Navigating the world of life insurance can feel overwhelming, with complex policies and varying costs. A life insurance price calculator offers a powerful tool to demystify this process, providing a personalized estimate of premiums based on your individual circumstances. This guide will equip you with the knowledge to effectively utilize these calculators, understand the factors influencing your costs, and make informed decisions about your financial future.

We’ll explore the functionality of different calculators, compare online and offline methods, and delve into the key demographic and lifestyle factors that significantly impact premium calculations. We’ll also examine the limitations of these tools and emphasize the importance of seeking professional financial advice to ensure you secure the most appropriate and cost-effective life insurance coverage for your needs.

Understanding Life Insurance Price Calculators

Life insurance price calculators are invaluable tools for individuals seeking to understand the cost of life insurance coverage. They provide a quick and convenient way to estimate premiums based on various factors, allowing potential buyers to compare different policies and make informed decisions. These calculators simplify a complex process, making it more accessible to the average consumer.

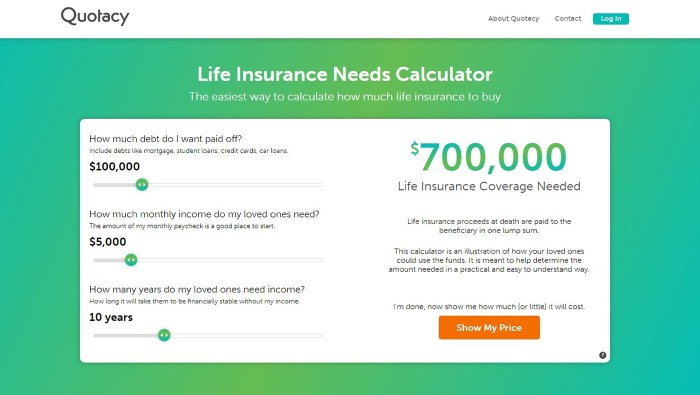

A typical life insurance price calculator works by gathering key information from the user, such as age, gender, health status, desired coverage amount, and policy type. This data is then fed into an algorithm that estimates the monthly or annual premium. The accuracy of the estimate depends on the completeness and accuracy of the information provided, as well as the sophistication of the calculator’s underlying model. Many calculators also allow users to adjust various factors, such as the length of the policy term, to see how it affects the premium.

Types of Life Insurance Policies and Cost Variations

Different types of life insurance policies have vastly different cost structures. Term life insurance, which provides coverage for a specific period, is generally the most affordable option. The cost of term life insurance is primarily determined by the length of the term, the coverage amount, and the applicant’s age and health. Whole life insurance, on the other hand, offers lifelong coverage and typically includes a cash value component, making it more expensive than term life insurance. Universal life insurance provides flexibility in premium payments and death benefits, with costs varying depending on the chosen features and riders. Variable life insurance invests the cash value component in market-linked funds, resulting in fluctuating premiums and death benefits. The cost of each policy type varies significantly based on individual circumstances. For example, a 30-year-old healthy male will likely pay less for a term life policy than a 60-year-old with pre-existing health conditions.

Online vs. Offline Calculator Methods

Online life insurance price calculators offer several advantages over their offline counterparts. Online calculators are readily accessible 24/7, require no specialized software, and often provide instant results. They can also easily compare quotes from multiple insurers, facilitating a comprehensive comparison. Offline calculators, typically found in insurance brochures or agency materials, may offer limited policy options and lack the dynamic comparison features of online calculators. However, offline calculators can provide a starting point for discussions with insurance agents, who can offer personalized advice and guidance. The choice between online and offline methods depends on individual preferences and needs.

Comparison of Key Features of Popular Calculators

| Calculator | Accuracy | Ease of Use | Policy Types Supported |

|---|---|---|---|

| Calculator A (Example) | High (Based on detailed health questions) | Easy (Intuitive interface) | Term, Whole, Universal |

| Calculator B (Example) | Medium (Simpler questions) | Very Easy (Minimal input required) | Term |

| Calculator C (Example) | Low (Estimates only) | Easy (Quick results) | Term, Whole |

Factors Influencing Life Insurance Costs

Several interconnected factors determine the cost of life insurance. Understanding these elements is crucial for making informed decisions about your coverage needs and budget. This section will explore the key demographic characteristics, health and lifestyle choices, and policy specifics that influence premium calculations.

Demographic Factors and Life Insurance Premiums

Age, gender, and occupation significantly impact life insurance premiums. Statistically, older individuals have a higher mortality risk, leading to increased premiums. Similarly, certain occupations with inherent risks may result in higher premiums. Gender also plays a role, although this is becoming less significant in many jurisdictions due to evolving underwriting practices. For example, a 30-year-old male office worker will generally pay less than a 60-year-old male construction worker with the same coverage amount.

Health and Lifestyle Choices and Premium Determination

Health and lifestyle choices are major factors in determining life insurance premiums. Individuals with pre-existing health conditions, such as diabetes or heart disease, or those engaging in risky behaviors like smoking, typically face higher premiums. Conversely, maintaining a healthy lifestyle through regular exercise, a balanced diet, and avoiding tobacco use can result in lower premiums. For instance, a non-smoker with a clean bill of health will likely receive a significantly lower premium than a smoker with a history of cardiovascular issues.

Coverage Amount and Policy Term’s Impact on Pricing

The amount of coverage and the policy term are directly related to the cost of life insurance. A higher death benefit naturally leads to a higher premium, as the insurer is assuming a greater financial obligation. Similarly, longer policy terms (e.g., whole life insurance) generally result in higher premiums than shorter terms (e.g., term life insurance) because the insurer is providing coverage over a more extended period. A $500,000 20-year term life insurance policy will cost less than a $1,000,000 whole life policy.

Examples of Specific Factor Impacts on Cost

Let’s illustrate the impact of specific factors with hypothetical scenarios. Consider two individuals applying for a $500,000 20-year term life insurance policy:

| Factor | Individual A | Individual B | Premium Difference (Illustrative) |

|---|---|---|---|

| Age | 35 | 45 | Individual B pays significantly more due to increased age and risk. |

| Smoking Status | Non-smoker | Smoker | Individual B’s premiums are substantially higher due to increased health risks associated with smoking. |

| Health Conditions | None | High blood pressure | Individual B’s premiums are likely higher due to the increased risk associated with high blood pressure. |

Note: These are illustrative examples and actual premium differences will vary depending on the insurer and specific policy details.

Using a Life Insurance Price Calculator Effectively

Life insurance price calculators are valuable tools for understanding the potential cost of life insurance. However, their effectiveness depends on accurately inputting your information and understanding how to interpret the results. This section will guide you through the process of using a calculator effectively and interpreting its output.

Understanding how to use a life insurance price calculator efficiently is crucial for making informed decisions about your life insurance needs. By following a structured approach and understanding the factors influencing the results, you can obtain a realistic estimate of your premiums and make a well-informed choice.

Step-by-Step Guide to Using a Life Insurance Price Calculator

Most life insurance price calculators follow a similar process. Accurate input is key to receiving a reliable estimate. The following steps provide a general guide, though specific fields may vary slightly depending on the calculator used.

- Enter Your Age and Gender: This is typically one of the first pieces of information requested. Insurers use age and gender as significant factors in assessing risk.

- Specify Your Desired Coverage Amount: Determine how much coverage you need based on your financial obligations and the needs of your dependents. This amount represents the payout your beneficiaries would receive upon your death.

- Select Your Policy Type: Choose between term life insurance (coverage for a specific period) or permanent life insurance (coverage for your entire life). Each type has different pricing structures.

- Input Your Health Information: Most calculators will ask about your health status, including any existing medical conditions, smoking habits, and family history of certain diseases. Be honest and accurate in your responses, as this significantly impacts the premium calculation.

- Provide Your Location: Your location may influence premiums due to variations in state regulations and healthcare costs.

- Consider Add-ons or Riders: Some calculators allow you to include optional add-ons or riders, such as accidental death benefits or long-term care riders. Adding these features will typically increase the premium.

- Review the Results: The calculator will provide an estimated monthly or annual premium based on your input. Carefully review all details before making any decisions.

Interpreting Calculator Results

The primary output of a life insurance price calculator is the estimated premium. However, many calculators also provide additional information, such as the total cost of the policy over the term and a breakdown of the factors influencing the price. Understanding this breakdown helps you to identify areas where you might be able to reduce your costs.

For example, a calculator might show that your smoking habit is significantly increasing your premium. This highlights the importance of healthy lifestyle choices and how they can affect your insurance costs. Similarly, the results might indicate that choosing a shorter term policy would reduce the overall cost, but offer less coverage.

Adjusting Input Parameters to See the Effect on Price

One of the most valuable aspects of a life insurance price calculator is its ability to demonstrate the impact of different input parameters on the final price. By systematically altering these parameters, you can gain a clear understanding of how each factor influences the cost of your insurance.

For instance, let’s say you’re considering a $500,000 20-year term life insurance policy. You could adjust the term length to see how a 10-year policy would affect the premium (it would likely be lower, but provide less coverage). You could also experiment with different coverage amounts to see how increasing or decreasing the coverage impacts the price. Similarly, if the calculator indicates that your health status is a major factor in your premium, you could research ways to improve your health, potentially leading to lower premiums in the future. Remember that any changes to your health status would need to be reported to your insurer.

Comparison of Different Calculator Results

To illustrate the variations in life insurance price estimates, we compared three popular online calculators using identical input parameters. Understanding these discrepancies is crucial for making informed decisions. While all calculators aim to provide an estimate, their underlying algorithms and data sources can lead to differing results.

The following analysis uses a hypothetical 35-year-old male, non-smoker, seeking a $500,000 20-year term life insurance policy, in good health, with no pre-existing conditions. This consistent dataset allows for a direct comparison of the output from each calculator.

Calculator Results Comparison

Three different online life insurance price calculators – Calculator A, Calculator B, and Calculator C – were used with the aforementioned input data. The results varied significantly, highlighting the importance of comparing multiple quotes before making a purchase decision.

| Calculator | Monthly Premium | Annual Premium | Notes |

|---|---|---|---|

| Calculator A | $55 | $660 | This calculator offered a relatively low premium, possibly due to a simplified algorithm or averaging across a wider range of providers. |

| Calculator B | $62 | $744 | This calculator provided a premium slightly higher than Calculator A, potentially reflecting a more nuanced assessment of risk factors. |

| Calculator C | $70 | $840 | Calculator C produced the highest premium. This could be attributed to a more conservative risk assessment or inclusion of additional fees not explicitly stated. |

Discrepancies in the results are likely due to several factors. Each calculator may use different underwriting models, incorporate varying assumptions about mortality rates, and consider different ranges of insurance provider offerings. Furthermore, the level of detail requested in the input data may also influence the final calculation. For instance, some calculators may weigh factors like family history of illness more heavily than others. Finally, the specific algorithms used to process this information and arrive at a premium are proprietary and not always transparent to the user.

Limitations of Life Insurance Price Calculators

While online life insurance price calculators offer a convenient way to get a preliminary estimate of costs, it’s crucial to understand their inherent limitations. These tools provide a snapshot, not a complete picture, and relying solely on them can lead to inaccurate financial planning. Several factors beyond basic information are often omitted, making the calculated price potentially misleading.

These calculators typically simplify a complex process, omitting nuances that significantly impact the final cost. The resulting estimate should be viewed as a rough guideline, not a definitive price quote. Accurate pricing necessitates a thorough review of individual circumstances by a qualified professional.

Factors Not Considered by Calculators

Many factors influencing life insurance premiums are not included in online calculators. These include pre-existing health conditions beyond basic health questions, specific lifestyle choices (like dangerous hobbies), family medical history, and the precise details of the policy’s coverage and riders. For example, a calculator might ask about smoking status, but it won’t delve into the specifics of nicotine use, the duration of smoking, or attempts at quitting. Similarly, a general question about health may not capture the complexity of a chronic condition or a family history of heart disease. These omissions can lead to significant discrepancies between the calculated price and the actual premium.

Importance of Consulting a Financial Advisor

Given the limitations of online calculators, consulting a financial advisor is paramount. A qualified professional can assess your individual needs, consider all relevant factors (including those not captured by online tools), and guide you toward the most appropriate and affordable life insurance policy. They can explain complex policy features, help you understand different types of coverage, and navigate the application process. Furthermore, they can provide personalized advice considering your overall financial situation and long-term goals, ensuring your life insurance strategy aligns with your broader financial plan.

Potential Inaccuracies and Caveats

It’s essential to be aware of potential inaccuracies when using life insurance price calculators. Relying solely on these estimates can lead to significant financial miscalculations.

- Incomplete Health Information: Calculators typically ask simplified health questions. Detailed medical history and pre-existing conditions are rarely fully assessed.

- Lifestyle Factors Omission: Specific lifestyle choices, such as extreme sports participation or hazardous occupations, might not be thoroughly considered.

- Family Medical History Neglect: Genetic predisposition to certain illnesses, a crucial factor in risk assessment, is often not included in the calculation.

- Policy Rider Exclusions: Additional policy riders, such as those for critical illness or long-term care, and their associated costs, are typically not factored into the estimates.

- Underestimation of Premiums: The calculated price might significantly underestimate the actual premium, leading to financial surprises later.

- Inaccurate Age or Gender Input: Slight errors in inputting personal data, like age or gender, can substantially alter the calculated premium.

Final Thoughts

Ultimately, understanding life insurance costs is crucial for securing your family’s financial well-being. While life insurance price calculators offer a valuable starting point, remember that they provide estimates, not guarantees. By carefully considering the factors influencing premiums, utilizing calculators effectively, and consulting with a financial advisor, you can confidently navigate the process and choose a life insurance policy that aligns with your specific requirements and budget. Proactive planning empowers you to protect your loved ones and secure your financial future with peace of mind.

Answers to Common Questions

What types of life insurance policies are typically covered by online calculators?

Most online calculators cover term life insurance and whole life insurance, sometimes offering variations like universal life insurance. However, the specific policy types available vary between calculators.

How accurate are online life insurance price calculators?

Online calculators provide estimates based on the information you input. Accuracy can vary depending on the calculator’s algorithm and the completeness of your data. They should be considered starting points, not definitive quotes.

Can I use a life insurance price calculator if I have pre-existing health conditions?

Yes, but you’ll need to accurately disclose your health conditions. The calculator will likely adjust the premium based on this information. Incomplete or inaccurate information will lead to inaccurate results.

What if I don’t have all the information required by the calculator?

It’s best to gather as much information as possible. However, many calculators allow you to input estimated values or leave certain fields blank, though this might impact the accuracy of the results. Consult a financial advisor for personalized guidance.