs between life insurance policies requiring a medical exam and those that do not. These are illustrative examples and actual costs will vary based on the specific insurer, policy details, and individual circumstances.

| Policy Type | Age Bracket | Smoker Status | Premium Cost (Annual) |

|---|---|---|---|

| No Medical Exam | 30-35 | Non-Smoker | $500 |

| No Medical Exam | 30-35 | Smoker | $800 |

| Medical Exam Required | 30-35 | Non-Smoker | $400 |

| Medical Exam Required | 30-35 | Smoker | $650 |

| No Medical Exam | 50-55 | Non-Smoker | $1200 |

| No Medical Exam | 50-55 | Smoker | $1800 |

| Medical Exam Required | 50-55 | Non-Smoker | $900 |

| Medical Exam Required | 50-55 | Smoker | $1400 |

Benefits and Drawbacks

Life insurance without a medical exam offers a convenient and accessible way to secure financial protection for your loved ones. However, it’s crucial to understand both the advantages and disadvantages before making a decision. Weighing these factors carefully will help you determine if this type of policy is the right fit for your individual circumstances and risk tolerance.

The primary appeal of no-medical-exam life insurance lies in its simplicity and speed. The application process is significantly streamlined, often requiring only a brief health questionnaire. This eliminates the need for potentially invasive medical tests, making it a particularly attractive option for individuals with pre-existing health conditions or those who simply prefer a less intrusive process. The quicker approval process also means faster coverage, providing peace of mind sooner.

Advantages of No-Medical-Exam Life Insurance

The benefits are clear: speed, convenience, and accessibility. These policies often provide a rapid application and approval process, allowing you to secure coverage quickly. This is particularly valuable for individuals who need coverage urgently or who are concerned about their health status impacting their eligibility for traditional policies. The simplified application process also makes it easier for those with busy schedules or limited mobility to obtain coverage. Furthermore, it opens up the possibility of life insurance to individuals who might otherwise be excluded due to health concerns or the inability to undergo a medical exam.

Disadvantages of No-Medical-Exam Life Insurance

While convenient, no-medical-exam life insurance policies typically come with higher premiums and lower coverage amounts compared to traditional policies. The insurer assumes a higher level of risk without the detailed medical information provided by a comprehensive exam. This increased risk is reflected in the pricing. Furthermore, the underwriting process, while simpler, might involve more stringent eligibility criteria based on the limited health information provided. The lack of a full medical examination could lead to a less accurate assessment of risk, potentially resulting in a policy that is either too expensive or insufficient in terms of coverage.

Comparison of Pros and Cons

Understanding the trade-offs is key to making an informed decision. The following points highlight the main advantages and disadvantages:

- Pros:

- Faster application and approval process.

- Simplified application; no need for medical exams.

- Accessibility for individuals with pre-existing conditions or those who find medical exams inconvenient.

- Potentially quicker access to coverage.

- Cons:

- Higher premiums compared to traditional policies.

- Lower coverage amounts may be available.

- Less comprehensive risk assessment by the insurer.

- Potentially more restrictive eligibility criteria.

Finding the Right Policy

Choosing the right life insurance policy without a medical exam requires careful consideration of your individual needs and financial situation. This process involves understanding your coverage requirements, comparing policy options, and selecting a plan that offers the best value for your money. Remember, while convenience is a significant benefit of no-medical-exam policies, it’s crucial to ensure the policy aligns with your long-term goals.

Finding the ideal no-medical-exam life insurance policy involves a multi-step process. Understanding your needs, comparing quotes effectively, and considering the long-term implications of your choice are critical to making an informed decision. This section will provide guidance on navigating this process successfully.

Policy Selection Based on Individual Needs

The most suitable policy depends heavily on your specific circumstances. Factors such as your age, health status (even without a full medical exam, your health history plays a role), income, family responsibilities, and financial goals all influence the type and amount of coverage you need. For example, a young, healthy individual with a young family might prioritize a term life insurance policy with a high death benefit, while an older individual nearing retirement might opt for a smaller policy with a shorter term. Consider the financial burden your death might place on your dependents and choose a policy that adequately addresses that potential loss.

A Decision-Making Flowchart for Policy Selection

The following flowchart illustrates a step-by-step approach to selecting a suitable no-medical-exam life insurance policy:

[Imagine a flowchart here. The flowchart would begin with a “Start” box. The next box would ask: “What is your primary need for life insurance? (e.g., debt coverage, family support, estate planning)”. Branching from this would be boxes representing different needs, each leading to a box suggesting appropriate policy types (e.g., term life, whole life, etc.). Further boxes would consider budget, coverage amount desired, and length of coverage needed. The flowchart would end with a “Choose Policy” box.]

Comparing Quotes from Different Insurers

Comparing quotes from multiple insurers is essential to securing the best possible rate. Don’t solely focus on the premium; consider the policy’s terms and conditions, including the coverage amount, policy length, and any exclusions. Pay close attention to the fine print to understand any limitations on payouts or situations where the policy might not provide full coverage. Use online comparison tools or contact several insurers directly to obtain multiple quotes and compare their offerings side-by-side. Consider factors like the insurer’s financial stability and customer service reputation before making your final decision. For instance, check independent ratings agencies like A.M. Best to assess the insurer’s financial strength.

Illustrative Examples

Choosing the right no-medical-exam life insurance policy depends heavily on individual circumstances. Understanding your specific needs and risk profile is crucial for selecting a plan that offers adequate coverage at a manageable cost. The following scenarios illustrate how different life situations can influence policy selection.

Scenario 1: A Young, Healthy Individual

This scenario focuses on a 28-year-old healthy individual, Sarah, who is starting a family and wants to secure her family’s financial future. Sarah is employed full-time with a stable income and has no pre-existing health conditions. She is looking for a substantial amount of coverage at an affordable price. Given her age and health status, Sarah is an ideal candidate for a term life insurance policy without a medical exam. This type of policy offers a large death benefit at a lower premium compared to whole life policies, aligning perfectly with her need for substantial coverage while keeping costs low. The shorter term (perhaps 10-20 years) would further reduce premiums. The simplicity and speed of the application process are also attractive, allowing her to quickly obtain the coverage she needs without lengthy medical evaluations. Should Sarah’s health change significantly later, she could always re-evaluate her coverage options.

Scenario 2: An Older Individual with a Pre-existing Condition

Consider John, a 60-year-old individual with a history of high blood pressure. He’s concerned about leaving his spouse financially secure after his passing. Due to his age and pre-existing condition, John would likely face higher premiums or even be denied coverage by traditional life insurance companies requiring medical exams. A simplified-issue life insurance policy might be a suitable option for him. These policies often have less stringent underwriting requirements than traditional policies, making them more accessible to individuals with health concerns. While the premiums might be higher than those for a younger, healthier individual, the policy provides a level of coverage that would be difficult, if not impossible, to obtain otherwise. The death benefit might be smaller than Sarah’s policy, reflecting the increased risk, but still provides valuable financial protection for his spouse. The streamlined application process is a significant advantage, reducing the stress and potential delays associated with extensive medical evaluations.

Final Thoughts

Ultimately, securing life insurance without a medical exam offers a convenient and accessible pathway to financial security for many. By carefully considering your individual circumstances, comparing policy options, and understanding the factors influencing premiums, you can confidently choose a policy that aligns with your needs and budget. Remember to thoroughly research different insurers and compare quotes to ensure you’re getting the best value for your investment. Taking proactive steps to protect your loved ones is a testament to your foresight and commitment to their well-being.

Quick FAQs

What is the maximum coverage amount typically available with no-medical-exam life insurance?

Coverage amounts vary significantly depending on the insurer and the type of policy, but they are generally lower than policies requiring medical exams. You might find options ranging from a few thousand to several hundred thousand dollars.

Can I still get life insurance without a medical exam if I have pre-existing health conditions?

Yes, but the availability and cost will depend on the severity of the condition. Guaranteed issue policies, for example, are available regardless of health status, but they typically come with higher premiums and lower coverage amounts.

How long does the application process usually take for a no-medical-exam policy?

The application process is typically faster than for policies requiring medical exams. You can often get approved within days or a few weeks, depending on the insurer and the complexity of your application.

Are there any specific health questions asked during the application process?

Yes, you will be asked about your general health, lifestyle habits (such as smoking), and any significant health events. However, the level of detail is generally less extensive than with policies requiring a full medical exam.